Money & the World

How the GameStop Phenomenon Happened. And Why the Losers May Not Be Who You Think

A conversation with Ben Reeves, resident market genius (and Chief Investment Officer at Wealthsimple), who explains what happened, the changes it shows in the world of investing, and how, in some ways, it reflects the same problems individual investors have always faced.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Look, this is a thing everyone’s talking about. It’s insane, a great story, evidence of some weird futuristic internet stuff, and there have been countless takes. But I want to talk about regular people who bought, thought about buying, or are still thinking about buying stock in GameStop. So let’s first quickly go over what happened so people can understand it, and then let’s get into what it means and what we can learn as civilians who may buy and sell stocks.

Sounds good. I’m ready.

So let's start here. You're on, say, Twitter, yesterday, and suddenly you see people talking about the company GameStop in your feed. Seemingly everyone's talking about it. Why did everyone start talking about it?

Basically, everybody started paying attention to it because the price went up. A lot. At this time last year, it traded at $4. Over the course of the year, the price moved to $20. But then on January 13th and January 14th, the price doubled to $40. Two days later, it doubled again. And on each of the following two days, the stock doubled again, bringing the price to about $350, or a 1,700% price increase over two weeks. The rise was absolutely insane, mind-boggling—very far outside of normal stock volatility. Companies of this size do not go up by 17x regularly, which makes sense because the prospects for a company usually do not improve that rapidly. To give you some context, Moderna’s stock went from $20 to $70 when COVID hit and then roughly doubled when they announced the COVID vaccine, which adds up to 6-8x.

You are a person who watches and understands market and human behaviours. What’s the reason a stock goes up like that?

Usually a stock goes crazy because something really good happens for the company—like when Moderna announced it had a viable vaccine—or there is good news for the economy as a whole. And there was good news for GameStop, in that they brought some investors with digital expertise to the board and had a decent holiday season. But it’s hard to tie that price movement to any prospects for the business.

So what made the price go up?

The price went up because of a big group of what's known as retail investors—normal civilians who buy and sell stocks as opposed to people who work for hedge funds or other financial companies and do it for a living. These regular investors started buying both stock and options of GameStop. They were motivated first by a view that the fundamentals were better than the price would suggest, but more importantly by the view that as a group they could force other investors—namely, hedge funds who'd made bets that the price of the stock would go down—to buy shares at these higher prices. That's called a short squeeze. And then it started sort of feeding on itself; we all saw that this stock was going up, and so more investors—lots of retail investors and probably some professional investors—piled on.

The real losers will be the followers. They are probably the worst off. If you're trading based on what you read online or because your friends are getting rich, it's a pretty lousy strategy.

Let’s go back to the short squeeze. How did that work and what did it have to do with Reddit?

GameStop is a sort of boring company, a video game retailer with a network of physical retail stores. Some hedge funds had taken positions on it that assumed it was overvalued, so GameStop has been a popular, and very profitable, “short” among some funds. That means people were selling short by borrowing shares—if you borrow a share that’s worth $100 and when you close the loan it’s worth $50, you have made $50. These folks were essentially betting that the price would go down.

Late last year, some prominent investors, as well as posters on a subreddit called r/wallstreetbets, started arguing that GameStop actually might be a good buy because the business had a lot of upside relative to the price. Also, investors on Reddit thought that they could orchestrate a short squeeze. They would buy shares together, which would drive the price up, and the investors who were shorting the stock would have to buy those shares back to close their position, which would end up driving up the price of the stock even more.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

So, it seems all these retail investors started buying it at once. Some of them may have done this to force a short squeeze. It also may just be that the small investors were enjoying pumping up the stock together. It's likely that what happened was a combination of these reasons.

It’s that people just piled on and didn’t know what was happening that seems dangerous to me. The other folks were making a strange and probably risky bet. But if you're an investor who doesn't really understand what's going on and you just have FOMO, you could lose a lot of money and have no idea what happened. Is that right?

There are a few players with different roles here, and all of the roles are classic market roles. The difference is the use of Reddit to take the roles to an absurd level. But generically, each role makes sense as long as you know what you are doing and what the risks are.

The hedge funds that were short took a bet, and they knew the risks. There's an investing cliché that the market can stay irrational longer than you can stay solvent, which means that even if you have an idea that should work given fundamentals, the market price may deviate long enough, and by enough, that you run out of capital to keep the position open long enough to be proven right. There are books and economic papers written about this and what it means for securities pricing. What's extreme, though, is the scale of the irrationality, and it probably broke some of their risk models.

The investors who thought the stock was a good buy are also doing a reasonable thing. They see an undervalued stock and buy it, and in one case a prominent investor even joined the board to try to improve the company. Then they publicized their positions, which is also very common—when you see investors on financial TV, that is often what they are doing. I would guess that a lot of the folks in this category have been selling their shares, taking some profits, and cutting exposure.

Then there are the orchestrators of the short squeeze. In many ways, this is an old trading strategy. There are some really famous cases from the early 20th century that made this illegal. But it’s also not uncommon. They thought that they would profit from an increase in price when the shorts had to buy back the stock to cover their position, and they promoted it on Reddit. This is a risky strategy and an ethical and legal grey area but one that professional investors sometimes covertly use.

But their method of promoting the short squeeze—using a populist narrative and openly coordinating over the Internet in a decentralized way—is new.

And finally, yes, the real losers will be the followers. They are probably the worst off. If you're trading based on what you read online or because your friends are getting rich, it's a pretty lousy strategy. My hope is that some of them make a nice profit, and that the cost for people who lose won't be too steep so it serves as a kind of tuition as they learn about investing. In a sense, they are following an old, tried, and tested trading strategy called “momentum trading.” There are ways to do this and take risks you can afford. But if you don’t realize that you are momentum trading, if you're not systematically limiting your exposure as you profit, you can get hurt. I worry that many investors are in this category. Also, if these stocks start to crash, it may be very, very hard to sell, simply because there will be no buyers on the other side. So even if you decide to get out, the price could drop very quickly.

The popular stocks for individual investors tend to be lousy investments on average, but some individual investors also consistently outperform and make money.

Recommended for you

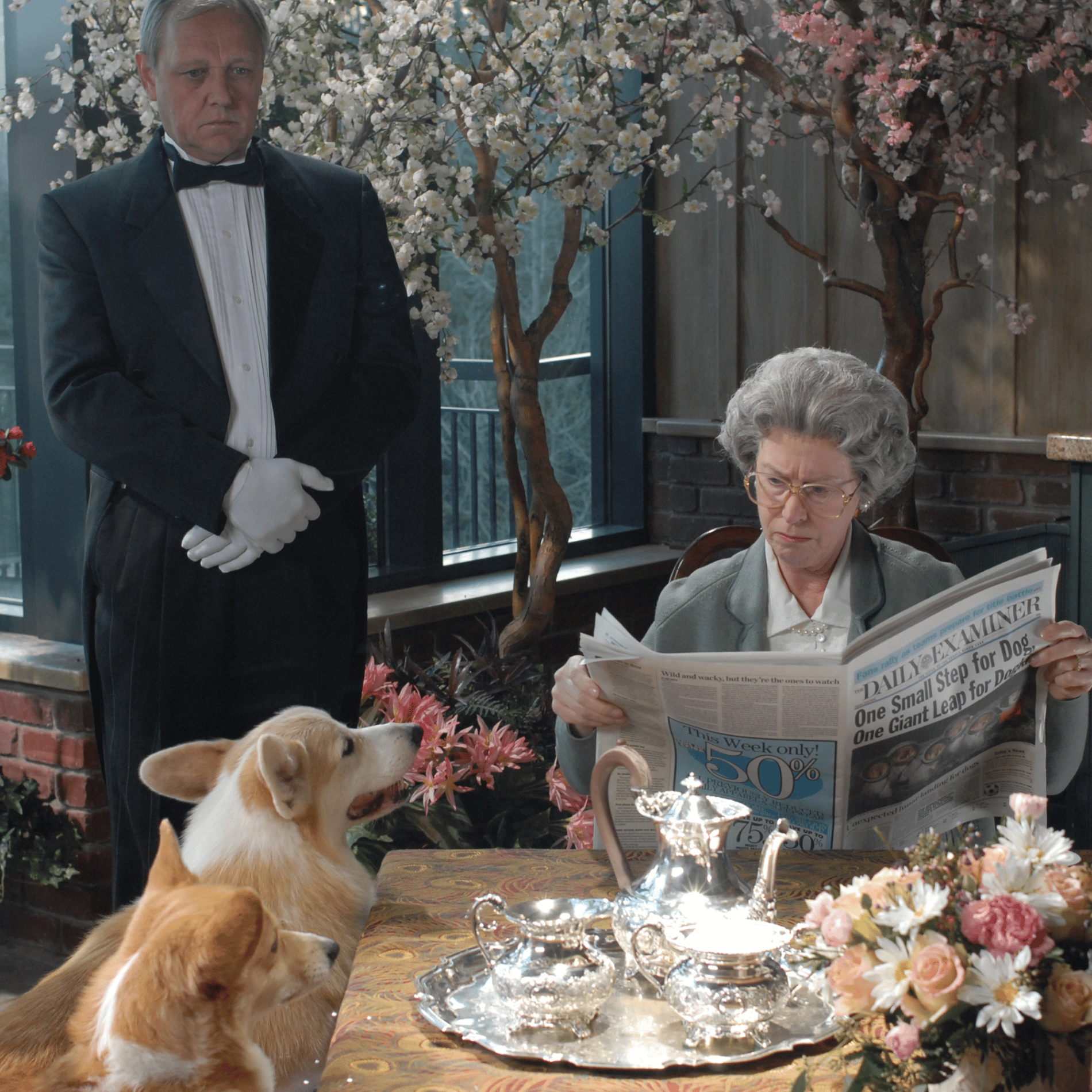

Dumb Questions For Smart People: Why Parenting Inequities Make Mothers Leave the Workforce

Money & the World

The Most Compelling, Surprising, and Delightful Ideas of 2025

Money & the World

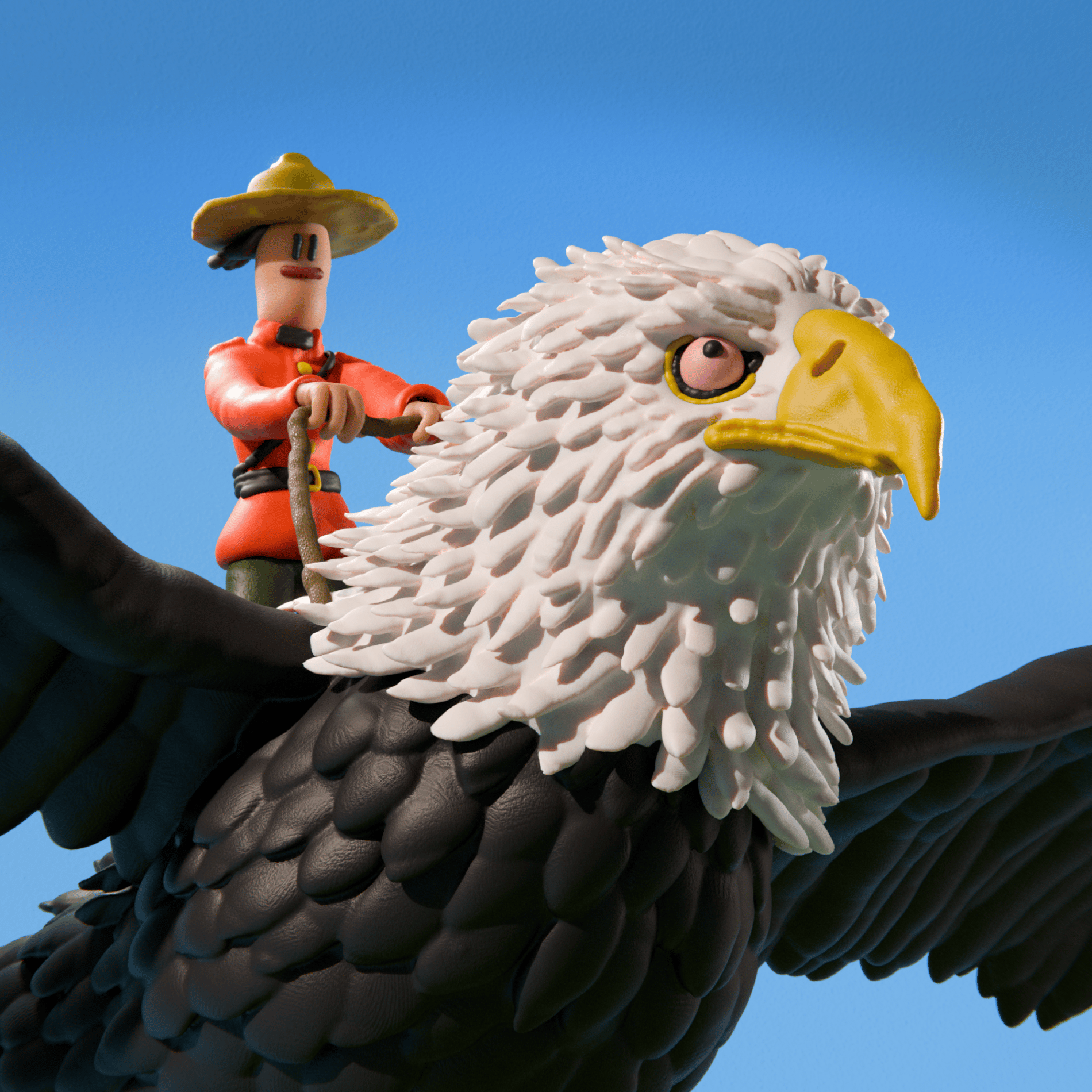

Canada’s Super-Secret Plan to Soar Past the U.S. Economy

Money & the World

How to Consume and Discern Information in Our Slop-Infested World

Money & the World

So if you’re one of the GameStop “followers,” what should you be learning?

OK, a couple of things. The first is about position sizing. If you are putting money into an investment and don’t understand the huge range of possibilities of what could happen, that’s a really bad thing. If you are putting in money you can't afford to lose because you need it to live, that's really bad investing. If you don't know what your edge is as a trader and you're not testing that quantitatively, that's bad. If you have a disproportionate amount of your money in a single stock, I would be concerned for you. If your position is small and you are doing this for fun, I'm not too worried, even if you don't have a great trading strategy.

I think the second lesson is: know what you are buying and why. Is “I am buying because the stock has gone up a lot” really your trading strategy? And if so, is that a viable and repeatable one? I’d argue it isn’t for most individual investors. Either way, the other question is: do you have criteria for when you will get out?

I think every investor learns the most by making mistakes and losing money. I know I have. And as you get better at investing, you get more humble and see the range of what could happen, what you don't know, how wrong you can be. That makes you start taking risks that you can afford to take and sizing positions so that you won't lose too much in a really bad scenario. Hopefully it will eventually be a learning experience that's not too expensive.

This all reminds me of a way of investing that is not at all new and that a lot of retail investors engage in—buying something because it’s buzzy or popular. I know that a huge proportion of retail investors trade a very small number of buzzy stocks. Is that a problem?

The popular stocks for individual investors tend to be lousy investments on average, but some individual investors also consistently outperform and make money.

The historical data are pretty clear that individual investors who trade actively tend to underperform on average, and they underperform by overbuying risky, low-quality stocks and by buying and selling at the wrong times. We see this in the data with our Trade clients. And I’d also note that Trade clients, as a group, tend to underperform even our most conservative investment strategies (except this past month, their performance has been phenomenal).

I think in explaining why this is gets you into the realm of storytelling, and my best answer is I don't know. One school of thought is that people tend to invest in things they know about because of a perceived informational advantage that they don't have. Another is overconfidence—just as everybody thinks they are an above-average driver, a lot of people think they can pick a winner. And a third is sensation-seeking—so, stock trading as gambling; these investors prefer lottery stocks and so bid them up relative to a fair value, which lowers returns.

Commission-free stock trading

WEALTHSIMPLE TRADE

Commission-free stock trading

Wealthsimple Trade makes it easy to buy and sell thousands of stocks and exchange-traded funds.

So your advice as a professional is to get way more boring.

Yes. I’d say that’s right.

Our history is replete with speculative bubbles. What makes this one different?

I think the difference here is that you have a loosely coordinated group of people challenging an institution with their money and using distributed mass-communications technology to coordinate. There's sort of a middle finger at institutions that's part of this, which I think is new.

And what about this is not new?

What's old is that people are buying based on a belief that other people will buy rather than what they think will happen with the company or industry. That's classically how bubbles work.

This is being framed as a kind of storming of the gates. The argument is that hedge funds are allowed to behave in ways and have advantages that regular retail traders who use stuff like Wealthsimple Trade can't. And they get bailed out when they get in trouble. As someone who used to work for the biggest, fanciest hedge fund in the world, how valid do you think that is?

I would frame it a little bit differently, but I think there's an insight in your question in that this is about power. I would put it in the context of populist backlash to a system that has given richer people the advantage that regular people don't have. In the past 40 years, there's been a real shift, at least in the United States, to make the rules of the game favour capital owners in the form of more deregulation, lower taxes, and globalization. That's increased the returns to financial assets.

I like a head of investing who is at least a little anti-capitalist!

I am definitely a capitalist, and if you look at the improvements in people’s lives since the 18th century, the case for capitalism becomes pretty clear. But there are also competing groups within society, and that can get out of balance, so I also think reforms are important—for example in the United States there were a lot of progressive reforms in the early 20th century that I think made the system better, and there have been many important ones since.

But what adds to this phenomenon right now is that we’re at a point where interest rates are at zero and the government is stimulating the economy through quantitative easing, and while that helps the economy, it also disproportionately helps rich people by inflating the value of financial assets. If you are working for your money and don't already have capital, you don't get to take advantage of that. So there is some anger there. Then you add in that the government bailed out the systemically important financial institutions in 2008 but didn't bail out individual debt holders, and it feels like the system is favouring the rich. And that's great motivation to give the rich institutions the middle finger if you can figure out little corners of the market where you can have power.

So in some ways it makes more sense as a kind of disruptive protest than it does as an investment.

You could say that. If you drive up the price and get out before it crashes, it's a good trade. You see people in financial TV or on Twitter doing this regularly. But you only make money when you get out before everybody else does. The sad part about this method of protest to me is that it will mean that most of the less informed, less powerful investors will be the ones who lose a lot of money.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.