Money & the World

How 2023 Cracked Wall Street’s Crystal Ball

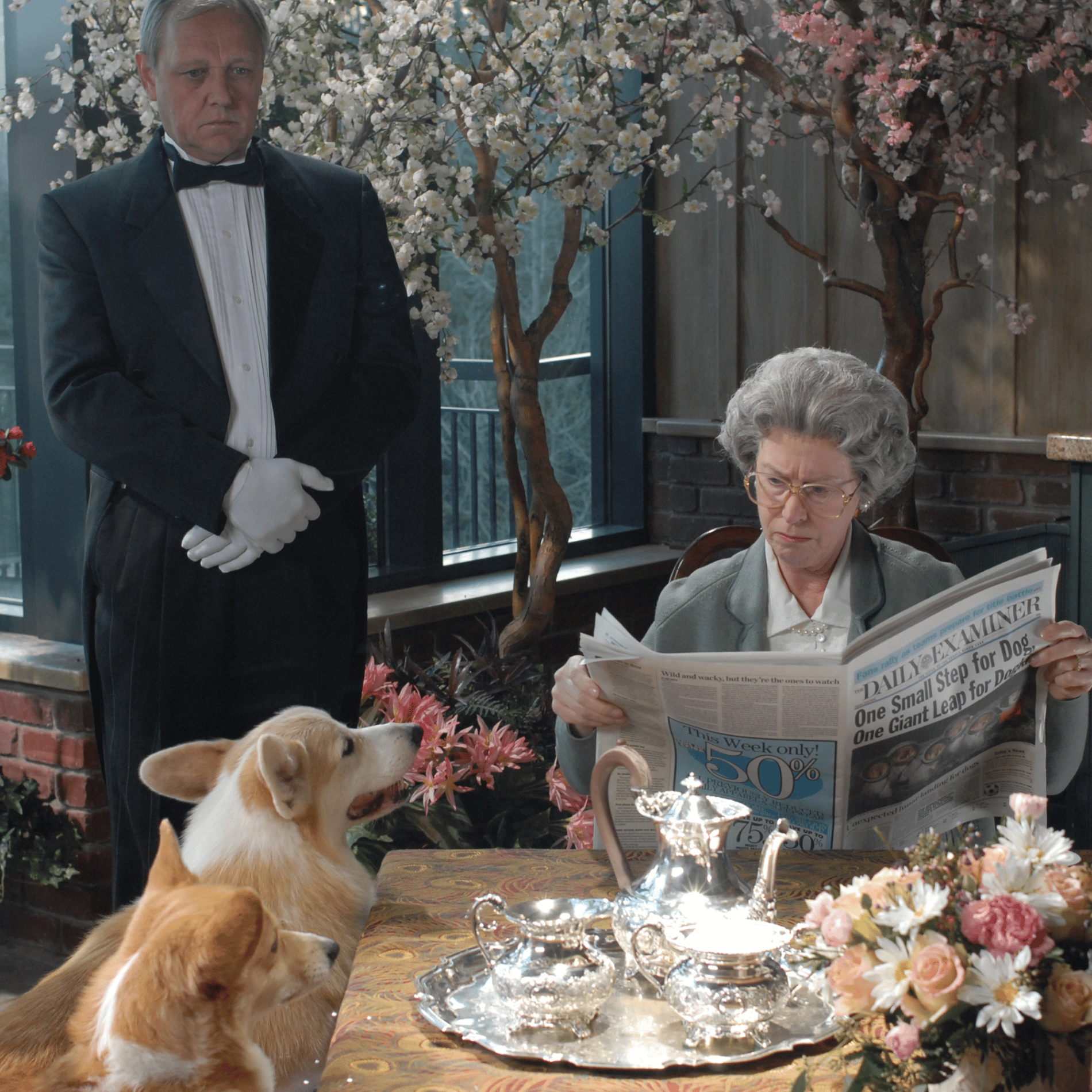

We asked Kyla Scanlon — a writer, video creator, and podcaster (surely you’ve seen her financial explainers on social media, right?) — to unpack why pro investors guessed all wrong about what would happen this year.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Imagine you have a crystal ball that can glimpse the future. Now imagine that crystal ball rolls down a hill, hits some rocks, splashes into a river, pops out over a waterfall, and magically rolls back to your feet. The crystal ball might still work, sure, but it’ll probably be damaged and everything inside will look murky. That’s not unlike what happened this year in markets. Surging oil prices, wildfires, a China slowdown, economic storm clouds retreating and reappearing: these unforeseen events clouded Wall Street’s and Bay Street’s yearly forecasts. And, as a result, nearly everything that professional investors expected at the beginning of the year — a recession! layoffs! — hasn’t come to pass; that, or the complete opposite thing has happened. The bad predictions began in January and have continued into autumn, with stocks unexpectedly sliding in recent weeks and inflation worries resurgent. So, why have pro investors been so wrong? Some of their biggest missed predictions help answer that question:

PREDICTION: People Would Stop Spending, Causing a Recession

What happened: If you raise interest rates a lot, as central banks did in 2022 to battle inflation — making it much more expensive to borrow money and simply to be alive — people will stop buying stuff and the economy will slide into a recession, right? That’s what pro investors assumed heading into 2023; economists put the odds of a recession at 60% for Canada and 70% for the U.S. And no wonder. Mortgage rates were near 5%! Excess savings from COVID-19 were being rapidly depleted! But what actually happened was that Canadians and Americans kept spending money — a lot of it — on TSwift tickets, on travel, on entertainment, on everything.

PREDICTION: There Would Be Mass Layoffs

What happened: In January, Wall Street was convinced that unemployment would shoot up if consumers stopped spending money, which would further dampen economic growth, creating a negative feedback loop of increasingly soft demand and more pink slips. But, partly since spending stayed strong, the labour market boomed. The job market was so tight that employers boosted pay to fill openings, and real wages finally rose. In fact, jobs were so plentiful that workers felt comfortable enough to demand better pay and working conditions, sparking a series of high-profile strikes — a sign, in their own way, of labour-market strength.

PREDICTION: Inflation Would Stay High/Inflation Would Keep Falling

What happened: Adding to the economic tailwinds, inflation fell far faster than expected, sliding from a high of 8.1% in 2022 to 2.8% in June. Some economists argued that this so-called immaculate disinflation stemmed not from rate hikes but from an increase in the supply of goods. Either way, the BoC and the Fed shrugged their shoulders and said, “Okay, good job then, everyone,” and paused their painful rate-hike path and said there wouldn’t be a recession after all. So investors changed their forecasts, predicting that central banks would cut interest rates, perhaps as early as December of this year. Wrong again: last month, inflation surprised everyone, coming in hotter than expected. So investors revised their forecasts again, betting the first rate cut would come well into 2024 (if it comes next year at all).

PREDICTION: Stocks Would Tumble … or Go to the Moon?

What happened: All the good news we got this summer fuelled an unexpected stock rally. The S&P 500 surged by 8.7% in June and July, while the TSX popped about 5%. Nvidia shares soared by 25% in a single day! But stocks didn’t shoot all the way to the moon as many investors hoped. That’s because if rates do, in fact, stay higher for longer, that will weigh on stocks, and that possibility has thrown cold water on the rally. The S&P 500 and TSX have slid by nearly 5% over the last month. Surprise after surprise (though, to be sure, drawdowns are so common they probably shouldn’t surprise us at all).

WHY WAS WALL STREET SO MISTAKEN?

One reason pro investors were so wrong is because they’re usually wrong. Analysts largely failed to predict the five big swings of the S&P 500 over the past 15 years. More specifically, though, COVID upturned much of what investors thought was true about the economy, and their trusty models weren’t built for the weird new world that COVID created. “Most economic models do not treat the economy as an evolving thing, undergoing constant change,” The Economist explained not long ago. “They instead describe it in terms of its equilibrium: a stable state…” And this economy is anything but stable. Implausibly strong consumer demand isn’t something you can predict, nor is the slowdown of a global power, nor is immaculate disinflation. And since there are still a lot of open questions about the near future — Will oil prices keep inflation stubbornly high? Will the BoC hike rates in 2024? How will the labour market fare? — the world might have a few surprises left for us yet.

Kyla Scanlon is a creator, the founder of the financial education company Bread, and author of the book, "In This Economy?: How Money & Markets Really Work".