Money & the World

2022: The Year We Said Farewell to FOMO

In the past twelve months, memestocks exploded, crypto collapsed, and the major stock indices slid. Felix Salmon makes sense of the market craziness and explains how — we actually got kind of lucky?

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

This article originally appeared in the December 19, 2022, edition of the TLDR Newsletter.

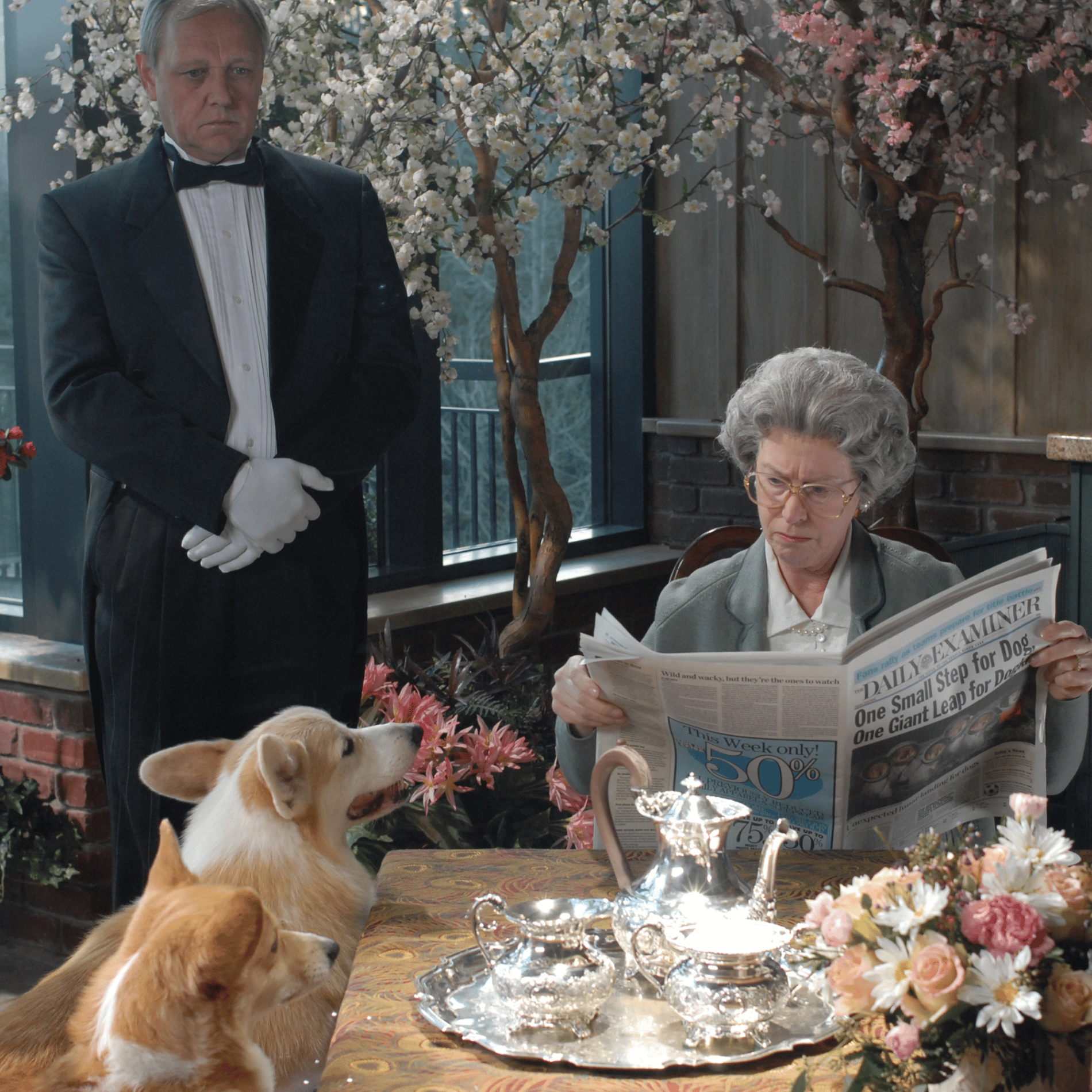

A year ago, FOMO was everywhere. Wall Street traders feared they were missing out on crypto. Crypto diehards feared they didn’t own enough NFTs. And NFT collectors feared that, by loading up on monkey jpegs, they might miss their chance to ride Rivian to the moon. Those of us who sat out the frenzy could hardly blame anyone who got swept up in it. The S&P 500 recorded 70 closing highs last year, and 171 Canadian companies went public, raising a record $10.2 billion. A Bored Ape Yacht Club NFT sold for US$3.4 million.

Then the calendar flipped to 2022, and the world changed. Russia invaded Ukraine. Inflation soared. Interest rates rose. The memestocks imploded. The vibes shifted. And, one by one, the pandemic-era highfliers fell to earth: Peloton, Netflix, Zoom, NFTs, cryptocurrencies. Even U.S. Treasury bonds, commonly considered the world’s safest asset, saw a record slump.

One by one, the pandemic-era highfliers fell to earth: Peloton, Netflix, Zoom, NFTs, cryptocurrencies. Even U.S. Treasury bonds, commonly considered the world’s safest asset, saw a record slump.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

As of October 1, global stocks and bonds had lost US$36 trillion, with a t, in value. (Assets have only slightly recovered since.) The remarkable thing is not so much that a bust followed the boom — no bull market lasts forever — but rather that the downturn hasn’t sparked a widespread calamity in Canada or in the U.S. Certainly there’s no sign of mass home foreclosures or failing banks, like we saw in 2008. Why not? For one, the average trader who swan-dived into the GameStop ($GME) frenzy last January was a 34.5-year-old male who earned a cushy US$86,000 a year. A Venn diagram of these to-the-mooners and the average crypto trader would almost be a circle. Tomayto, tomahto. These speculators were playing a massive multiplayer game with money as much as they were investing in the classical sense of the term. And they risked their money with their eyes open, since many had previously traded speculative stocks. They knew that they could suffer huge losses, and most $GME latecomers did.

Some might have regretted the whole thing. Yet the fun many of these YOLO traders had more than made up for their dismal returns. It was for the lulz. It’s no shock, then, that, after a bloodbath of a year, Redditors and crypto bros, as a rule, don’t have their tails between their legs: they’re tweeting about Bitcoin and Ethereum almost as much as they ever have, and they’ve kept $GME up more than 2,000% from early 2020, despite the company having lost billions.

Recommended for you

Fortunately for the rest of us, the pain caused by the bursting speculative bubble has been narrowly circumscribed. Researchers have found no evidence of contagion in the stock market from the $GME mania; only one hedge fund, Melvin Capital, landed in real trouble. Similarly, FTX’s collapse has spread no obvious hurt into traditional finance, since most big banks (smartly, in retrospect) avoided the space.

Zoom out to average investors — to us normies — who didn’t jump into the frenzy: few are thrilled by the declining markets, of course, but many remain cautiously optimistic. (Why else do we keep piling into stocks at any hint of cooling inflation?) The relatively rosy vibes at least partially owe to the fact that, while stocks have fallen, they haven’t fallen that much. This year’s losses leave the S&P 500 up 15% from February 2020 and the TSX 60 north 10% over the same period (with the latter down a mere 8% YTD). The 2022 drop was significant, to be sure, but the fact that it wasn’t worse is pretty impressive, given that the world is reeling from the worst global pandemic in a century and the outbreak of war in Europe and broad inflationary unrest.

For a market decline to really sting, it needs to be accompanied by a recession, mass layoffs, and a sharp hit to earnings. We haven’t seen any of that yet. But there are legions of doomsayers (many pro investors among them) who suspect that we will soon. If they’re right, it’ll likely be because stubbornly high inflation necessitates more jumbo rate hikes. That, in turn, could accelerate job losses and force people who are out of work and cash-strapped to sell their stocks and other assets. Or it could just freak out people enough to sell. Either way, the pain would spread. To avoid such a scenario, the Federal Reserve and the Bank of Canada need to pull off a so-called soft landing — that is, avoid a recession while steadily pushing down inflation. (There’s some evidence that Wall Street thinks they might just succeed.)

What if the central banks fail? So far, the end of the FOMO era has helped those of us who didn’t chase moonshots feel a tiny bit better about our comparatively small losses. If the doomsayers are right and the economy does tip into a recession, we may stop feeling so ahead of the game. But history suggests that the boring things that kept us from taking big risky bets last year — discipline, diversification, steadily investing over a long period — will again carry the day.

READ MORE: “GME, Doge, Supreme: How Getting Rich Went Full Internet,” by Felix Salmon

Felix Salmon is the chief financial correspondent at Axios and host of the Slate Money podcast.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.