Money & the World

The Racial Wealth Gap Is a Problem

Wealth isn't just the money you earn at work — it speaks to the financial history of a family and a people. And our history is fraught.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

A lot of people know a thing or two about income inequality, and for good reason — it is longstanding, growing, and economically and socially destructive. But the wealth gap is arguably a much bigger deal. Why? Not only is the wealth gap — aka the lopsided, inequitable distribution of assets among populations — rooted in centuries of discrimination and racism, it limits people’s potential economic outcomes. Because having less wealth means worse credit scores, higher student loans, and less financial stability for generations to come. This is a topic that’s important to us at Wealthsimple, because democratizing wealth and enabling Canadians to have financial power underpins everything we do.

So how big of an issue is the wealth gap in Canada (and America)? We broke it down in five snapshots.

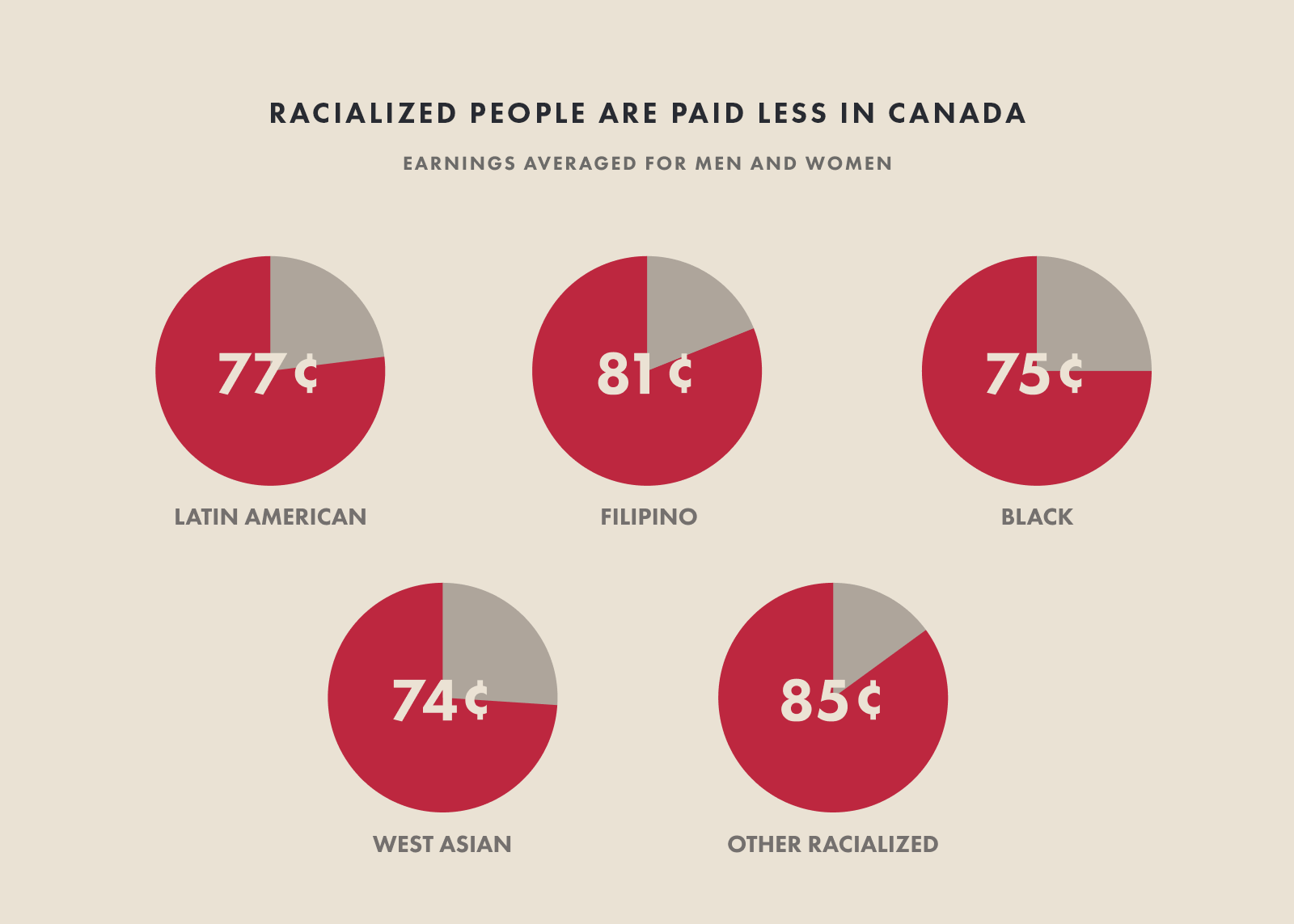

Part One: The Racial Wage Gap

Source: Canadian Centre for Policy Alternatives

A report by the Canadian Centre for Policy Alternatives shows that, for every dollar a white worker earns, a racialized worker tends to make far less. Which has long-term effects, because even a small disparity in wages can limit one’s ability to save and invest — exacerbating the wealth gap over time, thanks to the power of compounding.

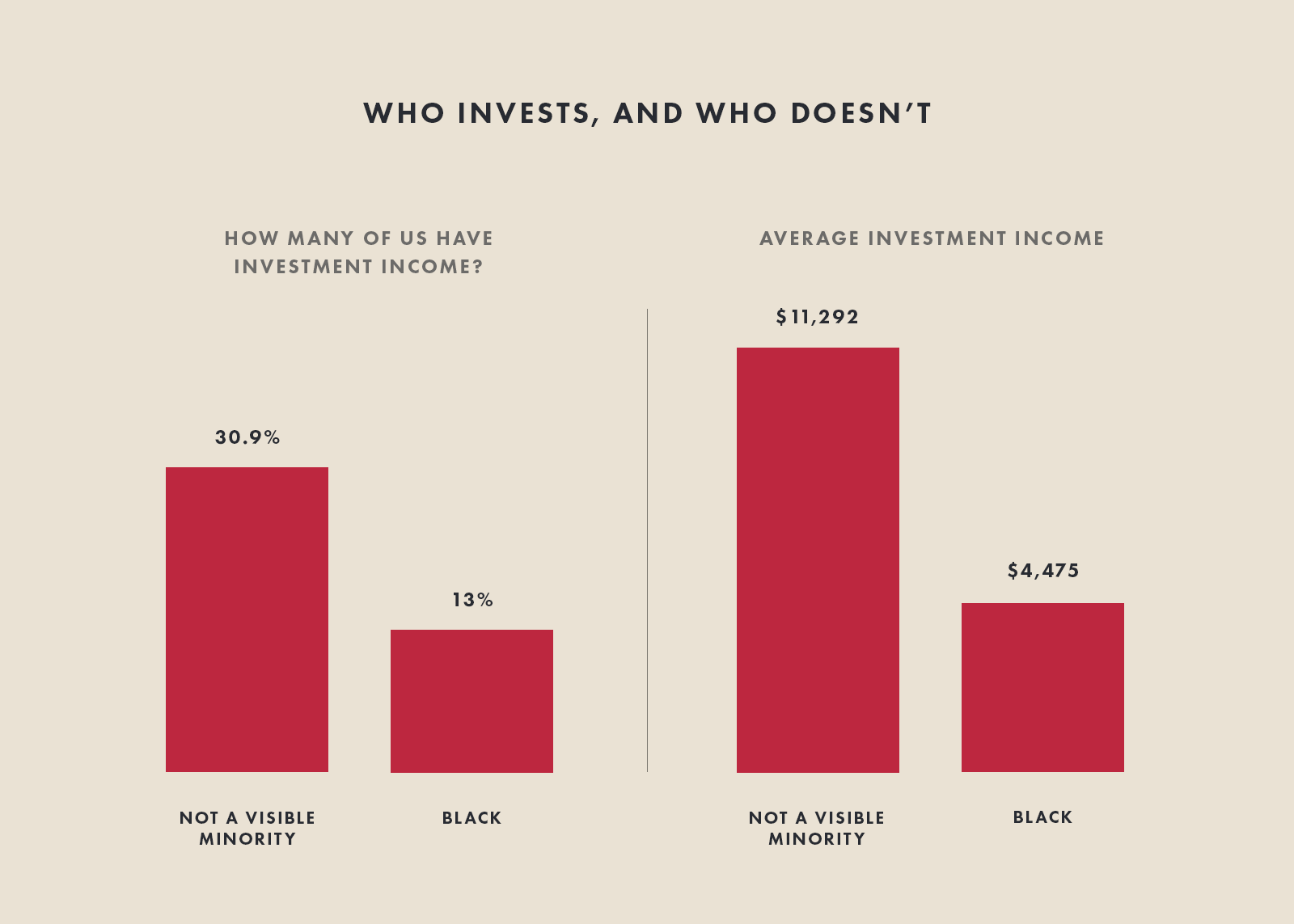

Source: Statistics Canada, 2016 Census

Investing is one of the main tools for building wealth in Canada, since it allows your money to work for you even when you’re not, yourself, at work. The disparity between Black populations and non-visible minorities (which includes white people but also Indigenous groups) who have investment income speaks to which populations have enough disposable income to invest, and which have access to educational resources to learn the benefits of investing and how to do it effectively.

Part Two: The Net Worth Gap

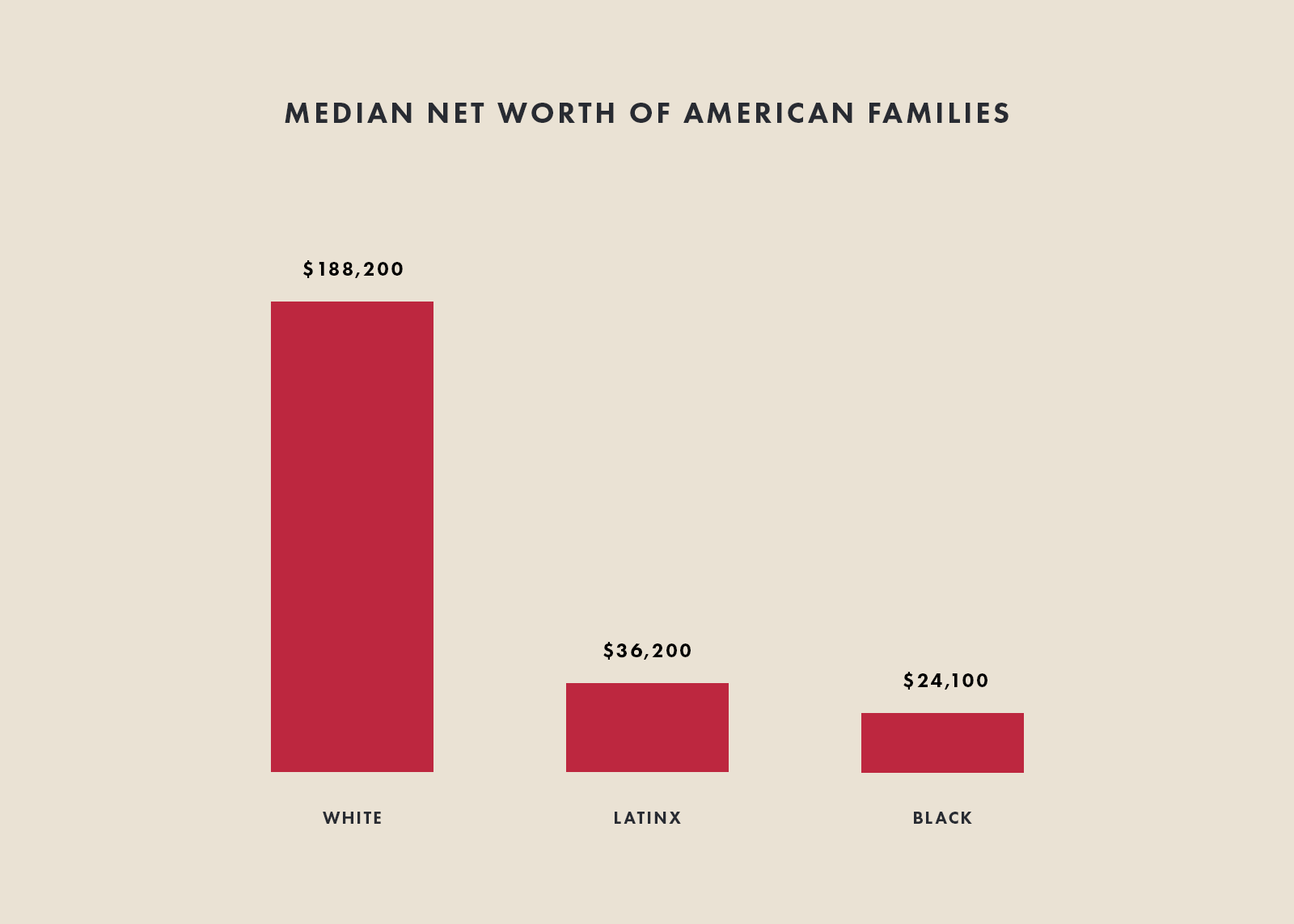

Source: Board of Governors of the Federal Reserve System, Survey of Consumer Finances 2019

Net worth is a family’s total amount of wealth — including savings, equity in real estate, retirement accounts, possessions, etc. In 2019, the latest year numbers were available, white families in America had a median net worth of $188,200 USD, nearly eight times that of Black families, and five times that of Latinx families. COVID-19 has, by all accounts, hit racialized families harder than white ones (more on this below), so the disparities in net worth have almost certainly grown more extreme. (Statistics Canada doesn’t publish comparable data, hence the U.S. numbers.)

Part Three: The Retirement Savings Gap

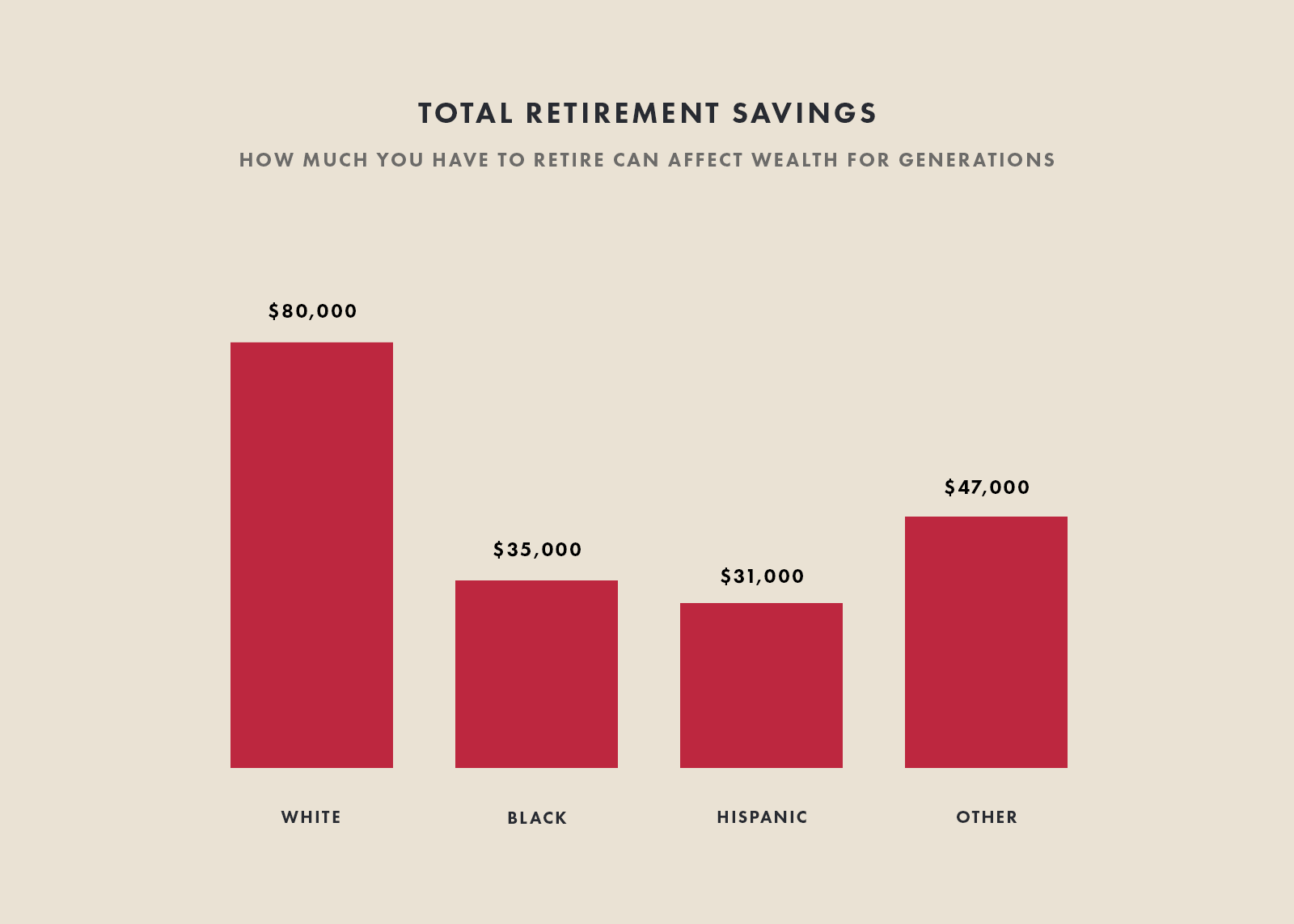

Source: Board of Governors of the Federal Reserve System, Report - Economic Well-Being of U.S. Households in 2020

Retirement savings accounts are hugely important, because this money not only helps people stop working without becoming destitute, it also relieves their family from the financial burden of caring for them. And that, in turn, allows younger generations to invest and save more of their income and build greater wealth. The above chart shows the median total savings for retirement by white, Black, Latinx, and other visible minorities in the U.S. Statistics Canada doesn’t provide comparable data — though we’d expect similar figures — but it does track annual income among the elderly. Keep scrolling.

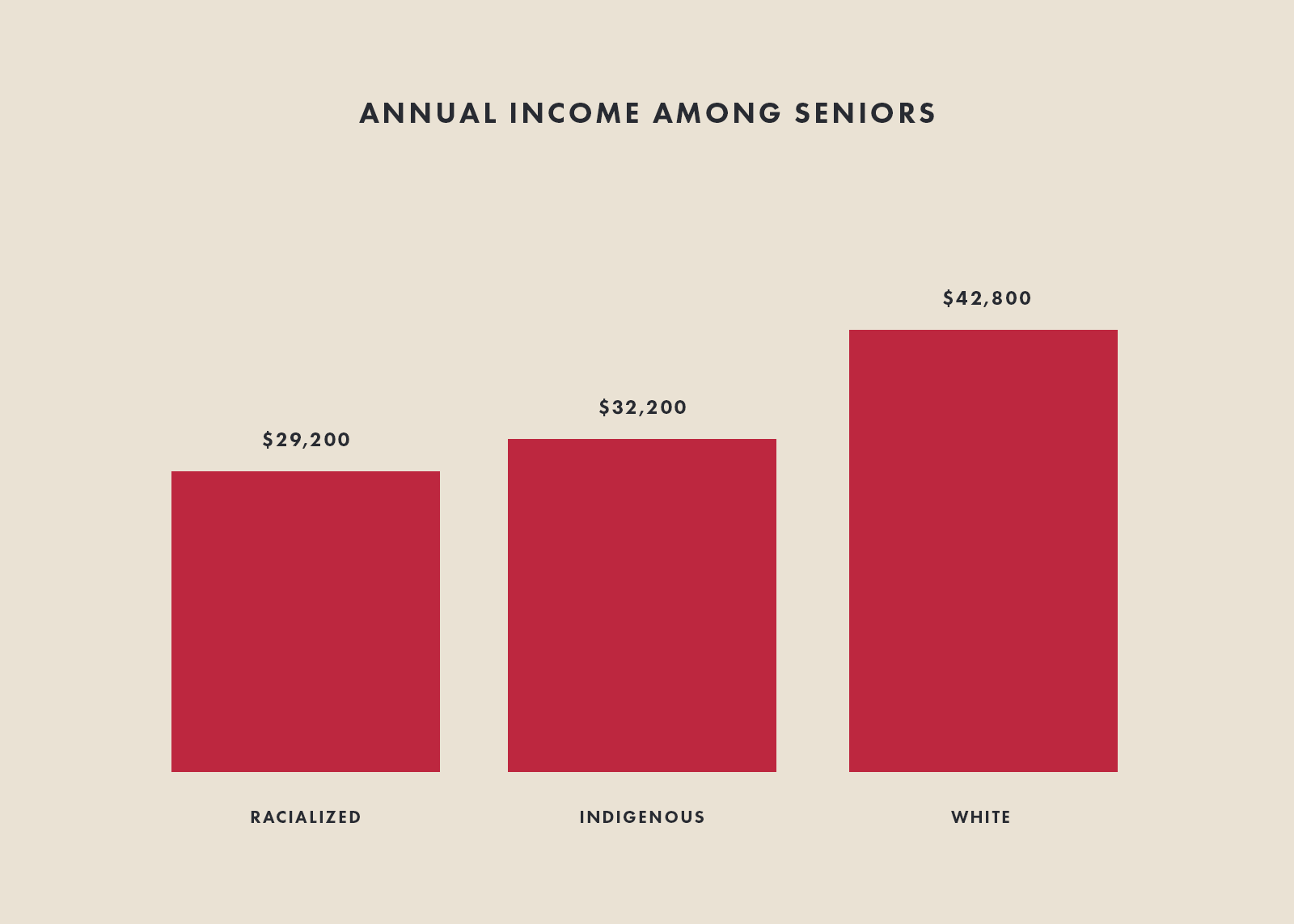

Source: Canadian Centre for Policy Alternatives, 2021 report on retirement income

According to the most recent data available, the average income of Indigenous seniors and racialized seniors in Canada is 25% to 32% less than that of white seniors. This largely owes to the fact that Indigenous and racialized workers are able to contribute less money to RPPs and RRSPs throughout their careers than generally better-paid white workers, leaving the former with less money in old age. Indigenous and racialized seniors also have less investment income than white seniors.

Part Four: The Generational Wealth Gap

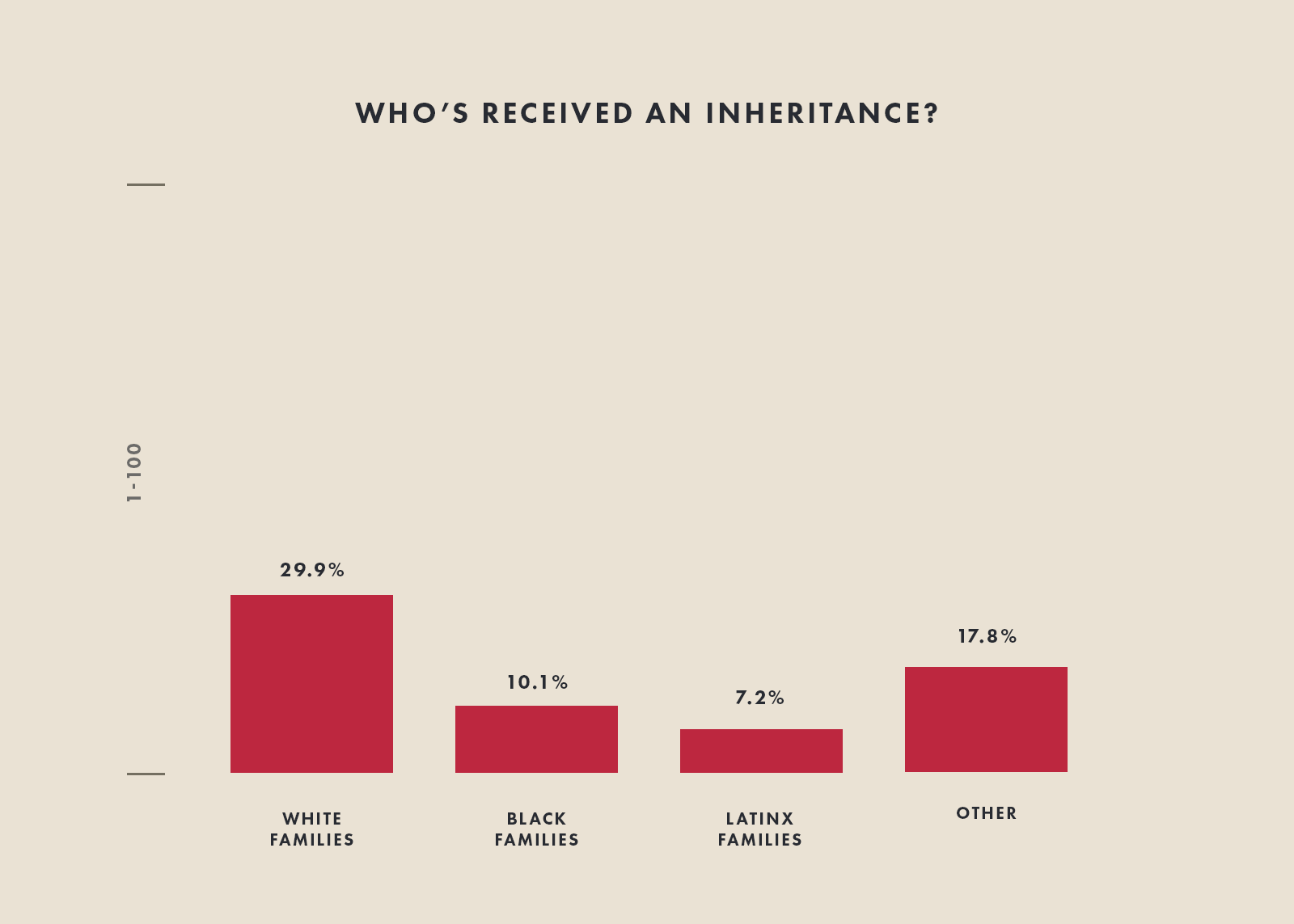

Source: Board of Governors of the Federal Reserve System, 2019 Survey of Consumer Finances

A big part of wealth accumulation is how it passes from generation to generation. White families in the U.S. are nearly three times as likely to receive an inheritance as Black families. (Again, no comparable data on Canadian families was readily accessible.) And the racialized families who do expect an inheritance anticipate it’ll be smaller, at around $100,000, than the ones received by white families, who expect $195,000.

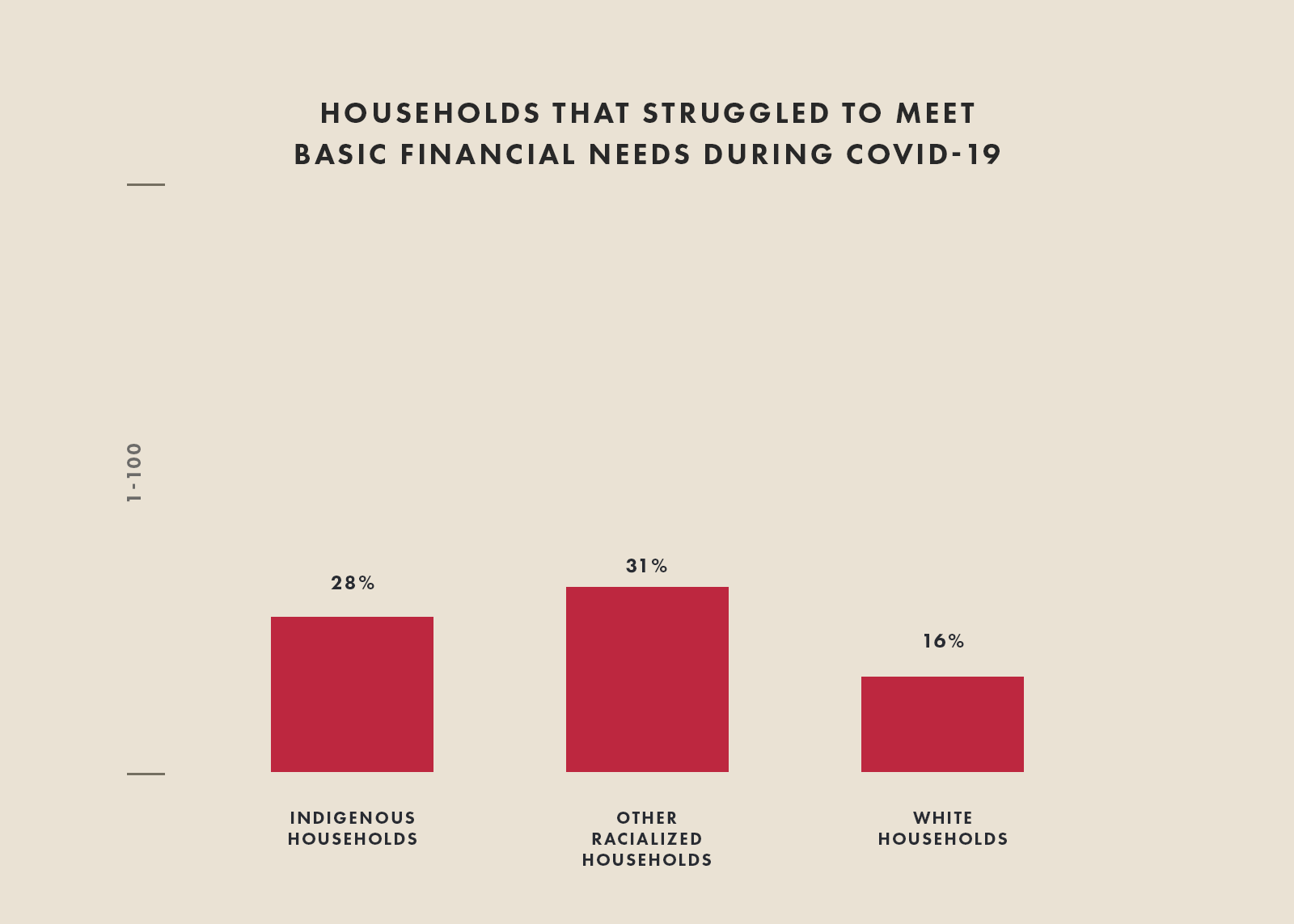

Part Five: The Pandemic Effect

Source: Canadian Centre for Policy Alternatives, 2021 report on COVID-19 labour market impacts on Indigenous and racialized workers in Canada

Indigenous and other racialized workers tended to face more severe economic hardships from COVID-19 than white workers did, no doubt worsening existing wealth gaps. Why? Racialized workers, for one, are more likely than white ones to hold jobs in the food-service, recreation, or retail industries — which together suffered 80% of all job losses at the outbreak of the pandemic. As a result, between May 2020 and June 2020, 34% of white workers reported job losses or reduced work hours thanks to the pandemic, while racialized groups reported as high as 47% unemployment or reduced hours during the same time.

Closing the Gap

The reality of the wealth gap is that centuries of discrimination have led to a deeply unequal concentration of assets — and fixing it will demand transformative thinking from our government and the private sector. But there are some steps that individuals can take. No matter your race, you can start by having open discussions about things like money, salaries, and investments with your colleagues, friends, and family. If you’re a privileged white person, for instance, a racialized coworker might have zero idea that they makes less than you for doing the same job unless you’re transparent about how much you earn. Obviously, use tons of tact when having such conversations. But being open about money can give racialized colleagues ammo to push for fair pay, or signal that it might be time to look for opportunities at a more equitable workplace. You can also encourage friends to look into Canada Learning Bonds for their kids. Post-secondary education is key to breaking cycles of generational poverty, and Learning Bonds go a long way in helping families save for school. Then there are groups like the Black Wealth Club, which aims to maximize the potential of future Black business leaders in Canada through mentorship programs, seminars, and community building.

The list goes on. But perhaps the most effective way for individuals to confront the racial pay gap is not to, you know, pay people less based on the colour of their skin. If you’re a hiring manager or in a leadership role at an organization, scrutinize your pay policies and practices and look for ways to address unconscious bias. Because it almost certainly exists where you work.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.