Money & the World

What Does it Mean to be a “Millionaire” Now?

It used to mean “super rich." But does having a million dollars make you actually rich in 2018? What does a million dollars buy? We decided to find out.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Millionaire. It's a word with some cultural power. And a lot of history when it comes to being an indicator of status, financial freedom, and the ability to burn hundred dollar bills just for fun.

Because somewhere along the way “millionaire” became shorthand for “rich.” Like, not just upper-middle-class, not merely comfortable, but actually rich. It meant, I made it, and everyone who ever doubted me is probably really really sorry. That's why they called it “Who Wants to be a Millionaire” instead of “Who Wants to be a Thousandaire.”

But we had questions: what does being a millionaire mean now? How much does a million dollars buy you in 2018 compared to, say, the 80s or even the 90s, which in some ways seemed like the formative era of millionaire-ism — when a million dollars was attainable enough to seem possible, but still a pretty fantastic notion. For instance: in 1993 the film Indecent Proposal came out, so apparently $1 million was such a bonkers amount of money that it would be hard to turn down a proposal so completely indecent from Robert Redford.

Not to mention maybe the most important question: what's the conceptual economic underpinning that renders a million dollars worth so much less now than it was worth twenty years ago? And how do we fight against that powerful force so our money doesn't become worthless?

So we set out to answer these important millionaire questions.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

How much is a million dollars worth now?

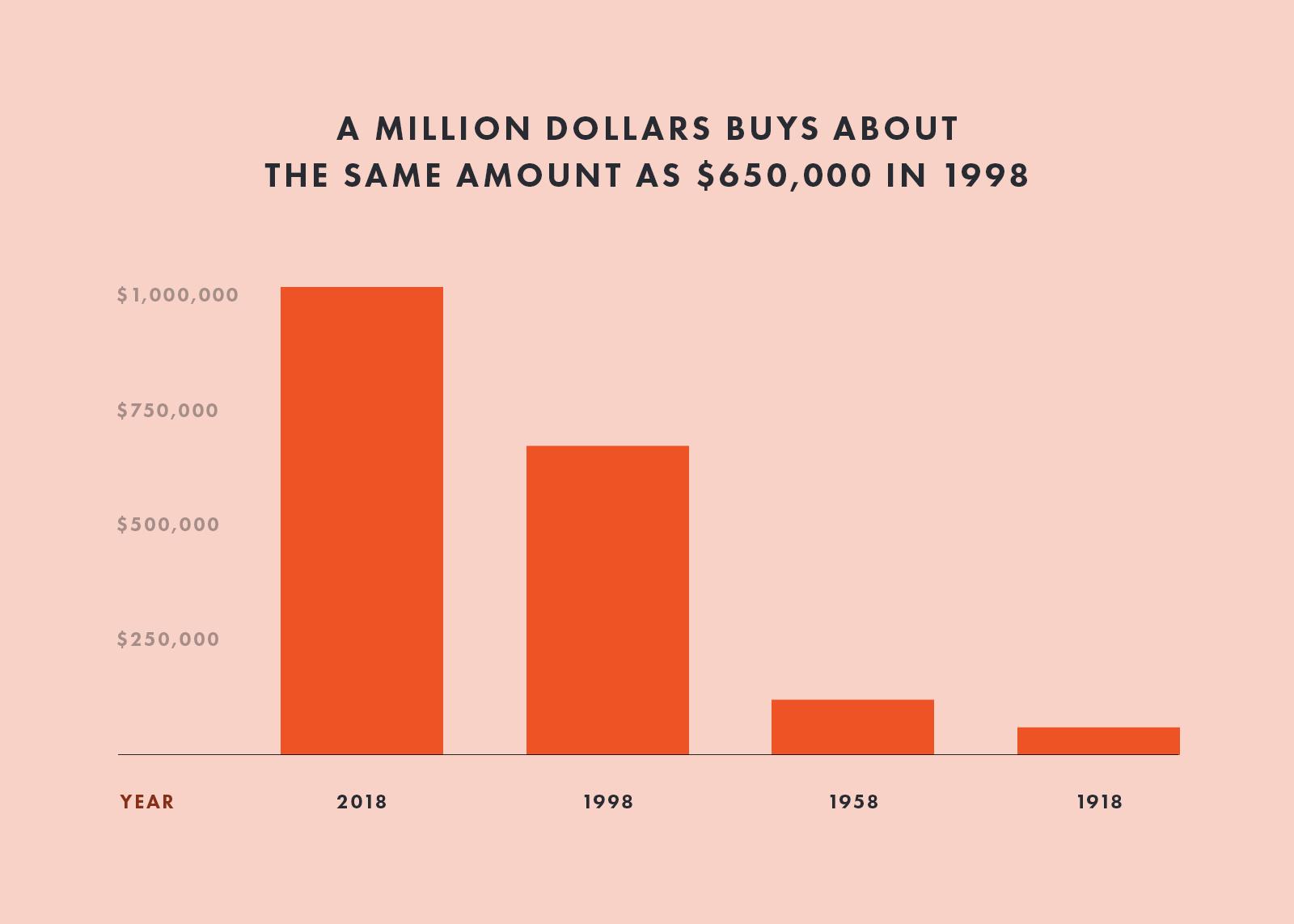

The answer to that is, of course, it's all relative. By which we mean: relative to how much things cost. A million dollars today buys a lot less than it used to. Here's an illustration of how the value of $1,000,000 has dwindled.

Source: LINK

Another way of saying it is: if they remade Indecent Proposal now, and Robert Redford offered a million dollars, it would be like offering about $575,000 in 1993, when the original was made — which seems like a way more indecent proposal.

So if you have a million dollars now, and you made it all on your own, you deserve immense congratulations. But you should probably put away the top hat and monocle and refrain from popping bottles of Dom, because of a little thing called inflation. And because, you know, it’s Wednesday.

So what's with the value of money going down? It sure seems like the world is moving the goalposts when it comes to being filthy rich.

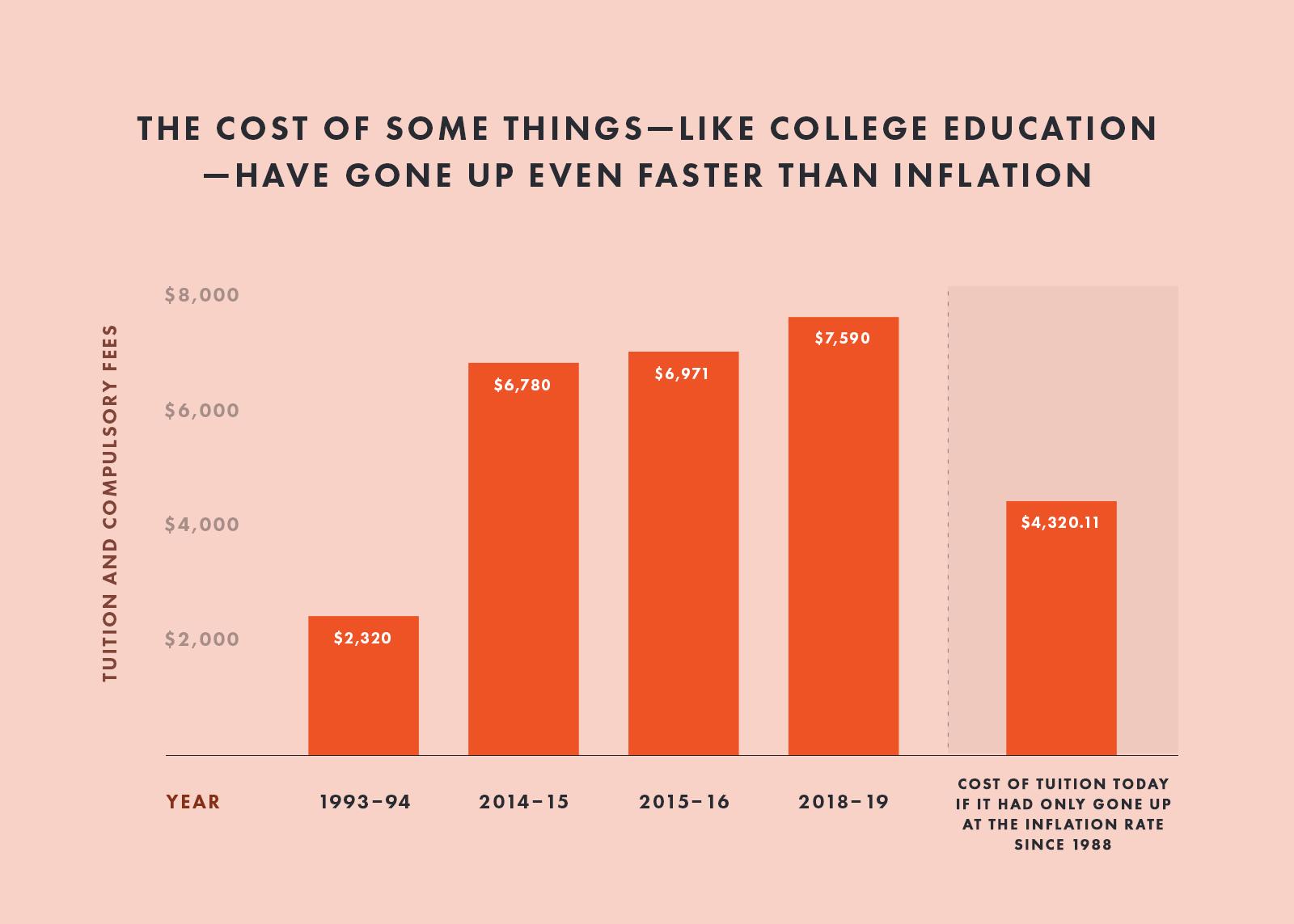

It is. Because of inflation, which has been between 1-2% recently, but has been much higher in the past. And that's just the average increase in prices — some things increase in cost even faster. Like medical care and a college education:

Source: LINK

The important thing to know here is that inflation isn't a glitch. It's the way our economy is supposed to work. The world's major central banks all believe that a small, persistent and predictable amount of inflation is helpful to make the economy function. It helps prices adjust to changing supply and demand. It also encourages people to buy things faster (if you know that the price of something is probably going up next year, you're more likely to buy it now). It also lets companies cut wages without actually cutting wages — if you keep paying someone ten dollars an hour, but ten dollars buys less, you're essentially paying them less. Governments think this helps the economy work more smoothly so they use the tools they have to keep inflation at the rate they want it — usually by adjusting interest rates.

The important thing to remember here is that inflation makes cash worth less and less. The only way to keep your million dollars from going down in value is to use it to make riskier investments.

Recommended for you

Canada’s Super-Secret Plan to Soar Past the U.S. Economy

Money & the World

The Racial Wealth Gap Is a Problem

Money & the World

What’s Up With All Those Crypto Laser-Eyes Profile Pics? A Definitive Investigation

Money & the World

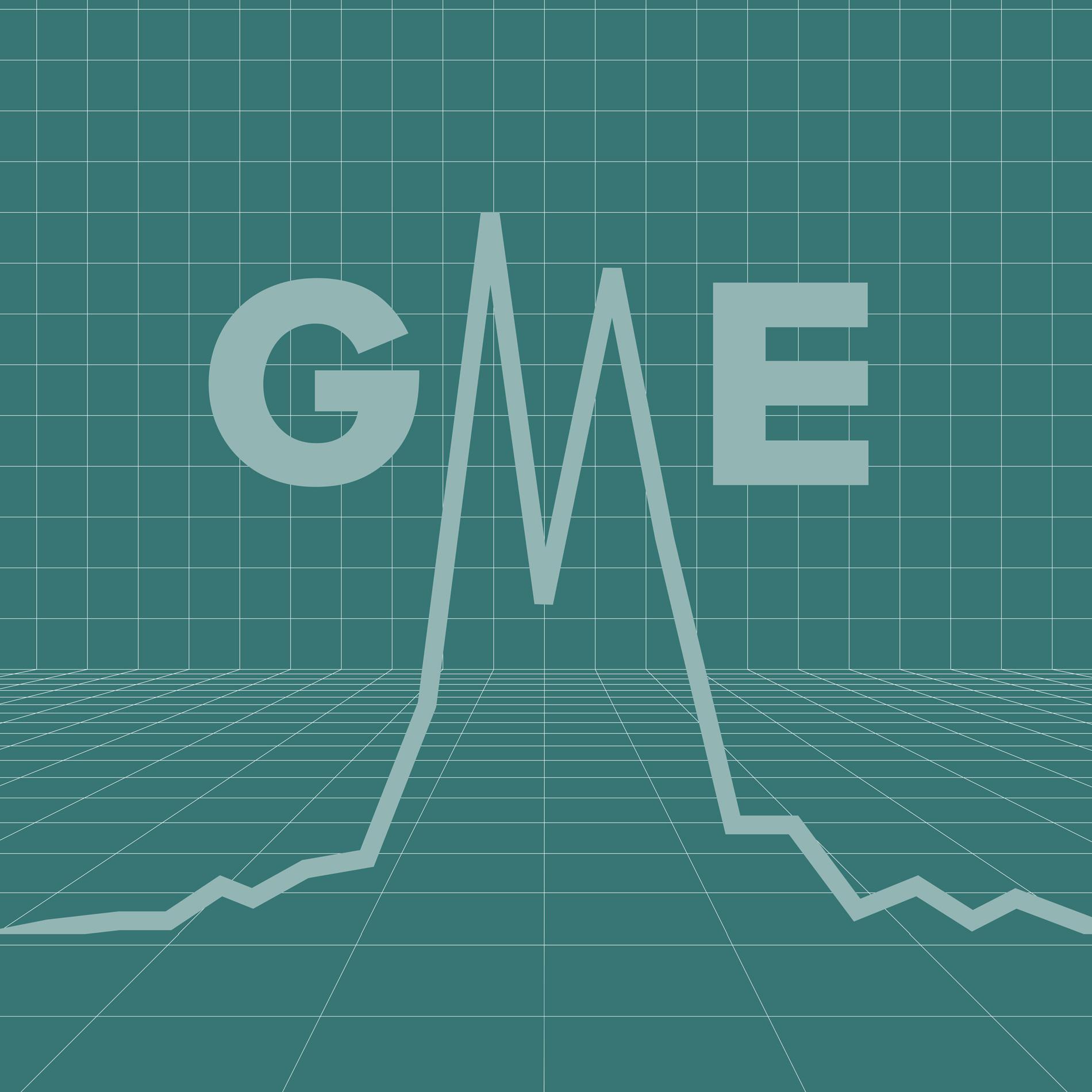

Data: Who Really Traded GME? Why? And What Happened to Them?

Money & the World

So what can you do so inflation doesn't crush your hopes and dreams and indecent proposals?

First, invest in yourself, if that's a possibility. Ask for that raise, improve your skills, and grow your income faster than you grow your costs.

Second, you have to put your money at risk. When you keep your money as cash — checking accounts, savings accounts, etc. — the value of that money, and what it can buy over time, will certainly go down. The best way to beat inflation has been investing — hopefully in a low-cost, diversified portfolio that's engineered to meet your financial goals, specifically.

While investing certainly has some danger, not investing can be even more dangerous.

If a millionaire now is only a 600,000-aire in 1998 dollars, what's the new millionaire?

First we should define what a millionaire is. We're not talking about $1 million in cash sitting in the bank (or even in a lovely, highly efficient low-fee automated investment account) ready to be spent. We're talking about people with a total net worth of $1 million, taking into account real estate, retirement accounts, savings, etc.

You could make the argument that $5 million — the penta-millionaire— is the new millionaire.

OK, with that in mind, if you use 30 years ago as a benchmark and adjust only for inflation, you would need $2,142,094 in assets to enjoy that lifestyle of matching jet skis and daily cryotherapy sessions.

But if we use millionaire as shorthand for feeling super-rich instead of just a measurement of buying power, you could make the argument that $5 million — the penta-millionaire— is the new millionaire. In a 2015 survey of rich people, UBS found that 60% of people worth $5 million or more considered themselves wealthy. Only 28% of those worth between one to five million said the same thing. Which we find bananas. But that's a different story.

If the rich are getting richer, does that mean there are more millionaires now? And $5-million-aires? Let's talk about income inequality.

The Spectrum Group, a consulting firm, estimated that, in 2017, there were 11 million households in the U.S. with a net worth of more than a million dollars — more than any other time in history.Another company put the number of millionaires in 2006 at 8.3 million. So, even accounting for the 2008 Great Recession, the number of millionaires in the US has basically doubled. The Boston Consulting Group, a consulting firm, estimates by the year 2020 the U.S. will gain 3.1 million new millionaires.

There's been a similar jump in penta-millionaires. The same Spectrum study found the number of households with net worths of $5 million to $25 million grew by 84,000, totalling 1.35 million households in 2017.

In 2018, Canada has 1.3 million millionaires but that’s expected to increase by 54% to nearly two million people by 2023 according to a report by Credit Suisse. The report studied 24 countries, and out of those twenty four Canada will have the third largest gain in millionaires, percentage-wise.

The change in the number of millionaires alone is not an indication that society is becoming more unequal. But what about the fact that there are more people who would call themselves rich, and those same people are accumulating wealth at a faster rate than other people? Well, yes, that's a sign that a society is becoming more unequal.

And that's what's happening. From about 1950 to 1980, gains in earnings were more equally distributed. But since the 1980s, even though real wages have continued to increase across the board — they’ve accelerated for people who were already among the highest earners at a much faster clip. And that’s increased the gulf between the vast majority of people with jobs and the really rich people — be they the millionaires of old, or the penta-millionaires of today.

Illustration by Sammy Yi

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.