Money & the World

Why Are Stock Market Numbers So Wacko Right Now?

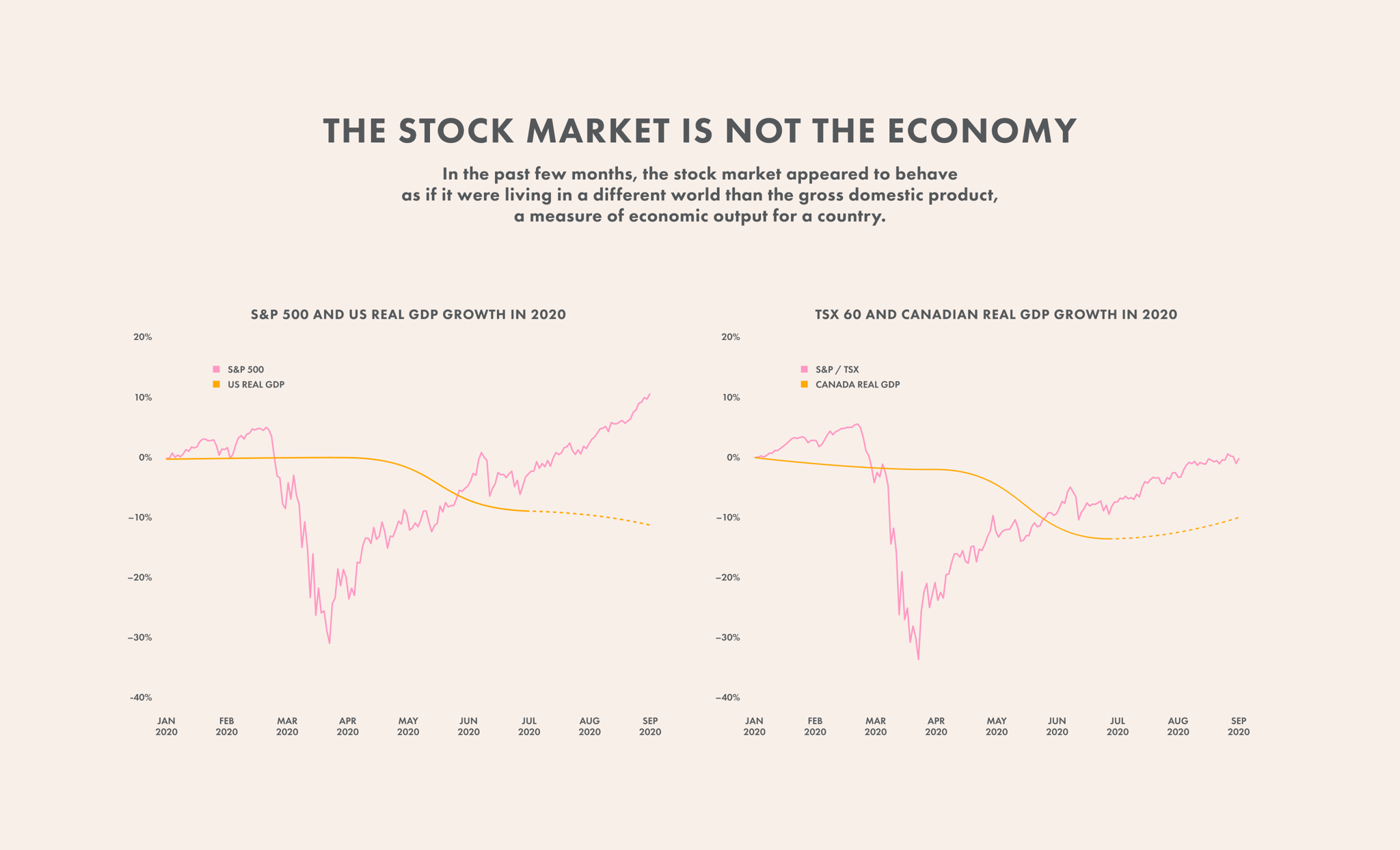

Because the stock market isn't the economy. Ben Reeves, Wealthsimple’s Chief Investment Officer, explains why things like unemployment are so terrible while the stock market has spent the past months at or near record highs.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Anyone still brave enough to read, watch or listen to the news these days could be excused for feeling, well, despair. Despair about what? Ha, like there’s a single answer to that. Ignoring the health crisis part of it, schools are just starting to reopen (and not all of them); there aren’t enough sports, the earth is on fire. The unemployment rate, sitting at 10% in Canada, hasn’t been this high since the Great Depression. Corporate bankruptcies are up 43% from 2019 (including Hertz, J. C. Penney and Neiman Marcus). Almost a third of Americans missed a rent or mortgage payment in July.

And yet North America’s biggest stock markets — Nasdaq, the Dow, the NYSE, the TSX — have spent the end of summer more buoyant than a beach ball bobbing in a swimming pool that no one can swim in because they’re afraid to die.

If the economy is seemingly crumbling, why are stock markets doing just fine? And technically speaking, way better than fine?

Part One: Why isn’t the stock market the same as the economy?

People who say don’t worry that you don’t have a job right now or can’t pay your rent because, look, the stock market is up! are, first of all, people who probably have jobs and can pay their rent. And second, people who don’t really understand what the stock market measures.

The stock market is not the scoreboard for the financial health of a nation. There are a few reasons why it’s not. First is that those numbers you see on tickers represent the fortunes of a relatively narrow slice of businesses: publicly traded corporations. And even within the world of publicly traded companies, each index represents a smaller, more specific range of companies. The Nasdaq is largely big tech. The TSX is heavily weighted toward Canada’s finance, mining, energy, and natural resources businesses. The Dow Jones is made of up companies like Walmart, McDonald’s, IBM — industry powerhouses.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

The companies that comprise those indexes are an important part of the economy, of course. But the stock market doesn’t really reflect the fortunes of the 99-plus% of businesses that aren’t publicly traded — small to medium sized, privately owned, employing more than 60% of Americans and 90% of Canadians. You know, all the neighbourhood restaurants, indie clothing stores, plumbers and electricians that comprise the majority of buying and selling, hiring and firing.

The stock market isn’t a picture of the present. It reflects what investors think is going to happen in the future

“Stock prices are based on an expectation of future profits,” says Ben Reeves, chief investment officer at Wealthsimple. “If you’re buying a piece of a company, you’re thinking about what it might turn into, and how much money it will make in the future — not just how well it’s doing right now. For example, people bought Google shares for a long time before it made any money. They weren’t buying what Google was at that moment in time, they were buying what they thought it would become. And they were greatly rewarded for it.”

The benefits of stock market rallies are not, shall we say, distributed evenly

When markets go up, not everyone benefits equally. In the United States, the richest 1% of the population owns 56% of the of the stocks that are directly held by households.

Because the stock market has been rising while the economy overall has been contracting, the value of the stock market relative to the economy has skyrocketed. Which means that as the investments of, more often than not, wealthy people get more valuable, financial power becomes even more concentrated, and already enormous inequalities become worse.

It’s worth noting that less-rich people own stock too — nearly every working Canadian does through the Canada Pension Plan — but the effects of market ups and down aren’t felt as immediately on these types of investments.

Part two: Sure, but why is the stock market up right now instead of down?

First, because the government is stimulating the economy in a way that helps the markets

When the economy is in trouble, it’s the government’s job (at least since governments learned the lessons of moments like the Great Depression) to step in. After the slowdown driven by the pandemic, governments stepped in with enormous economic stimulus. They’ve printed tons of money and thrown it at a myriad of problems. And it’s helped. “Central banks are doing a lot with their monetary policy to keep the economy going,” says William White, a Toronto-based economist and former deputy governor of the Bank of Canada (one of the central banks he’s referring to). “They are buying up bonds, keeping interest rates low. That creates a lot of money in the system, money that people are using to buy stocks.”

Recommended for you

Tariffs Are Here. How Ugly Could This Get for Canada?

Money & the World

The Most Compelling, Surprising, and Delightful Ideas of 2025

Money & the World

We Discovered the True Identity of the NFT Artist “Pak”

Money & the World

This Is Not Normal: A Letter From the Toronto Real-Estate Forever Boom

Money & the World

Meanwhile, because interest rates are now lower than inflation, money sitting in a savings account is actually losing value over time. That drives investors to riskier assets where they at least have the possibility to make money. Riskier assets like... stocks. Which is why low interest rates tend to drive stock prices higher.

The government has also given a lot of money to people and companies directly through programs like the Canada Emergency Relief Benefit (CERB). That money replaces lost income from people losing their jobs. So it’s mostly been spent to pay their rent, buy groceries, etc. But some of this money has been saved and put into the stock market, which increases the value of the stock market.

The government has also given money to companies, so that those companies can keep employing people. These companies are more likely than most companies to be publicly traded, because publicly traded companies have pre-existing access to banks and funding, which makes it logistically easier to get money to them. These transfers have saved a lot of jobs, but again, more money to publicly traded companies is another thing that keeps stocks higher.

The businesses that are doing well right now are overrepresented in the stock market, while the businesses suffering are more likely to be private

There’s been a big shift in spending from IRL to virtual, which is hurting some businesses but helping others. This has shifted spending towards technology companies, helping their profits and outlook, and away from products and services that need to be purchased in person, hurting their profits and outlook. This shift and slowdown is helping keep people alive in a pandemic, but also creates winners and losers. And more of the winners — like big tech companies — are represented in the stock market, while the losers — barbers, your local bistro — are not. However, it’s also worth noting that the publicly-traded companies that have been hurt by this shift in spending have really suffered (for example, Hertz went bankrupt).

So what does the stock market measure besides how rich already rich people are getting?

If the stock market has soared in the midst of one of the bleakest moments of our modern economy, does it mean that it’s just completely disconnected from reality? Is it a garbage indicator? The answer to that is: nope. Why not? The first part of the answer is that it’s not an indicator of the present; it’s an indicator of the future. “Right now people are afraid to spend to eat out, shop in malls, fly on planes, even breathe,” Reeves says. “But if investors think that McDonald’s or American Airlines will be profitable in months or even years from now — owing to a promising vaccine or some piece of technology or business model — stock prices will go up.”

So the question is whether it’s a valuable indicator of the future. And the answer to that is yes.

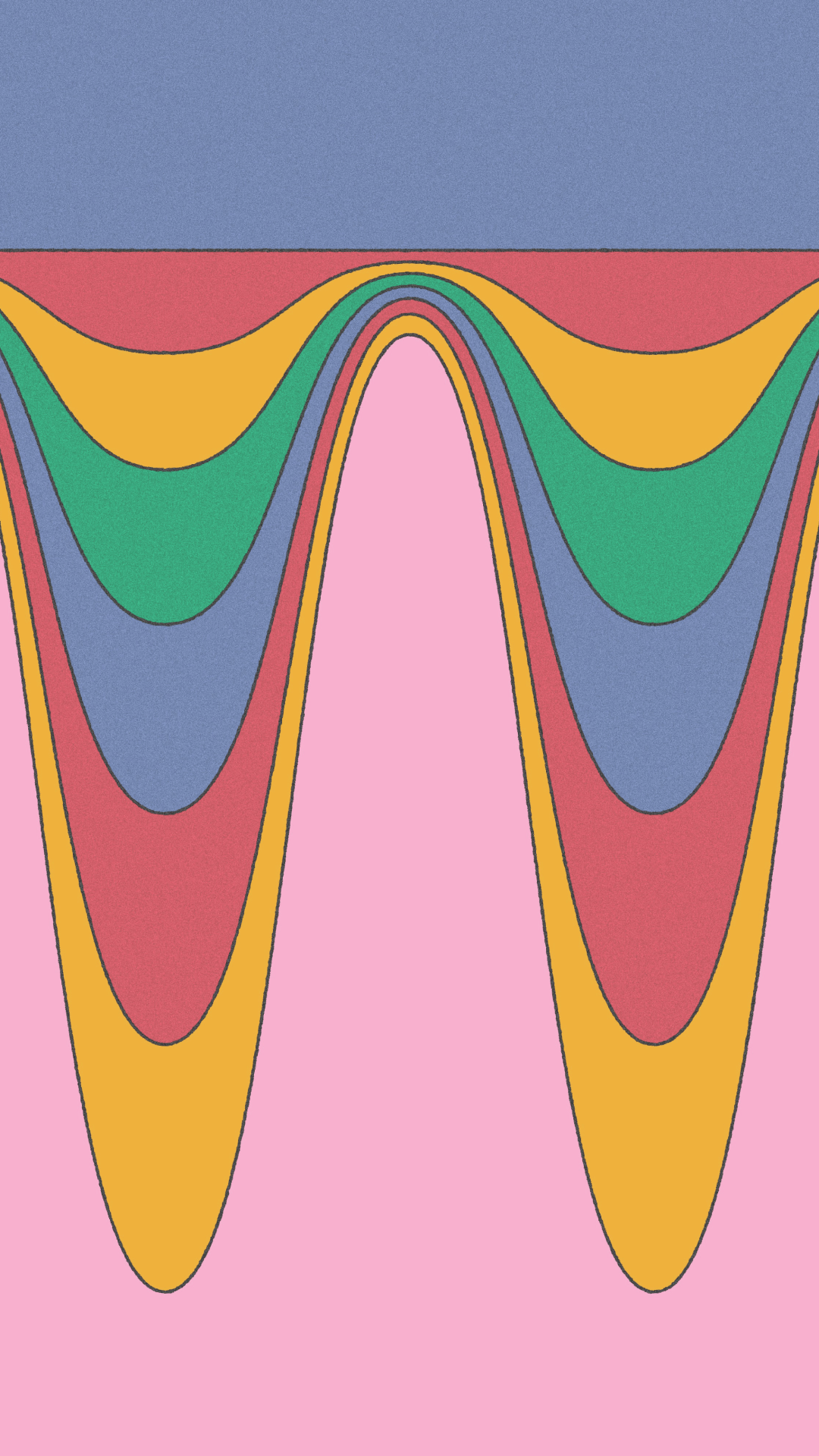

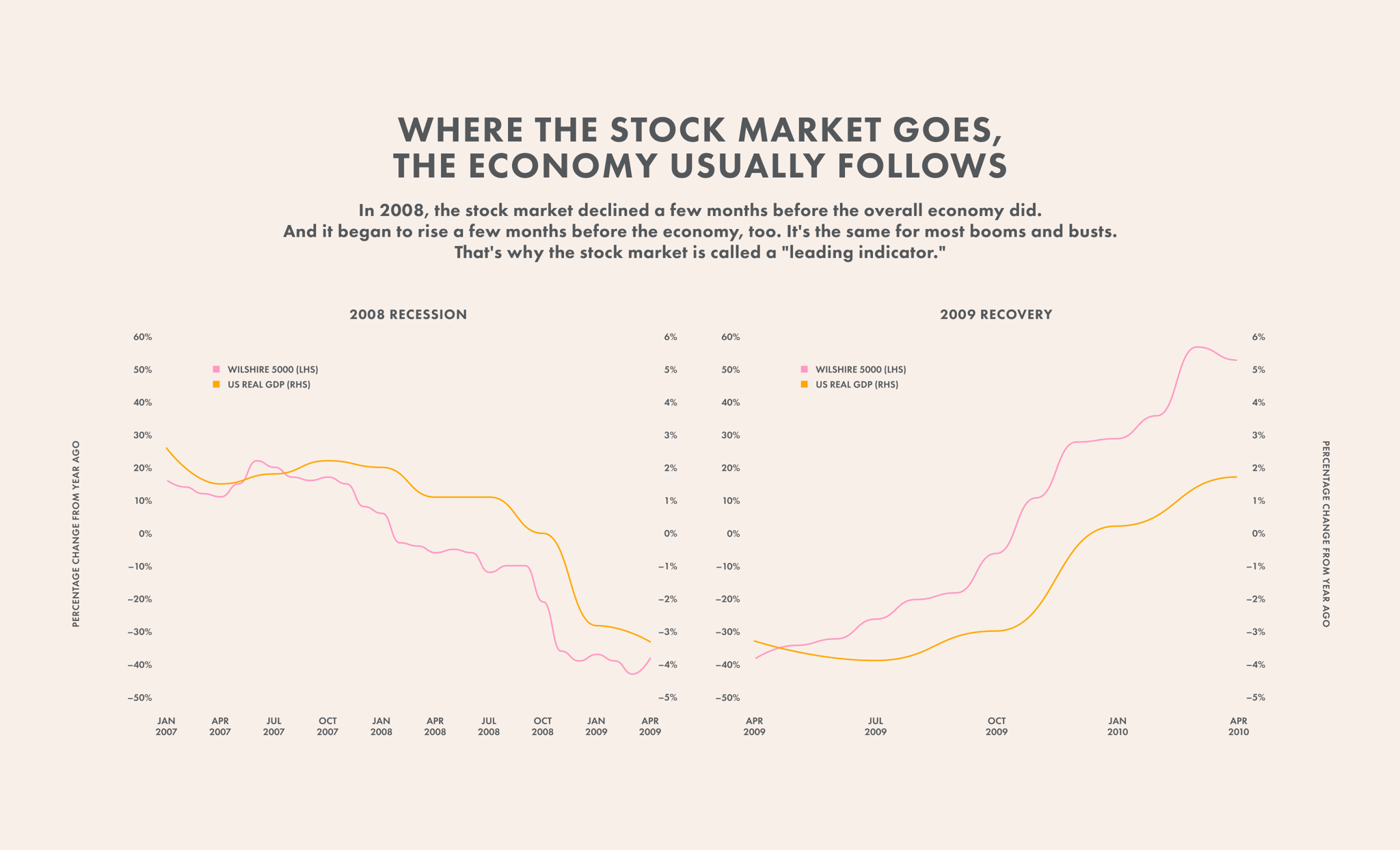

The stock market over the last several decades has been a pretty good indicator of what the economy will do in the future

The chart above shows a pretty simple relationship: when the stock market experiences a sustained uptick, the overall economy tends to improve. Though the improvement often happens after a lag. Same for when it goes down. It’s what’s known as a leading indicator. For example, the stock market during the Great Recession of 2008 declined before the economy as a whole declined. It started to recover before the economy started to recover. It also was a good indicator of the unemployment rate — the market started to recover while the unemployment rate was still deteriorating, but the improvement in employment was soon to follow.

This happens because investors are projecting sales in the future, and economic growth and employment tend to change around the same time that sales change. And they’re more often right than wrong.

So if not the stock market, how do you measure the health of the economy?

There’s no single metric that reflects the overall health of the economy. But you can get a good idea if you look at a few different measurements. Productivity — the amount that can be produced for a given amount of people and capital — gives you a view about how wealthy a country will be in the future. Income mobility (how many people from modest economic circumstances are able to change their relative standing) is important, distribution of income (how is the pie divided between the rich and poor) is important. And shorter-term indicators like GDP growth, unemployment, and inflation.

But you’re going to have to drill even deeper than that to see how healthy the economy is. With these metrics we care about absolute levels and the composition of those metrics. Like, inflation may be low, but if health care inflation is high, that’s a problem. Which is all to say: economies are complicated things. Anyone who points at one number and tells you everything’s great... let’s just say they’re probably not an economist.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.