Money & the World

Dumb Questions for Smart People: Why Our Brains Like Gambling

Humans are drawn to gambling, whether it's picking stocks or playing slots. Gambling expert Dr. Luke Clark explains how this is a feature, not a bug, in our wiring.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Dr. Luke Clark is an expert on the psychology of gambling and the Director of the Centre for Gambling Research at the University of British Columbia, which studies the “cognitive, behavioural, clinical and neuroscience aspects of gambling.”

How did you become an expert on gambling?

Not from personal experience! I studied experimental psychology at Oxford and did my Ph.D. on decision-making in the late 90s. A few years later, the British government overhauled their gambling laws. There was some concern that liberalizing the laws could lead to an increase in the number of people with gambling problems, so the government put some funding into research. I applied for a grant, and it turned out that gambling is a great way to study the psychology of choice.

How well do we understand the psychology of gambling?

We think about problem gambling as a result of two primary factors. The first is individual — some people are more likely to develop a gambling disorder, so psychiatry and neuroscience have focused on trying to understand the personal risk factors. But there’s also a question of the games themselves. Certain features in the design of a game can make it more addictive. In the U.K., for example, nearly half of the clients who seek treatment from the National Problem Gambling Clinic have an issue with one particular game.

Wow, which game is that?

It’s a form of electronic roulette that you find in casinos. Basically, you walk up to a gaming terminal and you have a choice of several games — but among the people who seek help for gambling addiction, by far the most popular game is this specific version of electronic roulette. Now, in Vancouver, we don’t have that particular game, but problem gamblers gravitate to another. It’s a modern slot machine that looks very different in some ways, but on a psychological level, is very similar. We have a few of those slot machines in our lab, so we can study how it affects the brain.

Have you figured out why it’s more addictive than other games?

We’ve identified several factors. One is simply the speed of the game. Each spin on the slot machine takes five seconds or less, and the roulette game was nearly as fast. So as soon as the player finishes one bet, they can make another, which creates a feeling of continuous play in a game that never really stops. Another key feature is the near-miss. There’s no real difference between one losing spin of the wheel and another, but if the result seems close to a win, it produces cognitive distortion where players feel like they’re about to win.

One of the most curious factors in these games is sensory feedback. Think of all the bells and whistles that you hear when a slot machine pays out. The sounds and lights have nothing to do with the actual reward of money, but we’ve found that a player will take greater risks in a game if the reward is accompanied by visual and auditory cues. We can even observe this in lab rats. The reward for a positive interaction might be food, but if you add sensory feedback, they show an increase in risk-taking to get the food.

There is certainly a lot of overlap between gambling and stock trading. In fact, it’s difficult to come up with a definition of gambling that wouldn’t also include trading.

That’s crazy, but what does it mean?

It means these behaviours are connected to the dopamine system in the brain. We generally think about dopamine in terms of drug addiction, where the brain reacts to a positive experience by releasing chemicals that stimulate more of the same behaviour. But the dopamine system is not only activated by drugs. It can be triggered by any rewarding activity, and if something is rewarding enough, the dopamine system will hijack the decision-making process.

Recommended for you

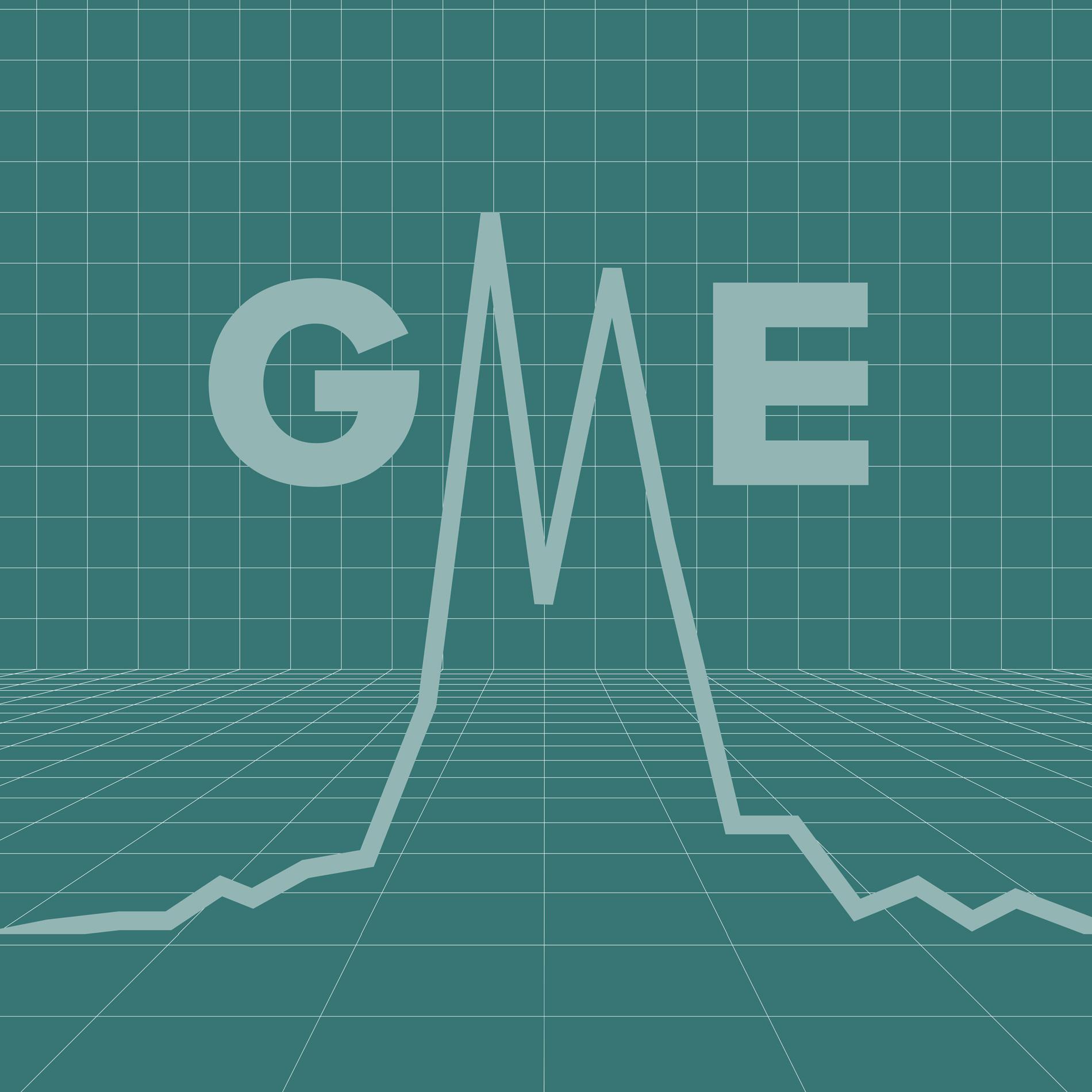

Data: Who Really Traded GME? Why? And What Happened to Them?

Money & the World

Dumb Questions For Smart People: Why Parenting Inequities Make Mothers Leave the Workforce

Money & the World

The World Is on Fire. Yet Life Is ... Getting Better?

Money & the World

The Most Compelling, Surprising, and Delightful Ideas of 2025

Money & the World

One thing that’s particularly attractive to the dopamine system is uncertainty. We see in human imaging studies that a subject will experience a greater dopamine response if they don’t know a reward is coming, compared to receiving the same reward when they know it’s coming. So it’s not just about the reward itself. It’s about delivering the reward in a way that activates the dopamine system to hijack decision-making. The lights and noises accentuate the surprise of winning and heighten the dopamine response.

That reminds me of people who get a rush from picking stocks, even if they know it’s better to leave their money in index funds.

There is certainly a lot of overlap between gambling and stock trading. In fact, it’s difficult to come up with a definition of gambling that wouldn’t also include trading. You’re putting your money on an uncertain event in the hope of getting more money.

Of course, the trader doesn’t think the outcome is random — they have a complicated theory about what the market will do.

We find a similar cognitive distortion in gambling: Choosing your numbers in the lottery, or throwing the dice in craps, doesn’t objectively change the chance of winning, but it gives you a feeling of influence over the outcome. We call this “the illusion of control.” Another example is the “Gambler’s Fallacy,” where the player believes that a series of losses means they’re due for a win. Of course, that’s not true, but even for people who understand that, the fallacy can be powerful.

I’ve experienced this myself. If I watch a roulette wheel for twenty minutes, at some point it will land on red four or five times in a row, and you just get this conviction that a black is going to come up next.

It's kind of like watching the market fall and assuming it’s due for a rebound. If this behaviour is so destructive, what's the evolutionary advantage of rewarding uncertainty? Wouldn’t it be preferable to look for resources in a reliable place?

It’s a fascinating question, and to some degree, we can only speculate. One thing to keep in mind is that the world has always been uncertain, but it’s rarely random. Things are usually somewhat predictable if you can recognize the underlying patterns. So the brain is always trying to find those patterns and locate a signal in the noise. When is the best time to return to this food source, to be sure of reaping the apples? But with gambling, there isn’t a pattern. It’s pure chance, so the brain is perpetually trying to detect a pattern that isn’t there.

Does the research community have a dark side — do gambling companies hire psychologists to make the games more addictive?

The simple answer is: I don’t know. If game designers are doing psychological studies, the results are not publicly available. But remember, companies are also getting information directly from the players. There might be several hundred machines in a given casino, and a manufacturer can very quickly tell which are more popular than others. So you get this rapid evolution — they keep the features that are working, and drop the ones that aren’t.

Do people who are gambling addicts always know it?

It’s almost paradoxical. Most gamblers are well-informed — they know the odds are working against them, they understand things like "house edge," they read books on this stuff, they talk about it with their friends, and yet they continue to play.

Have psychologists found effective methods to help people overcome addiction?

Cognitive behavioural therapy can help identify these faulty beliefs, but these are powerful impulses that hijack the brain and it remains difficult to correct them. We need to understand them better if we want to develop stronger defenses.

Wil S. Hylton is an American writer. His last book was VANISHED.