Money & the World

Data: Who Really Traded GME? Why? And What Happened to Them?

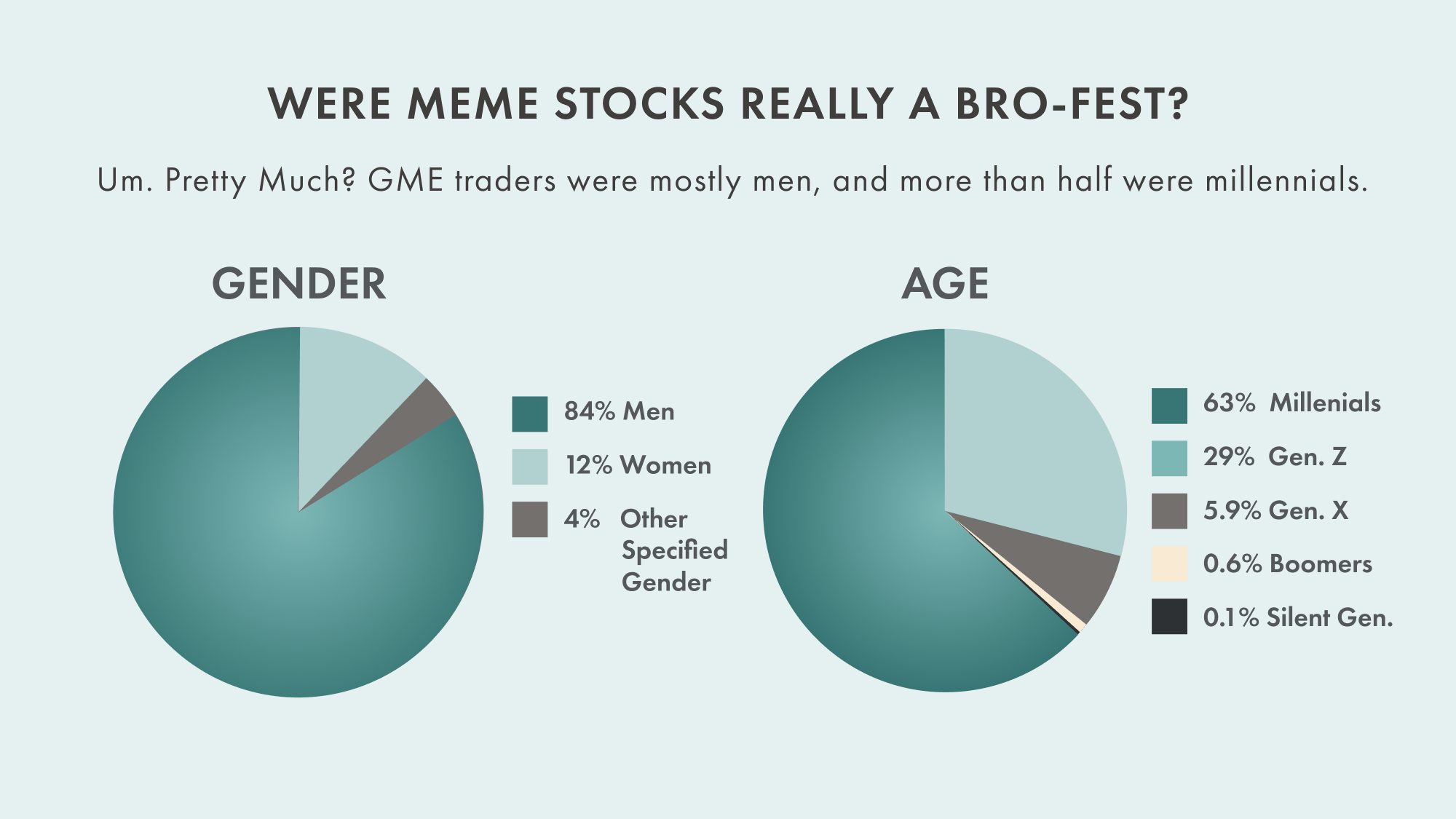

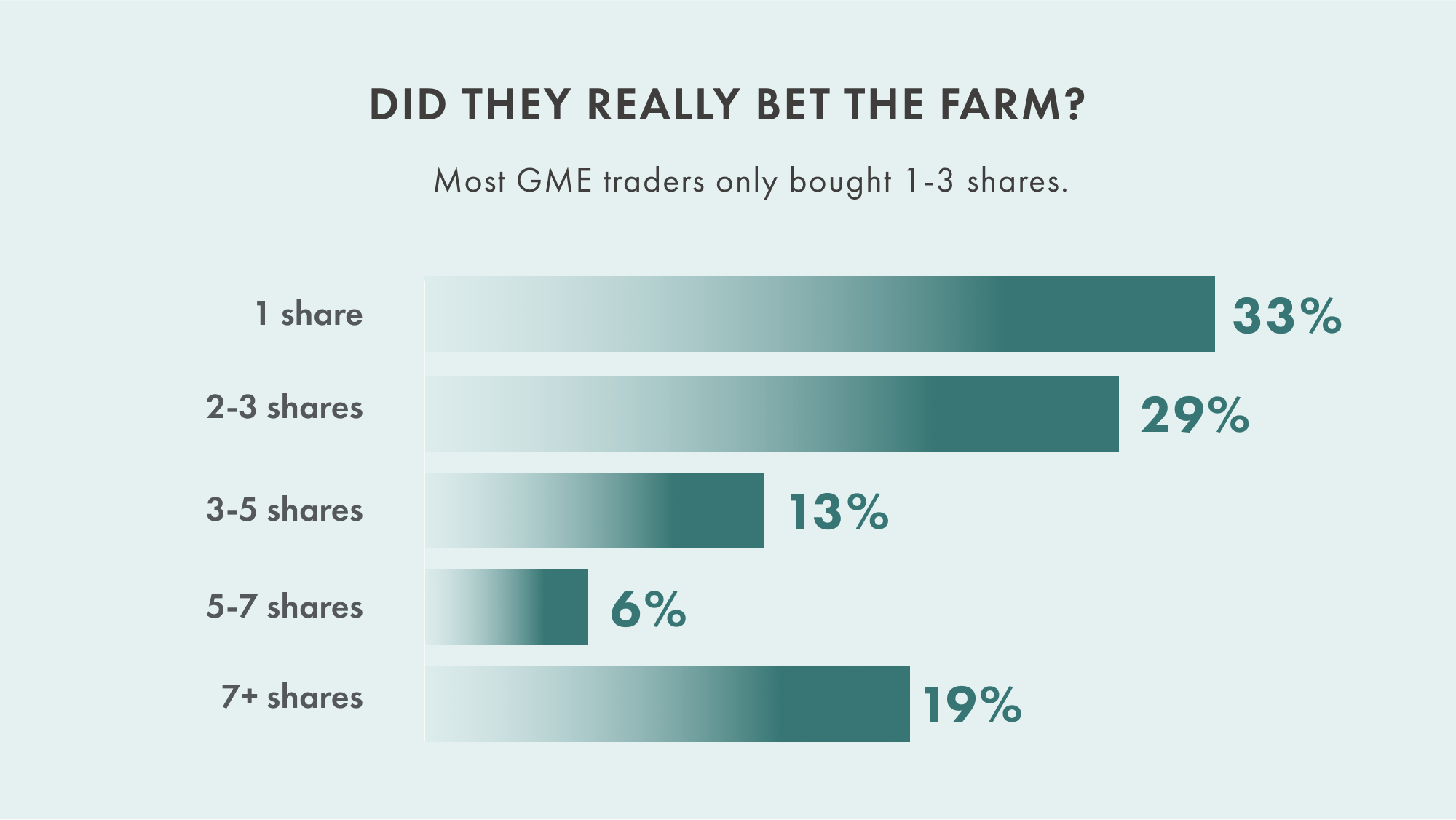

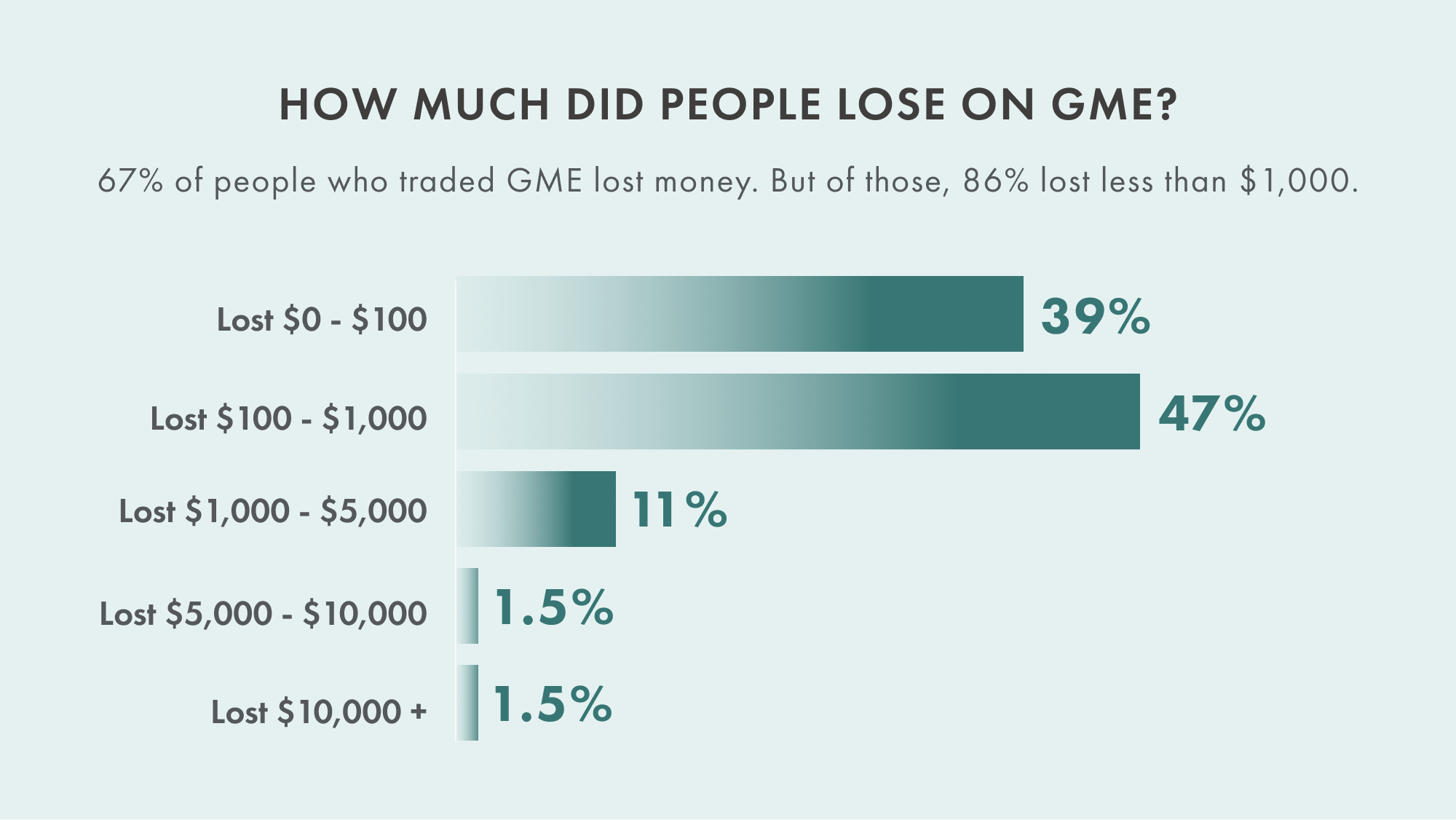

We dig into our own Wealthsimple Trade data to find out how traders behaved in the midst of the meme stock feeding frenzy. TL;DR: yes, meme stocks are kind of a bro-fest. But weirdly no, most people did not throw caution to the wind.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

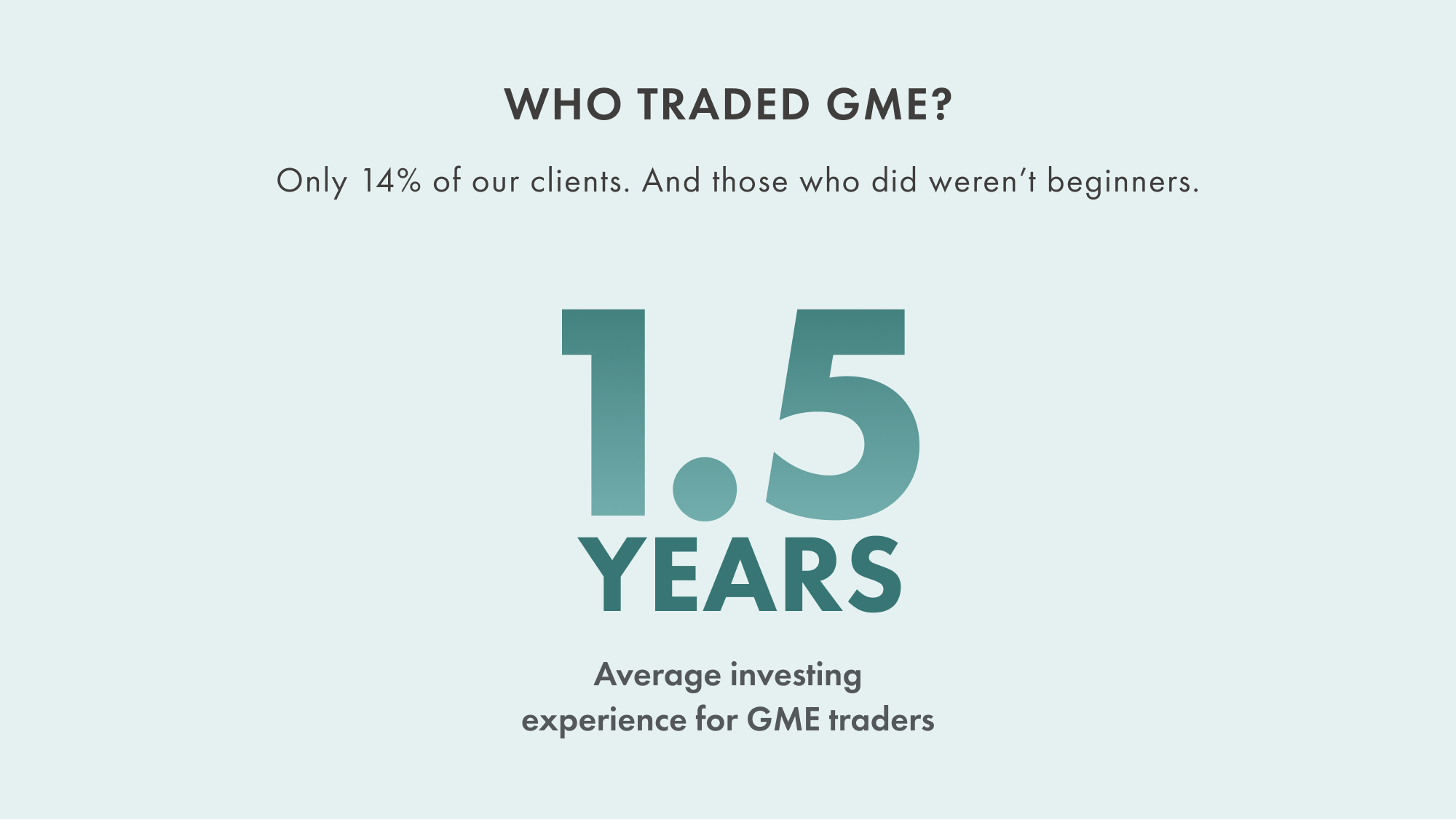

There’s been no shortage of takes about what the GME/meme stock phenomenon was, how it happened, and what it means. People were lemmings and flung themselves into the abyss and lost their life savings! Millionaires were minted! Everyone who jumped onto the bandwagon was a novice who just downloaded a trading app out of a desperate sense of FOMO!

Since we happen to run the largest (and only) no-commission stock trading app in Canada, it turns out we have a lot of data about who the GME traders were and what happened to them. We also wanted to understand why new traders who signed up in January were interested in meme stocks. So we asked a group of them: did they come to bet it all or was there something else at play?

Herewith, the story of GME trading in four graphs and a fun video:

Toronto Star: “Millions of amateur investors took part in a trading frenzy that sent the stock prices of several unsuspecting companies soaring.”

New York Times: “Amateur traders egging on one another on Reddit bet heavily on shares of the company in January.”

Business Insider: “GameStop, AMC, and other Reddit darlings rebounded on Wednesday as retail investors banded together to "hold the line." The phrase has become a popular rallying cry on the Wall Street Bets subreddit among day traders hoping to preserve recent gains."

Washington Post: “As GameStop stock crumbles, newbie traders reckon with heavy losses.“

Yahoo! Finance: “In two short weeks, GameStop and AMC stock investors have gone from the new Wall Street kingmakers to naïve newbies. As Reddit-fueled stocks fell back to earth, young Reddit investors watched in dismay as their heat-seeking investments turned to dust.”

Lastly, we asked 1,140 brand new Trade users to tell us, in their own words, why they purchased meme stocks. Most of them said they wanted to build their wealth (73%)—many said they wanted to become financially independent or make up for lost wages. Apparently not many of our clients bought these stocks for the reasons you read about on Twitter:: 19% of respondents stated “YOLO: big risk, big reward” as their reason; 11% reported it was to “eat the rich” and take on Wall Street. See what else they said below:

The data in the graphs is aggregated and anonymous Wealthsimple Trade user data, from the time period January 15, 2021 to February 12, 2021. Investment experience is self-reported by Trade users.

The data in the video is from a survey of 1,140 new Wealthsimple Trade users who onboarded during or after the week of January 13, 2021 and purchased a meme stock (including GME, AMC, NK, BB).

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.