Money & the World

The Most Compelling, Surprising, and Delightful Ideas of 2025

A cheat sheet to the year’s best and boldest thinking in finance, tech, and beyond.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

This story first ran in the TLDR newsletter.

Each week, we do our darndest to deliver a smart, non-boring summary of the latest business and financial headlines. Which is always fun. But today we’re doing something different: we’re talking about ideas, not companies or stocks or CEOs. Why? Because ideas have a habit of turning into policies or business plans or consumer habits. So it’s good to know what new ideas and/or theories are animating people if you’re trying to understand where the world and economy are heading. Here are the eight ideas that we found the most intriguing these past 12 months.

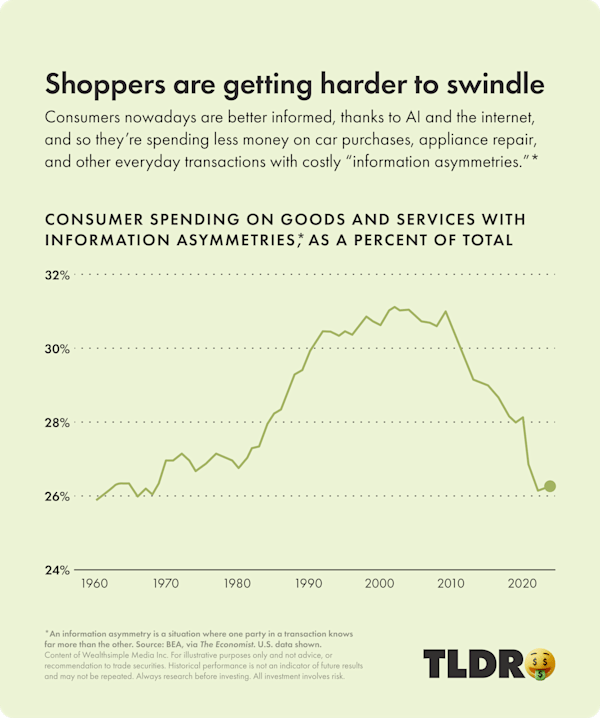

Idea #1: AI is probably making consumers smarter. If you believe the headlines, AI will soon steal your job, melt your brain, and conquer the world. And maybe it will! In the meantime, at least it’s become a valuable tool for helping everyday folks avoid getting ripped off in situations with information asymmetries — you know, those moments when you nod along to whatever a repairman or veterinarian is saying, hoping they’re not exploiting your ignorance to overcharge you. Now you can easily double-check their mumbo jumbo and get fairly reliable (though not flawless) feedback on whatever you’re being told. Which helps to explain why folks today are spending less cash with these businesses than in the past (see chart). “The days of the know-nothing consumer are well and truly over,” The Economist argued. —Claire Porter Robbins

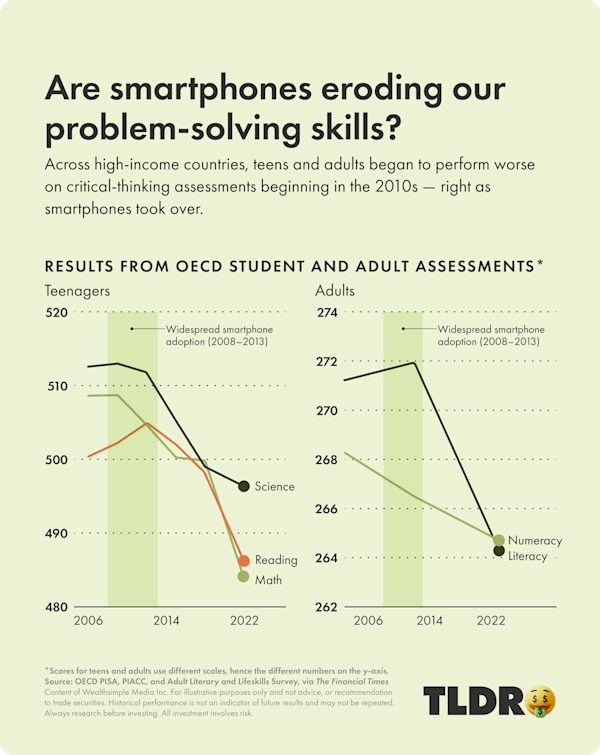

Idea #2: Overexposure to stupid ideas is making us stupider. The world appears to be getting dumber. IQ scores are slipping. Student test scores are down. Adults increasingly struggle with reasoning. One popular explanation is that social media’s infinite scroll is rewiring our brains, one dopamine hit after the next. But in a sharp essay for New York, Lane Brown contends that social media’s real harm has less to do with scroll-induced brain rot than with the widespread platforming of morons. “Not so long ago, the dolts among us were free to think their thoughts quietly to themselves with no easy way to share them,” he writes. Now “we can see the full distribution of human thought in one infinite scroll, and it turns out the median is lower than we ever could’ve imagined. In theory, this is the democratization of expression. In practice, it feels like a crowdsourced lobotomy.” —Jared Sullivan

Idea #3: The biggest social-media flex is having no followers. Social media is not only making us dumb; it’s also increasingly uncool. In this Always Be Posting era, opting out of trying to build a giant audience has become a quiet luxury. Hence many elites of fashion, music, and media are now keeping their Instagram private and sharing unpolished photos. “There’s a certain status that comes from ignoring the usual signs of success online,” New Yorker tech columnist Kyle Chayka explained, “and an envy inspired by those who can grow a career without the pressure of performing on social media.” —C.P.R.

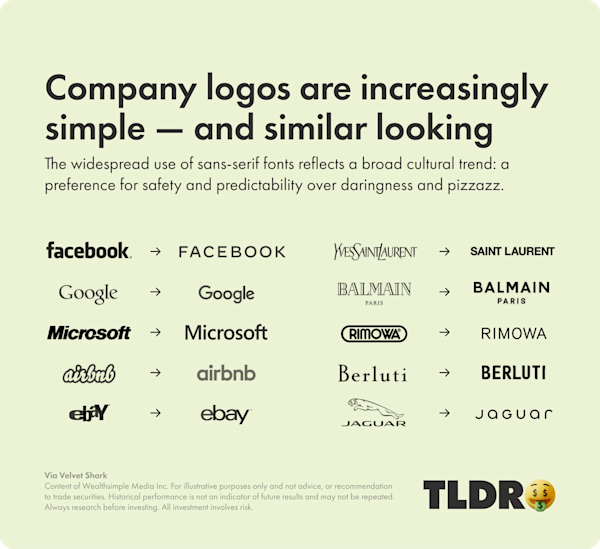

Idea #4: Prosperity has made us all a little basic. Have you ever wondered why every apartment building, book cover, or company logo looks the same now? In a fun, chart-heavy essay, the experimental psychologist Adam Mastroianni argues that people’s tastes have become bland for the same reason that we’ve grown more risk-averse and less deviant: we’ve got way more to lose than any generation before us, and we’ve become more cautious and more, well, boring as a result. In 1900, the typical Canadian died before turning 50 and made the equivalent of $6,000 a year in today’s dollars. In the face of such bleak prospects, the thinking went, why not be bold and dream big? Nowadays the name of the game is preservation, Mastroianni writes: “You go to Pilates and worry about your [retirement account].” —C.P.R.

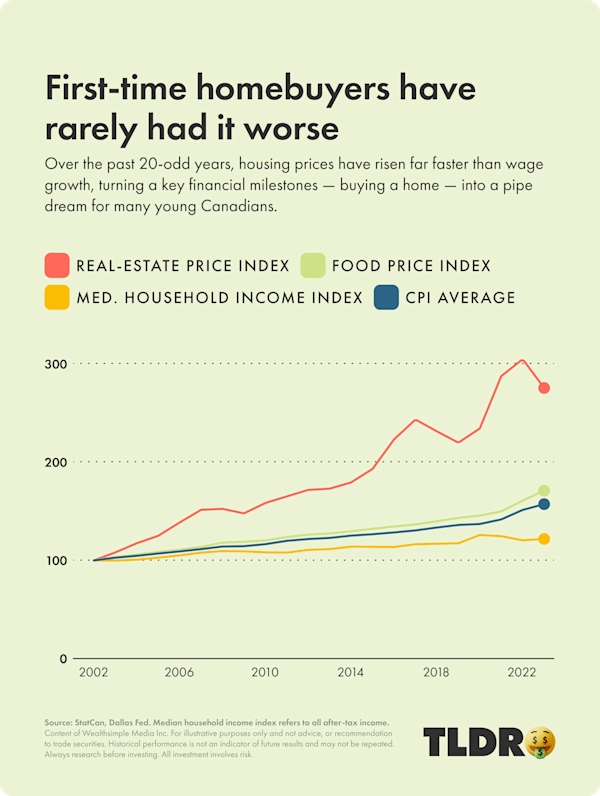

Idea #5: Locking a generation out of home ownership has a lot of not-great consequences. Owning a home has historically been one of the surest ways for young people to build wealth and establish a foothold in the adult world, so what happens when homes become unaffordable and an entire generation becomes lifelong renters? Their priorities shift in worrisome ways. In the U.S., for instance, renters are more likely to YOLO away their money on very-risky investments and not save for the future. Young Canadians report lower life satisfaction. And Chinese, Korean, and Japanese renters are forsaking their career ambitions. Because why even bother trying if homes are prohibitively expensive? None of this is good news for national morale or economic health, but it’s an understandable response to a moment when financial discipline feels pointless. —Brennan Doherty

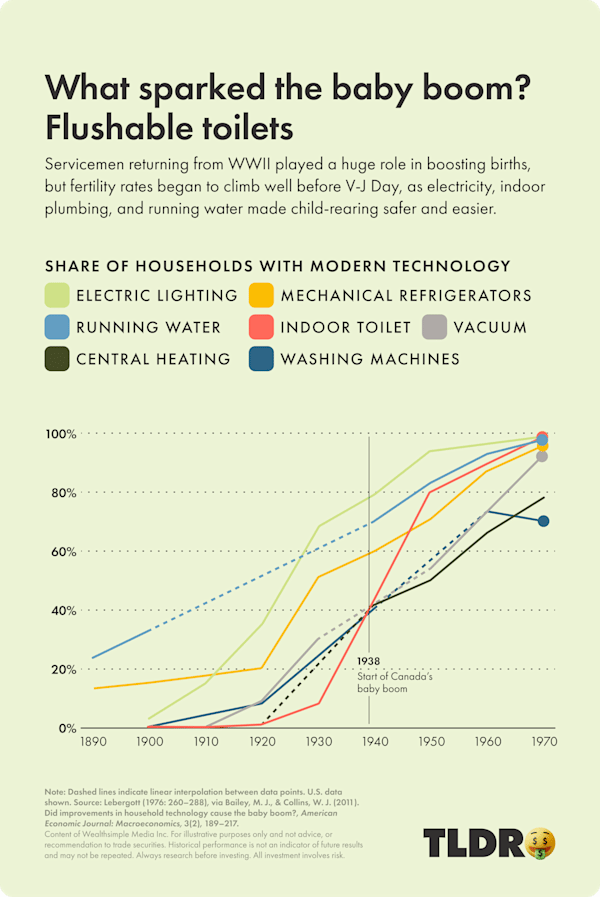

Idea #6: Can technological progress help reverse the baby bust? Writer/podcaster/Abundance guy Derek Thompson challenges the notion that the mid-century baby boom resulted from servicemen returning home from the Second World War, falling in love, getting good jobs in the postwar economy, and then using government programs to secure affordable homes in which to raise a family. Thompson argues that, in truth, the war’s end was only part of the equation and that the true catalyst was advances in medicine and consumer technology (refrigerators, washing machines) that made parenting easier. According to government data, the baby boom actually began in the late 1930s, long before WWII was decided, when the adoption of home appliances began en masse. Today fertility rates are collapsing worldwide, and Thompson wonders if technology (e.g., better IVF or egg retrieval) could help spark another birth bonanza. —J.S.

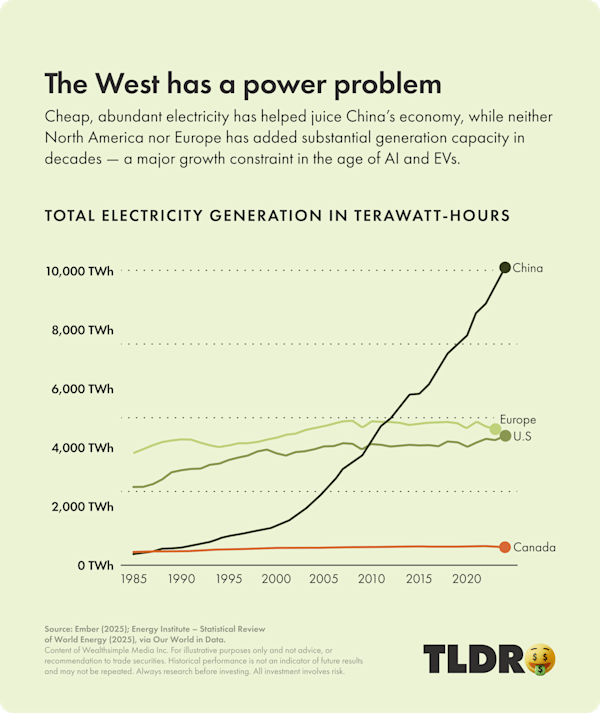

Idea #7: Progress hinges on abundant, affordable power. For many decades in the U.S. and Canada, the prevailing focus around electricity was conservation: make appliances more efficient, turn off the lights, etc. And it worked! Since 1980, power consumption has stayed flat on a per capita basis, as has power generation. But the recent explosion of AI data centres, the adoption of EVs, and a groundswell of enthusiasm for reindustrializing have come with a sobering reality for the West: we’re losing the race to power the future. The problem is production. Whereas China has 33 nuclear reactors under construction, the U.S. has zero and Canada has one (and it’s small). The U.S. intends to build 10 reactors ASAP, and Canada is planning three — but electricity costs are soaring now. If the government wants to position Canada for success in this energy-hungry era, increasing our generation capacity would be a decent place to start. —C.P.R.

Idea #8: Optimism is one of our most powerful natural resources. Yes, it’s been a tough year, for Canada and beyond. The American-led global order has frayed. The economy is bruised. Autocrats are on the march. But as John D. Boswell reminded us in The Guardian, there’s another side to the story: humans keep making dramatic breakthroughs in medicine (GLP-1s might cure addiction!), the global poverty rate keeps plunging, and we’re “getting a grip on climate change.” All of these are products of optimism, Boswell argues, and the harder optimism is to find, the more desperately the world needs it. —J.S.

Jared Sullivan is an editor for Wealthsimple Magazine and author of the book "Valley So Low: One Lawyer's Fight for Justice in the Wake of America's Great Coal Catastrophe".

Claire Porter Robbins is a freelance journalist. She founded Btchcoin News, a financial and economics newsletter, and has written for a variety of publications including The Atlantic, the New Yorker, and The Globe and Mail.