Money & the World

Dumb Questions for Smart People: A Money Conversation with Insurgent Presidential Candidate Andrew Yang

Yang’s candidacy has taken off in a way almost no one predicted. And at the center of it is an unconventional economic idea: universal basic income.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

You have worked at the highest level in Silicon Valley and received major awards from the Obama White House. But you’ve come to believe that humanity is on the verge of a global crisis. You call it “The Great Displacement.” What does that mean?

The Great Displacement is a term I’ve given to the automation of jobs by technology. Between 2000 and 2015, the U.S. automated about four million manufacturing jobs, and we’re on the cusp of automating call-centre workers, fast-food workers, truck drivers, retail workers, and the like. We are eliminating the most common jobs in the U.S. economy. We’re entering the most dramatic economic shift in human history, and anybody who believes the labour market is self-healing is mistaken.

If that’s true, then why do we keep hearing that unemployment is historically low?

The headline unemployment rate is essentially government malpractice. It only measures people who are actively looking for work. So if someone were to stop looking for a job, then it helps the unemployment rate. The more important statistic is labour-force participation. That’s down to 62.7%, which is a multi-decade low, comparable to El Salvador and the Dominican Republic. It reflects the fact that 95 million working-age Americans have left the workforce, and 1 in 5 working-age men hasn’t worked in the last 12 months.

Is it difficult to convince people that we’re on the verge of a crisis when the stock market is skyrocketing?

If you're a young person, you know that something is wrong. You know that none of the jobs you're being offered have benefits. You know that your friends can't afford to live on their own, or have children. So people know the realities around them.

A lot of people who can’t find work believe that American jobs are being sent overseas, or that they’re being taken by new immigrants. What are the statistics on that?

Only 20% of the job loss in manufacturing is due to outsourcing and globalization. The other 80% is automation. And it’s not just manufacturing jobs. There are many, many white-collar jobs that are also prone to automation — bookkeeping, accounting, being a lawyer, and medical fields like radiology and pharmacy. Journalism and content creation are increasingly threatened by automation. Advertising used to be about developing a brilliant ad campaign or slogan or tagline. Now a lot of it is just an algorithm getting products in front of the right people. Even things that you think of as sacrosanct, like being an artist or a musician, artificial intelligence can often create in a way that’s indistinguishable from work done by humans. So the impact of technology is going to be much broader than many people believe.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

The reality is that, as jobs are going away, they are not being replaced.

People will say that technology also creates new jobs. So you may not have farriers shoeing horses anymore, but now you have auto mechanics.

[Laughs] Farriers!

Is it wrong to believe that technology will also create new jobs?

Sure, there are new jobs that will come about, but they're going to be too small in number, in different places, for different people, with different skills. It’s not realistic to take 3.5 million truck drivers, who are 94% male with an average age of 49, and have them all go back to school for a job that doesn’t exist yet. And you know, they might be underwater on their mortgage, they might want to stay close to their extended family. It’s not possible for many people to reinvent themselves completely and move for a new job.

So if we're heading into a world with high unemployment forever, what can we do?

My proposal is a form of Universal Basic Income. Every American adult between 18 and 64 would get $1,000 a month — free and clear, no questions asked. This would help people pay their bills and meet their basic needs. It would enable people to move and think about the kind of work they want to do, maybe even start a new business. That’s one way to help people through this period.

Where does this idea come from?

There's a rich American heritage behind this idea. One of the founding fathers, Thomas Paine, advocated for every citizen to get a certain amount of money. It only seems dramatic now because we've gotten so far away from solutions that are meant to improve people's lives. But this was mainstream political wisdom in the 1960s and early ’70s. Richard Nixon was for it. Martin Luther King was for it. A thousand economists signed a letter saying it would be great for the economy and society. The conservative economist Milton Friedman was for it. It passed the House of Representatives in 1971, before stalling in the Senate because Democrats wanted more money. It's been implemented for the last 36 years in Alaska, which is a deeply Republican state. Every Alaskan gets between $1,000 and $2,000 a year.

Recommended for you

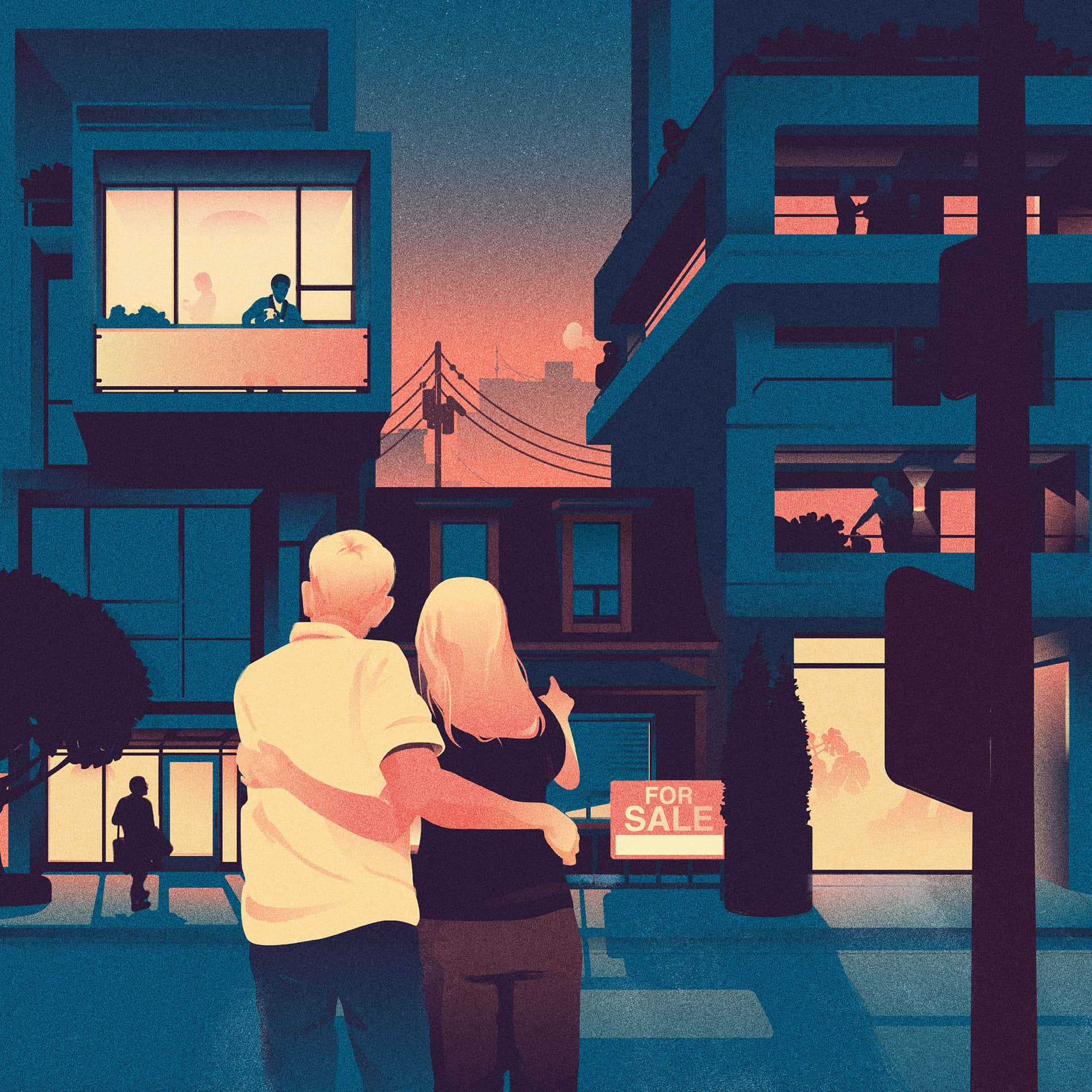

This Is Not Normal: A Letter From the Toronto Real-Estate Forever Boom

Money & the World

Prediction Markets Are, Suddenly, Everywhere. Wall Street Wants In

Money & the World

How Canada, and Much of the World, Got Stuck in a Land Trap

Money & the World

The Most Compelling, Surprising, and Delightful Ideas of 2025

Money & the World

Am I right in understanding that even wealthy people would qualify?

That's right.

And how do you explain that?

Well, you want to de-stigmatize it, so it's not an us-versus-them. It also lightens the administration, so if people change circumstances, they don’t have to wait a year or prove that they qualify. It also never penalizes you for working harder.

Where does this money come from?

I’m funding it with a value-added tax, which is like a sales tax, but more broad. It extends throughout production, so companies pay it at every level.

Wouldn’t this impose a new tax on some of the people you’re trying to help?

If you give someone $12,000 a year and you impose a 10% tax on purchases, then the only way they have less money is if they spend more than $120,000 on purchases. The average American, let’s say, is making $38,000 a year. So if you give them an additional $12,000 a year, their total income is $50,000 and the most they would pay for the new tax is $5,000. It ends up helping the bottom 94% of Americans in terms of purchasing power.

How much would this increase the federal budget?

If you were to look at it as a share of the federal budget then it would seem like a lot. But it’s not a federal program. You’re just taking this money and returning it to the American people. It’s much more analogous to a dividend.

People sometimes argue that Universal Basic Income is a disguise for socialism. Is that a fair comparison?

It’s a complete distortion of both. Socialism advocates for nationalizing the means of production, so the government would take over Facebook and Google. Universal Basic Income supports the consumer market, because people have more money to spend.

But doesn’t UBI reflect on the evolution of capitalism? It was the efficiency of capitalism that led to all these technological advancements.

Yes, completely. There needs to be a massive adjustment and recalibration, because many of the presumptions of capitalism – about the profit that would go to workers – are being transformed. The people thinking about capitalism as an economic model many decades ago could not fathom software and computers that could do limitless work for near-zero cost.

What about the human need to feel productive and accomplish things? Wouldn’t that be jeopardized in a world without work?

The key is that we have to broaden our definition of “work” to include things the market will not reward. It is fundamentally human to want to work, but we have to create new structures that encourage new forms of work, with greater ambitions.

There’s also a natural tension between generous social services, like UBI, and a generous immigration policy. If you’re sending big cheques to everyone, it becomes expensive to let new people enter the country.

It’s certainly appealing to move somewhere that people are given money. If you just give out money to anyone who shows up on your shores, then obviously you'd have a massive rush of people. So you need to be more circumspect than that. You need to enforce immigration laws and have long waiting periods to become a citizen. Under my plan of Universal Basic Income, there would be a very long waiting period to become a citizen — up to 18 years.

Your concern about these issues has inspired you to launch a quixotic presidential campaign. Do you think that will get people talking about these issues?

You know, it's shocking how dysfunctional our political system has become. We have McKinsey and Bain both projecting that we’re going to automate between 20 to 30% of America’s jobs in the next 12 years. But people in the political establishment aren’t going anywhere near this. There are a few local officeholders, and President Obama recently came out and said that we need to explore Universal Income, which I suspect will help generate additional interest. So we just need to keep talking about it. I think the movement is coming our way. We just have to convince people and start solving these problems before they become even more insurmountable.

Wil S. Hylton is an American writer. His last book was VANISHED.