Money & the World

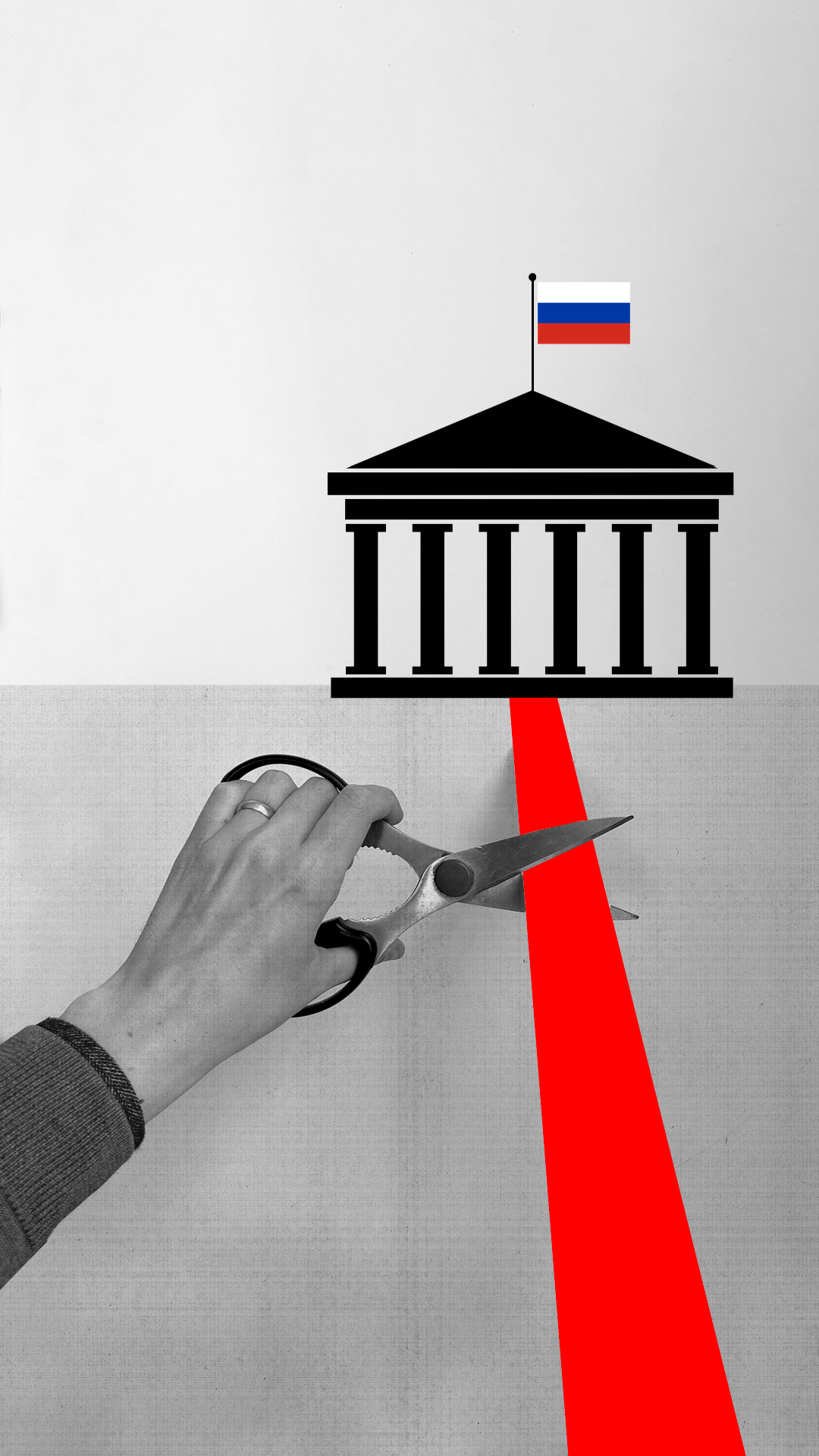

The Global Banking System That Could Cut Off Russia

A little-known communications tool helps transfer trillions of dollars around the world daily. If Russia loses access, it could spell economic mayhem for the country, if not the world.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Update: On the evening of Saturday, February 26, the EU, the U.S.A., and Canada announced that they would move to block selected Russian banks from SWIFT.

As countries mull sanctions against Russia following its invasion of Ukraine, a word — an acronym, actually — has popped up in the news a bunch: SWIFT. It stands for the Society for Worldwide Interbank Financial Telecommunications. Which sounds boring. But. It. Is. A. Huge. Deal.

SWIFT is basically the tubes that connect the international financial system. Canada, the U.S., and the U.K. have already announced tough sanctions against Russian banks, and have frozen an estimated $1.4 trillion USD in assets. But cutting off Russia from SWIFT would be a much bigger step — and it’s one that U.K. Prime Minister Boris Johnson has urged European leaders to take. At the moment, the U.S. and EU look unlikely to make such a move, but on Friday morning, the New York Times reported that France’s finance minister said France favored blocking Russia’s access to SWIFT. So things could change as the conflict in Ukraine continues to unfold.

SWIFT, explained

Headquartered in Belgium, SWIFT is a cooperative founded in 1973 and overseen by central banks, including the Bank of Canada, the U.S. Federal Reserve, and the European Central Bank. Before SWIFT, 90% of international bank payment messages were transferred through the mail. SWIFT changed that, by introducing what was essentially a quicker, less-error-prone teleprinter machine. Nowadays, though, when people talk about SWIFT, they don’t mean a piece of hardware or an organization, but the communications system that SWIFT manages, which is responsible for more than half of all high-value, cross-border payments around the world. Think of it like a text-messaging network, except instead of sending SMS it delivers 42 million financial messages — blocks of codes written in the SWIFT language — each day between more than 11,000 financial institutions in more than 200 countries. These messages include things like payment and trade confirmations. SWIFT doesn’t send money itself, but it makes the transfers possible by communicating information, like where money is going. If you’ve gotten your bank’s ID number for a wire transfer, that’s really its SWIFT code.

SWIFT is so central to the global financial ecosystem that you can’t really move money without it, even through back-channel means. Some blockchain networks, like Ripple, have at times positioned themselves as SWIFT competitors, but there’s no real comparison.

How would cutting off SWIFT work?

SWIFT, a self-described “neutral utility,” doesn’t monitor or control the messages that users send. But, like any lawful organization, it’s subject to national and international regulations. That means if a country enacts sanctions against another country, SWIFT has to comply. And it’s happened before.

In March 2012, in an attempt to curb Iran’s nuclear ambitions, the European Union passed regulations prohibiting financial providers, like SWIFT, from servicing sanctioned Iranian banks. Since SWIFT’s HQ is in Belgium and it’s thus part of the EU, it was obligated to disconnect Iranian banks. Well, a few years later, after Iran agreed to reduce its uranium stockpile, it got SWIFT access again. But then in 2018, the U.S. pushed SWIFT to cut off Iran once more, over persisting nuclear concerns. The cutoffs were economically ruinous for the country. Both times, Iran’s oil exports dropped by more than half, and suddenly tens of billions of dollars had no way of making it into or out of Iran. Its economy has struggled ever since.

Recommended for you

Prediction Markets Are, Suddenly, Everywhere. Wall Street Wants In

Money & the World

The World Is on Fire. Yet Life Is ... Getting Better?

Money & the World

How to Consume and Discern Information in Our Slop-Infested World

Money & the World

GME, Doge, Supreme: How Getting Rich Went Full Internet

Money & the World

Fen Hampson, a professor at Carleton University, told Wealthsimple that cutting off Russia would be a far more consequential move, since Iran isn’t nearly as connected with the global economy as Russia is. “It would be costless for Canadians,” he explains, “because we don’t do that much trade with Russia, and we’ve just announced a new package of sanctions that is basically going to bring that down to zero.” But, Hampson adds, if you live in Germany, which gets about half its natural gas from Russia, “you’re in a much more exposed position.”

What if Russia’s access was revoked?

Ukraine’s Western allies entertained cutting off Russia’s SWIFT access back in 2014, when it annexed Crimea. Russia responded by creating its own financial messaging system, which not only costs the country an estimated $50 billion a year to use but also connects to only 400 banks or so. So it’s not great.

If booted from SWIFT, Russia would surely suffer. Capital Economics, an independent economic research firm, has predicted that harsh sanctions could cause the ruble to fall more than 15% against the dollar and for Russia’s GDP growth to fall by more than 5%. Oil-and-gas exports make up about a fifth of Russia’s US$1.7-trillion GDP, and the country is also a major automotive and electronic-materials exporter. It’s impossible to say for sure how many exports would stop if SWIFT was cut off, but it would likely be a huge share, since most major banks outside Russia use SWIFT.

Cutting off SWIFT to Russia would be a financial last resort, to the point where even talking about it is surely making politicians and financiers nervous. Many European countries depend on Russia to meet their energy needs, and a sudden inability to buy Russian energy commodities — which have thus far been excluded from sanctions — would cause all sorts of economic havoc across the continent. Energy costs and inflation would rise. Central banks would have to tighten fiscal policy more than they already are. It would be a mess, for the Russian government but above all for its people. Those who work for foreign companies would likely struggle to receive their paycheques, and international trade would decrease precipitously. Hampson, of Carleton University, says that targeted sanctions — like seizing assets from wealthy oligarchs with close ties to Putin — would help minimize harm to ordinary Russians, and for that reason are a more attractive alternative to a SWIFT cutoff at the moment.

Blocking Russia from SWIFT, moreover, would escalate tensions considerably. In 2014, the last time world leaders considered cutting off Russia from SWIFT, then-prime minister Dmitri Medvedev said that Russia would consider such a move a declaration of war. And if this week has proved anything, it’s that Putin isn’t unafraid of following through on threats, however ill-considered.

Wealthsimple Favourites

- A computer language that controls the financial world

- The perfect guide to every annoying tax question you have

- What’s up with all those crypto laser-eye profile pics?

- How do I diversify, anyway?

- Why the stock market goes up over time

- Raising middle-class kids when you’re no longer middle class.

Sarah Rieger is a senior news writer for Wealthsimple Media, and co-host of the TLDR podcast. She was previously a reporter at CBC News and editor at HuffPost Canada. You can reach her at srieger@wealthsimple.com.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.