Finance for Humans

Markets Have Been Bananas. Is It Time to Hold Defensive Stocks?

Investors tend to flock to stable (that is, boring) companies in times of turbulence. We investigated whether that’s such a good idea.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

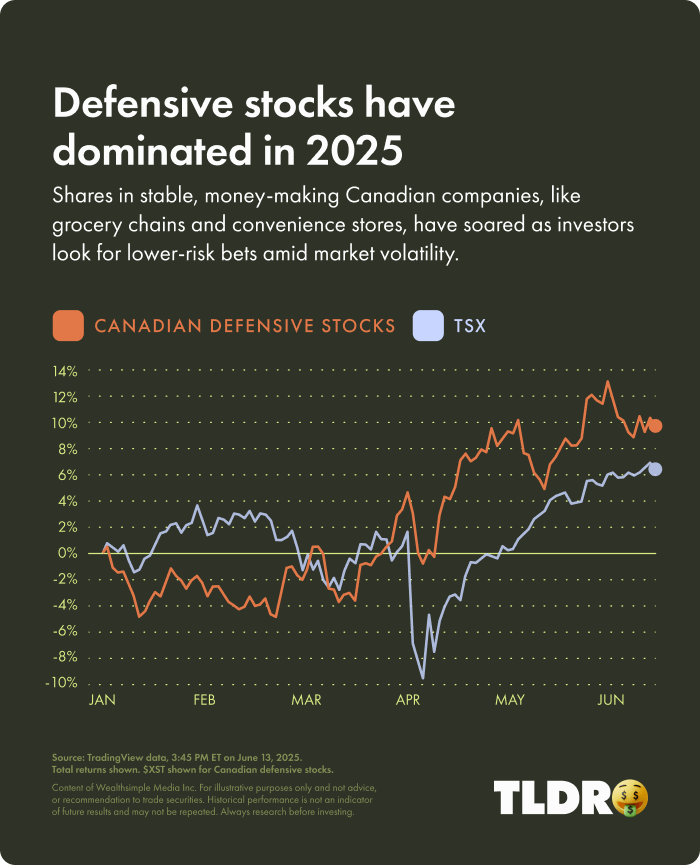

In case this is your very first time reading about markets in 2025 — news flash! — stocks have been bouncing around a lot. After cratering in April, the TSX is back up 6.4% for the year, with the S&P 500 lagging behind at only 1.8%. The tariff-related volatility has sparked a lot of chatter, both in fancy business papers and on Reddit, about so-called “defensive” stocks, which refers to shares in boring, stable companies that generate a lot of cash. We decided to examine whether the buzz is warranted.

What’s a defensive stock anyway? Sounds scary. Just so we’re clear, defensive stocks are not the same as defence stocks, like Lockheed Martin. There’s no hard-and-fast rule about what qualifies as a defensive stock, but they tend to be well-established companies whose share prices don’t fluctuate much because they sell stuff we all need to live. Think groceries, fast food, utilities, telecom, etc. Companies in these industries tend to have a stable cash flow, because weak economic conditions don’t radically change the demand for their goods or services. If you lost your job, you would cut back on a lot of things before you, say, start skipping grocery runs. The catch is that in boom times, defensive stocks don’t typically boom quite as high as the rest of the market.

So how do defensive stocks stack up? A good proxy for defensive stocks is the consumer staples indexes for the TSX and the S&P 500. The TSX version includes Loblaw, Metro, George Weston, and Alimentation Couche-Tard, while the S&P 500’s has Coca-Cola, Kraft-Heinz, and Walmart, among other blue-chip royalties.

So far this turbulent year, both indexes have delivered steady, modest growth in line with what investors would expect: the TSX’s consumer staples index, as tracked by $XST, is up almost 10% YTD, besting the TSX’s (very solid) 6.4% return and the S&P 500’s (far less solid) 1.8% return. The story is similar when it comes to the S&P’s consumer staples index. $VDC, which tracks the sector, is up 4% YTD, putting it ahead of the broader American market.

What if you zoom out? The story gets a little more complicated if you look at the past decade. Since June 2015, American consumer staples have risen about 120% (total return), underperforming the S&P 500 by about 60%, which is in line with what you’d expect. Far more surprising, Canadian consumer staples have risen by 181%, trouncing the TSX by about 100% and (impressively) keeping pace with the S&P 500. Which is not what you’d normally anticipate and says one thing about Canadian grocery chains: they’ve made a lot of money since COVID.

So should you hold defensive stocks? We’re not in the business of telling people which securities to buy, in part because we don’t know your risk tolerance or, for that matter, what the market will do next. That said, American and Canadian defensive stocks have, as noted, generated solid returns in recent years. Advisors tend to tell conservative investors to devote 30% to 40% of their equity holdings to defensive stocks.

But fair warning: over the past century, just 2% of all U.S. stocks have generated 90% of the market value, meaning that any investor who’s made serious money has almost certainly needed to hold those stocks. And in recent years, tech companies have carried the value-creating baton. The tech-heavy Nasdaq 100, tracked by $QQQ, has soared by 430% over the past decade, easily outperforming defensive stocks and the S&P 500’s 185% return and the TSX’s 81% return. Will tech companies repeat that performance? That’s a matter of debate. But if you’re young and/or able to take some risk, keep in mind that risky, innovative companies — be it AT&T and GM in the 1950s or Amazon and Google today — have long tended to drive the biggest returns, and playing it safe with defensive stocks carries a risk of its own: missing out on hefty returns you might need to reach your savings goals.

Brennan Doherty is an education writer and researcher for Wealthsimple. His work has appeared in the Toronto Star, The Globe and Mail, TVO Today, MoneySense, BBC Business, and other publications.

Topics related to this article

Click a topic to exploreThe content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.