Finance for Humans

Inflation Freakout 2021: What Happens Next?

OK, so inflation is high — really high. And central bankers are in a tough spot, because there’s no clear way to bring it down. Here are three paths they’re probably considering, and what each might mean for the rest of us.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

This article is part of Slow Money, a column by Wealthsimple’s investment team about growing wealth over time.

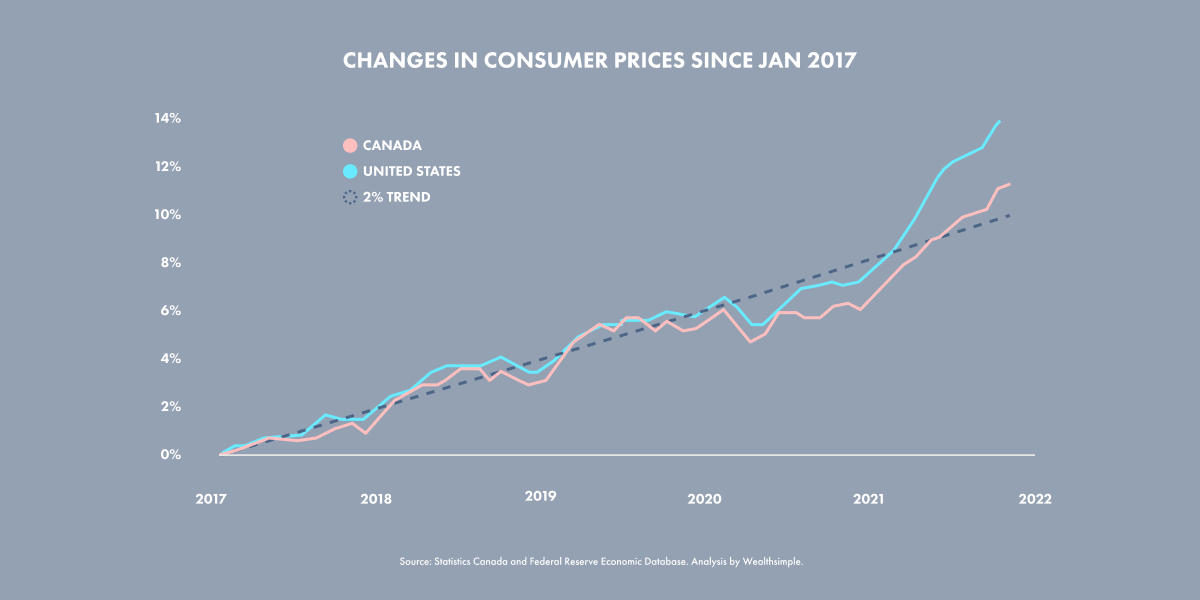

Let’s say your name is Tiff Macklem. And let’s say you happen to be the governor of the Bank of Canada. Well, Tiff, you probably haven’t had the most fun year of your professional life, we’re afraid. Because inflation is up — a lot. It’s not quite approaching 40-year highs, as it is in the U.S., with its 6.8% annual increase. But prices have still spiked 4.7% in Canada. You probably already know that people aren't happy about that, since their hard-earned money is suddenly buying them noticeably less stuff. In fact, a lot of folks are pretty ticked off about the whole thing and wondering how central bankers like you and your American counterpart, Jerome Powell, let inflation get out of control and why you haven’t fixed it yet. Everyone assumes that you’re the guy who can solve our economic problems, by adjusting interest rates and by using quantitative easing to either stimulate or cool down the economy.

But, Tiff, we get it: these things can be a lot more tricky than your detractors realize. You can use the powerful tools at your disposal to pump the brakes on the economy and bring down prices. But doing so almost always hurts employment, and if you go too far, you could even trigger a recession. On the flip side, you don’t want to be overly concerned about employment and not do enough, and risk inflation getting way worse. So you’re in a jam. And there’s a lot of pressure on you to bring down prices ASAP, since the way inflation evolves will have a big impact on the economy and the stock market in the coming years. To help people understand just how difficult the choices are, let’s walk through your options.

The dotted line shows a 2% annual uptick in inflation — what’s considered price stability. Both Canada and the U.S. are well north of that over the last year.

Option #1: Tighten!

Some bad news first: supply-chain issues are a large cause of inflation right now. (We’ve all seen photos of the container-ship backups, right?) Unfortunately for you, Tiff, central bankers can’t do much about supply problems other than hope they get resolved ASAP. What you can do is reduce spending by tightening monetary policy — mostly by raising interest rates and buying fewer bonds to support the stock market. And, if you reduce spending enough, you can relieve some pressure on supply chains and help cool off prices. You’ve already taken some big steps toward tightening: the BoC recently announced that it’s going to end quantitative easing. The next step would be to raise interest rates, making it more expensive to borrow money. And when money is more expensive to borrow, spending and demand usually drop, as do prices. The catch is that unemployment, which in Canada is nearly back to pre-COVID levels, would go up as spending drops.

Example: The early 2010s

You don’t have to look far in the past to find an example of aggressive tightening in response to rising inflation. In 2011, people were just beginning to spend money again after the worst financial crisis since the Great Depression. That spending led to a pop in prices, and people started to worry about inflation growing out of control. The U.S. Federal Reserve and the Bank of Canada reacted by halting quantitative easing. The U.S. and Canadian governments, meanwhile, were slashing fiscal spending. These two factors slowed price gains — but at a cost. Inflation stayed low, yes. But, in retrospect, the economy probably needed more support than it got, and aggressive tapering was almost certainly an overreaction that prolonged the Great Recession.

If you tightened today:

The COVID-fueled crash of 2020 resembled the 2008 financial meltdown in that both were massive and awful and scary. But the recoveries have been very, very different, and the economy is in a much better place than it was in 2011. Way more people are employed now, for starters. Wages are gradually rising. And demand is booming, rather than limping along. So you might have some room to tighten, provided you don’t tighten too much. With some luck, you might be able to split the difference by tightening enough to combat inflation but not enough to cause tons of layoffs and maybe a recession. Central banks have pulled off this soft-landing approach in the past; the Fed did it as recently as 1994. So it’s not impossible, but it’s certainly not easy, especially when there are as many variables at play as there are today. Like we said, Tiff, being a central banker is tricky.

Option #2: Do Nothing — or Mostly Nothing

Rather than risk triggering a recession by tightening too much, you could do little or nothing and just pray that inflation resolves itself. Sometimes this actually works! The catch is that it’s hard to know how much support the economy needs at any given time, and the difference between sagely letting inflation pressures work themselves out and being caught asleep at the wheel as prices soar is sometimes clear only in retrospect.

Example: The 1970s

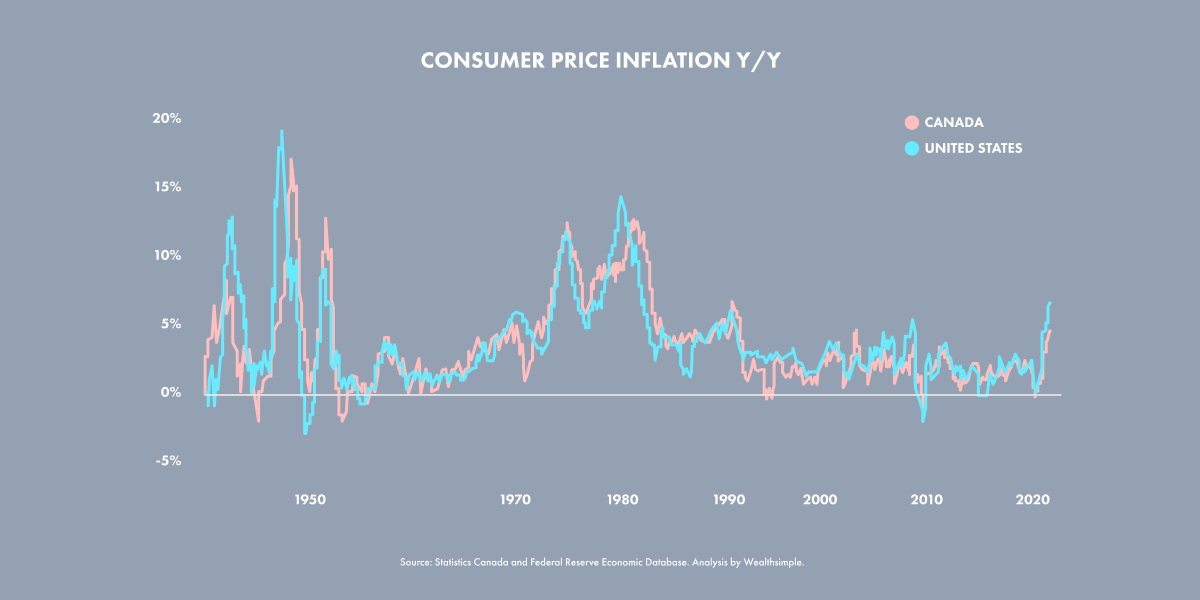

In the late 1960s, inflation was beginning to tick up, largely thanks to massive U.S. spending on the Vietnam War and on Great Society programs. But prices really got out of control in 1973, when OPEC declared an oil embargo. Fuel prices skyrocketed — which caused all sorts of supply shortages and drove up the price of pretty much everything; Canadians saw prices soar by more than 9% in 1973 alone. Policymakers responded to this dramatic inflation — but pretty slowly and ineffectively in retrospect. Which turned out to be a big mistake! Supply shocks persisted throughout the 1970s, and inflation got baked into people’s expectations, exacerbating the problem. People panic bought gas and rice and toilet paper, while many unions, which had a lot more power back then than they do today, started demanding inflation-adjusted contracts and wages for their members. The result was an upward price spiral that lasted till the early 1980s. Prices finally fell thanks to a massive and painful increase in interest rates that killed demand and caused a recession — but which eventually reset inflation expectations.

The recent inflation spike is the biggest change in prices since the early 1990s — but is pretty measly compared with the inflation we saw throughout the ’70s.

Another example: Post-WWII

OK, so the ’70s were bad. But the sit-on-your-hands strategy worked pretty well about three decades earlier. After World War II, consumer prices went nearly vertical in Canada and the United States, since people were finally spending money on stuff they couldn’t, or wouldn’t, buy during the war. At the same time, factories that had spent much of the 1940s making munitions or tanks had to transition back to making consumer goods, and this switchback took time. Prices rose quickly. But central bankers kept interest rates low anyway, at the risk of overheating the economy. Unlike in the 1970s, however, the public didn’t freak out about rising prices and inflation didn’t get baked into consumer expectations, since folks were apparently just too happy to have just won a world war than to stress about a jump in prices. And, thanks in part to their cool heads and to the fact that a lot of factories quickly boosted production, inflation would come down by the late 1940s.

If you did nothing (or almost nothing) today:

It’s hard to say, and hotly debated, whether we’re closer to 1973 or 1946. On one hand, there are a lot of structural differences in the economy today — weaker unions, more globalized production — that make a ’70s-style inflation spiral somewhat less likely. And the economy’s emergence from COVID does, in some respects, resemble a postwar boom, mostly in regards to temporary supply issues. A big difference today, though, is that we won’t have a huge numbers of North American factories suddenly start churning out products to help meet demand. Also, compared with folks in the 1940s, people today seem to have less confidence that inflation spikes will abate quickly. So a concern moving forward is whether people in today’s economy will come to expect inflation as a way of life and begin demanding higher pay because of it. If that happens, bringing prices down will be way more challenging. Lucky for you, a good number of working adults were not alive yet or were children in the 1970s, and therefore don’t have strong memories of living through a period of rapid price gains. Plus, the recent inflation spike is far less severe than the one in the ’70s. So, while COVID still lingers, people might be more willing to look at inflation as a temporary phenomenon. But if that changes, you might need to step in with more force than you have so far.

Option #3: Stimulate More!

To be sure, no one is really arguing that you or your American counterparts ought to stimulate more right now; conversation instead centers around when, and how much, the central banks should tighten. Still, one country — Turkey — is decidedly stimulating, partly since tightening would hurt employment and government leaders are apparently unwilling to let that happen. For the sake of thoroughness, though, let’s just consider what might happen if you followed suit and squeezed even more lighter fluid onto the roaring economic barbecue.

Example: Right now, in Turkey

Despite major price surges, Turkey has cut interest rates, in a bid to jump-start its economy and bolster employment. The results have not been great, with the rate cuts fueling inflation and devaluing the country’s currency. This combo has made Turkey’s economic future very uncertain — and businesses, especially foreign ones, tend not to invest very much in countries with uncertain economic futures. And yet it’s uncertain whether Turkish policymakers will stop stimulating anytime soon: Turkey is on its fourth central banker in two years; President Erdogan has made it clear that he won’t tolerate policymakers who raise interest rates — never mind that on December 17th the country suspended stock trading, owing to its ongoing currency crisis.

The simplest way to invest in crypto

WEALTHSIMPLE CRYPTO

The simplest way to invest in crypto

Buy and sell Bitcoin, Ethereum, Aave, Uniswap, and more — instantly.

If you stimulated more:

You probably won’t! The Canadian economy is humming along well enough that you don’t need to goose it back into gear, like Turkey is trying to do. The one thing that might change that is if a new COVID variant — maybe Omicron, maybe one not yet mutated — triggers renewed shutdowns and grinds business and spending to a halt. In that case, we could see demand plummet in the same way it did right after the first wave of 2020 lockdowns, perhaps necessitating more stimulus. But, even with Omicron spreading like mad, that seems like a distant possibility at the moment.

OK, So What Now?

Tiff: if anything, we realize that you have a tough job and that people are going to be mad at you and think they know better than you until the inflation problem is fixed. Trying for a soft landing seems like a good idea — but getting the timing perfect, without being too aggressive or not aggressive enough is a hard needle to thread. Making your job even harder than it already is, these three factors could change the inflation equation and affect your decisions moving forward:

Supply constraints: Some measures suggest that supply snafus are getting better and that the worst might be behind us. Cross your fingers that these early reports prove correct and we see inflation quickly abate just as it did after WWII. What’s more, some manufacturers have responded to the shortages by ramping up their production capacity for semiconductors and other products, but whether this influx of supply will hit markets fast enough to alleviate the current price pressures remains to be seen.

Consumer expectations: Right now, people are upset about inflation, but they aren’t acting as if they expect prices to rise indefinitely, but that could change if food, energy, and home prices stay high. The credibility and perceived effectiveness of you and other central bankers comes into play here, because if consumers come to doubt that you have the inflation problem under control, they might assume that prices will keep rising and rising. Which leads us to our next point:

Wages: On one hand, it’s good if wages rise broadly, because that jibes with your goal as a central banker to make people’s lives better. But rising wages could also mean that employees are pushing for more pay to keep up with inflation, which is one of the main ways that prices spiral. If that happens, you could find yourself having to tighten more aggressively, and that would come with some pain.

Wealthsimple Favourites

- A computer language that controls the financial world

- The perfect guide to every annoying tax question you have

- What’s up with all those crypto laser-eye profile pics?

- How do I diversify, anyway?

- Why the stock market goes up over time

- Raising middle-class kids when you’re no longer middle class.

Spencer Gaffney is a writer based in New York.

Matthew Karasz is Director of Investment Research at Wealthsimple.