Money & the World

Why Sometimes Markets Go Up But Good Portfolios Go Down

Canadian investors have noticed that portfolios have declined lately. And a lot of them have wondered why. Here's an explanation, and why it's not a bad thing.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is a whole new kind of investing service. This is the latest installment of our “Data” series, where we dig into the numbers to learn more about how the world of money works.

The stock market is going berserk! If you turn on the TV or your computer, that's the one thing you're going to hear from the media about financial markets. New heights reached, records broken, stupendous returns, etc.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

But that’s not what everyone’s been seeing when they check their balances lately. If you’re investing in an efficient, well-diversified passive portfolio, like the ones our team builds at Wealthsimple, you’ve likely noticed a small drop in value over the spring and summer of 2017. Our investments have still capitalized on strong market performance — for example, the Wealthsimple balanced portfolio, designed for clients with medium risk tolerance, is up 4.9% for the year. But the gains would have been even greater if not for the past four months of so. And a lot of investors — including our clients — are wondering why.

The answer is that it's part of a sound investment philosophy.

First, remember that the short-term doesn't matter. If you're in it for the short-term, passive investing may not be the right way to go for you. Our recommendation is to tune out market fluctuations — time has proven that to be a winning strategy. Still you may be wondering why: if a service like Wealthsimple uses funds that tracks the markets as a whole, and those markets are going up, why did the value of my account go down? The answer is that the Canadian dollar has gotten stronger.

Recommended for you

The Most Compelling, Surprising, and Delightful Ideas of 2025

Money & the World

What’s Up With All Those Crypto Laser-Eyes Profile Pics? A Definitive Investigation

Money & the World

How 2023 Cracked Wall Street’s Crystal Ball

Money & the World

This Is Not Normal: A Letter From the Toronto Real-Estate Forever Boom

Money & the World

OK. From here on out we are going to go a little deep on financial theory. Not too deep. But we want to warn you.

We believe you can't have a truly good portfolio unless it's a diversified portfolio. Diversified means that you don't just own lots of different kinds of investments in one country; you also own investments in other countries, in case the market in Canada goes down. When you're diversified across borders, your returns are affected by two variables. The first is how well the investments do themselves. The market goes up? Your returns go up. The second one is something a lot of investors don't think about: changes in the value of the Canadian dollar. Let's say you own a fund that tracks America's S&P 500 index. That fund would be in U.S. dollars. Now let's say the U.S. dollar went up in value by 5% against the Canadian dollar. Even if the fund was flat, a Canadian investor would earn 5% on the investment because their US dollars could buy 5% more Canadian dollars. Likewise, if the Canadian dollar increased in value against the U.S. dollar by 5%, a Canadian investor would lose 5%.

Here's the bottom line: foreign currency is another source of diversification in your portfolio. Like any other position you hold, sometimes it'll help your returns and sometimes it'll hurt.

Canadian Currency Lesson: When Interest Rates Go Up, The Dollar Gets More Valuable

Starting in the spring, Canada's central bank began the process of raising interest rates — we saw two hikes this summer. When interest rates in Canada rise, that causes the value of the Canadian dollar to go up relative to most world currencies. In the last 4 months the Loonie strengthened 12% against the US Dollar and 5% against the Euro. So even though U.S. and European stocks are higher in their own currencies, they are worth less in Canadian dollar terms. And that affects the value of your portfolio.

Why We Are OK With These Fluctuations

It's possible to reduce the impact of fluctuations in exchange rates. There are funds that do something called “currency hedging.” These funds are designed to deliver investors the return of the underlying asset in its local currency.

We do invest in some funds that hedge currency. They've helped soften the blow of the Canadian dollar's recent surge. But we wouldn't want to dull that blow completely. We believe that having some exposure to currency fluctuations is a good thing.

Why? It's not because we think that the Canadian dollar will depreciate next week, or month or even year. We are not in the business of trying to outguess the market. No one knows for certain the direction of an exchange rate in the short term. It's that just like we don't think it's wise to have all your investments in one particular sector, we don't think it's wise to hold all your investments entirely in the same currency.

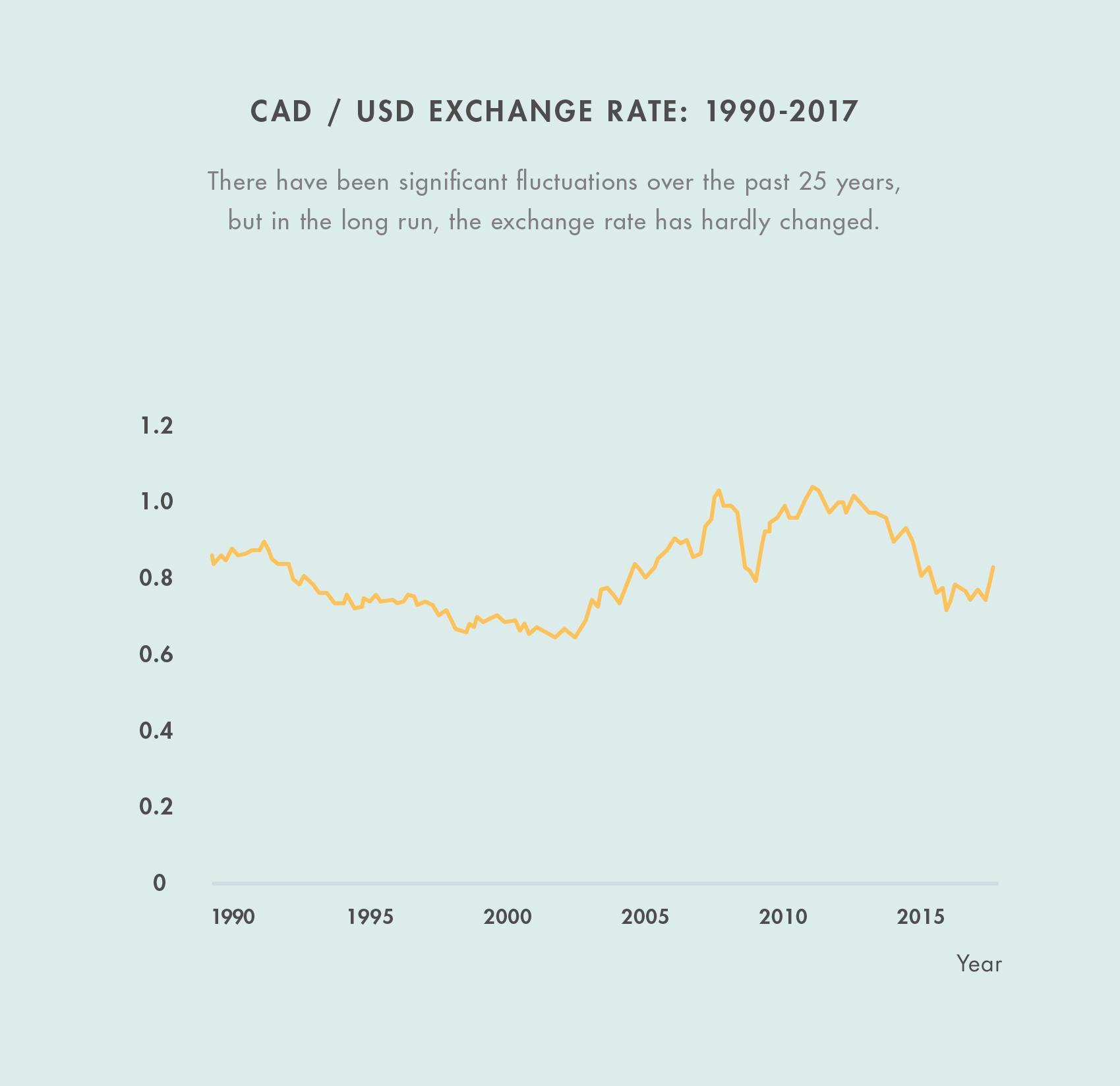

One of the factors that goes into that decision is that we know that, in the past, exchange rate fluctuations have evened out over time. Just look at the exchange rate of the Canadian and U.S. dollars over the past 27 years.

And there's a more important factor. It turns out that, even if exchange rates are volatile, when combined with stock market investments, they can actually make your portfolio less volatile overall. At least if you're Canadian.

Canada has an economy that is disproportionately commodities-based. And over the last 30 years, in countries with commodities-based currencies like Canada, portfolios that don't hedge their foreign equities have experienced less overall volatility. Why? Because the Canadian dollar has usually increased in value when the global stock market has risen and decreased in value when it's fallen. For example, in 2008, when world equities markets sank, the Canadian dollar fell by roughly 20% relative to the U.S. dollar. That means Canadian investors would have seen their stock market losses partially offset by currency gains.

There's a Price for Trying to Protect Yourself Against Currency Fluctuation

When it comes to investing, it's more expensive (and often not any more effective) to do stuff. To trade, to manage, etc. These are some of the costs passive investing reduces. Funds that do currency hedging usually charge higher management fees. In addition, hedging currency exposure isn't simple. Funds often aren't able to do it perfectly. Check out the performance of a popular ETF that invests in the S&P 500 index and hedges currency. It's designed to do at least as well as the S&P 500, but it's actually trailed that index by 12% during the past decade.

Do Your Best to Avoid Freaking Out About Fluctuations of All Kinds and You Will Be a Wise Investor

Here's the bottom line: foreign currency is another source of diversification in your portfolio. Like any other position you hold, sometimes it'll help your returns and sometimes it'll hurt. No one without a really accurate crystal ball is going to know when it's going to do one or the other. If you believe, as we do, that having some foreign currency exposure in your portfolio can help decrease volatility, the best thing to do is keep your eye on the long-term.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.