News

We Just Won The Oscar (of FinTech)

After being named to the FinTech 100, it's been a good week for awards at Wealthsimple

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

Technology-industry awards may not be as fun to watch as the Oscars (or, let’s face it, the Little League World Series). But they’re often a pretty good gauge of what’s going in an interesting and quickly changing world. That’s why we’re proud to announce that Wealthsimple was just named one of the FinTech 100—the annual list of the 100 best FinTech companies. That puts Wealthsimple in the company of businesses like Square, SoFi, Oscar, Stripe, CoinBase, and on and on.

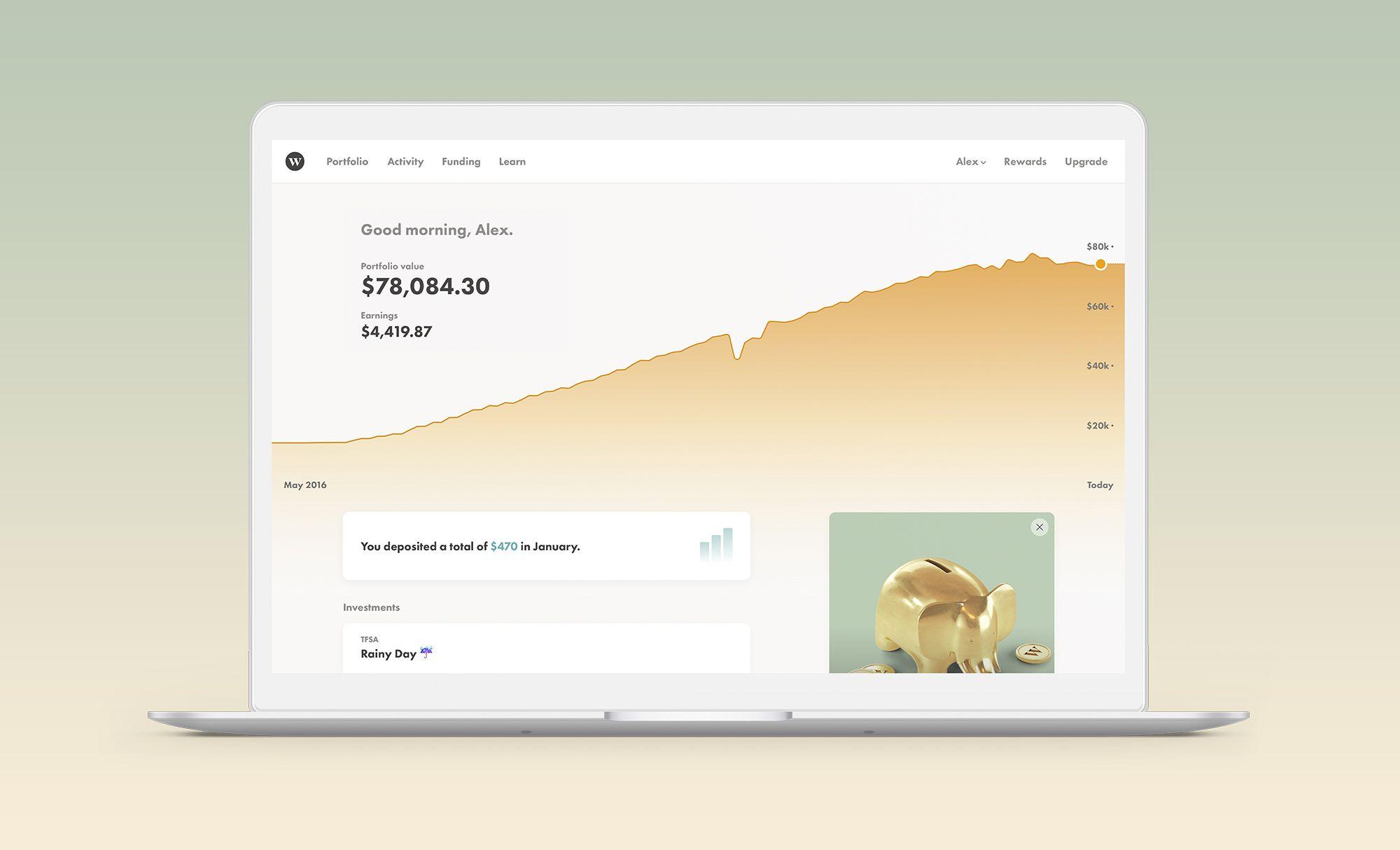

First you might want to know what Fintech is. That’s a term for technology firms that operate in the financial industry. In general, Fintech companies are the product of a bunch of smart people who looked at the way older institutional banks and insurance and investment (etc.) companies worked and thought, Hey, there’s a better way. Take, for instance, how Wealthsimple makes investing simpler, less arduous, more efficient, and lower-cost than investing with your traditional investment company. That’s the mission of these companies: to find a better way. It’s a competitive space to be in—everyone seems to realize the old way of doing business is going to change—which is part of the reason we’re proud to be given such an award.

Oh, and last night we got news that we think of as the cherry on top of our Fintech accolade sundae: Our CEO, Michael Katchen, was named Entrepreneur of the Year by Ernst & Young Canada. A pretty heady compliment from one of the most august, old-guard accounting firms in the world.

Why all the fuss? Well, we think it’s because at Wealthsimple it’s as easy to take care of Future You as it is to get started.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.