Money & the World

We Know About the Gender Pay Gap and the Race Pay Gap. But There’s a 2SLGBTQIA+ Pay Gap, Too.

Two experts talked to us about the influence sexuality has on income — and what can be done to fix it.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

2SLGBTQIA+ people are nearly twice as likely as everyone else to live in poverty. And if you’re a bisexual woman or transgender, on average you make significantly less — like half as much — as your straight or cisgender colleagues. For racial minorities who identify as 2SLGBTQIA+, those problems are compounded even more.

There’s not a ton of data, but what we do have is troubling. For every $100, a straight man earns in Canada:

A gay man earns $91.

A lesbian woman earns $80.

A straight woman earns $70.

A bisexual man earns $57.

A bisexual woman earns $45.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

Discrimination plays a big role. In one 2016 study, a doctoral student sent two sets of resumes to more than 800 companies. The resumes were identical, except on one set applicants were listed as having been involved with a 2SLGBTQIA+ organization. That group was 30% less likely to receive a callback. Another study found that about 1 in 10 queer people in the US said they faced workplace discrimination in 2021, and nearly half had at some point in their careers.

This is a problem for obvious, human reasons, but it also causes even larger economic issues. Brett House, formerly the deputy chief economist at Scotiabank, says wage gaps like these lead to food and housing insecurity and general poverty. And that, he says, hurts society as a whole by bringing down a country’s total economic growth and creating a system of haves and have-nots. Which is bad whether you measure growth as gross domestic product or gross domestic happiness.

We asked House and Spencer Watson, president and executive director of the U.S.-based Center for LGBTQ Economic Advancement and Research, to walk us through the factors behind the problem.

Recommended for you

GME, Doge, Supreme: How Getting Rich Went Full Internet

Money & the World

Dumb Questions For Smart People: Why Parenting Inequities Make Mothers Leave the Workforce

Money & the World

We Discovered the True Identity of the NFT Artist “Pak”

Money & the World

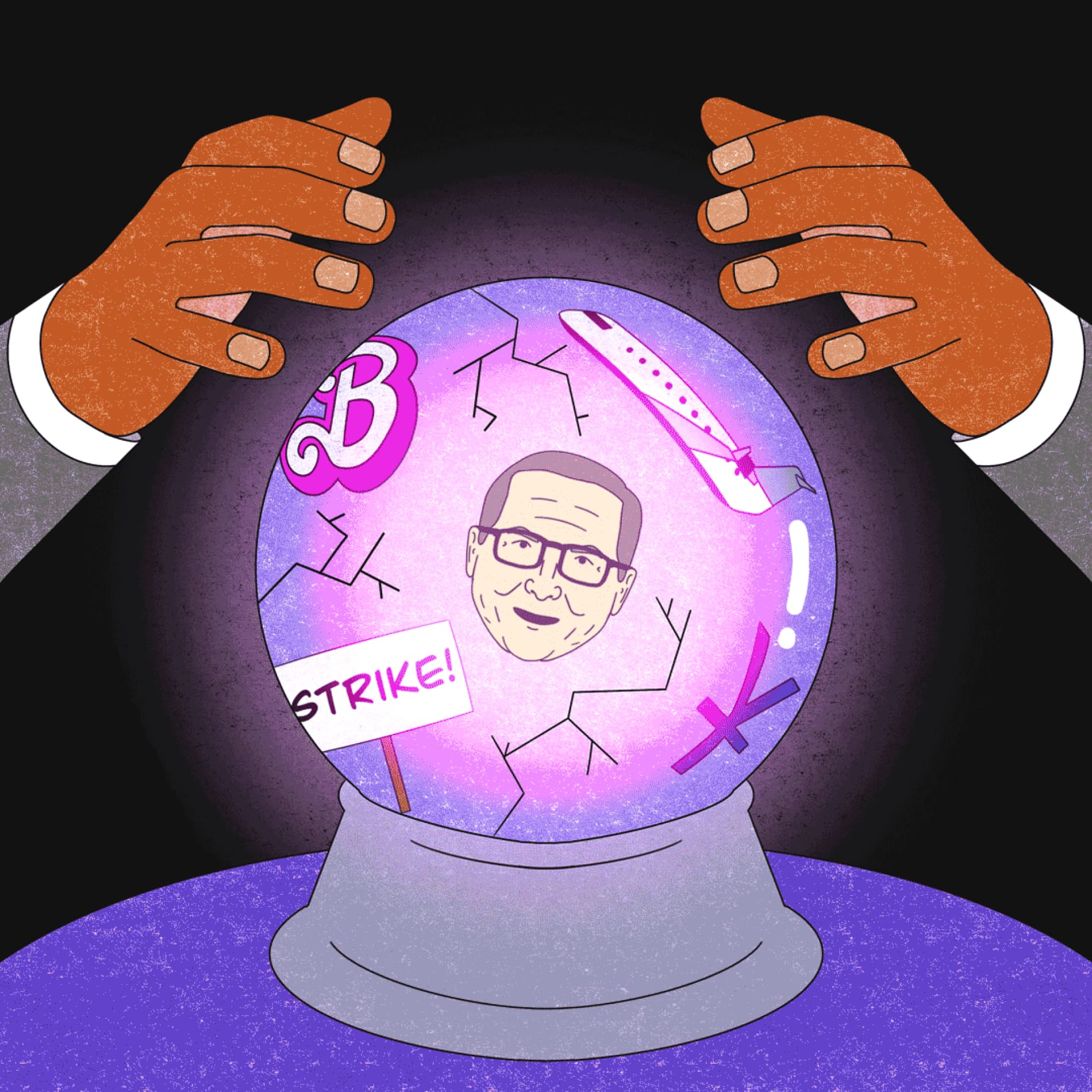

How 2023 Cracked Wall Street’s Crystal Ball

Money & the World

Step 1: Lack of research

It’s hard to address a problem when you don’t know how big it is. Statistics Canada has collected limited data since 2003 that breaks down income, wages, and savings by sexual orientation or gender, but it wasn’t until the most recent census, in 2021, that there was the option to register as transgender or non-binary. “An absence of data isn’t an indicator that there’s an absence of a problem,” House says.

Step 2: Marketing myths

Watson says a lot of marketing is built on inaccurate and harmful myths about the 2SLGBTQIA+ community — like the caricature of queer people as hedonistic, brand-loving shoppers who can be targeted for niche, upscale things. “It belies this reality that 2SLGBTQIA+ people are suffering from wealth gaps [and ends up] marketing products that aren’t actually geared toward the interests or needs of the community.” For example? When a travel company rainbow-ifies its ads for weeks-long singles cruises but doesn’t show a single queer couple when it’s marketing more affordable family vacations.

Step 3: Rainbow-washing

House says he appreciates the advancement he’s seen over the past few decades: instead of companies being completely unwilling to associate themselves with the queer community, it’s started to look like a Crayola box exploded in their lobbies every June. “That sends a signal to people that they’re valued and that corporations want to work with, employ, and sell to queer Canadians,” he says. The problem, for some companies, has been that all those crayons disappear on July 1.

Step 4: Lacking (or unenforced) legislation

Amazingly, it was legal until the ’90s in Canada to discriminate in the context of employment on the grounds of sexual orientation. Canada’s workplace equity law identifies only four designated groups as disadvantaged in the workplace: women, Indigenous peoples, persons with disabilities, and racial minorities. That act is currently undergoing a much-needed overhaul, with preliminary recommendations expected later this year. Everything’s on the table, from protecting new groups, new rules to ensure workers get hired, promoted, and retained, and better ways to enforce those rules.

Step 5: A too insular view

“We need companies to go beyond marketing to real allyship, and not just in Canada,” House says. “It’s wonderful to see a rainbow splashed at King and Bay in downtown Toronto. But it’s important that Canadian companies represent their commitment around the globe where they operate.”

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.