Money & the World

Money 2023: The Year of ‘Wow, That Wasn’t So Bad After All’

The investing world expected a brutal 2023. Instead, stocks soared and the economy is (probably) headed toward a soft landing, which underscores an important economic truth: predictions are often wrong.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

If this year in money could be summarized in a sentence, it would be: That went really well, all things considered! Twelve months ago, economists and market prognosticators almost universally believed that a recession was not just imminent but necessary — the idea being that the only thing that could rein in inflation was an economic downturn courtesy of painful interest-rate hikes. This gloomy view was validated by periodic discouraging news. In March, Silicon Valley Bank collapsed and the stock market plunged — a roller-coaster drop that made everyone think, Is all the pain about to start? Then, over the summer, China’s COVID reopening sputtered.

But a five-alarm economic crisis never materialized, or at least it hasn’t yet. Canada’s inflation rate fell from 5.9% in January to 3.1% in November. Unemployment remains fairly low, at 5.78%, despite 10 (!) interest-rate hikes since 2022. Consumer spending is at an all-time high. And stocks have rallied as more and more investors have come to see sunshine and rainbows in the future, based on the assumption that central bankers will cut rates next year. In other words, it looks like we’re getting a soft landing.

That leads us to one of the year’s major takeaways: don’t put too much faith in forecasters. But 2023 had a few more big lessons for us, as well. Here are three.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

[1] The COVID cycle has been loooong — and it’s still going.

The pandemic long ago stopped disrupting most people’s daily lives. But four full years after the coronavirus swept the world, COVID’s ripple effects are still being felt throughout the economy. Think about it: In 2020, the pandemic caused the most severe economic contraction since the Great Depression. Unemployment spiked, and the global supply chain fell apart, causing all sorts of shortages. Governments, in response, handed out money to stimulate the economy. And, boy, it worked. In 2021, the economy took off like one of those water jetpack things as the freshly vaccinated masses started trying to spend cash.

The problem was that all the sudden demand — coupled with lingering supply-chain chaos and a spike in energy prices resulting from Russia’s invasion of Ukraine in early 2022 — sent inflation to its highest rate since 1982. And because of that, central banks raced to raise rates to cool demand. And that seemed certain to crush consumer spending and drag the economy into a recession. But — surprise! — spending stayed strong, supply chains got fixed, energy prices fell, and inflation cooled unexpectedly quick.

Recommended for you

Dumb Questions For Smart People: Why Parenting Inequities Make Mothers Leave the Workforce

Money & the World

Data: Who Really Traded GME? Why? And What Happened to Them?

Money & the World

GME, Doge, Supreme: How Getting Rich Went Full Internet

Money & the World

The Racial Wealth Gap Is a Problem

Money & the World

And this whole chain of events stemmed from the COVID shock. The part that really surprised investors was that businesses were able to quickly meet all the pent-up demand unleashed by the post-lockdown recovery, and prices mostly stabilized as that happened. As for consumers, the ride wasn’t comfortable. Everything costs more than it did before the pandemic, and no one is used to it yet. And, unfortunately, it could take years for wages to catch up across the board and ease the discomfort.

[2] It’s really, really hard to fix housing.

Affordable housing has been a Big Issue in Canada for a long time, but the pandemic turned the problem into a fiasco for prospective buyers. Home prices have soared by at least 25% since 2019. The solution is fairly clear: Canada needs to build more houses, — as in 3.5 million additional units by 2030. So why can’t we just do that?

Well, we’ve learned that it’s not easy to get projects going. Interest rates bear some blame. Developers need to take out loans to build, but borrowing is expensive now, so they’re not rushing to do it, hence they’re building fewer new homes today than they were two years ago. But a more fundamental problem are restrictive zoning rules that prevent or limit building high-density housing. A construction labour shortage is complicating the situation. All these factors recently led the federal government to revive a war-time program that will allow developers to build pre-approved home designs quickly — a desperate measure for a desperate time.

[3] The end was not nigh for tech stocks.

We published an essay in April about traders — namely Steve Eisman, of The Big Short fame — who speculated that tech might soon lose its dominant place atop the stock market. Eisman’s argument went something like: tech companies live off borrowed money to grow and develop moonshot products that could generate big profits far in the future. And in the zero-rate, pre-pandemic era, investors were happy to wait for said profits, because tech companies were growing like crazy and seemed sure to deliver. But, according to Eisman and others, in a world of higher rates, investors would favour companies that are highly profitable right now, because the rising cost of borrowing would kneecap tech companies dependent on cheap capital to grow.

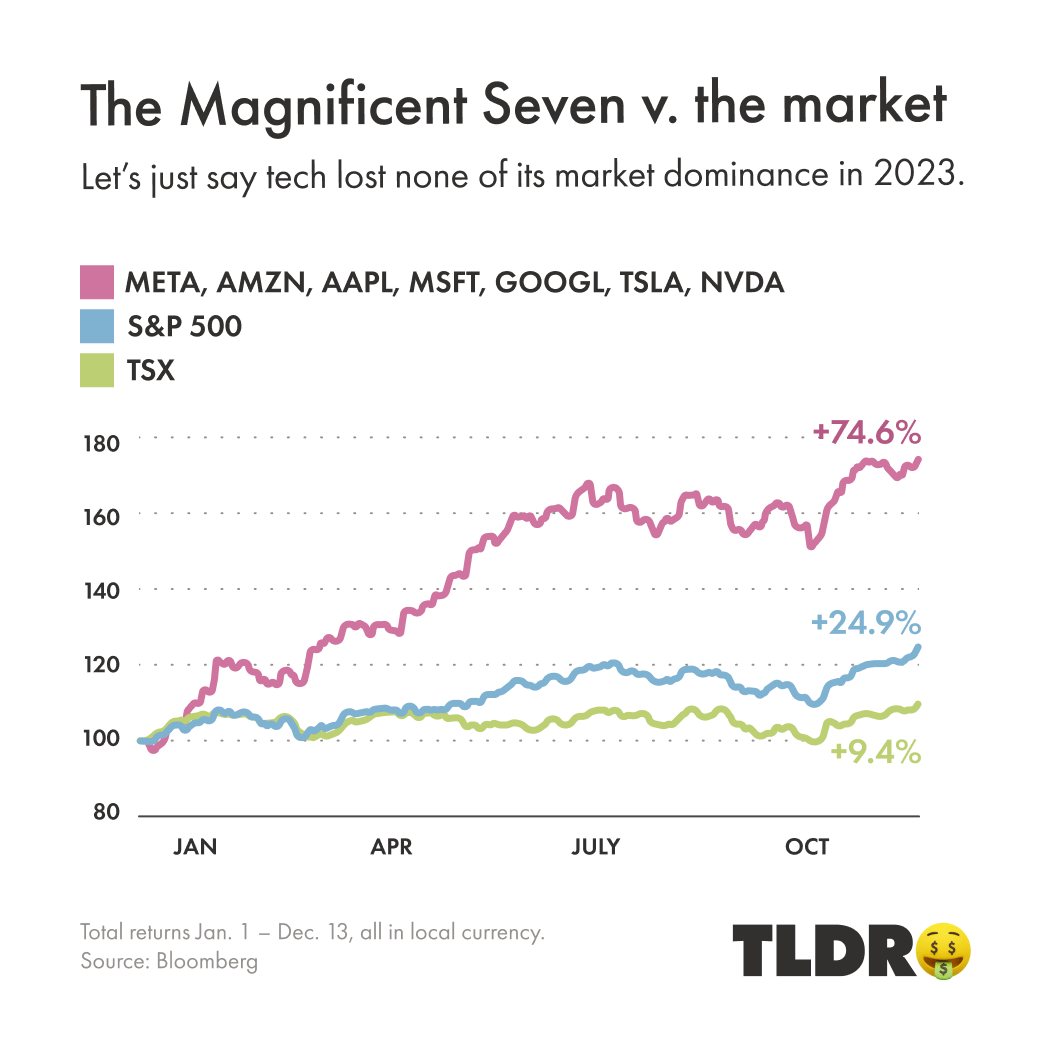

All of this seemed plausible; none of it happened. As the chart below shows, seven big U.S. tech companies carried the stock market by improbably rising almost 75% YTD. Why? Profits boomed, for one. But investors also became captivated by artificial intelligence and felt sure it would be a boon for the tech giants developing it. A gold rush ensued (helped along by rate-cut optimism). Shares in Microsoft — widely seen as an AI leader — have risen by 55% YTD. AI-chip designer Nvidia raked in US$18.1 billion in Q3. Its stock sits +237% YTD. Who knows whether the so-called Magnificent Seven will live up to investors’ high expectations. But all the speculation about tech losing its stock-market crown now seems premature at best and flat-out wrong at worst.

2024: The Too-Good-To-Be-True Year?

What’s next? Goldman Sachs and other fancy firms have rosy views, believing that inflation will keep falling, central bankers will cut rates (perhaps as early as the spring), and the economy will chug along nicely. But let’s not forget a major lesson we mentioned up top: predictions are often wrong. Forecasters were wrong about this year being terrible, and they could be wrong that next year will be all cookies and ice cream. Their expectations are wildly high, and potential curveballs abound. Inflation could rise from the (almost) dead, say. Or consumer demand might slow. Or China could act on its threat to invade Taiwan and disrupt the world’s semiconductor supply, to say nothing of the human toll. Then there’s Russia’s war against Ukraine, Israel’s war in Gaza, and the possible reelection of Donald Trump. Let’s cross our fingers for the cookies-and-ice-cream scenario. ◆

Wealthsimple Favourites

- A computer language that controls the financial world

- The perfect guide to every annoying tax question you have

- What’s up with all those crypto laser-eye profile pics?

- How do I diversify, anyway?

- Why the stock market goes up over time

- Raising middle-class kids when you’re no longer middle class.

Ben Mathis-Lilley is a senior writer for Slate.com and the author ofThe Hot Seat: A Year of Outrage, Pride, and Occasional Games of College Football. He's also written for BuzzFeed and New York magazine.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.