Finance for Humans

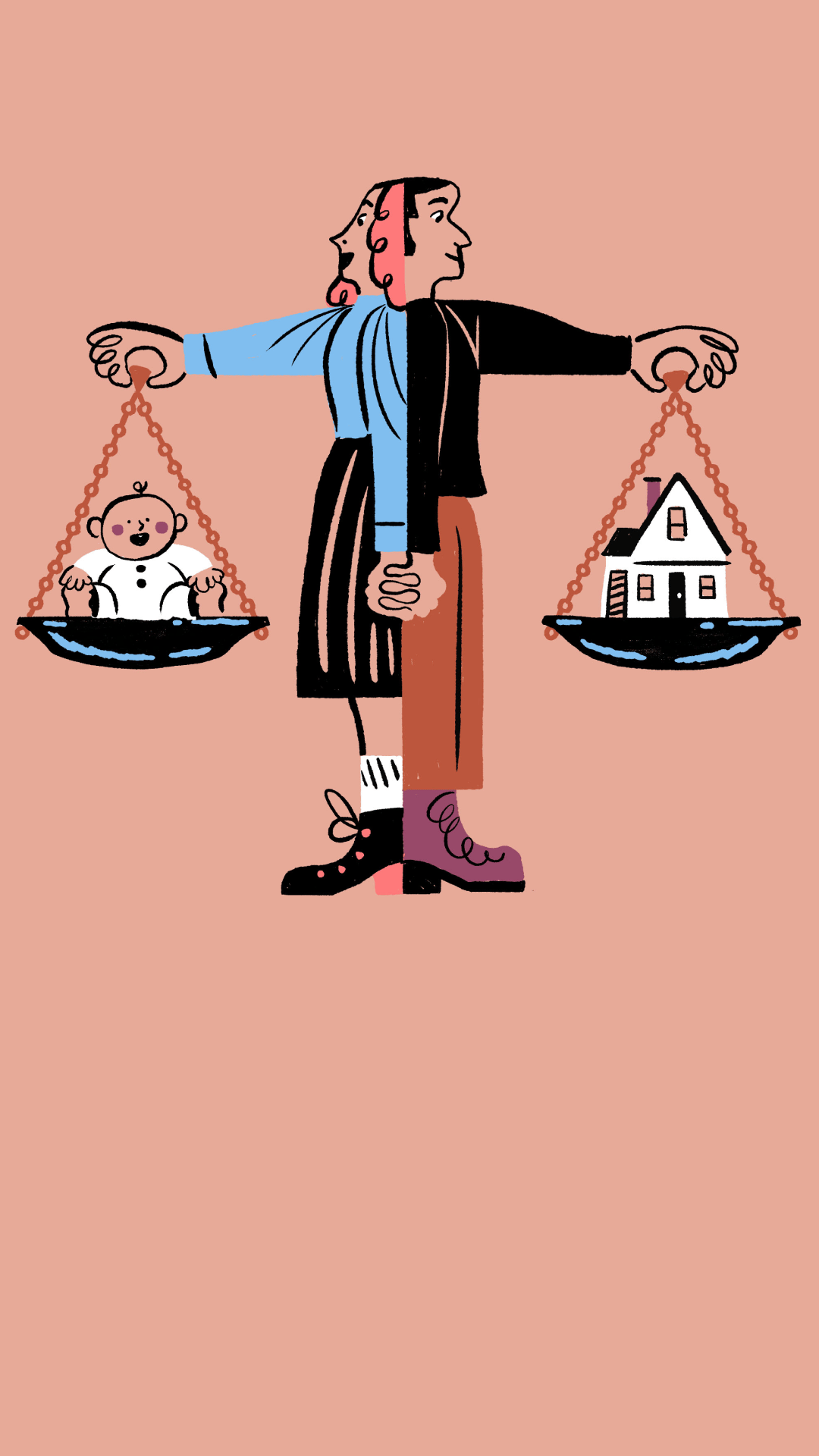

Ask Lizzie: I Want Another Baby. My Husband Wants to Build a Dream House. Help!

This week, our columnist wades into the messy business of balancing savings goals with having kids, and how to compromise when you disagree about… big things.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Dear Lizzie,

My husband wants to build a house for our family in the next five years. I’d rather have another child, quit working, and stay home full time with our kids now — but that would slow our savings and delay when we can build a home. My husband supports my wanting to stay home, but would prefer I work another couple of years first so we can keep socking away money. What should we do?

Thanks,

Vacillating in Vancouver

Dear Vacillating,

Let’s state the obvious up top: you and your husband are not on the same page about some of the biggest decisions parents have to make, and your priorities aren’t at all aligned. Which, for some couples, could spell big trouble. But there’s one thing working hard in your favour, and it’s in your letter: your tone. You wrote me a matter-of-fact note, with no trace of vitriol or resentment. And you described your husband as supportive. Both these things bode well for your reaching a workable solution, since you and your husband seem to respect each other, even if you disagree about how to move forward.

So how do you move forward? I called Andrew Sofin, a psychotherapist and the president of the Canadian Association for Marriage and Family Therapy. He had the same reaction to your letter as I did: you and your husband are in different places but not in different corners — which is great. Still, “you’re not talking about, Do we get pizza or sushi for dinner?” he says. These are big life choices. So a solution might not come easy.

First, Sofin said, you need to understand that you can’t bend your partner to your will. A lot of couples try that when making tough decisions, and it never works. You’ll probably both need to compromise some. And, to do that, Sofin suggests deconstructing exactly why each of you wants what you want. “You have to pull it apart into bite-size pieces,” he said, and get to the core of the problem.

Your husband, for instance, says that he wants you to keep working so you can save for a new house — but is there more going on? Maybe, because of his job situation, he feels uneasy about being the sole provider if you stayed at home. Or maybe he’s worried about adding another kid to the mix. You can’t know until you dig into the fine print and figure out his underlying motivations.

Why the rush? I would ask. Why is it so important to build a house in five years and not, say, in 10 or 15?

Next: let’s just say your husband doesn’t have a deeper reason for wanting you to work besides saving for a house. It’s important, then, to understand the thinking behind his timeline. Why the rush? I would ask him. Why is it so important to build a house in five years and not, say, in 10 or 15? I bring this up mostly because, while it might be nice to build a home sooner rather than later, a woman’s window for having children is finite, whereas building a house is not. Sofin agreed that this biological factor should weigh heavily on how you decide to proceed.

Of course, I don’t know your age or how easily you conceived last time. Maybe you’re super young and get pregnant easily and waiting five years to have another kid is totally realistic, and your husband’s timeframe is reasonable. But maybe you’re approaching an age where the whole pregnancy process gets more difficult, and potentially more expensive. If the latter is true, you need to clearly lay out why you want another child now as opposed to waiting. I trust, or at least really hope, that your husband will understand the pressure that time adds to the equation.

Another important consideration is that, if you do have another child and become a stay-at-home mom, the power dynamics in your relationship will almost certainly shift. In our capitalist society, money is power, even in loving marriages. “Whoever makes money has more power than the person who doesn’t, period,” Sofin said. That doesn’t mean you’ll be powerless as a stay-at-home mom; it just means that you need, again, to talk with your husband. If you stay home with the kids, for instance, will he expect you to do more household chores? And if so, are you OK with that? You’ll want to establish clear expectations along those lines before you stop working outside the house.

Similarly, in a recent column, my friend Ron Lieber cautions against a “financial spouse” handling all the money decisions for a family, while a “non-financial spouse” is left in the dark, since doing so can exacerbate feelings of financial inequity in a relationship. So you and your husband should talk about your involvement in finances moving forward. You don’t want to feel like you’re suddenly a supporting player, instead of part of a strong team

I know I’m throwing a lot of heavy stuff at you, but I have this weird faith that you can handle it. Also, I think it’s worth the money to have some of these hard conversations with a professional therapist. Sometimes, especially in a situation like yours, even a couple of sessions can have huge benefits.

I wish you all the best,

Lizzie

Lizzie O'Leary is a longtime economic and policy journalist. She hosts the podcast “What Next: TBD” at Slate.