Money & the World

Tesla Invested Billions in Bitcoin. But That May Not Be the Biggest Crypto News

What does it mean when a giant company parks billions in cryptocurrency? It’s a vote of confidence, sure. But maybe not the kind you’d imagine. We unpack what it means, who it’s going to affect, and what it portends for the future of Bitcoin.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

In early February, Tesla, a company known for doing weird things, did something...weird. They used a bunch of cash they had on hand to purchase $1.5 billion in Bitcoin. Afterward, there was a ton of analysis (as is the case with the many weird things that Tesla does), not to mention a flurry of buying and selling. Only in this case, it wasn’t just stock in Tesla. It was buying and selling Bitcoin, which drove the price up by more than 16 percent to an all-time high of $44,795.20.

While it’s almost certainly a bad idea to get swept up in any wave of hype when it comes to investing or understanding the big picture of how the world works (or first understanding and then investing), this was a moment worth unpacking—because of what it suggests about Bitcoin and, more than that, what it shows about the way investing works in the world of hype.

We sat down with Ben Reeves, Wealthsimple’s Chief Investment Officer, and Andreas Park, an associate professor of finance at the University of Toronto and research director at the school’s Rotman FinHub, to figure out what to take away from it.

Why it’s weird

Companies don’t own a lot of Bitcoin. The only company that owns more Bitcoin than Tesla at this point is a business-analytics company called MicroStrategy Inc. Last August, it bought $250 million worth of Bitcoin. Convinced there was more value in Bitcoin than in cash, it kept buying more. As of the end of last month, the company had 70,784 Bitcoins worth $2.25 billion at the time—and more than $3 billion today. PayPal and Square have also been buying sizable amounts of newly mined Bitcoin in recent months.

If you think of Bitcoin as cash (which, actually, is only one way to think of it), you could argue that having it on hand isn’t that weird because companies all need to keep cash of one currency or another on hand. If you’re the chief financial officer of a company, you’d most likely want a bunch of the same currency as the company uses to do its transactions (in Tesla’s case, that’d be US dollars) so that you don’t have to worry about having enough if there is volatility in the value of currency. If there’s extra cash, that tends to be returned to shareholders or kept on the balance sheet for a rainy day.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

But that’s not what Tesla’s doing with its Bitcoin. The company said the decision stemmed from a policy change it made in January to “further diversify and maximize returns” on the $19 billion cash it had. In other words, Tesla thinks Bitcoin has the potential to make the company money—certainly more than it would make holding an equivalent amount of cash. Which is actually a pretty unconventional way for a company to use cash.

“Companies make their money from providing goods and services, not from investing. They’re companies, not hedge funds,” says Reeves. “So they usually keep cash on their balance sheet to fund expenses, not to make investments in financial assets that they think will appreciate a lot. And investors usually buy stock in companies because they think the company is good at their core business and is going to make a profit. If an investor thinks Bitcoin is a good investment, she’ll buy Bitcoin, not a car company that owns Bitcoin. The bottom line is that investing in Bitcoin is highly unusual for a company. One of the only companies I can think of that both provides goods and services and invests for gain is Berkshire Hathaway, which invests in publicly traded stocks but also operates companies like GEICO, Duracell, and Dairy Queen.”

Was this really a big vote of confidence in Bitcoin?

The price went way up on Bitcoin because of what Tesla did.

“It shows that they must have some trust in the current value of Bitcoin—that they don’t consider this to be a bubble,” says Park. “Or at least for the holding horizon that they envision, they don’t foresee dramatic drops in it.”

Recommended for you

What’s Up With All Those Crypto Laser-Eyes Profile Pics? A Definitive Investigation

Money & the World

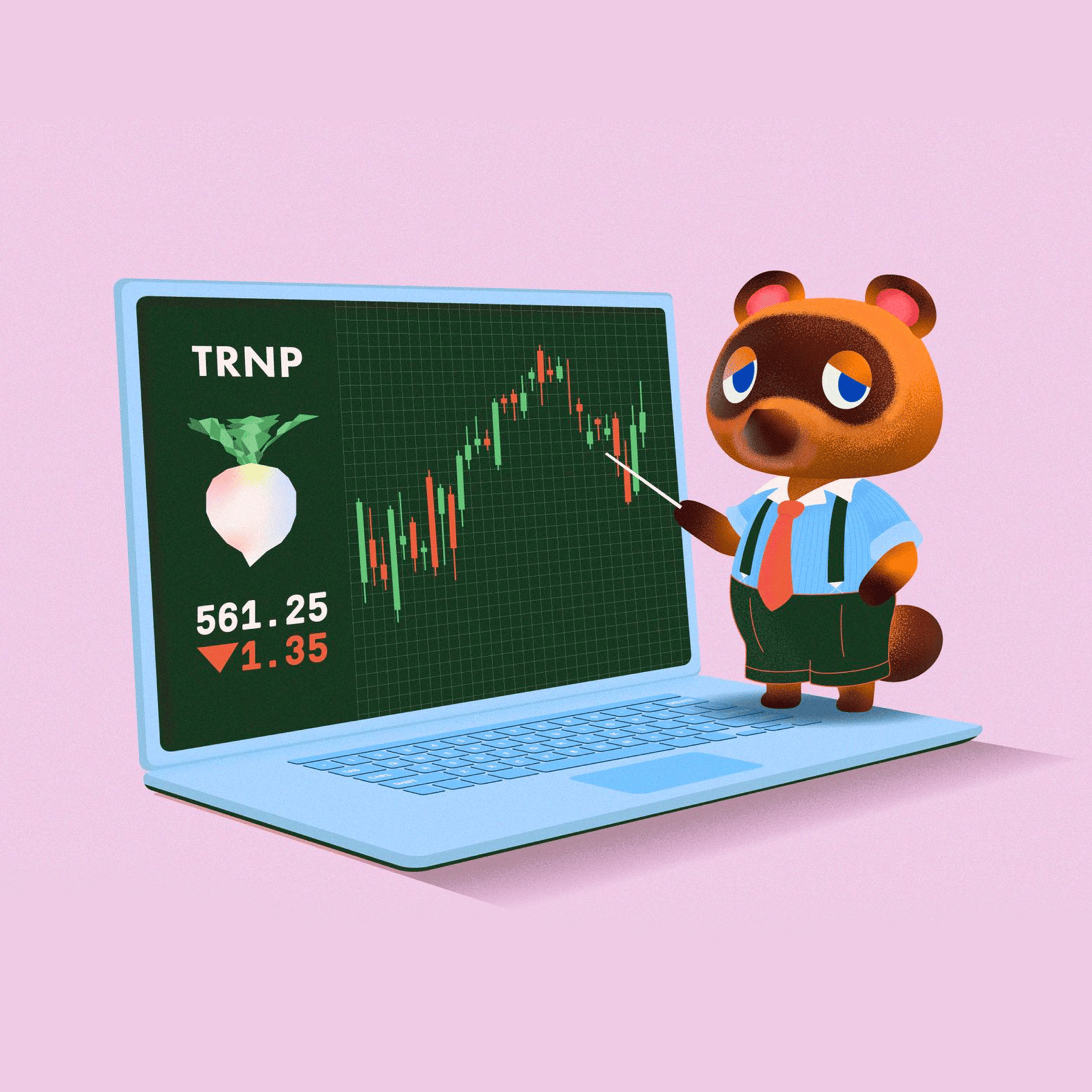

We Asked Our Resident Stock Market Genius About the Animal Crossing Economy

Money & the World

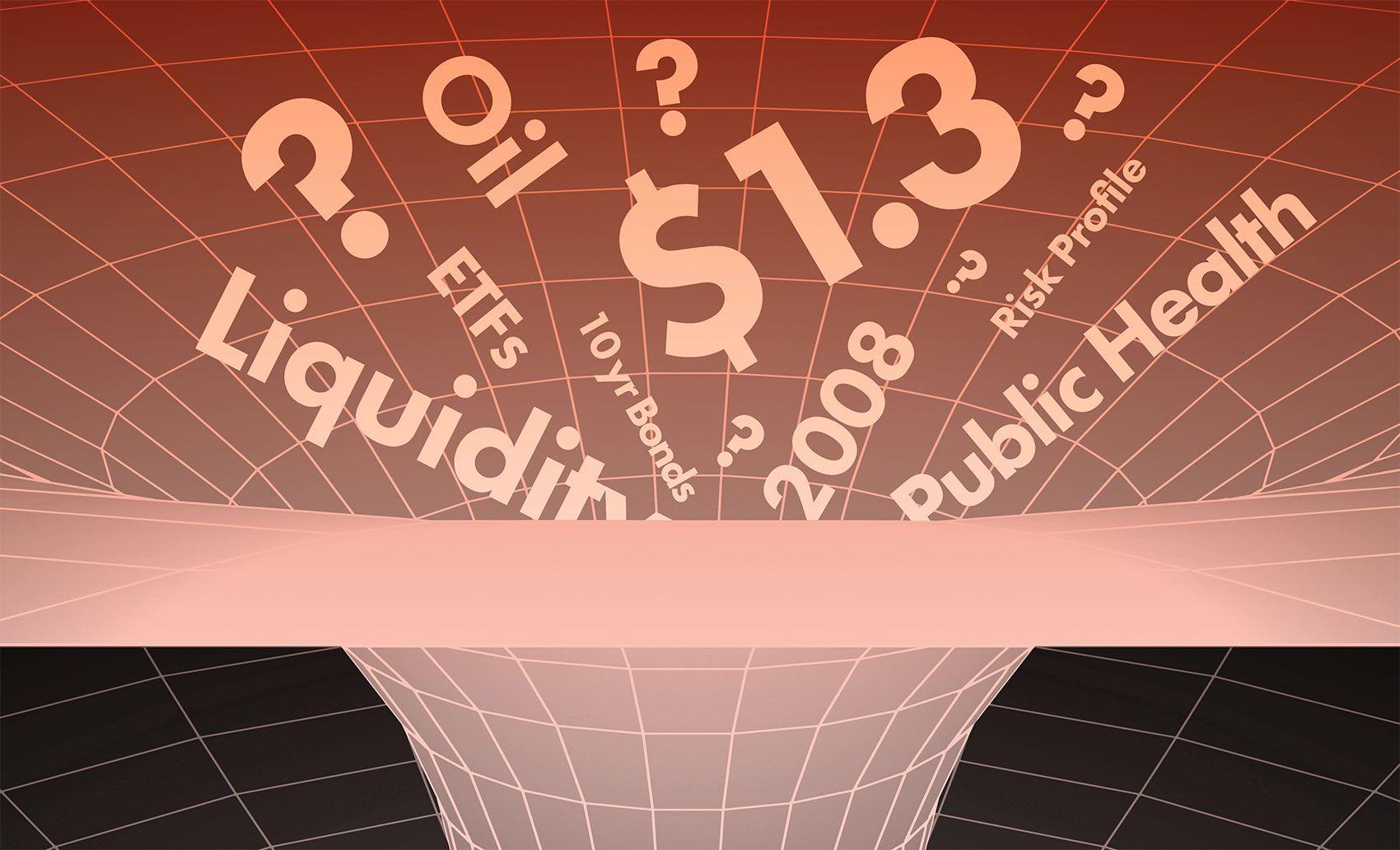

Tariffs Are Here. How Ugly Could This Get for Canada?

Money & the World

What the Hell is Actually Going on in the Economy Right Now?

Money & the World

But Reeves says, “All of the companies [Square, Microstrategy, and Tesla] that have bought Bitcoin are controlled by powerful CEOs who retain majority voting rights, which is unusual for big corporations. So I’d say that if it’s a vote of confidence, in this case it’s a vote of confidence on behalf of three people in unique governance structures. Which should be seen differently than a broad-based vote of confidence by corporations.”

Was it market manipulation? Was Elon Musk just juicing the price to reap the rewards?

On some level, you could think of this as one more kind of publicity play to juice an investment—not the same as hyping GameStop but also not totally different.

“It is market manipulation if Musk pumps up the price only to sell out a short time later,” says Reeves. “But I doubt that is what is happening here.”

Why does he say that? Because Tesla really does have a ton of their money parked there, and they didn’t simply sell it once the price went up. And Tesla seems to think Bitcoin can be a viable form of currency too. Not only did it buy Bitcoin but the company also announced that it would join the growing ranks of retailers who accept purchases made in Bitcoin. So eventually, you’ll be able to buy a Tesla with Bitcoin.

“That definitely gives it more credibility,” says Park.

The simplest way to invest in crypto

WEALTHSIMPLE CRYPTO

The simplest way to invest in crypto

Buy and sell Bitcoin, Ethereum, Aave, Uniswap, and more — instantly.

What does it mean for the long-term value of Bitcoin?

In the short-term, we know the answer: it means that the value of a Bitcoin went up. Over the longer term, Reeves argues that this is more of a signal than a movement so far.

“This was a few believers in Bitcoin with lots of power over their companies investing in Bitcoin,” he says. “It’s not a wave of corporations investing in Bitcoin. That’s not because corporations don’t believe in Bitcoin; it’s more because most corporations do not make financial investments as part of their core business. And right now Bitcoin is more of a financial investment than an operating currency. What I’m interested in is whether larger institutional investors like major pension funds begin to put real money in Bitcoin and whether the supporting infrastructure becomes institutional quality. For me, BNY Mellon announcing that they will custody Bitcoin is bigger news than what Tesla did.”

What does it mean for people who day-trade crypto?

If you’ve bought Bitcoin in search of short-term gains, then you’re likely happy about this news, too. Of course, it could also go down again—a risk that Tesla readily admits in the regulatory filing announcing its Bitcoin buy. And people are notoriously bad at timing the market and knowing when to sell.

“The announcement clearly builds momentum for Bitcoin, and it extends a nice bull run,” says Reeves. “But Bitcoin is and will remain a very volatile asset. If you’re trading in and out, you should have a strategy for when you will get out and why.”

What should it mean for normal smart people?

“For me, the bottom line is the nature of the corporations who are buying,” says Reeves. “You can think of it as a big decision made essentially by three people—Jack Dorsey, Elon Musk, and Michael Saylor—who have more control over their companies than CEOs typically have. That they are willing to put their companies’ balance sheets on the line is a sign of their confidence but not really a sign of broader acceptance among corporations, mostly because speculating using their balance sheets is not something that corporations do.”

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.