Money Diaries

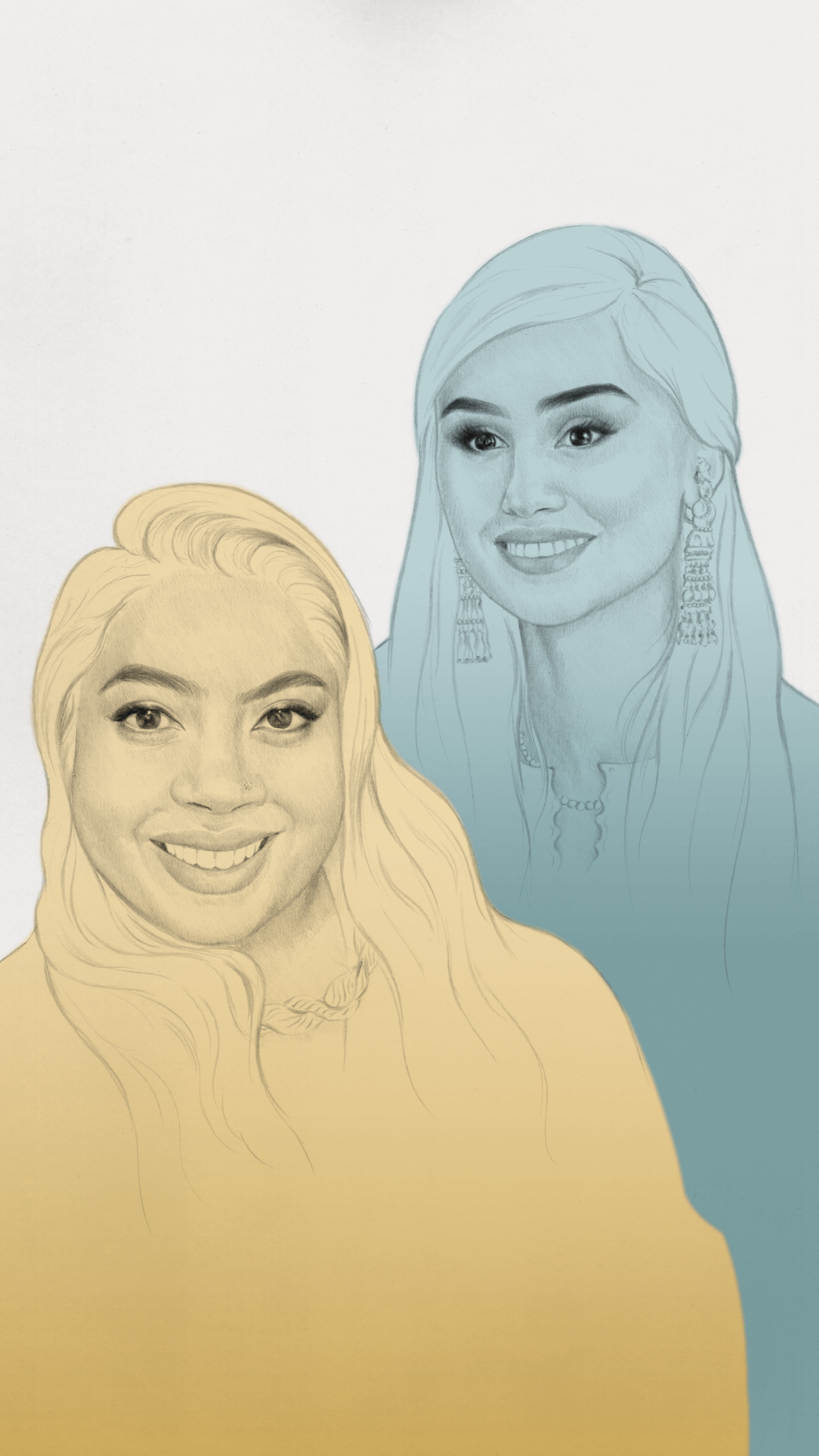

Wealthsimple Money Diaries: Two Women Helping Families Save and Invest

Education plays a major role in breaking cyclical poverty. We spoke with two Wealthsimple employees who have devoted themselves to helping families access and save for school.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple was founded on one really straightforward idea: democratize wealth. Our main goal as a company is to give Canadians across the economic spectrum the tools to achieve financial freedom. We’ve tried to do that by creating intuitive, non-clunky investing and trading apps. But we also know that education plays a huge role in breaking cycles of generational poverty. That’s why we created the Wealthsimple Foundation, a nonprofit that helps modest-income families save for their children’s post-secondary education. You can read all about the Foundation here.

One neat thing about the Foundation is that it each year it names a Volunteer of the Year, to recognize a Wealthsimple employee who, on top of their day job, has spent tons of time helping families access and save for post-secondary education. Well, this year the Foundation has two Volunteers of the Year — Mubnii Morshed and Scheherazade Hasan. They’ve both placed a premium on giving back. And, as it happens, they both have compelling money stories. Morshed is a 34-year-old staff UX researcher at Wealthsimple; Hasan is a 26-year-old associate portfolio manager. We spoke with them to learn more.

First, tell us a little about yourselves and your family.

Scheherazade Hasan (advisor): I grew up in Dubai, before moving to Toronto when I was 18. My dad worked various roles at a bank; he was, and still is, a workaholic. My mom was a teacher. Dubai is a very flashy place, and we were well off. But my parents were very frugal, and they made sure that we weren’t spoiled. I had to save up for things I wanted. Still, I knew as I started my career that I could fall back on them if things got dire financially. But it’s always been important for me not to rely on anyone and to stand on my own two feet.

Mubnii Morshed (staff UX researcher): I was born in Bangladesh and grew up in Japan and Vancouver, before I eventually landed in Toronto. My parents both came from very big families and were the only ones who were able to pursue higher education. Education was their ticket to a better life — it was freedom. Now, my dad is a clinical microbiologist, and my mom is a botanist with a PhD in plant-tissue culture. Still, despite their jobs, money was relatively tight when I was growing up. My parents tried never to let me know about their financial struggles. But when you’re young, you notice when your parents are stressed, and I wanted to help however I could. I knew my parents would pay for my education — that’s a very South Asian thing to do — but I didn’t want to ask them for much else. I started working at a young age; my first “job” was helping my mom repot plants for $5 an hour at her botany lab, and I did odd jobs throughout high school.

So how did you end up at Wealthsimple?

Hasan: After I graduated from university, I basically took the first job I was offered, which was at a large bank. I thought I was going to be, like, some serious businesswoman. I bought a ton of new clothes and wore high heels on my first day. Well, I didn’t know till after I started that it was effectively a call-centre job. So, not great! I stayed for only four or five months; one day I saw a job posting for Wealthsimple that said, in effect, Do you want to work somewhere that makes you excited to wake up each morning? Yes!, I thought.

Morshed: I’ve spent most of my career in health care; my previous job was at a start-up in San Francisco. When my partner’s work moved us back to Toronto, in 2018, I wanted to find a job where I was challenged to learn something new. At the time, I didn’t know much about money. And I realized that the only way I would learn more was if finance was part of my job. That’s partially why I applied to work for Wealthsimple. I also liked its mission of democratizing and demystifying finance for everyday people.

How has your background, or your time at Wealthsimple for that matter, shaped your approach to money?

Hasan: Well, I see the stats all the time about how women of colour are underpaid. I don’t want to contribute to that statistic, and I don’t want other women to either, because if women were paid fairly, they would have greater financial independence and less stress. One way to address income inequality is simply by talking about money more openly. But I know that’s hard. I grew up feeling as though talking about money was crass, especially when it came to negotiating salaries. But my job has taught me that most people would benefit from being more open about finances. But, again, I know it’s not easy. Every day as part of my job, I talk to clients about their finances, and I’ll catch myself being bashful, asking people, “Do you mind if I ask what your income is?” Only once has someone ever said they did mind, but I still can’t help being, like, “I’m sorry for asking!”

Morshed: This job has driven home that there is, and has long been, a very calculated and purposeful gatekeeping of financial information from communities of colour. Predatory lending, redlining, limited small-business lending — the list goes on. Culture also plays a part: some well-off kids are gifted their first stock when they’re 13, or their dad teaches them how to trade in high school. So they begin to understand the financial world a lot earlier than their peers. Further widening the divide, some communities of colour are skeptical, given past mistreatment by financial institutions, about the stock market. My parents, for one, think trading is gambling — that it’s throwing away your money. So, when I came to Wealthsimple, the idea of investing in a diverse, relatively safe basket of assets was a new concept for me and one I’ve leaned into.

Talk about your role in the Wealthsimple Foundation, and why you decided to get involved.

Hasan: Well, I’ve always valued giving back, and I’ve known for a long time that I wanted to support historically misrepresented communities. And yet I also felt as if I had to reach a certain place in my life — you know, the power suit and the pencil skirt — to be able to have a positive impact on others. But that’s not the case. In 2021, I helped the Foundation team create content for financial literacy workshops, on such topics as saving, budgeting, investing, managing debt, and financing post-secondary education. I also hosted workshops for the community groups that the Foundation partners with. I like knowing, that I’ve helped people, in big ways and small, access education and find financial freedom.

Morshed: I’ve been actively involved in the Wealthsimple Foundation for a couple of years, and I’ve done all sorts of things — provided feedback on its mission and strategy; offered guidance on how to prioritize community partners; weighed in on how to speak to certain communities. I also led a workshop on Wealthsimple Volunteers. Whatever the project or setting, I make sure that I speak transparently about money, because the system is built in a way where the less you know, the more you fall behind. I try to encourage people to be open-minded and confident in their abilities to understand the financial world. It’s filled with jargon and misinformation, yes. But, if you find a solid, informative resource or have the help of someone you trust, you can figure it out, and that’s really empowering.

We like to end these things by asking for some wisdom. What’s your favourite piece of financial advice?

Hasan: I say this so often: make a budget. I know that’s like telling people to count calories or floss — it’s a drag — but once you know exactly how much you’re spending and where your money goes, you can set up yourself for success in other areas of your financial life, whether your goal is to pay off debt or to save up for a big purchase.

Morshed: My tip is to acknowledge financial shame. I think a lot of people feel humiliation around their financial situation but never talk about it, despite it being top of mind. During COVID, for one, families have taken a huge hit; some have lost their life savings and now struggle to make it week-to-week. So when we talk about building wealth, I try to be sensitive to the fact that a lot of people are just trying to get by. At the same time, though, I don’t want people to think that you have to be super well-off to build wealth; there are ways for people across the financial spectrum to be smart with and grow their money. And you shouldn’t be embarrassed about asking how to do it if you don’t know, because finding out will only help you and your family in the long run.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.