Money & the World

What’s the Best Way to Put Your Tax Refund to Work?

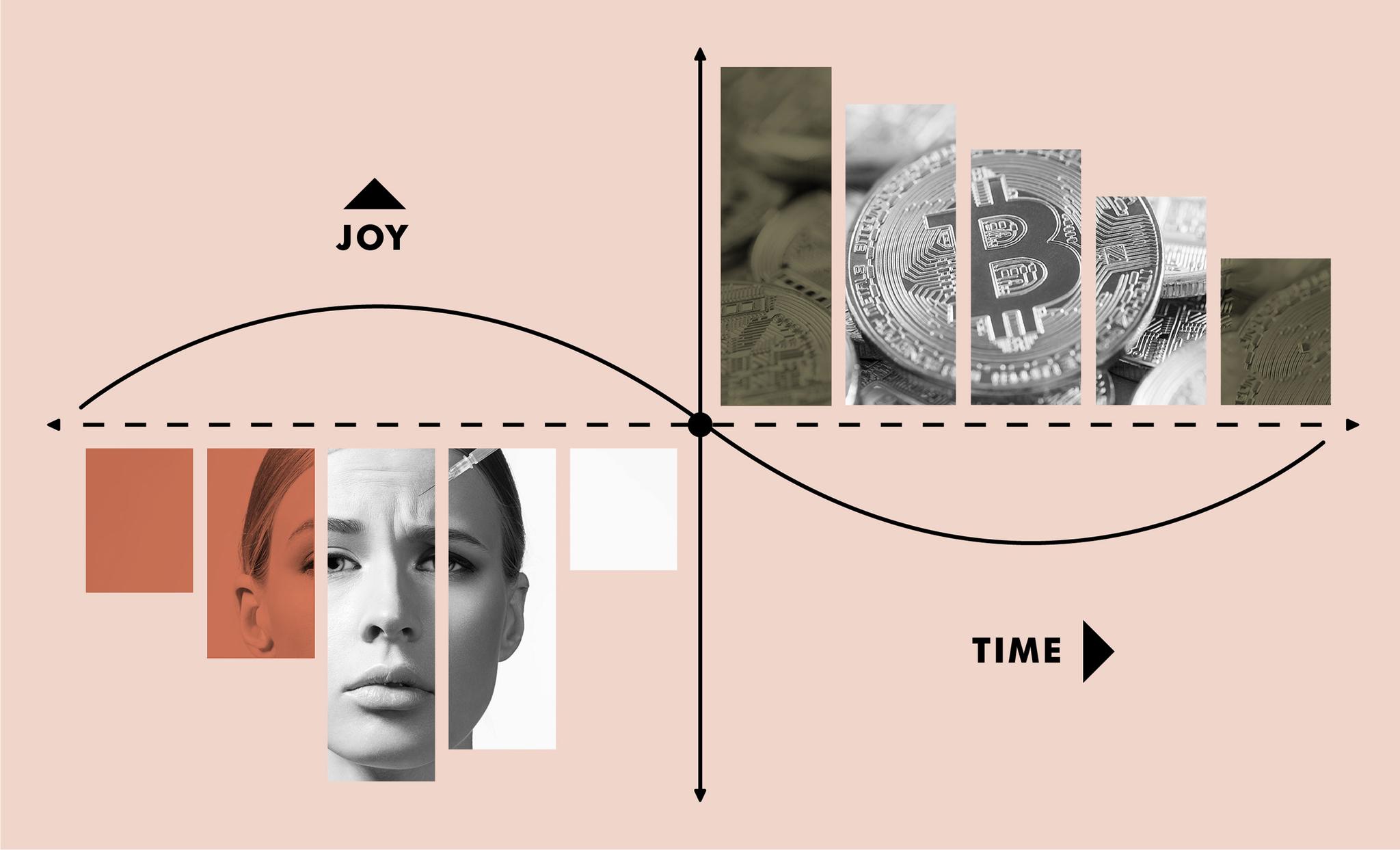

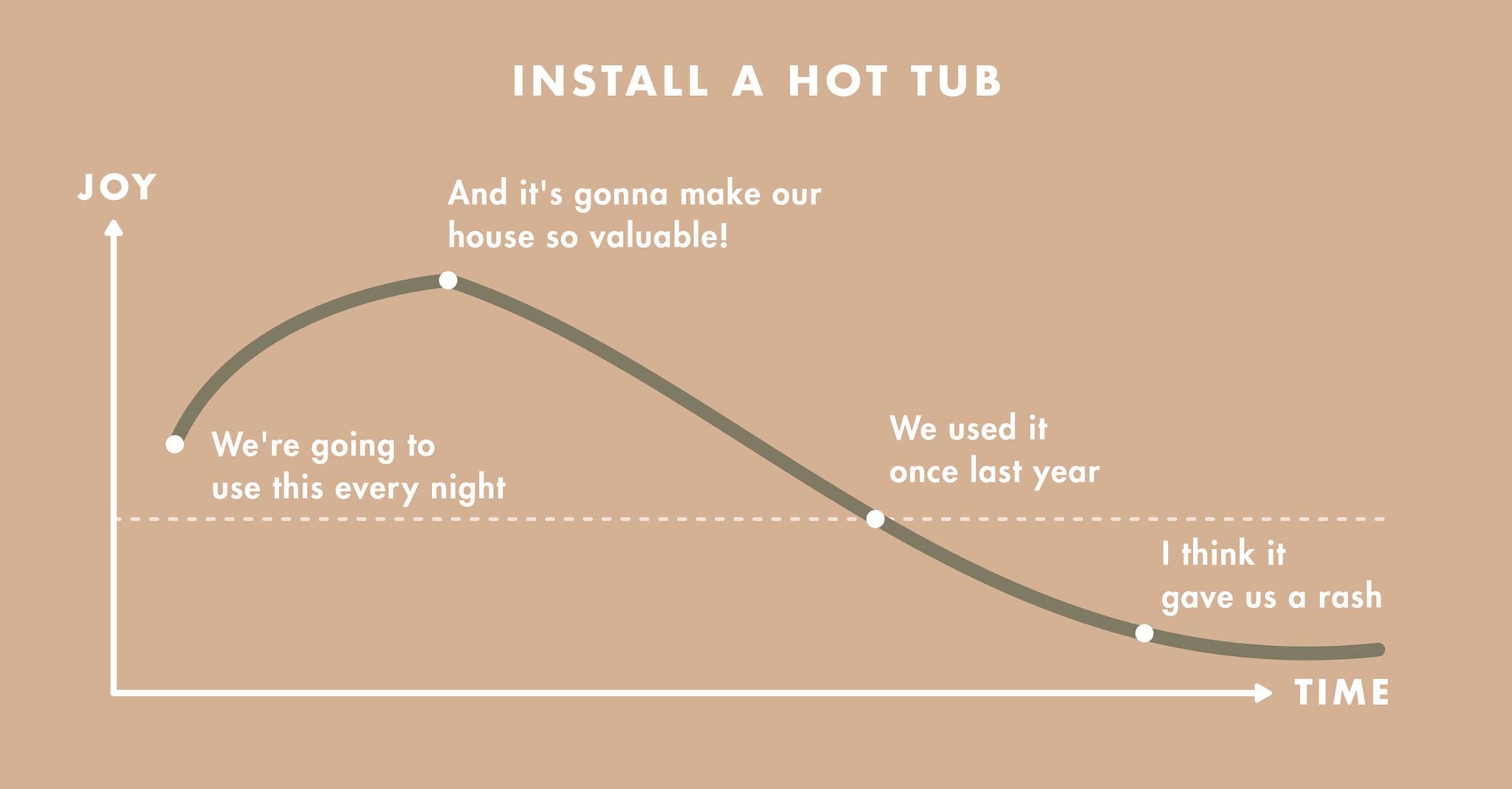

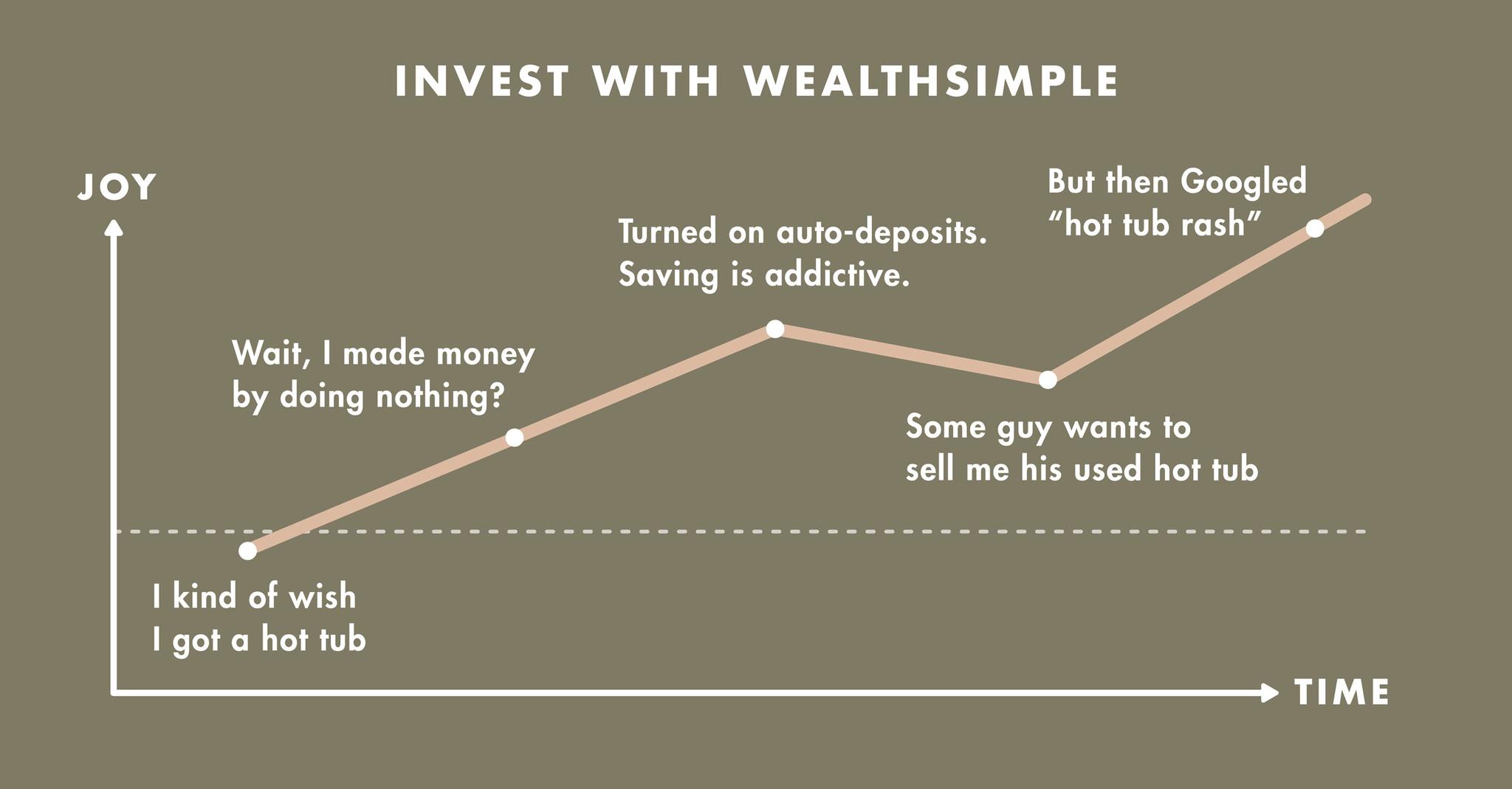

What to do with a refund? We used our deeply scientific formula to calculate the joy different investments (or savings plans) will bring over time. Hint: don't buy a hot tub.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Tax refunds have been called the biggest paycheque of the year. And for some people they are. The average refund is $1,735, and some are even bigger than that. And as the great spirit guide to financial wisdom says: with great windfalls come great responsibilities.

And, for a lot of us, great temptation.

So when we see our cheques we may remark that yes, drones are pretty cool; or that, hmm, now you do have enough to get the full Ben Affleck-style back tattoo. But this time of year we like to remind you that the financial spirit guide also instructs us to ask ourselves the essential tax refund question: what's really going to make you happy?

To help you figure out the answer, we employed some really complicated math and tons and tons of science in our patented Tax Refund Joy-Over-Time index. Here are our AI-assisted, data-driven algorithmic scientific results.

You pulled the trigger! Bubbles and steam in the backyard! Joy rating just got sky-high. And everyone who comes over is gonna want to hang out in it!

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

Except Nancy.

And Sanjay and Phil.

And your kids' friends.

When's the last time you even used it? And what's growing in there?

Recommended for you

And that's not even counting when you find out that it doesn't necessarily increase the value of your house — because the new buyers want you to take it out.

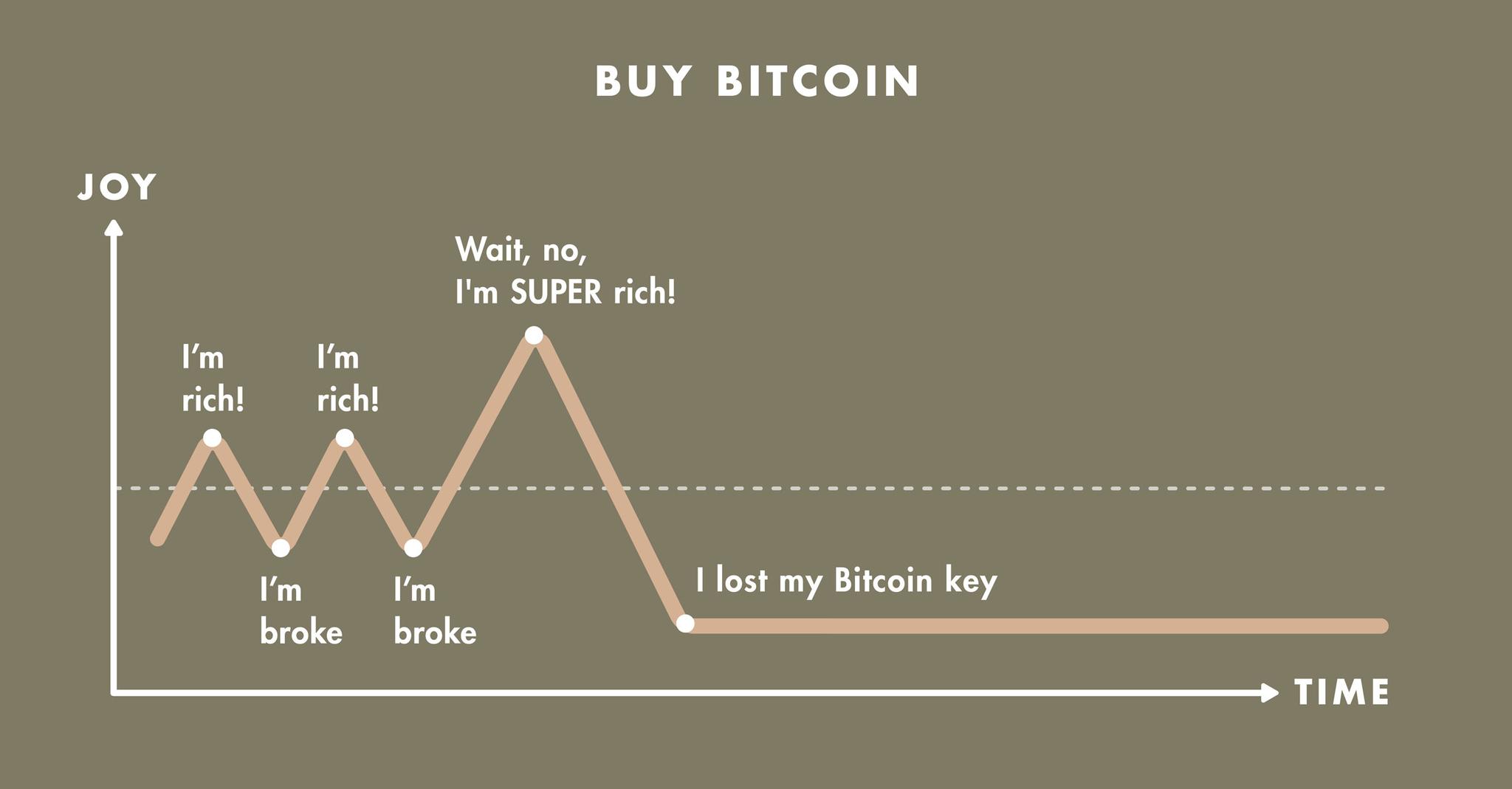

Guys! Bitcoin! It's huge!

I mean it's a hoax and sham!

No, really, it's the future!

It might be the future.

Bitcoin is what's known as a speculative investment. It could make you a bazillionaire (once they invent the number “one bazillion” because it was decreed by the newly moneyed Bitcoin-ocracy). But it could also decidedly not be worth a bazillion dollars. And the truth is we don't know where the future lies. Because no one does.

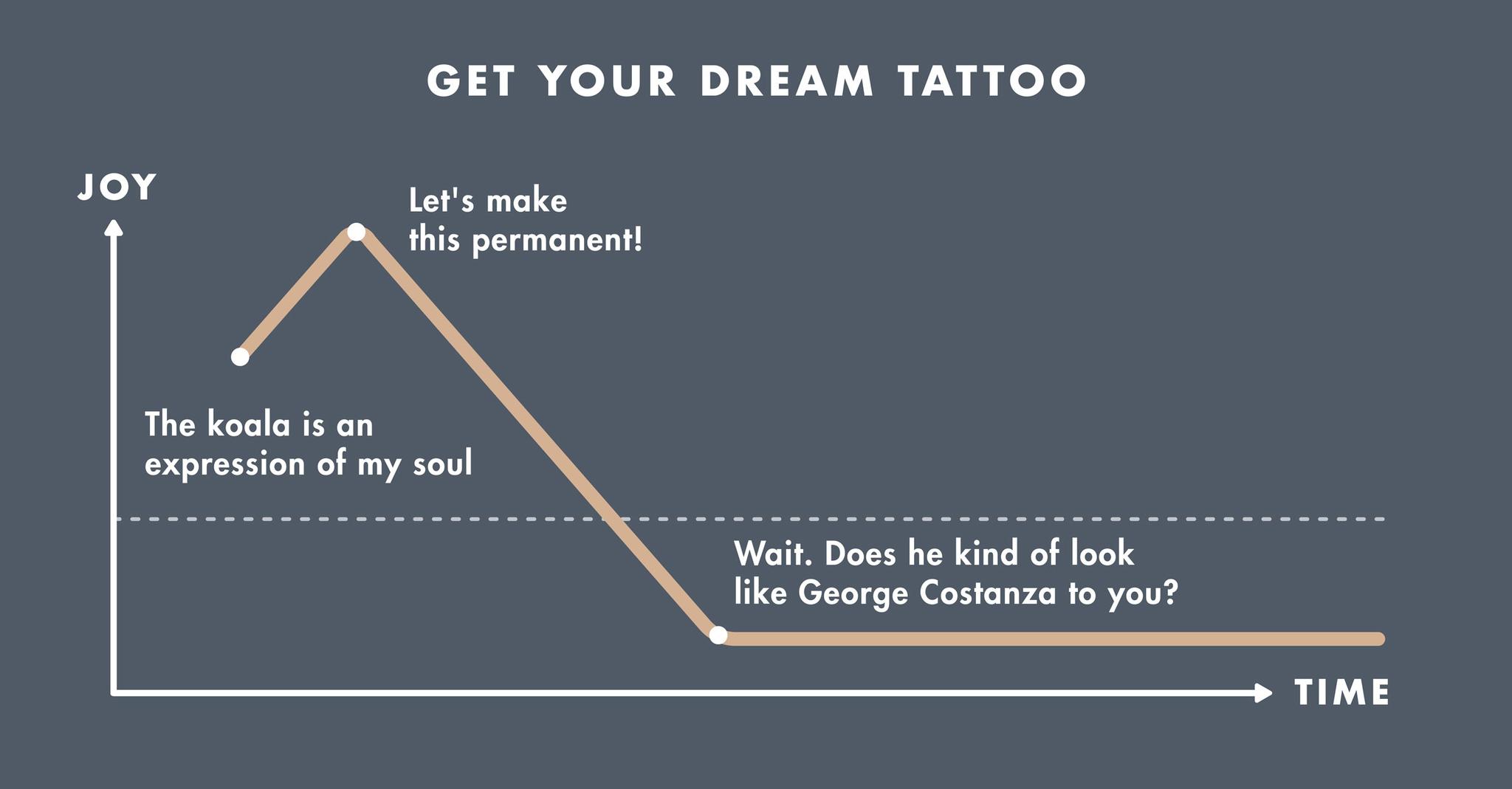

It's a small investment. And it lasts a lifetime.

And you've thought long and hard about the very thing that represents your soul. And yes, of course it's a marsupial.

Wait, did you say it lasts a lifetime?

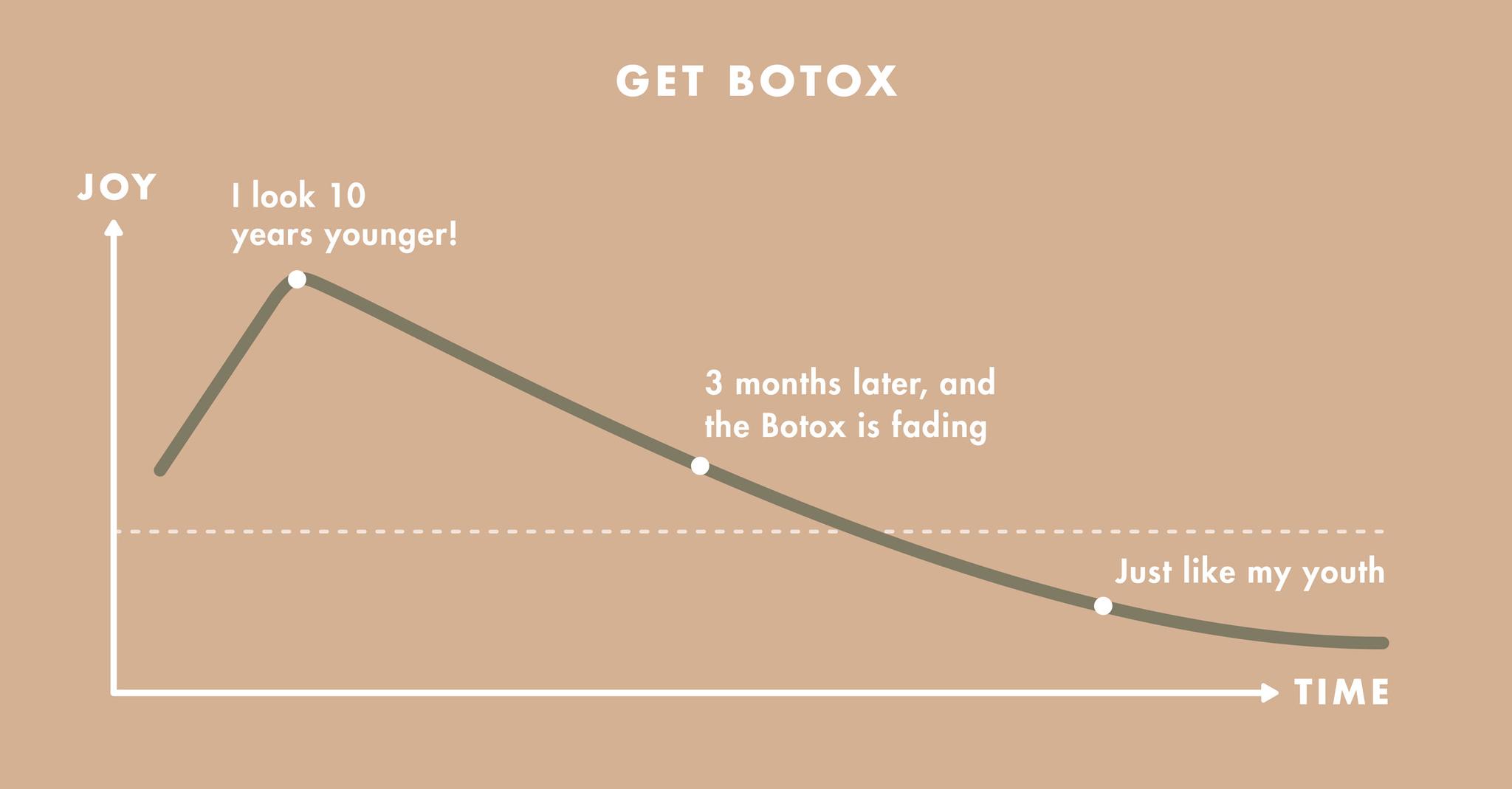

We do not judge at Wealthsimple. Happiness is happiness (unless it comes at the expense of another human). But we do happen to be data-driven. And we want to ask you: is youth-by-injection a good long-term investment? Is the fountain of (laugh-line) youth worthwhile if it's really just a way to get you on the hook for a few hundred bucks every few months?

Also: needles.

It’s low-cost, it’s optimized, it outperforms pretty much anyone who thinks they’re good at picking stocks, and offers returns 21x higher than the national savings account average (but if you’re looking to save for the short term, high interest rates and compounding go a long way too). All you have to do is click here to get started — in the long run it’s the smartest thing you can do with your money. Sorry, Jacuzzi.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.