Money & the World

How to Understand Your Portfolio Performance When Everything is Down

Here’s how we build our managed portfolios to withstand a downturn. (And, yes, that means some losses are normal.)

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

A lot of financial advice can be boiled down to two words: diversify and wait. But that doesn’t make it any easier to look at your portfolio in a downturn and see numbers dropping — even if you know that negative returns are part of investing sometimes. Seeing those numbers fall can lead to two very common investor errors: panicking and abandoning the long-term plan.

To help you fend off that panic — and because we think it’s important for everyone to understand the basic strategy behind how their money is invested — we want to explain the philosophy behind our Managed Investing portfolios.

How we design our portfolios

Stocks are an excellent bet to outperform cash by an attractive margin over time. However, they also have a boom and bust profile that we try to manage through more diversification. Our portfolios are designed to largely track global markets. They’re based on risky assets, like stocks, but with protections added for stability. The goal is a mix of investments that is more stable than the markets. In theory, that means they go up a little bit less when the market is up and also go down a little less when the market is down.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

What makes Wealthsimple’s portfolios unique is the precise mix of stocks and bonds from around the world that we buy on behalf of our clients. We use a few different strategies that we think make a difference over time:

We ensure our portfolios are globally diversified. Because most stock markets are down relatively equally, this hasn’t had much of an impact this year, but it can be very helpful in making sure the portfolio doesn’t lose for a long period of time compared with a geographically concentrated portfolio.

We hold defensive stocks — stocks that tend to outperform when the economy is weak — to act as a bit of a cushion when markets are stressed. But, of course, not all defensive stocks are created equal. We selected based on criteria like the quality of a company’s cash flows and the stock’s volatility. ETFs composed of defensive stocks we’ve selected outperformed the global market as a whole by about 4.5%, adding an average 0.85% return to our portfolios this year so far.

While the vast majority of risk (as an investor, you’re essentially paid for taking on risk) in our portfolios comes from stocks, we do hold slightly more bond risk than many other options. What that means is we hold bonds with longer maturities, which makes their prices more sensitive to changes in interest rates. Although that choice has recently hurt our performance by about 1% year-to-date, it’s a long-term play. It’s not intended for times when the market is depressed for a few months, but in case it’s depressed for a few years.

Another one of our philosophies is to, by and large, avoid active trading, which is costly – and, data shows, not effective. Our process is to monitor our portfolios to make sure that they’re working the way we want them to (and that the risks we’re taking are paying off as expected). We don’t make changes based on short-term losses, but instead put a premium on setting our clients up for future (and long-term) success.

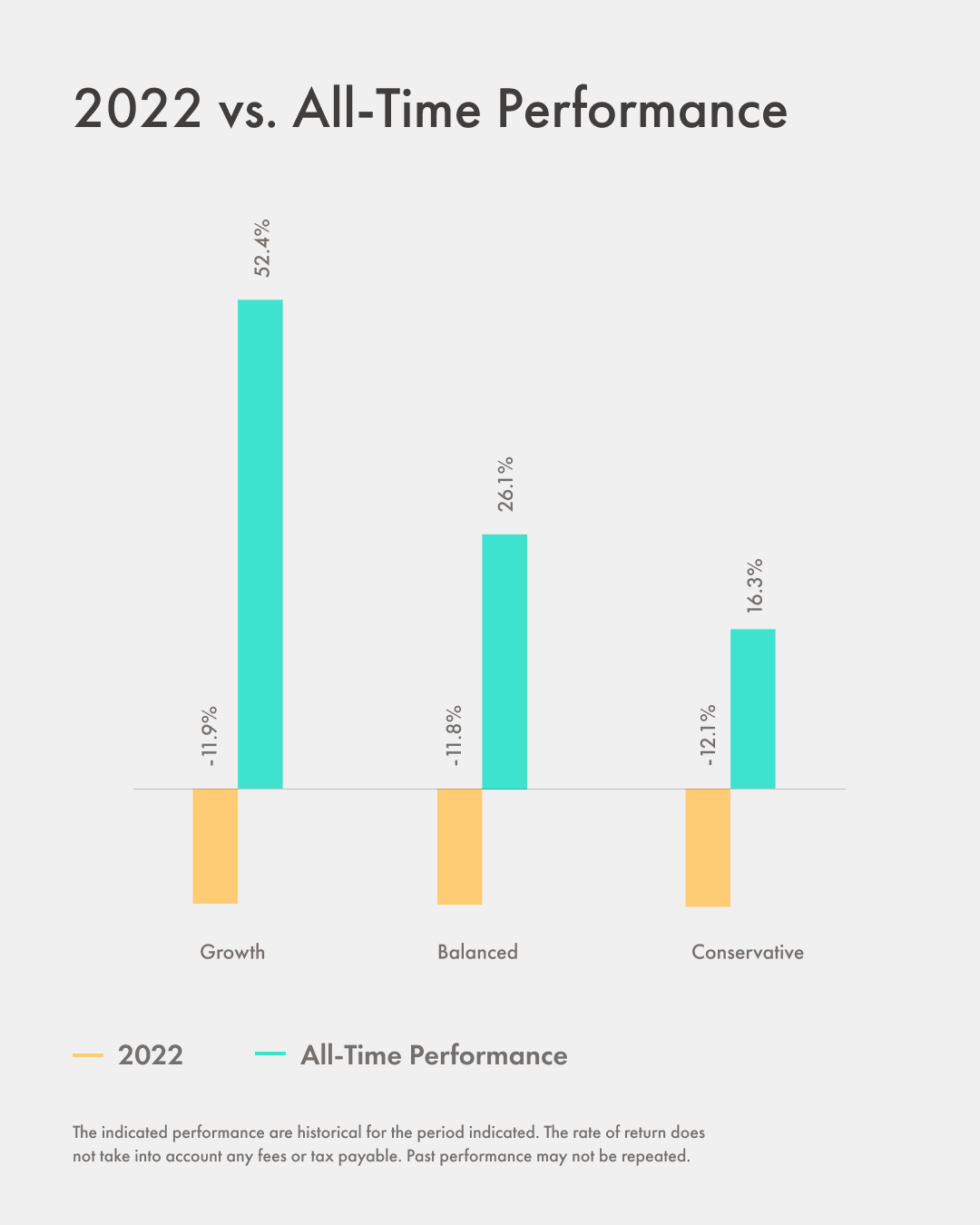

How those portfolios are doing

As we mentioned above, our portfolios are designed to follow the markets over the long-term (and markets tend to go up over time). Here’s a look at how Wealthsimple’s Managed Investing portfolios have performed so far this year.

(The indicated performance is historical for the period indicated. The rate of return does not take into account any fees or tax payable. Past performance may not be repeated. All charts shown are for illustrative purposes only and do not reflect the returns of an actual account.)

Recommended for you

Dumb Questions For Smart People: Why Parenting Inequities Make Mothers Leave the Workforce

Money & the World

The Ten Words That Defined This Topsy-turvy Year in Money

Money & the World

The Long-Term Economic Disaster of Cash Bail

Money & the World

We Discovered the True Identity of the NFT Artist “Pak”

Money & the World

Yep — we’re in a downturn. Our performance is about the same as holding global stocks and bonds.

Here’s how those are looking: MSCI ACWI, a global stock equity index, is down -12.9%, and the Canada Aggregate Bond Index is down -10%. It’s actually about the worst bond market in the past 40 years, while the drop in the stock market is more normal. This is reflected in our portfolios.

So, what now?

It’s really tempting to make changes when you see returns that don’t feel good. Generally speaking, our advice is to stick to the strategy that aligns with your timeline, goals, and risk tolerance. But there are times when making changes is good. Like, if you didn’t have a strategy to start with (here’s some guidance on that.) Or, if something has changed for you personally: your goals, your timeline, your financial situation. But, generally, the best way to react to changes in the market is to not do anything about it right away. Take some time, think it through, or just sit on it.

We wish we could tell you exactly what to expect. Unfortunately, no one has a time machine to definitively tell you what’s going to happen with the markets (we’d totally find out who wins the Stanley Cup this year while we’re at it, too). There is one thing we can look to: the main determinant of long-term returns is their starting valuation. Based on that, it seems that expected returns for international stocks are high, expected returns for North American stocks — which have recently outperformed — are still sort of low, and bonds are now looking more attractive. But, really, the stock market’s in control of returns. All we can do is control what we can: and keep saving and investing. Given all that, we’ve run the numbers to see how we expect our portfolios to perform over the next 30 years.

Here’s what we found: the longer you invest, the higher your chance of big returns. That’s true across our portfolio types. We calculate this by looking at historical data and then using a statistical method called bootstrapping to simulate what might happen. To really test the theory, we repeat that process more than 2,000 times to calculate the percentiles — similar to the odds — of the different returns you’re likely to see.

The main takeaway? We’re in it together, for the long haul. Hopefully next time you feel the urge to nervously check your portfolio, you can glance at this article, too.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.