Finance for Humans

Is it Better to Pay Down Your Mortgage or Invest?

With interest rates up and markets… not, a few tips to help you decide where your money will work harder.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

In case you’ve somehow blocked it out, here’s a quick recap of the last 10 months: 😬.

The TSX is down 8.3%. The S&P is in the hole 20%*, and Nasdaq hopes you’re so distracted by crypto (-55%) that you won’t notice it’s dropped nearly a third of its value since January. In case this economic wound isn’t salty enough for you yet, inflation’s also at 7%, year over year — the worst we’ve seen since the line-up-for-gasoline recession of the early 1980s. That’s why Tiff Macklem and the Bank of Canada have been so gonzo with rate hikes. The more expensive he makes it to borrow money, the less money people are expected to spend. Which should lead to lower demand and (hopefully) lower prices. Eventually.

If you’re a homeowner, one effect you’ll feel from those hikes is higher mortgage payments. The average 5-year rate most borrowers now get on mortgages is 4.7%, up from 2.1% a year ago. Between that and the lousy market, we’ve gotten a lot of questions from investors who wonder if it’s smarter to use extra money to pay down the mortgage or invest. In past years the answer was clearer: invest. But now it depends a lot more on your particular circumstances.

Even if you aren’t facing a jump in your mortgage payments — or any mortgage at all — understanding how you might figure this out is a great way to understand how money works. Here’s how to think it through.

Consideration #1: your mortgage rate

Like tickling rattlesnakes, mortgages have a guaranteed negative return. If you’re paying 5% interest, that’s a loss of 5%. Which means paying down your debt is like earning 5% compound interest. You just need to consider the opportunity cost: In order to save yourself that 5%, you have to tie up money that could possibly earn more somewhere else.

Consideration #2: how much you expect to make in the market

You’re probably sick of hearing this, but we’ll say it one more time: past performance is no guarantee of future returns. Nobody knows what the markets are going to do (not even this guy), but we do know what they’ve historically done: gone up, although it sometimes takes a while. (We get into why in more detail here.) Which means despite the suckfest this year has been so far, there’s nothing wrong with a little hope — especially if you have time to wait things out. (See below for a handy chart showing you the effects of time on investments.) There’s also nothing wrong with a little pessimism. In whatever way you feel comfortable — by asking an advisor or doing your own research — figure out what your return expectations are and judge based on that.

One more thing to consider? The record-high stock prices of the last couple years are back to more reasonable levels, and with both stocks and bonds lower, long-term return expectations are once again up. (It’s a lot easier to go up when you’re on the middle of the mountain than the very peak.)

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

Consideration #3: how long you have to invest

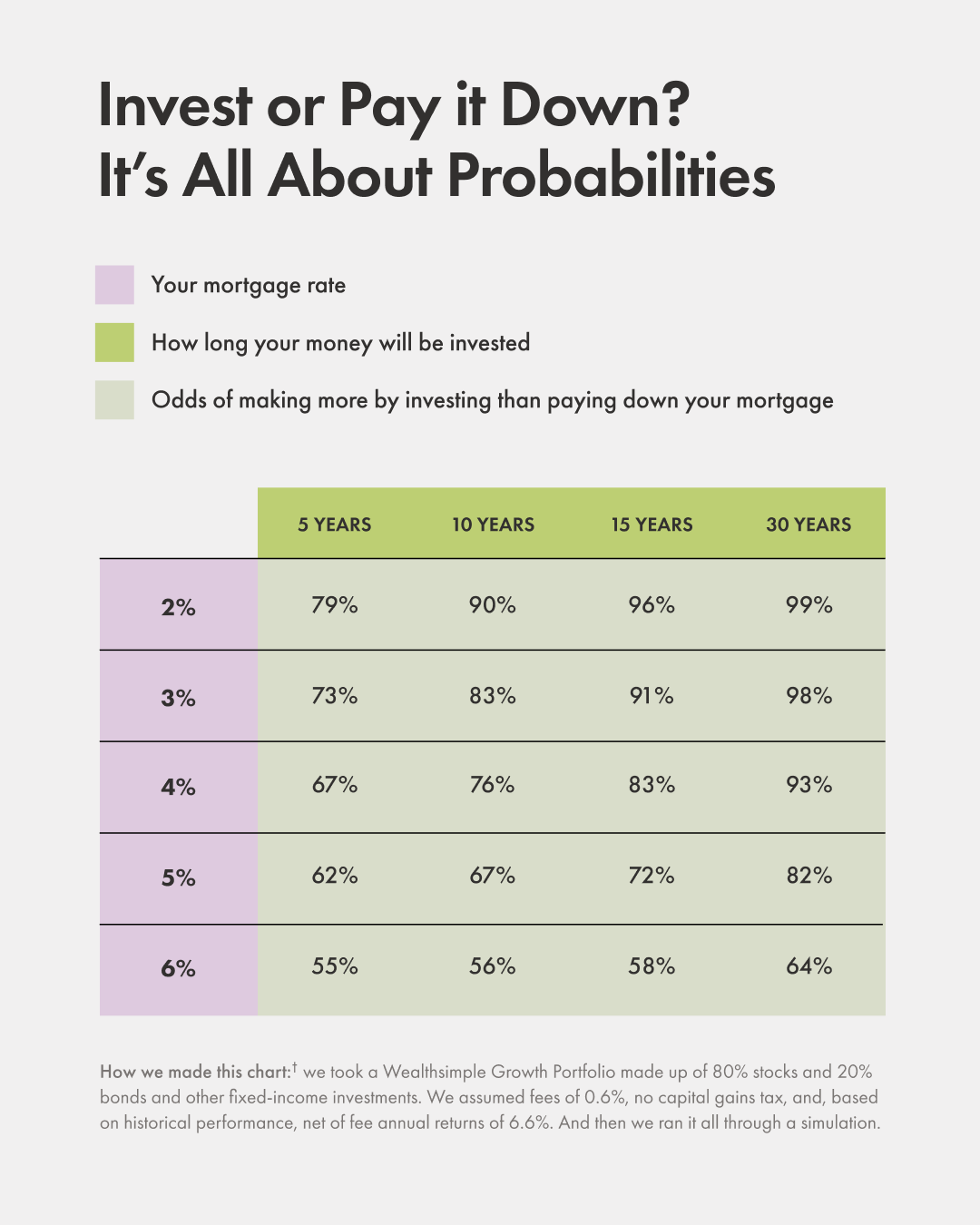

We can’t predict the future, but we can get a pretty good guess of how likely something is based on the past. And then we can put it in a chart!

The longer you have till you need your money — whether it’s for retirement, a new house, leg-lengthening surgery, whatever — the better your chances of surviving market downturns.

Why? It’s all about reducing the chances of a negative outcome. When you’re only invested for a short period of time, one big dip can cost you a lot. The longer you stick it out, though, the lower your chances of taking a loss and the higher your chances of making money.

Consideration #4: how much tax-sheltered savings room you have left

One thing that can change the math is whether or not you’ll get a tax break from investing. If you have contribution room left in a registered retirement account like a TFSA or RRSP, you might want to fill ‘em up. Tax-advantaged accounts like these effectively boost whatever returns you get, since you save on taxes. Otherwise, you’re taxed twice: the money you invest was taxed when you earned it, and your returns will be taxed, too.

If you’ve fully maxed out both accounts, you’ll lose a percentage of any investment returns to taxes. (If you’re in a high tax bracket, you can expect to pay roughly 35% of your gains back in capital gains and dividend taxes.) When you pay down a mortgage, however, the money you save is not taxed.

Grab those calculators! 🤓

If you earn 7% returns and pay a 25% tax rate, your returns are 25% less than 7%, or 5.25%. So if you have a 5% mortgage, the risk is probably not worth the hope of a 0.25% reward — and that’s assuming you get 7% returns. If it’s less than that, you’re not even clearing your 5% mortgage rate after taxes anymore.

If you’re in the highest bracket (showoff), the cutoff point gets even lower. If you got those same 7% returns, minus an estimated 35% tax, you’re looking at returns of 4.55%. If your mortgage rate isn’t well below that, investing starts to make less sense.

Recommended for you

Did You Lose Money Trading Stocks? Blame Your Caveman Brain

Finance for Humans

Ask Lizzie: Is it OK if I Use Shopping to Make Me Feel, You Know, Happier?

Finance for Humans

The Perfect Guide to Every Little Tax Question You Have

Finance for Humans

Five Tax Enigmas That Confuse Basically Everyone

Finance for Humans

Consideration #5: your taste for risk

Which of the following scenarios worry you?

a. Making a call on your cell phone while close to a gas pump

b. Swimming 29 minutes after eating

c. Using a public restroom without one of those crinkly paper toilet covers

If your heart skipped at the thought of any of those things, the market may not be a great space for you. And that’s okay! The less comfortable you are with the idea of losing any of your money — and there are a lot more of us feeling that way after the last ten months — the less appeal the markets have. But as the chart above shows, if you are open to risk with the possibility of higher rewards, the market has historically been a strong place to be.

The more risk you take on, the higher your potential for return. Paying down your mortgage has no risk. You know exactly what return you’ll get. Investing has higher risk, but it could also earn you a lot more than 5% in the long run.

Now that we’ve given you the information that’s out there, it’s time to decide what’s best for you. It's also time for ...

Examples!

Couple A

They’re nice! They have a house and a dog named Tiff. (The house doesn’t have a name.) Now say they are 20 years from retirement. They’ve just renewed their mortgage and have a 4% fixed rate for the next five years. They have a healthy emergency fund, a high tolerance for risk, and a sizable amount of contribution room in their RRSPs and TFSAs.

The numbers suggest: INVEST!

The table above shows that their odds of being better off investing during the five-year term of their mortgage are 67%. If they’re able to renew their mortgage at 4% or better until they retire, that probability jumps to 80-90%. Plus, they’re investing in tax-sheltered accounts, so they’ll also benefit from tax deductions.

Couple B

Also nice people! But they don’t love how much dogs shed, so they’ve always stuck with fish. (They have a betta fish named Alpha.) They also have a 4% fixed-rate mortgage on their condo, but they’re older, closer to retirement, and not as comfortable with risk. They don’t have any room in their registered investment accounts, leaving them with the choice of investing in a taxable investment account or paying down the mortgage.

The numbers suggest: PAY IT DOWN!

Because of their risk tolerance and tax situation, this couple would be better off taking the safer approach and paying their mortgage down. Their odds of being better off investing are less certain. On top of that, they’ll have to pay about a third of their investment gains to the government.

___________

*all percentages are based on local currencies

†- the very technical description: to avoid making any assumption about return distribution, we have adjusted the mean of historical returns to match with our expected gross annual return. We then used the block-bootstraping method to simulate thousands of different return paths for the growth portfolio. Then using these simulated return paths we estimate the probability of the growth portfolio outperforming paying down the fixed mortgage rate.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.