Finance for Humans

Five Tax Enigmas That Confuse Basically Everyone

OK, OK: they’re not technically enigmas, but these are the things most likely to trip you up when it comes time to file. We make sense of the madness and hopefully spare you some confusion.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

The best part of filing taxes is finishing — so that you can move on to enjoy the fleeting, precious time that we each have on this spinning hunk of dirt. The trouble is that a few confusing, predictable sticking points tend to leave people scratching their heads, cartoonlike, while surrounded by mountains of last year’s receipts — in our imagination anyway. Here's how to get your head around these predictable stumpers of filing taxes to help you drag your tax return across the finish line.

Bewildered by tax brackets?

Let’s start with something easy-ish: tax brackets. Canada has what’s known as a progressive tax system, meaning the more money you make, the higher tax bracket you’re in — and the larger percentage of your taxable income (i.e., your gross income, minus deductions, like RRSP contributions) that you’ll owe. This is really important info to have — especially if you’re a freelancer and self-employed — because it tells you how much you’ll owe come filing time. That way, you can budget, save, and invest accordingly. (Mosey over to our freelancer’s savings guide for more.)

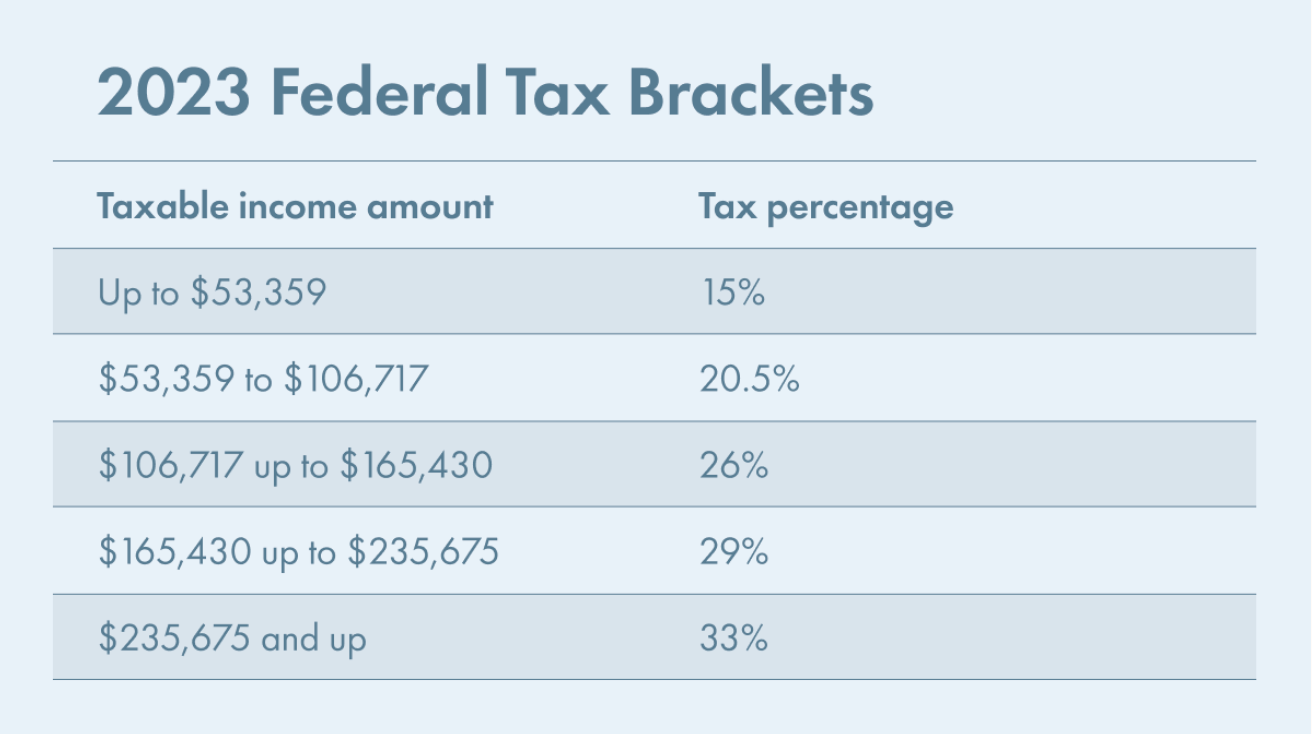

OK, so here are the federal tax brackets for 2023:

But wait! The fun doesn’t stop there. Because, on top of federal tax brackets, there are also provincial and territorial tax brackets. Which, as you could guess, vary based on where you live. The CRA’s website lists them all.

Mystified by marginal tax rates?

Here’s where things get a smidge complex regarding tax brackets: your tax rate doesn’t get applied evenly across all your income. Instead, tax is applied to your income on progressive, sliding percentages, otherwise known as marginal tax rates. If you made $200,000 last year, for instance, you won’t owe 29% on all your taxable income. Instead, the first $53,395 of your income is taxed at 15% (the lowest tax rate in 2023), no matter your total annual income. Then any dollar you earn above that gets taxed at the next highest rate — 20.5% — until your income reaches the next tax bracket. And so on and so forth.

Let’s crunch some numbers. Here’s how the math actually works. Let’s keep pretending that your annual gross income is — congratulations! — $200,000. Like we said, the first $53,359 of your income is taxed at 15%, which works out to $8,004. Then, whatever you make from $53,359 to $106,717 (which, somewhat confusingly, is $53,358) is taxed at the next-highest rate — 20.5%. Which comes out to $10,938 ($53,359 x .205). Next, all your income in the third tax bracket ($106,717 to $165,430, or $58,713) gets taxed at 26%, which comes out to $15,265 ($58,713 x .26). Finally, in the fourth bracket, the remaining $34,570 of your income gets taxed at 29%, which adds $10,025 ($34,570 x .29) to your tax bill and brings the grand total of your federal taxes to — wait for it — $44,233, before deductions and credits.

And don't forget provincial taxes! To figure out how much you owe for those, you basically do the same math as above with your income, but using provincial rates instead of federal ones. And then you combine the numbers to find your total tax obligation. If you live in Ontario and earned $200K, say, you’ll owe about $69,000 total in taxes — $44K to the feds, $25K to the province.

PRO TIP: All this math is pretty tedious, we’ll admit. Which is why Wealthsimple made a handy tax calculator to help you out. And we have a hunch that, after you crunch the numbers, you might be thinking, So how exactly do I reduce my tax bill? Can we get to that part of the article, please? Yes, yes we can…

Confounded by charity donations?

Donating to charity is great because 1) it’s a super nice thing to do 2) the government rewards your benevolence with tax breaks (provided you save the receipts and give to qualified donees). On the federal level, you can get a tax credit of 15% on the first $200 you donate each year, and a 29%–33% credit on whatever you chip in above that. (Caveat: in most cases, you can’t donate more than 75% of your annual net income.) So if you donate $1,000, you can deduct roughly $262 from your federal taxes — with a $30, or 15%, credit for the first $200 and a $232, or 29%, credit on the remaining $800. Provinces offer tax breaks for charity donations, too, so check up on those.

Recommended for you

The Perfect Guide to Every Little Tax Question You Have

Finance for Humans

You May (Still) Have to Pay Taxes on COVID-19 Benefits

Finance for Humans

Five Tax Enigmas That Confuse Basically Everyone

Finance for Humans

Ask Lizzie: Is it OK if I Use Shopping to Make Me Feel, You Know, Happier?

Finance for Humans

PRO TIP: One big thing that a lot of folks fail to realize about charity-donation credits is that you don’t have to claim them the same year you give; you can carry them forward for up to five years. That means, in some cases, you might be able to bundle your credits together for a larger tax deduction. If you donate $100 a year over three consecutive years, you’ll get only a $45 tax break if you claim the credits individually, since the tax rate for the first $200 of annual donations is 15%. (So over three years: $15+$15+$15=$45.) But if you bundle your donations together, you’ll get a $59 tax break ($200 x .15 + $100 x .29).

Baffled by bond (and stock) donations?

This is more of a little-known tip than something that confuses people, but we’re throwing it in anyway: you can donate stocks, bonds, mutual funds, and other securities to qualified donees to earn credits to lower your tax bill. And, unlike with typical trades, you don’t have to pay capital-gains taxes on donated securities. But you get the same tax credits on the gains as if you had donated cash. For example: you donate stocks worth $20,000 that you bought for $10. You get the tax credit of having donated $19,990, just as if you had handed over a big pile of money worth the same amount. But the government doesn’t treat your truly incredible gain as income, so you don’t owe any taxes on it. The CRA goes into more detail about the whole thing here.

Reticent to ask about RRSPs?

We’re obligated by the commandments of personal-finance reporting to mention RRSPs in every article about taxes, so let’s do it: Registered Retirement Savings Plans not only help you save for retirement, they also reduce your tax bill, by basically lowering your taxable income in the eyes of the government. Say you earned $100,000 in 2023, but you contributed $18,000 to an RRSP. Well, the government will basically pretend that the $18K you put into an RRSP doesn’t exist and tax you as if you made only $82,000. Which is a pretty nifty way to reduce your taxable income, especially since you’re socking away money for old age. (Fair warning: when you retire, the government will tax whatever money you withdraw from your RRSP, but likely at a lower rate if you’ve stopped working.)

In 2024, the RRSP limit is either $31,560 or 18% of your earned income from 2023 — whichever is less (provided you don’t have any rollover RRSP room; more on that in a moment). Check your CRA My Account to verify.

PRO TIP: You can carry forward unused RRSP contribution room from one year to the next. So if you contribute $5,000 less than your max for that year, you’ll have $5,000 of extra room to contribute in another year.

CONGRATS! If you made it this far, you should have a solid grasp on the big tax questions that trip up a lot of people. Now stop procrastinating and get your taxes done so that you can literally go do anything else with your life.

Renee Sylvestre-Williams is a finance and money journalist who covers the topic for the Globe and Mail, Ontario Securities Commission and MoneySense. She is also the creator of The Budgette, a newsletter focused on sole earner finances.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.