Money & the World

Congratulations, Millennials! You’re Doing Way Better Than People Think.

We crunched the numbers and found out that Canadian millennials are wealthier, better educated, and more financially ready for the future than the generation that came before.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

If you’re a millennial, you get a bad rap. People like to think you’re selfish. You’re debt-ridden. You’re an overconfident, social-media-addicted young person who will never leave home who lives only for self-affirmation. And of course you have committed the cardinal sin against earlier generations: You’re young!

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

But the truth is a little different. And pretty darn encouraging. How do we know? We looked at the data. Here’s what we learned when our number crunchers checked out the details on Canadians under the age of 35.

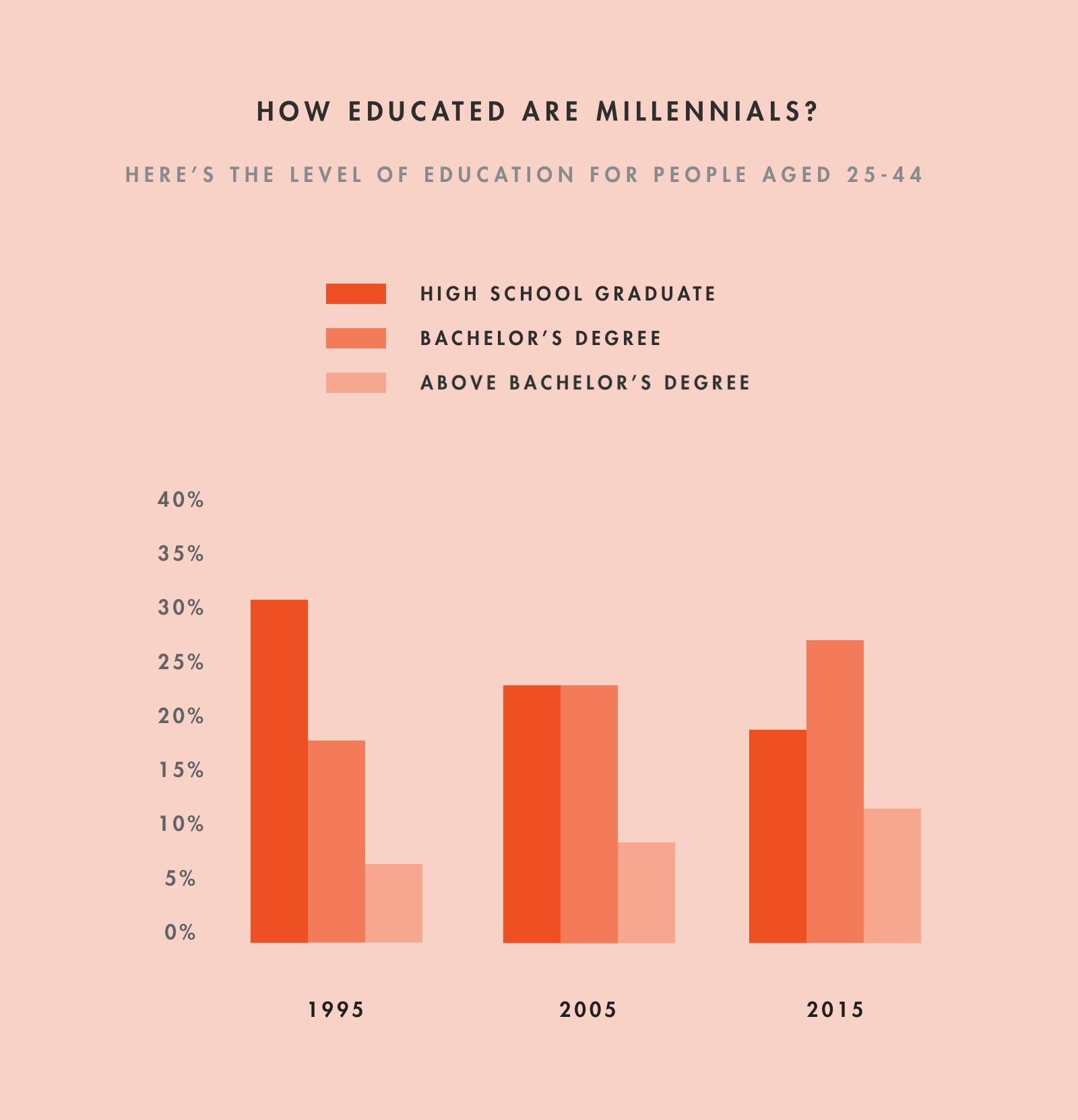

Millennials Are Better Educated and More Responsible Than Their Parents.

Millennials are the first generation for whom it’s more common to obtain a bachelor’s degree than just a high school diploma.

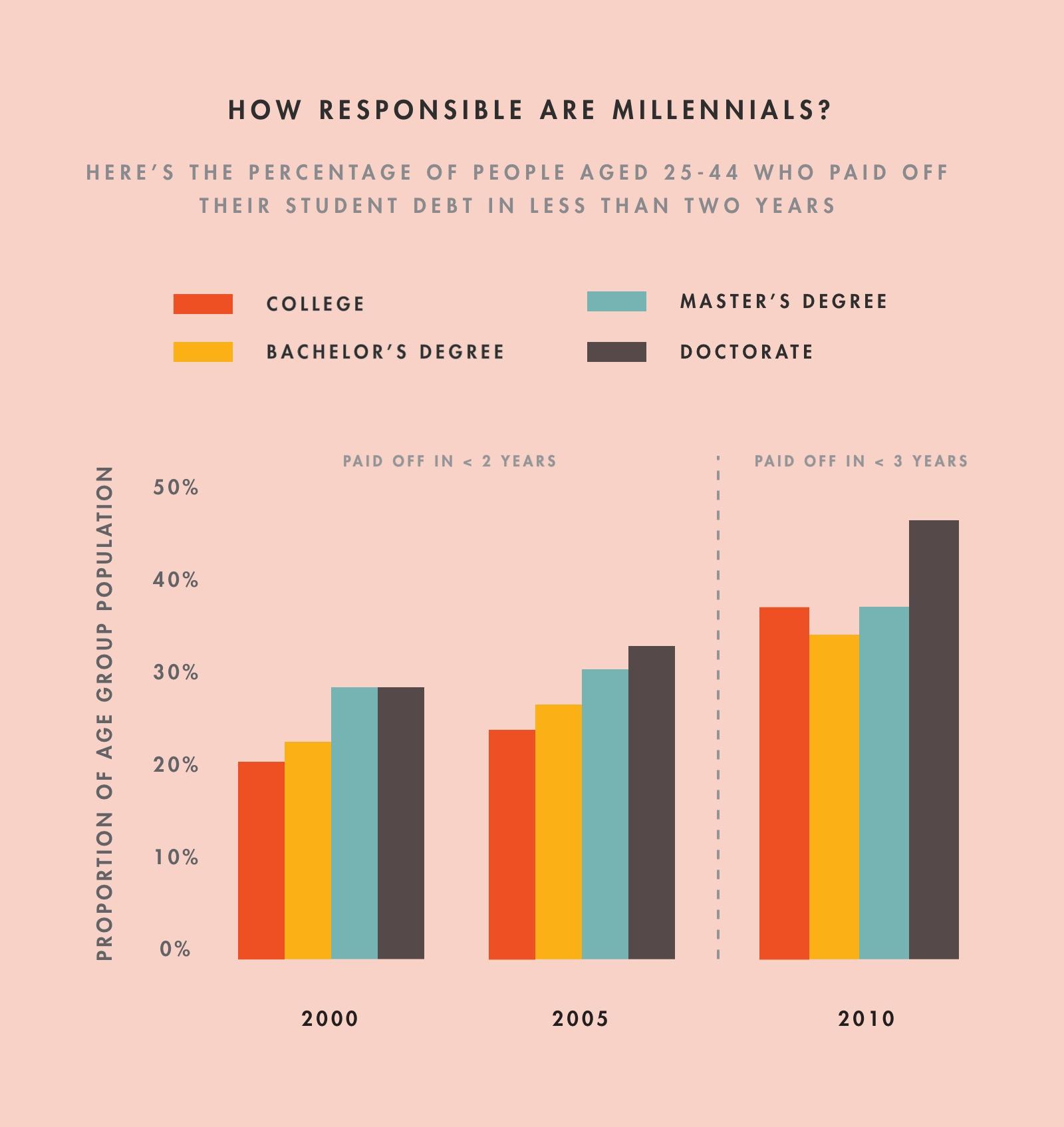

Not only that, but Canadian millennials are paying off their student debt faster than Canadians under the age of 35 did 20 years ago—of those who take on debt, one in three pay it off entirely within three years.

And even though tuition cost has increased, the number of people graduating from undergraduate school without any debt has increased from 51% to 57% between 2000 to 2010.

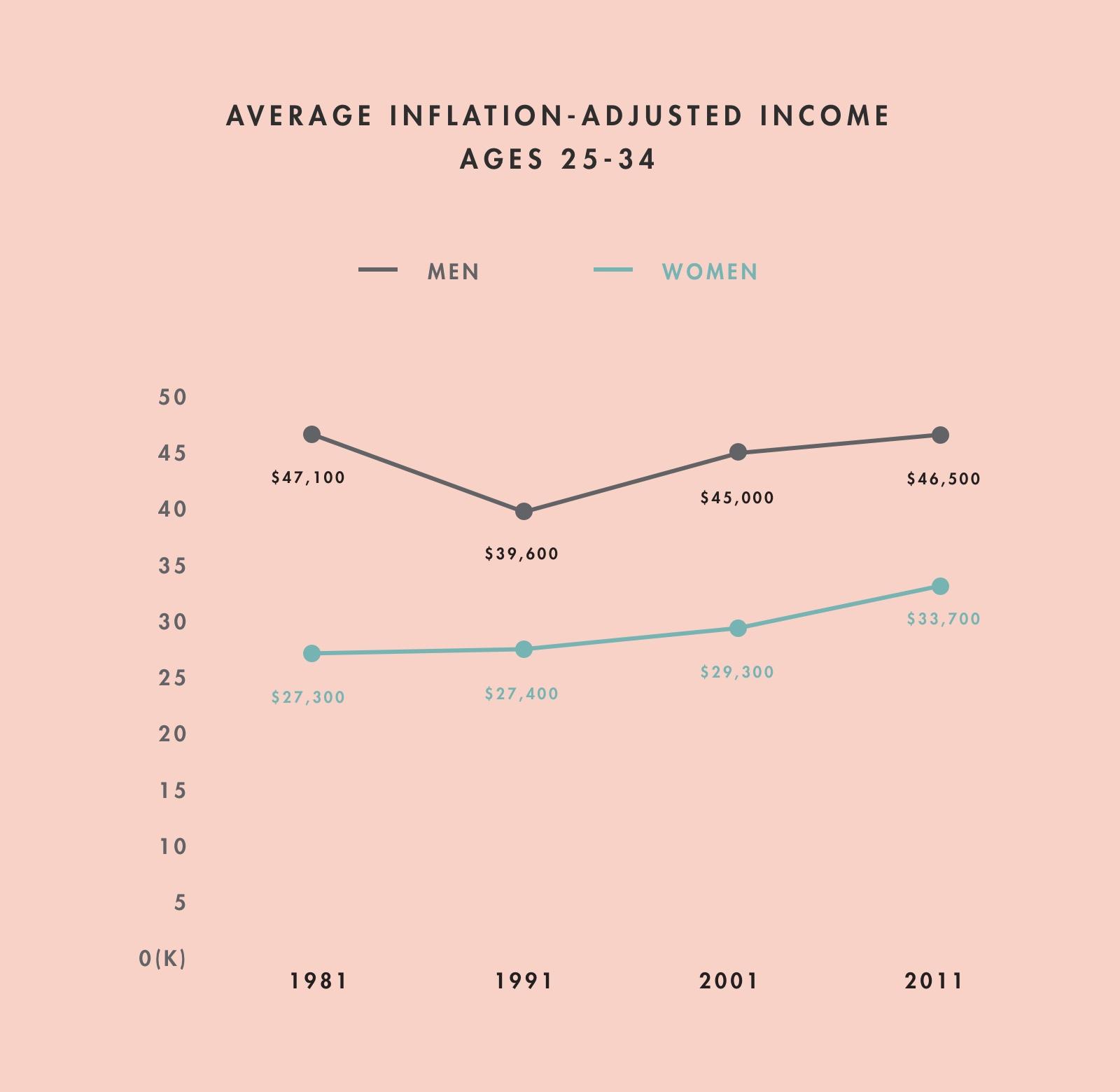

Male Millennials Are Doing Better Financially Than Their Counterparts a Generation Ago.

Incomes for men under the age of thirty five took a big hit in the recessions of the early 80s and 90s. But since then, incomes for this age group have risen. Male millennials are doing better than their counterparts a generation ago, and have incomes that are even beginning to approach an all-time high.

Female Millennials Are Doing Financially Better Than Their Counterparts

On average, young women have higher incomes today than at any time in the past. Which might say a lot more about income inequality (though there's lots of room to improve) than it does about unparalleled financial opportunity. But we’ll take it.

Across both males and females, the average net worth of this age group has increased from $23,300 in 1999 to $25,300 in 2012.

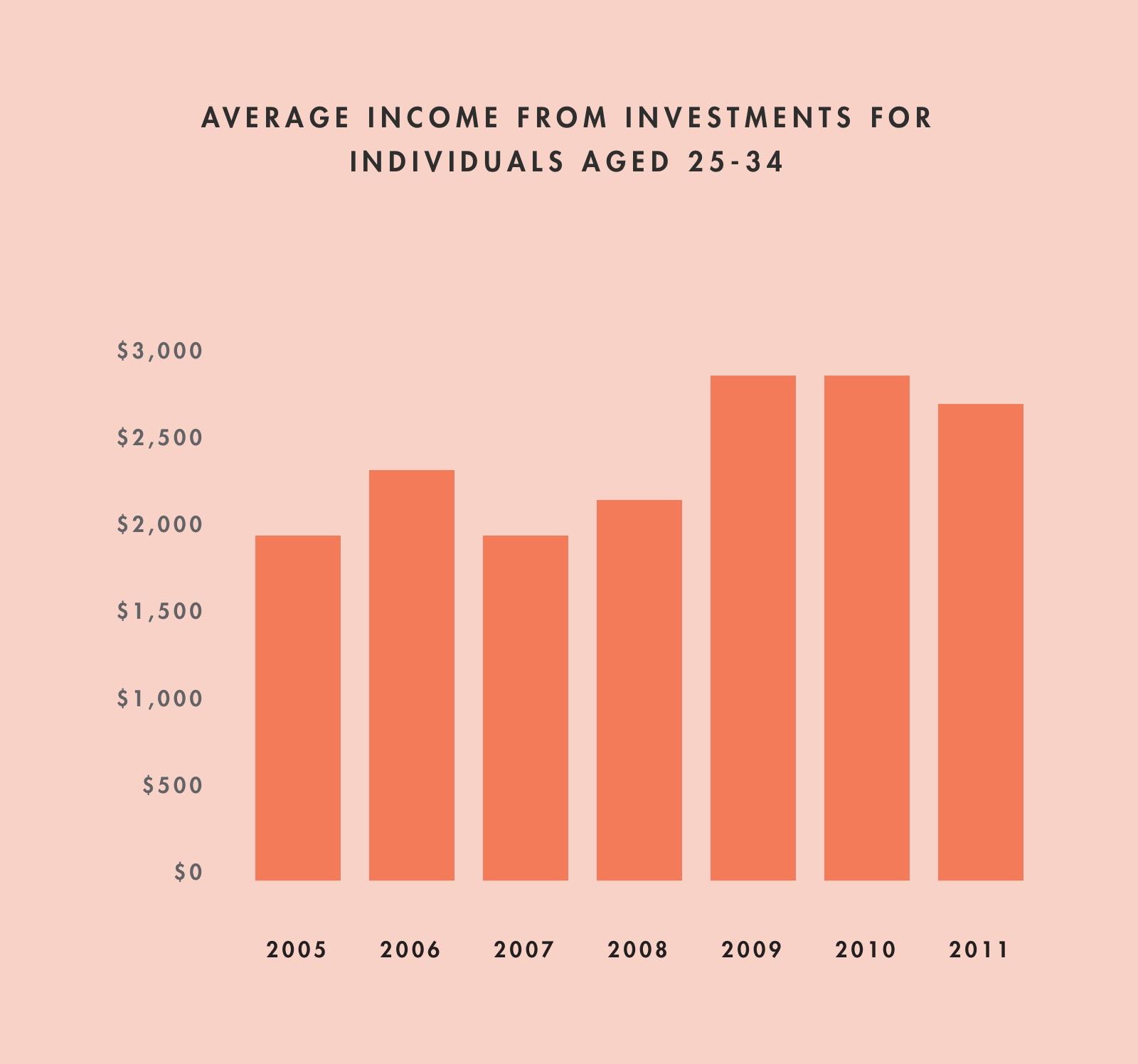

And They’re Being Smart With That Wealth.

Today, on average, people under 35 have significantly more total assets, available cash, and nonpension financial assets than the previous generation. And they’ve invested twice as much in RRSPs as the same age group did two decades ago.

They’ve also been good at smart saving. Millennials have contributed an average of $7,600 to tax-free savings accounts. In fact, millennials now have yearly investment incomes averaging near $3,000.

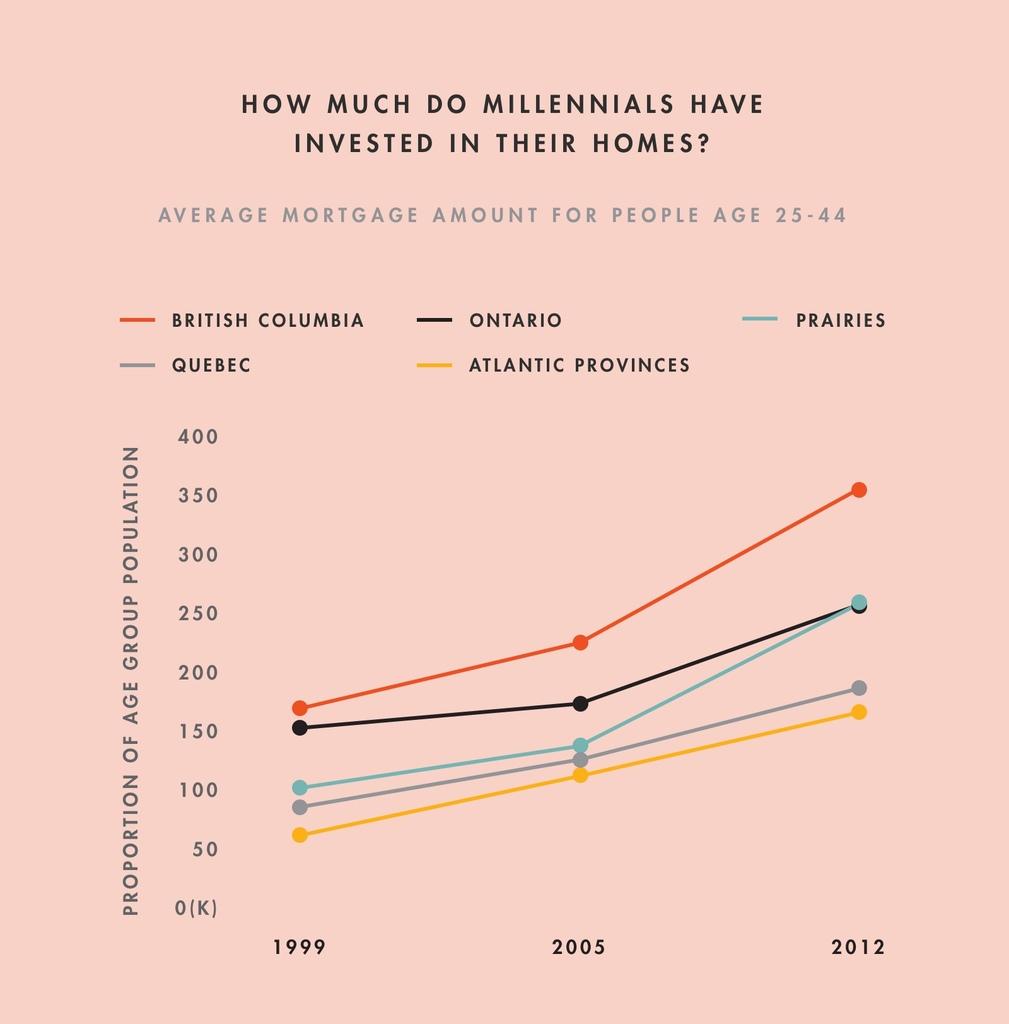

They’re Also Buying Homes.

From 1999 to 2012, the number of Canadians under age 35 who purchased homes increased from 32% to 34%. This despite the fact that homes have only gotten significantly more expensive in every part of Canada.

So if you’re a millennial, next time someone criticizes you for being “entitled,” maybe you should think to yourself, Yep, I am entitled, considering how hard I’ve been working and how wise I’ve been with my money.

Recommended for you

How Canada, and Much of the World, Got Stuck in a Land Trap

Money & the World

What’s Up With All Those Crypto Laser-Eyes Profile Pics? A Definitive Investigation

Money & the World

We Discovered the True Identity of the NFT Artist “Pak”

Money & the World

How 2023 Cracked Wall Street’s Crystal Ball

Money & the World

Just don’t say it out loud.

Sources

Graph 1. Source: Statistics Canada Labour Force Survey, CANSIM Table 282-0004

Graph 2. Source: Source: Statistics Canada National Graduates Survey, CANSIM Table 477-0069

Graph 3, 6. Source: Statistics Canada Income of Individuals, CANSIM Table 202-0407

Graph 4, 5. Source: Statistics Canada Survey of Financial Security, CANSIM Table 205-0002

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.