Money Diaries

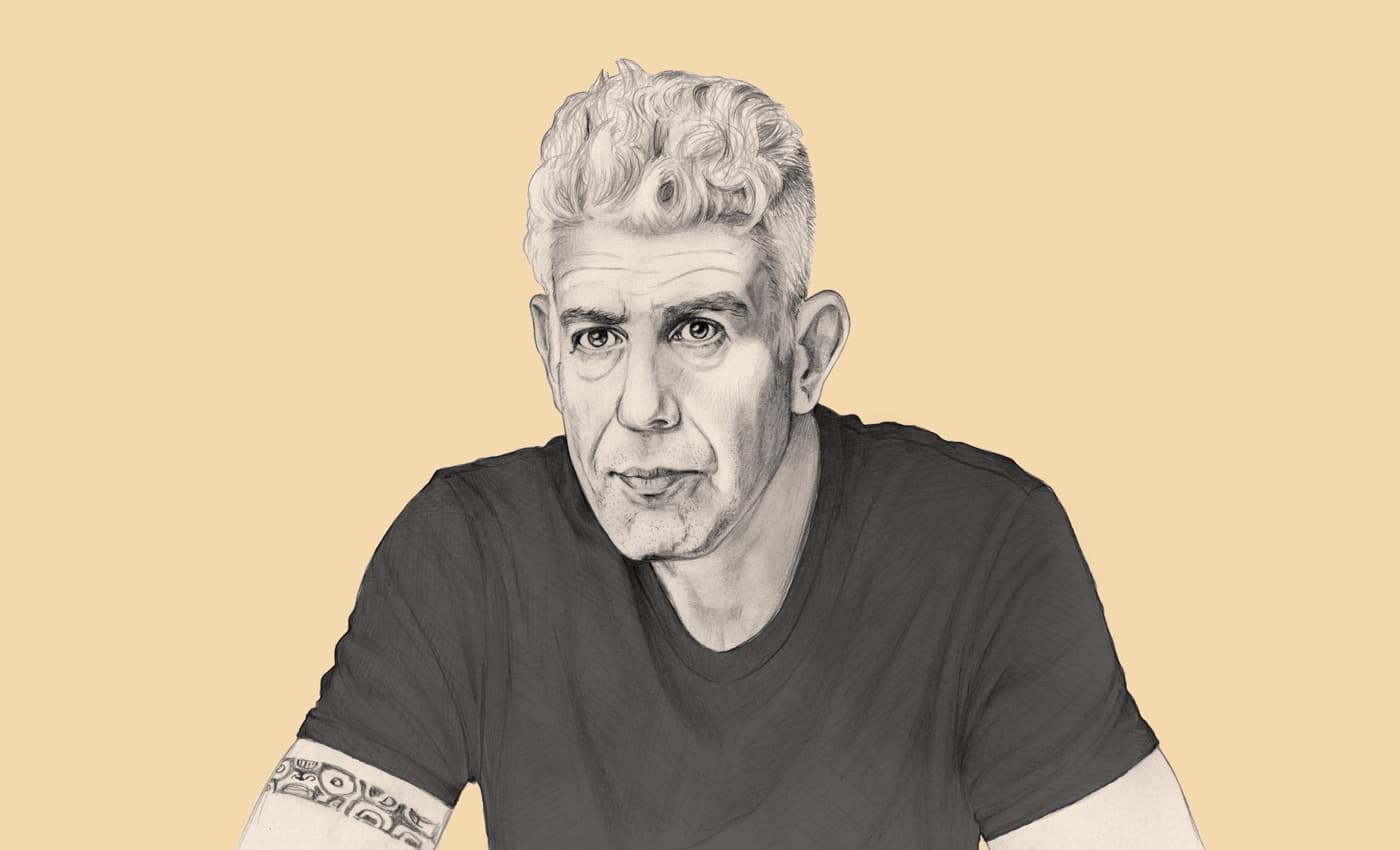

Michael Katchen Believes Everyone Should Have the Same Starting Line

The founder and CEO of Wealthsimple talks about the purpose of money, the importance of canoes, and how learning to be boring was one of the most important lessons in his financial life.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is an investing service that uses technology to put your money to work like the world’s smartest investors. In “Money Diaries,” we feature interesting people telling their financial life stories in their own words.

I don’t know that I was ever fascinated by money. I’ve always liked investing, but it wasn't the notion of investing that got me going on Wealthsimple. It was a practical problem that I had to help my friends figure out.

About six years ago, the company I helped build was sold. It was a startup called 1000memories — it helped families remember loved ones who’d passed away and it had all sorts of interesting tools to help archive family photos and create family trees and genealogies. When it was bought by a company called Ancestry.com, we found ourselves with a problem. It was a good problem, of course, but we suddenly had a little bit of money for the first time and had to figure out how to make the most of it. Two of the company's founders, Rudy Adler and Brett Huneycutt (who are also cofounders of Wealthsimple with me), started asking me about how they should invest. Even though I was only 25, I'd been interested in investing for a long time. It was a kind of obsession of mine. So I tried to show them what I’d learned; that smart investing wasn't about picking stocks, it was actually incredibly boring but very disciplined. I gave them a few books to read and made this spreadsheet for them that was designed to help them manage their own money. Thinking about it now, so much of me went into that spreadsheet – my dad’s tax law background, an almost religious belief in dispassion, and the power of data, not to mention a crazy love of spreadsheets.

The spreadsheet was really Wealthsimple Invest in its most rudimentary form.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

But what I discovered is that not everyone shares my passion for investing — or spreadsheets. I’d shared this spreadsheet before and everyone said the same thing: this is too boring, it takes too much time, it’s not what I’m good at, and it’s definitely not what I’m interested in. What they wanted was to have me do it for them. And I started thinking: OK, this could be interesting.

I grew up here in Toronto. My mom’s a psychologist — and both of my wife’s parents are shrinks, too, incidentally. We’re comfortable with our feelings at my house. My dad's a tax lawyer. He’s a real character. His favourite thing to do when I was growing up was to talk about... tax law! He’d get really giddy at the dinner table talking about it. This probably had an impact on us. I remember one of my sisters trying to force me to open up an RRSP account when I was 10.

Growing up, no one would have described me as a crazy risk-taker. People always said I was “nice,” maybe “humble.” I played a lot of sports. I was never the best, but I always kind of made it onto the teams, and I'd always win the same award: hustler of the year. I guess that was my strength.

When I was 12, my eldest sister entered me into a stock-picking contest. She actually started the contest, which was called the Canada Trust Investment Challenge, to raise money for Multiple Sclerosis research — our mom had been diagnosed with MS a few years before. For the contest, they gave you $100,000 of pretend money to invest in a portfolio of ten stocks. My dad and I sat at the kitchen table, and he opened up the Globe and Mail, and we went through the ticker symbols. I didn’t do any internet research — I actually used a phone book and called people to do my research. We decided the best strategy was to go for broke and bet the entire portfolio on one stock. Because unlike saving for retirement, this was a winner-take-all game — second place was the same as last place. I picked a company called MGI Software that sounded like a cool company. Then, over the course of the contest, the company went up 260%. We blew away the competition and my dad and I won a week-long ski trip in Whistler. I felt like the coolest 12-year-old kid around. My dad bought me a couple of investing books, which I devoured.

It also taught me a pretty important lesson, because after I won this contest, a couple of my dad's friends bought me shares in MGI software as my Bar Mitzvah present. It was 1999, and you can imagine what happened to MGI software when the tech bubble burst in 2000/2001. I lost all my Bar Mitzvah savings overnight. That experience taught me a valuable lesson and made me the kind of investor I am today — a very boring investor, which is what we should all be.

I went to business school, and I worked for a while at a high profile consulting firm, and I founded Wealthsimple, obviously. But there was an event that happened before that which is probably more formative than that for my career. In university, I went on a trip to Israel as part of a group. The purpose was to meet with startups, and try to understand why Israel — a small country with few resources — was producing a lot of really interesting new companies. The transformative experience of the trip for me wasn't meeting with any of the tech companies, it was meeting the founder of a tool company called ISCAR. The company set up all its factories right on the border, and hired both Israelis and Palestinians to work in them. But there was one condition: workers had to move their family to the company grounds, where the company had built a whole community — housing, schools, community centres, etc. He had data that suggested that as soon as a country hits a certain GDP per capita, conflict disappears. Once you provide everyone with enough so they can live and have the opportunity to dream of a better life for themselves, there's peace. He created those conditions on a micro scale, and he did it in the place that we associate with irreconcilable conflict, and he posed the question: how many of our conflicts could be solved by providing everyone with the resources to live with dignity?

Wealthsimple’s mission is firmly planted in these values. We want to enable everyone to achieve financial freedom. Financial freedom can be one of the greatest forces for good in the world. It enables people to live the lives they want, to provide for their loved ones, and to invest in their communities.

There’s a simple mechanism at work in our culture. It’s something you learn in Econ 101: the returns to capital outweigh returns to labour. If you have a dollar to invest, you'll always make more in the long-term than if you have an hour of your time to invest. The fact that capital out-earns labour is why the rich get richer. It may not be fair, but it's the way our society functions. And one way to address that disparity between rich and poor is to give everyone access to that lever of capital. To make capital returns more accessible, so a broader group of people can benefit. If Wealthsimple has a battle cry (besides “low fees!”) it would be: compound interest for everyone!

We think a lot about accessibility. When we launched we had an account minimum. We did this for logistical reasons — it's hard for a business to manage a lot of small accounts and it's harder to make a profit off of a lot of small accounts. But we realized that by imposing a minimum we weren't really fulfilling our mission — that Wealthsimple would be for everyone. So we changed that and ever since have had no minimum account size — even if someone literally has $1, they can invest it.

Financially, I’m still pretty boring. I lease a 2016 Mazda CX-5. It's super reliable. I'm pretty frugal. For a long time I've been pontificating about how even buying a house is an unnecessary expense. People put themselves in enormous amounts of debt to do it, they sacrifice cash flow, the freedom to travel, and have experiences and nights out, because they have to pay these crazy mortgages. But then my wife got pregnant, and suddenly we decided we wanted a home where we could raise our family — to know that we would be in this place for a long time. I realize now there are lots of reasons to buy a home — but I still don’t think one of them is because houses make great investments.

But becoming wealthy and passing that wealth onto future generations — that’s not what I’m interested in. Andrew Carnegie, the steel magnate, who was one of the wealthiest people in history, wrote an essay called “The Gospel of Wealth” that captures a lot of my beliefs on the subject of wealth and inheritance. He said: “The man who dies thus rich dies disgraced." He believed the rich should repay their debt to society by giving away their money.

Passing vast sums of money on to future generations is a tricky idea. We don’t want to live in a world where what a person can become is determined simply by whether their great, great-grandparent made a good investment. Everyone should have access to the starting line. I like to think we are all the trustees of wealth, which ultimately belongs to society. It doesn’t belong only to our own kids — and too much of it can mess them up.

Right now, we’re building the Wealthsimple Foundation to help kids get an education even if they don't come from means. The Canadian government provides really great grants for education savings, but a lot of people don't take advantage of them. Applying can involve a lot of confusing paperwork; often they require you to go into a bank branch, which can be intimidating for people who haven't had great experiences with financial institutions. So we thought: we already have a product that makes it easier to open these accounts than it is anywhere else, so we're in a unique position to help solve this problem. The foundation will make it really easy for people to access these grants and will provide additional funds for post-secondary education to low-income families. Our society needs people with the skills and training to solve tomorrow's biggest problems. If we're only providing those opportunities to people who happen to have been born with more wealth, that's a huge waste of human capital. Even just the belief that getting an education is possible can be transformative not just on an individual level, but on a societal level.

Right now, we focus on saving and investing. But for me, that's just the beginning. There are so many other things we can do to enable financial freedom. So get ready for some cool, impactful products in the future. And in the meantime, I don't want to make it sound like I don't have any material desires. What would I splurge on if Wealthsimple had its IPO tomorrow and it was a huge success? Probably a really nice canoe.

As told to Andrew Goldman exclusively for Wealthsimple; transcript edited and condensed for clarity. Illustration by Jenny Mörtsell.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.