Money Diaries

Stories From Our New Economy: Bullish on Bidets Edition

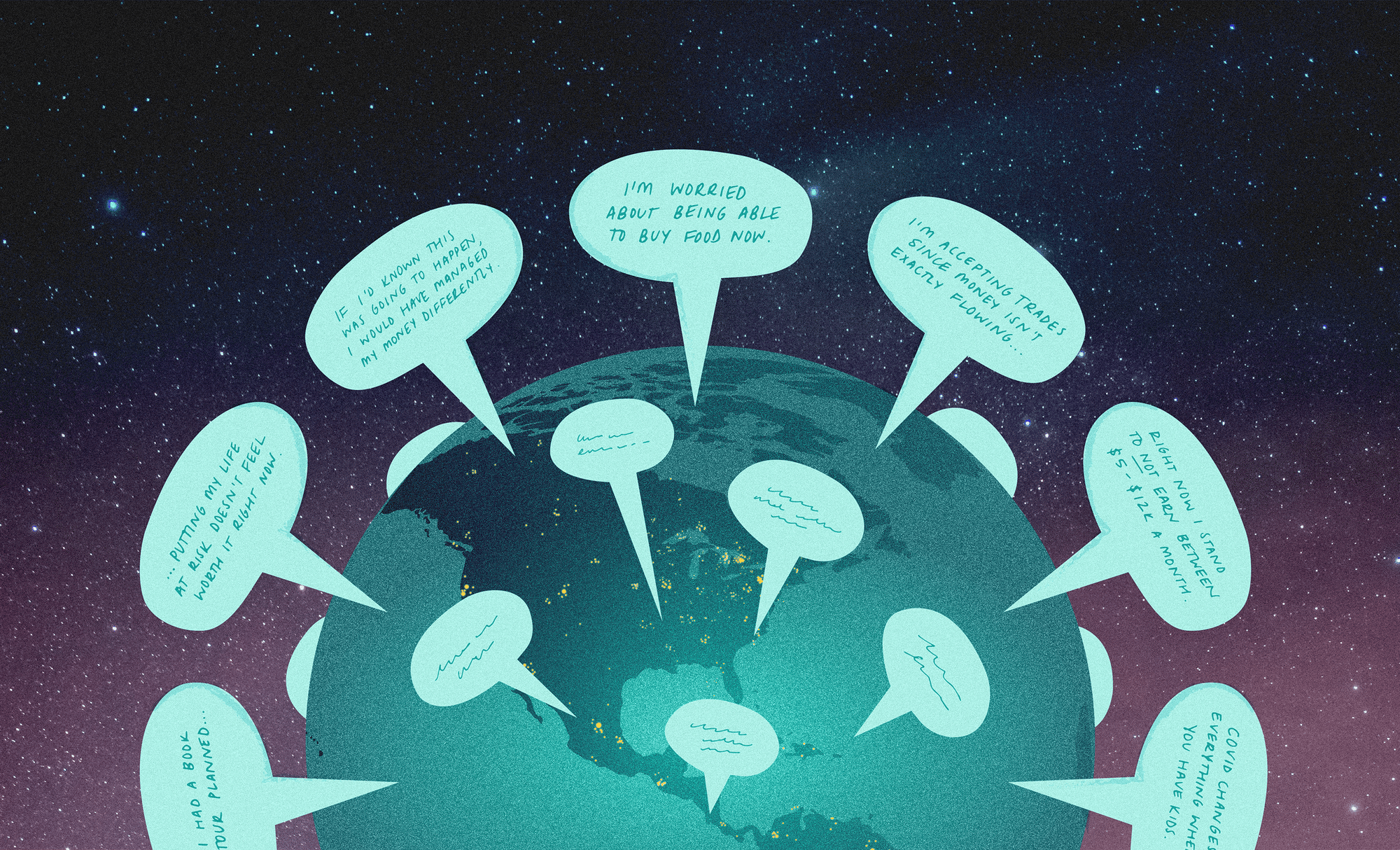

Our new Money Diaries series tells stories of humans whose lives have been upended by this crisis. In this edition we meet four businesses (the owner of a bunker company, a bespoke distiller, a day-trading celebrity, and a bidet magnate) that took unexpected turns.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Part One: A demand surge in the Armageddon business

Robert Vicino is the founder of The Vivos Group, a company that builds and sells underground bunkers for those who want to spend the “cannibalistic hoards roaming the countryside” period in relative comfort.

Back in 1982, when I was in my twenties, I got an inspiration, clear as a bell. It just came to me one day, a loud female voice in my head. It said, "Robert, you need to build underground shelters for thousands of people to survive what's coming our way." I was not a conspiracy theorist. I have a strong belief in God but not in religion. I was already successful. At 25, I had a business with 200 employees. I started in my garage with nothing, then built it up, had 200 customers from the Fortune 500, a Rolls Royce, I was doing pretty good. So, I didn't need this inspiration and tucked it away. And every five years or so, I would give it another thought. And each time I did, my gut said I still had time. Then in '07, I had a very strong instinct that there was no time left, that I couldn't put it off any longer. So, I did it. I focused 100%, shifted all my business energy and finances into Vivos. We launched in '08 and really it's never slowed.

I remember when I first met with my CPA and told him I was going to shift gears and do this 100%. He looked at me and he said, "You're crazy." He almost ushered me out of his office. He retired a year ago and a week after he retired, he had a heart attack on a golf course and died. I said to my wife recently, "I wonder if he's looking down and saying, 'uh oh, Robert was right.'"

Our business is going crazy. We're up probably 2,000% in serious inquiries — we get 150, 200 inquiries a day. And sales are up, I would say, 500% year over year. We're probably selling one bunker every one or two days right now. We're frankly having trouble keeping up with it. We were never set up for this kind of volume, but we predicted it. We knew it would come. People don't believe until they see it. And once they see it, everybody's a believer.

We currently have enough space to accommodate about 7,000 people. Our biggest project is xPoint, which is three quarters the size of Manhattan built into a complex we acquired called Fort Igloo, a base the U.S. Army built in South Dakota in 1942 to store bombs for World War II. There are 575 concrete and steel blast-proof bunkers there, and in 2017 we started selling them off to families. Each private shelter is 2,200 square feet and can house up to 24 people comfortably. You get power from a generator; NBC Air Filtration, which is for nuclear, biological, and chemical, to scrub all the air coming into the bunker; blast valves to avoid any overpressure or under-pressure from, let's say, a nuclear blast; and, of course, water and sewage treatment in the form of underground septic.

At xPoint, for $17,500 you can buy what we call a C-class bunker, meaning it needs a little work, maybe some concrete floor repairs. The next level is $35,000 which gets you an A or B bunker and those need nothing. You can then furnish it yourself for probably as little as $25,000 or you can do it first class like you see the pictures of in our showroom for about $100,000. Some are doing Class A, almost like a yacht on the inside. Others are doing what's called glamping, which is fabrics, tents — low-cost ways to just hunker down within a bunker and to survive.

We also have a complex called Vivos Indiana, which is a shared bunker for 80 people. It sold out in 2014. But we've transferred some people from there to South Dakota so we currently have some spaces available in Indiana for resale. It's $35,000 per share, and that includes everything. If you bought today and there was an event tomorrow, you're entitled to go there and all you'd have to go bring is some comfort clothes while you're inside. You have your bed, we're pre-stocked with all the food, water, fuel, medicine, hygienic supplies, and entertainment devices to ride out whatever is happening on the surface for a minimum of one year without opening the door to come back out. Everything is in that shelter — it's really four star.

We also grow food in Indiana. We have underground gardens, so we're growing leafy greens and vegetables. Everybody gets a salad every day. And the food stock provides effectively 2,500 calories per day per person, which is plenty if you're just sitting. We even have a means for disposal if somebody dies. And that's grim, but on the positive side, I can tell you there probably will be a baby boom inside Vivos nine months later.

And now, what’s been happening is validation, because I knew all along. I've never had any doubts of what is coming our way. And so, my job over the last 12 years has been to convince others, to enlighten them, to open their eyes. A lot of people believe, "Well, if something happens, the government's there for us, they'll take care of us, and they have bunkers underground and I'm sure they're going to have a spot for me." That's very naive thinking. It's going to be every man for themselves.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

You don't need to go underground for quarantine. Stay in your house. So, when do you need to take the next step? When it's no longer safe to stay in your house. And what would cause that? The domino effect — we have a depression, people don't have money. And when that happens, people are going to start going door to door to see what you’ve got. The have-nots are going to go after the haves. It’s going to be right out of the movies. Do you know what happens after 21 days of starvation? What humans will do? The answer is cannibalism. Most people, when they hear this, they put their fingers in their ears and put their head in the sand. But remember, when your head's in the sand, your ass is hanging out.

Part Two: A second life for a gin mill

Geoff Dillon is the owner of Dillon’s Small Batch Distillers in Lincoln, Ontario. When he shut down, he realized he had all the ingredients for hand sanitizer, even if he had no license to make it.

It didn’t take long to realize we could make hand sanitizer. The stores were selling out, but it’s easy to make. All you need is ethanol, which is a powerful disinfectant, and a little bit of moisturizer to keep your hands from drying out. It was still easy to find moisturizer, and we have giant tanks filled with pure ethanol.

It’s weird because we’re busier than ever, but I’ve had to lay off half my staff. The restaurants are closed, so we can’t make money, and our stills are running as fast as we can, but we’re giving it all away.

Most people don’t realize this, but a distillery produces ethanol. That’s what a still actually does. You start with a base ingredient, like corn or grapes or grain. You ferment it, then you heat it up, and you trap the alcohol that steams off. That alcohol is ethanol. If you’re making something like brandy or whiskey, you stop distilling when you have about 75% alcohol. You don’t want to go farther, because you need to keep some of the flavour. But if you’re making gin or vodka, you distill it all the way to 95%. For gin, you add botanical flavours back. For vodka, you water it down to about 40%. That’s all vodka is: ethanol with water in it. So on a normal day, we have a still producing pure ethanol that we stockpile to make vodka and gin. Then the coronavirus comes along, and it turns out what we actually have is tanks of disinfectant.

I knew we couldn’t sell it. It would take at least a year to get the federal certifications for a natural health product. So I just mixed a few bottles and put them in a basket at the front of the store. That was a Friday, and by Saturday, it was spreading by word of mouth. We had customers calling and coming into the store for it. I made another batch, but then on Sunday, people started asking if we could make large quantities. We got a call from the police department, and the superintendent of emergency medical services told us that he had 50 ambulances on the road, and none of them had disinfectant. We heard from hospitals in Toronto and Hamilton. They didn’t have anything to sterilize their equipment. I knew there could be legal ramifications if we produced a lot, but I figured, “Screw it. We’re in the middle of a pandemic.”

We produced another 2,500 bottles on Sunday. By Monday, they were gone. We bought all of the aloe in the area and we still ran out. So we started filling the bottles with alcohol and telling people they could add their own moisturizer. Now we’re filling full-size wine bottles. They’re 750 millilitres each, and we’ve produced more than 12,000 of them. It’s weird because we’re busier than ever, but I’ve had to lay off half my staff. The restaurants are closed, so we can’t make money, and our stills are running as fast as we can, but we’re giving it all away.

We aren’t doing it alone, though. The community has really come together. I’ve had five or six wineries donate bottles. I just got another 10,000 today. The wineries and breweries are also donating some of their wines and beers. We don’t care if it’s corked or skunked. We just want to process the alcohol out. Two other companies in the area have come forward to help with deliveries. Their vehicles are on the road right now, bringing twelve-packs to doctors and essential workers across Ontario. In the beginning, we printed our own labels and cut them by hand. Now we have 5,000 glossy labels that a printing company gave us. Yesterday, they printed 5,000 more. Two greenhouses just donated hundreds of aloe plants. We haven’t figured out how to use them. The woman who runs our lab is working right now to see what we can do. And people are starting to send us donations. It’s relatively small, compared to how much alcohol is going out the door, but it helps. And it’s better than sitting here with no staff, feeling depressed.

We’re exhausted and it’s been crazy. We’ve been in tears so many times. But the other day, I read about this guy in New York who’s hoarding 17,000 bottles of hand sanitizer. We just want to do the opposite. We have a building full of disinfectant and all I want to do right now is give it out.

Part Three: A day-trading personality meets the craziest market he’s ever seen

Timothy Sykes became famous by day trading in college and now has a career as a teacher and a kind of day-trading celebrity (we do not think, it should be said, day trading is a wise thing to do with your money). He always knew day trading was gambling, and now it’s gambling on steroids.

This is one thing I tell my students: we’re all degenerate gamblers, and I’m a degenerate gambler, too. I have to control the degenerate gambler inside of me, and I have to recognize that he is there, and I have to keep him in a little cage because if he breaks out, then he just runs amok and nothing good comes from that.

Recommended for you

Right now, I’m trading and teaching in West Hollywood, which was not my intention. I hate Los Angeles, but I ended up being quarantined here, along with the team of videographers, photographers, and editors who help me with both my video lessons and the charity I run, Karmagawa. We’re actually on our third Airbnb, because the first was booked for a week, and the second for two weeks, and now I’m like, OK, we’re here for a month. Apparently I was renting Jeremey Piven’s house, but now he is back in L.A. and he is quarantined, too, so we had to find a new place. It was a beautiful house.

I hate it here, not just L.A., but the time zone. To trade on New York hours, I have to get up at 4 a.m., and I’m not a morning person. I chug a can of Blue Bottle coffee delivered by Instacart, put on a T-shirt and boxers and from the moment I start my work day, my screen is shared with a chatroom full of my students. I show them all my trades and explain my rationale and answer questions. This is my life in any time zone, but since I’m currently getting around five hours of sleep per night, every trading day ends with a three or four-hour nap. It’s even worse when I’m in Bali, where Karmagawa has built two schools. Trading hours are 11 p.m. until 5 a.m. and I’m just a zombie there.

Teaching has really helped me with my number one problem, which is over trading. When I’m teaching, I’m like the alcoholic bartender who’s serving everybody else drinks but I’m trying to control my own drinking problem by serving it to them. It’s me versus me. Even as we speak, I’ve got my eye on this stock, the ticker is MARK and the fucking stock just keeps going, and grinds my gears, because I feel like I should be watching it but there’s only so much I can do. And when I’m trying to multitask, I do not trade. But right now it’s up 52%.

People don’t know how dangerous this game is. 90% of traders lose, if you look at academic studies, but I would say 100% of beginning traders lose because they have no idea. Like, they’re walking into a battlefield where there’s grenades and machine guns going off and they are carrying a little knife. The truth is that if you’re not willing to spend a ridiculous amount of time learning this profession, you should just invest in the S&P 500. Go for your predictable returns and live your life. Putting 8 to 15 hours a day into this is the table stakes, and it doesn’t guarantee success. It just increases your odds.

I got into day trading because of my elbow. When I was growing up, I played tennis pretty much every day for ten years, but just after I got into Tufts University on an athletic scholarship, I had an elbow injury and I had to have intensive surgery. I was walking around in casts for months. During this time, since I couldn’t do anything, my parents gave me an advance of $12,000 of my bar mitzvah money, told me to invest it in the stock market, and they assumed that I’d lose it all and learn a valuable lesson. I just watched the stocks move up and down. I didn’t have any rules, I didn’t have any experience, I didn’t know what penny stocks were or why I'd end up trading them. I just observed a lot of internet companies moving and a lot of biotech companies moving. So I basically started trading patterns. Through some combination of luck and skill, by the end of my freshman year, I’d grown my money to $800,000. This was during the tech bubble of 1999 to 2000, and I profited from it.

Though the coronavirus is a new development, the feeling of trading through it isn’t totally new. I was trading during the Ebola virus breakout, I was trading during Y2K. So when the whole world starts getting crazy about something, I’m sympathetic, but I immediately start thinking about, OK, which companies are going to benefit, what’s this going to do to the market. I have to be endlessly curious, and change where I look for stocks in play. Right now, it could be a mask company, a vaccine company, remote learning, telemedicine. But, fundamentally, it doesn’t matter what the company is, it doesn’t matter the technology, they all move based on hype and fear and then panic.

There was a time before this all happened when I was rooting for a crash just because it might mean time off. But I haven’t taken any time off. I feel guilty if I miss trades. I’m a small town kid from Orange, Connecticut, so I have a hard time saying no to money. But at the same time, I haven’t really had much of a life. I missed my college graduation for a trade. It’s made me fortunate and I’ve travelled the world, but at the same time, every single day, I’m a slave to my stocks and my students, for better or worse.

Originally, my childhood dream was to buy a Lamborghini, and I did that after I bought a house for my parents. But my dreams have evolved, my goals have evolved. Every year, I begin trading again with an account with $12,000 in it, and every year I donate all of my trading profits to charity. Karmagawa has built 68 schools worldwide, and my goal is still to build over 1,000. When I attend the opening of a new school and I meet the communities and I get hugs from the parents and the teachers, that just makes me feel infinitely better than going 150 miles per hour.

Part Four: When your second act is a bidet company and then the toilet paper crisis hits

Miki Agrawal was famous for being the feminist CEO of an underwear company for periods, and then infamous for a series of workplace scandals. Years later, she became the founder and Chief Creative Officer of Tushy, and its fortunes have taken a new twist.

2014 was when the idea really came for Tushy. My husband got me a really ugly Chinese bidet attachment for Valentine's Day. I was like, "Wait. What is this?" We put it on the toilet and it changed my whole life because, at the time, I was struggling with a very intense hyperthyroid condition that made me poop up to eight times a day — and they weren't clean poops. It was messy so I had to jump in the shower almost every single time. It was really, really frustrating. And so I went from having to waste so much of my time and energy to having this spray of water precisely to my bottom. It was perfect. I can't live without this product. I raised the first bit of money in 2014, but Tushy didn't launch until 2016.

It was all just so fast and furious. We blinked and all of a sudden, we're quarantined, right? The toilet paper shortage happened and people [online] would be saying, "Have you tried TUSHY?" Then, suddenly, people were like, "Oh, right. TUSHY." And we saw this gigantic spike in sales overnight. We didn't even do any promotion or additional advertising. In fact, we turned all of our marketing off because we were so backed up. We're on pre-orders right now, and we're five weeks behind on shipping.

I started my first business when I was 25 — a gluten-free, farm-to-table, pizza restaurant called WILD. I have four restaurants now. Then, in 2014, I started my next business, called Thinx, which was the real, hockey stick growth one. It's a period-proof underwear company that prevents leaks, and stains, and all these issues for women.

Prior to coronavirus, Tushy’s target for 2020 was about $20 million in revenue. That was a good, audacious goal to hit. But with this, we went from doing a million dollars a month to having a million-dollar day a couple of Fridays ago — and a few days over $500K in addition to that. It's been wild. Now, I think we're gunning for over $50 million for the year, if not more. We'll see what happens as this coronavirus unfolds.

People are like, "Oh, you guys got lucky." Yeah, we definitely got lucky, but we've been really chipping away at this for quite a bit of time. We've been singing the bidet tune since 2014, prepping people for years now for this day to come. The coronavirus and toilet paper shortage just accelerated it. It's a way more sustainable product than dry paper, which not only hurts your health and hygiene, but is terrible for the planet. It kills 15 million trees per year, plus wastes billions of gallons of water to make the toilet paper. Our product is only $79. You buy it one time. You attach it to your toilet in 10 minutes, and all of a sudden, you cut down your toilet paper consumption by 80%. You're still padding dry with some toilet paper but we also have organic, bamboo butt towels that you can use to pat dry, so you can actually eliminate toilet paper completely if you like.

We're quintupling our manufacturing right now and trying to get a second manufacturer ready to go. Our product is made in Asia in a family-run factory. They're doing their best to ramp up as fast as possible — they have a second floor that they now acquired. We just weren't prepared to need five times the normal amount of product. And all this happened while everyone has had to work remotely, so the whole thing has been fascinating.

I've always seen the company as being a minimum $100 million business and I won't stop until we at least get that as a valuation. Now I think it has legs for way more than that. I predict in 10 years, people are going to be like, "I can't believe I used to wipe my ass with dry paper."

All interviews have been edited and condensed.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.