Money & the World

The ETH Merge Is Almost Here. Probably Time To Understand It…

Crypto could soon become a lot more energy efficient — and a lot more scalable — thanks to a fundamental change to the Ethereum blockchain. Here’s our best attempt to explain the radical update in real non-jargony English, and how it could change our tech.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

One of the biggest gripes about cryptocurrencies is that they use huge, earth-wrecking amounts of power. Because, well, they do. But that could soon change. On Sept. 6, the Ethereum blockchain began a gut-level overhaul, called the Merge, that will entirely change how it operates. The update, slated to be complete sometime around Sept. 15, has been in the works for, oh, six years or so, and there’s a lot riding on its success — since Ethereum is, after all, the most-used blockchain (since NFT marketplaces and all sorts of applications run on it) and its currency, $ETH, has the largest market value behind only bitcoin ($BTC). Here’s our best jargon-free explanation of what the Merge is, and why no one will shut up about it:

So what will the Merge actually do?

As you probably know, there’s no centralized authority, like a bank, that executes transactions on blockchains. Instead, transactions, like buying or selling ETH, are carried out by computers around the world that are all in consensus, i.e., in agreement about what’s happening. The Merge will change how Ethereum reaches consensus.

Proof-of-Work (PoW), Ethereum’s (and bitcoin’s) current consensus protocol, involves computers racing to crack complex math problems to verify transactions. This is what people mean when they talk about “crypto mining.” The trouble is that, since these math problems require tons of energy to solve, a single Ethereum transaction uses as much power as the average U.S. household does in a workweek.

Proof-of-Stake (PoS), Ethereum’s new method, resembles a voting system. So-called stakers put up crypto as collateral to validate transactions. Then, once there’s agreement that a transaction looks OK, the blockchain rewards the stakers with money. But if a staker tries any funny business (e.g., voting for fishy transactions), they lose their collateral. This process requires roughly 99% less energy than PoW.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

Why is the Merge only happening now?

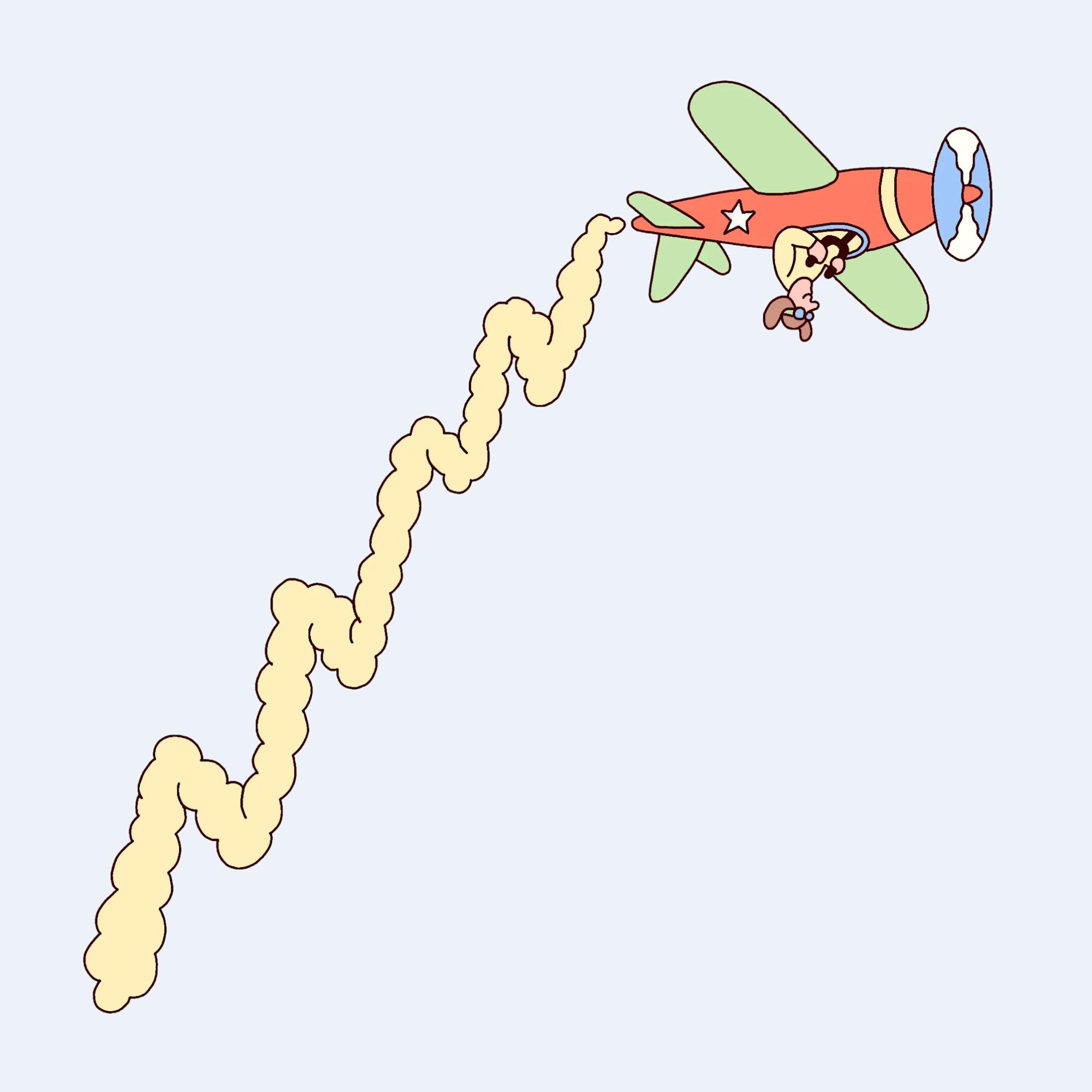

There are more than a million transactions on Ethereum each day, and so developers can’t just take it offline to fix and overhaul. Instead, they had to figure out how to update the blockchain without disrupting all the applications that run on it. Imagine a jumbo jet, Preston Van Loon, an ETH developer, recently told Wealthsimple Magazine. “Someone’s out there on the wing trying to replace the engine,” he said, “and not just replace it with another fossil-fuel burning engine, but something that’s solar powered.” That’s the Merge.

What does the Merge mean if I own ETH?

Well, you and your fellow ETH holders will no longer have a larger carbon footprint than Singapore’s. So there’s that. Functionally nothing should change, though, unless you want to stake your tokens. You can do that either by joining a staking pool or exchange, or by setting up a node yourself — provided you have the required 32 ETH (roughly C$66,000) to do so. (Fair warning: Ethereum won’t enable staking withdrawals right away, so your tokens might be tied up for at least six months, if not longer.)

⛔ Scam alert: watch out for people saying you need to transfer ETH or buy a new ETH token because of the Merge. You don’t.

Recommended for you

Wait, what about the price of ETH? Could that change?

We’re not in the predictions game here at Wealthsimple Magazine, but cryptocurrencies are highly volatile assets, and if an Elon Musk tweet can send prices soaring or nose-diving, the Merge will probably have an effect, too. And it’s totally TBD which direction the price could go. In the last week of August, ETH climbed roughly 10% in anticipation of the Merge, but that trend could reverse in a hurry if the update goes awry. Also, for what it’s worth, some crypto whales have sold off piles of ETH in recent weeks, suggesting there’s some uncertainty about ETH’s post-Merge value.

If I don’t own any ETH or crypto, why should I care?

Crypto is evolving, or trying to. Whereas the Bitcoin blockchain has basically one purpose — buying and selling BTC — all sorts of applications are built on Ethereum, and its developers want it to find broader mainstream adoption by expanding its uses. The Merge works toward this goal by laying the groundwork to make Ethereum more efficient and more scalable. If the Merge works, don’t be surprised if more of your tech life moves to the blockchain in the coming years.

How are other people feeling about the switch?

It’s a mixed bag! The Ethereum community is, no surprise, hotly anticipating the Merge, in part owing to the future upgrades it’ll unlock. Even noted crypto hater David Gerard told us, “I think the whole industry sucks and should disappear,” but, he added, at least post-Merge, Ethereum “won’t use a whole country’s worth of electricity.” Miners are pretty irked, though, since PoS puts them out of work. (Some have grumbled about splitting off their own chain and continuing to use the PoW system, but the odds of that happening look pretty slim.)

THE UPSHOT

Inside the crypto world, one of the big questions surrounding the Merge concerns centralization. Cryptocurrencies and web3 were founded on the idea that tech, finance, and the world generally should be less centralized and more egalitarian. The thing is, there’s concern that PoS could make Ethereum far more centralized, since the largest, wealthiest ETH holders are bound to dominate staking and, in doing so, control the motor that drives the blockchain. (Even Mr. ETH himself, Vitalik Buterin, is a bit worried.) That’s why DeFi diehards have rejected attempts to switch bitcoin to PoS, and view the Merge as a battle for crypto’s soul.

What average investors mostly care about, though, is whether ETH will overtake BTC in market value, and how much they stand to gain if it does. And if the Merge does translate into serious market momentum for ETH, Ethereum’s gamble to switch to PoS will have paid off, and signal that perhaps crypto’s philosophical underpinnings increasingly matter less than popularity or profits.

Sarah Rieger is a senior news writer for Wealthsimple Media, and co-host of the TLDR podcast. She was previously a reporter at CBC News and editor at HuffPost Canada. You can reach her at srieger@wealthsimple.com.