Money & the World

Economic Freakout 2020: The ‘What Now’ Edition

As the pandemic rages on, and government stimulus winds down, and an important election looms, we channel our anxiety into a desperate interrogation of Ben Reeves, Wealthsimple’s chief investment officer. On the agenda: interest rates, gold, the end of the world, and whether it’s all going to be OK.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

We are coming to you for wisdom. And our first question is: given how terrible everything looks at this particular moment, is everything going to be OK?

Everything’s not OK at the moment, obviously. I’m not a mental-health professional so I can’t address the psychological trauma so many are experiencing, but as someone who studies the economy, I know that people are hurting financially. Some of the wealthy people in our society are doing well, but poverty and unemployment are increasing and many people are suffering economically. This will continue to be the case until the public-health crisis eases. But the amount of financial hurt people experience going forward will depend a lot on how much governments borrow to replace people’s lost incomes.

The first time we did this you were pretty certain this wasn’t going to lead to something like the Great Depression. But things are now worse than expected. Give it to me straight: is this going to be like 1930?

I’m glad you brought up The Great Depression, because in my view, it’s an illustration of the power of government to either right a bad situation or else make it worse. The initial crisis, then, was terrible, but it was compounded by extremely unwise economic policies. Herbert Hoover put up tariffs and insisted on a balanced budget in the United States, which crippled any attempt at recovery. When FDR was elected in 1932, he brought in a lot of fiscal stimulus and devalued the currency — the economy improved a lot. There was a real boom from FDR’s inauguration in 1933 until 1937, when the Federal Reserve prematurely tightened monetary policy and caused another pretty severe recession. See what I mean when I say that the quality of the governmental response determines a lot of the outcome?

While the nature of the challenge is much different now, regardless of how well the United States and Canada have done from a public health perspective, they’ve both done pretty well in their economic response. The main question is whether they will continue to support the economy while the virus is still impacting people’s ability to work and spend.

The other thing giving me cold sweats at night is the stock market, where all my retirement savings are. People are losing their jobs, nobody’s doing much of anything outside their homes, yet my portfolio’s doing pretty well. Once this stimulus money runs out, is it going to be like Wile E. Coyote — we're running along and the ground drops out from under us?

First, I’m not saying that things won’t get worse if there is no stimulus. There could be a sell off. But this possibility is no mystery to investors, and when there is an obvious risk out there, it is usually incorporated in the price of assets. But to see the effect of those risks you have to look at different types of assets. For example, dividend futures, which investors use to invest only in dividends and not the underlying stocks. From the prices of dividend futures, we can see that investors expect a few years of low profits and low dividends.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

There are real reasons the stock market looks the way it does. People are still spending money — they are doing it in different ways. There’s been a major shift toward products and services that publicly traded companies provide. Your local diner might be suffering, which is of course terrible, but Amazon, Home Depot and Zoom Video are far from hurting, right? Then you’ve got to take into consideration the effect of lowering interest rates. These rate cuts raise the price of all assets, including stocks.

I admit that I've never really understood the relationship between interest rates and my portfolio.

Let’s start here: when interest rates go down, it makes putting money in things like savings accounts less attractive because they often don’t even outpace the inflation rate. So people put more money in the stock market, which drives prices up. But you should know that lower interest rates will also likely dampen your expected returns a bit. Cash interest rates declined by about 1.5% in the past year. That means expected returns in equities decline by about the same amount. In general, we expect our Growth portfolios to offer 4-5% above the cash rate and this year our portfolios are all up for the year — our standard portfolios are up 4-6%, our Socially Responsible Investing portfolios are up 6-9%, and our Halal Investing portfolios are up 1-2%. The decline in the interest rates contributed to the strength of this year’s returns, helping offset the decline in economic activity. Though that is probably at the expense of the returns we can expect in the future.

Then there’s bonds. Since interest rates are extremely low, you won’t get any return from most government bonds that will mature in the next 5 to 10 years.

How does all that change how people should approach investing for the long term?

Here at Wealthsimple, we have shifted away from those bonds into other bonds that offer more diversification, and we have added some gold to the portfolio, because gold can diversify equities well. Beyond that, our basic approach is still the same. We believe that, over long periods of time, diversified portfolios of risky assets will provide attractive returns. And, by and large, you get higher returns when you take more risk. Unless your personal situation has changed, our advice would remain the same.

What if your time horizon is shorter term?

If you absolutely need the money in the short term, the best option is cash or a GIC. They literally provide a guaranteed amount of money.

This is all helpful. But what would be most helpful is knowing when I can expect the economy to start behaving in a, you know, normal way?

It’s hard to say exactly. The primary determinant will be the public health response. Can we find ways to adapt to the virus or treat it effectively? Until we have truly effective treatment or a vaccine, I expect that we will see a series of increases and declines in infection rates which will directly affect economic activity. In some ways it reminds me of how people drive: when roads get safer, people drive faster, which then makes driving more dangerous again.

I would expect a kind of economic muddling through as this dynamic plays out, and then a recovery when the health crisis is over.

The long term bad news is that the longer this goes on, businesses will increasingly find it harder to hold on and stay viable. People are already moving from being furloughed to being unemployed. This will probably be a permanent decrease in growth because companies, which are basically just networks of productive relationships, go bankrupt, breaking those relationships. There is cost to reforming those relationships and making new, productive companies.

Muddling through sounds... not very hopeful. I’d love to hear any kind of ray of hope if you’ve got one.

A lot has improved since the lockdowns in the early days of the pandemic. We are figuring out how to live with the virus in many ways. Therapeutics are improving, we are learning which public health measures — like masks and social distancing — work, and which aren’t as important. Employment and production are growing as people are getting out and spending more, even though they are below pre-Covid levels. So things are definitely improving. Sales are growing, companies are reporting more confidence in future sales growth, and indicators like cell phone data show that people are moving around more. Of course it’s all still well below pre-crisis levels. Though people will do less, and be less confident, when Covid cases start to trend up. This is what we are seeing at the moment in Ontario.

Is this a moment when all of us should be socking more money away, being more conservative, stowing our nuts for some long hellish winter?

First of all, you will most likely know if your company or industry is struggling. A lot of the economy is doing well. On the other hand, permanent layoffs are approaching levels of previous recessions.

The amount of cash you want to have on hand is a personal decision. Take me, for example. I am comfortable with risk and have investments I could turn into cash in an emergency. So I personally just keep enough cash on hand to pay my monthly bills. But many investors want enough cash on hand to cover a few months of expenses because it gives them the peace of mind to put other savings in riskier investments. Any cash you have is a drag on returns, so if you do have an emergency fund, you should keep just enough in it to feel secure (our advisors suggest 3-6 months worth of expenses); that way you can keep the rest of your savings in a portfolio that will offer better returns.

The American presidential election is just days away. That just adds more stress — personal as well as financial. Is it smart to pull my money out of the market until there’s some clarity?

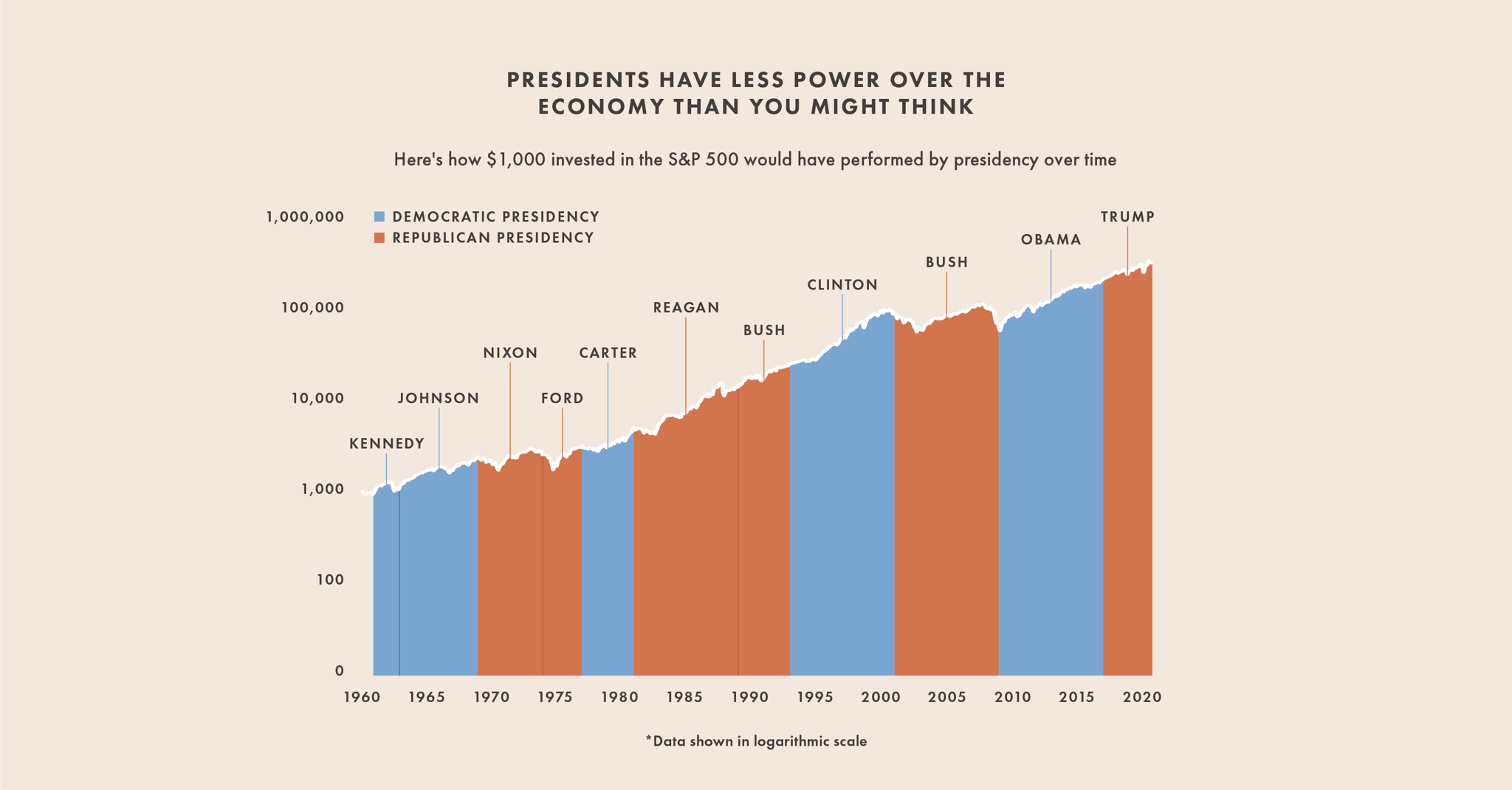

Resist that temptation. Our advice is to do absolutely nothing. Despite what they say on the stump, presidents tend to have very little to do with economic growth, productivity growth, or stock market returns. They can affect things around the margin if they lower corporate tax rates, for example, which increases equity values, but the economy is largely governed by cycles and forces that are outside of the control of any one person, even the U.S. president.

Plus, to the extent the outcome of an election will change things economically, much of what is likely to happen is probably already reflected in the price of stocks.

We make our portfolios to protect investors against a wide variety of outcomes — you invest with us because you don’t want to, and probably can’t, trade to profit off of things like election outcomes. Don’t feel bad — we can’t either. So our advice is, despite the stress caused by the political circus down south, just take a deep breath, take your hand off the “trade” button, and encourage all your American friends to vote on November 3.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.