Money & the World

How to Get Rich (or Go Broke) By Buying Pretend Sushi

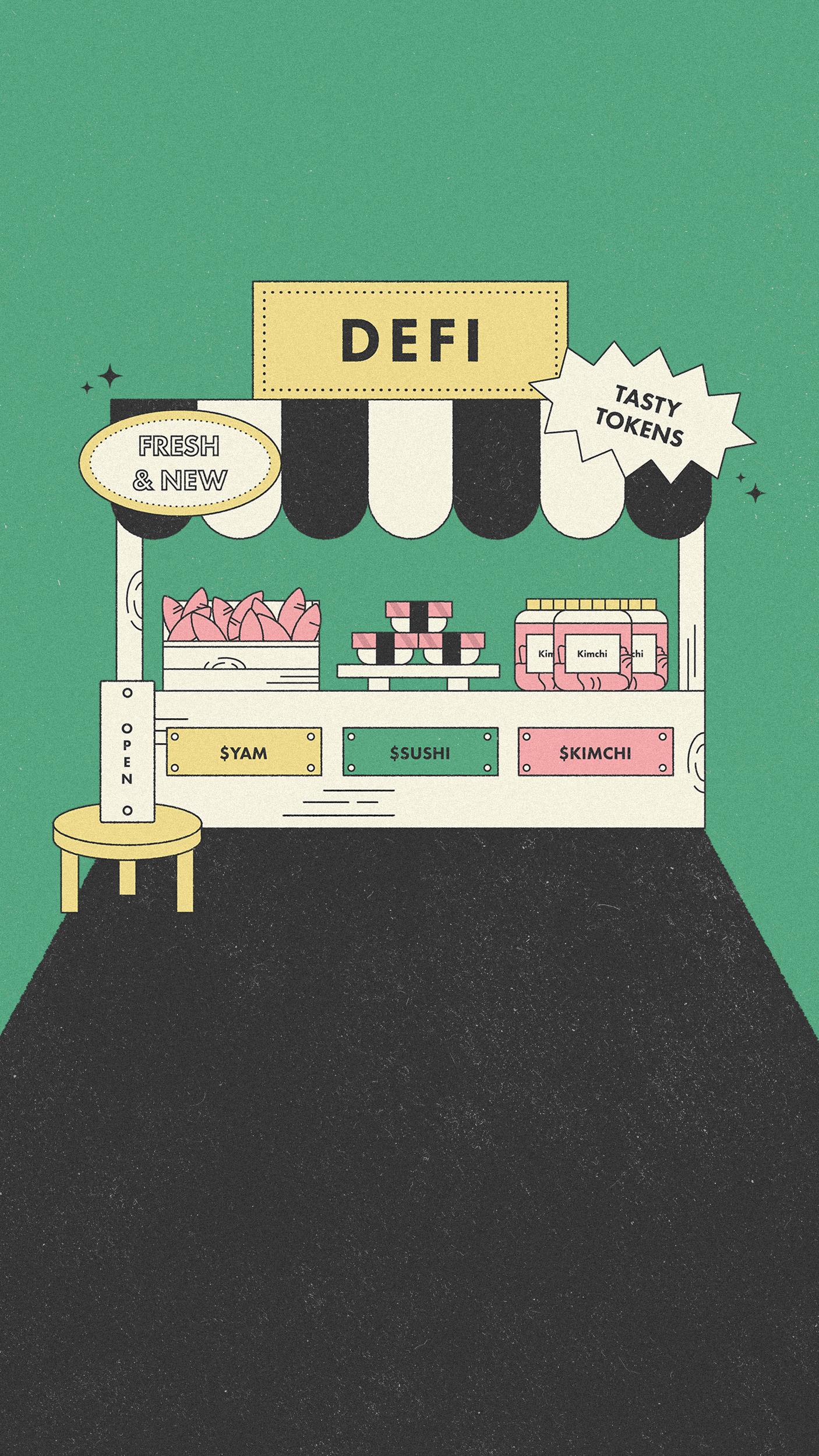

Welcome to DeFi, a bizarre corner of the crypto world some people think will replace the financial system, but right now is a place where people speculate on weird assets named after food. Our guide to what it is, why it matters, and where you can get some digital spaghetti.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

If you want to understand the promise — and greedy inanity — of the crypto world, look no further than DeFi.

If you haven’t been paying attention to the latest developments in the world of crypto — fair enough, it can be pretty baffling — you missed one of the biggest and strangest financial stories of the year. A tiny, emerging corner of the cryptocurrency space is called DeFi, short for Decentralized Finance. In March, there was about $1 billion in value sloshing around in DeFi. By October? More than $10 billion. With this flood of new capital, the idea that a strange, but potentially viable alternative to our entire global financial system could emerge — powered by startups you’ve never heard of and funded by VC giants — suddenly seemed within the realm of possibility.

There are some good reasons to think the world of DeFi is going to be pretty consequential. But in the meantime it’s spawned this really weird world where people are making millions of dollars on stuff like spaghetti coins.

We thought it was interesting enough to dig into and explain.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

WHAT IS DEFI AND WHY DOES IT EXIST?

First, some history. A little more than a decade ago, Bitcoin — the first and still biggest cryptocurrency — clawed its way out of the internet’s digital ooze. It made it possible for anonymous strangers on opposite sides of the planet to exchange value without a bank or government or anyone else in the middle. It introduced the concept of the Blockchain, basically a really fancy database which evangelists say is transforming everything from logistics to medical research. It also made a lot of people (including both Winklevoss twins) crazy rich and lost a bunch of other people their shirts.

Think of it this way: DeFi is to Wall Street what Bitcoin is to the dollar. It’s an attempt to replicate all the stuff the financial giants do — loans, insurance, interest-bearing savings, etc. — but without any of the costs associated with the banks and the office towers. And of course without the massive profits historically hoarded by people who work at fancy banks. Instead, deals would be peer-to-peer and they happen via open-source algorithms spread across the entire network of users’s computers. (Remember the way you shared Eminem hits in the Napster era? No? Well you missed out, it was fun and no, I’m not a boomer.) Probably the biggest draw to DeFi right now is a kind of high-interest savings account for your cryptocurrency. In a world of almost negative interest rates — the world we’re living in right now, for instance — a place that can pay an appreciable rate on your money is a legitimate attraction.

Recommended for you

What’s Up With All Those Crypto Laser-Eyes Profile Pics? A Definitive Investigation

Money & the World

GME, Doge, Supreme: How Getting Rich Went Full Internet

Money & the World

Canada’s Super-Secret Plan to Soar Past the U.S. Economy

Money & the World

The Story of the Stock Market, Told by Five Companies

Money & the World

And it’s out of these savings-like accounts that the weird yam-centric phenomenon emerged.

SO WHAT DOES BUYING AND SELLING SUSHI HAVE TO DO WITH IT?

Now here’s where the pretend food and the Wild West speculation of the crypto world comes in.

A lot of the money that poured into the DeFi world this fall? It wasn’t just because people wanted to earn a few more percentage points on their savings. It was for one of the same reasons a lot of stuff goes berserk in the world of bitcoin: a bunch of smart (or not so smart) people on computers trying to get rich quick, sometimes succeeding and sometimes not so much.

We won’t get too into the weeds about yield farming. It’s pretty arcane and complicated. The craze began in earnest when an app called Compound — one of the more popular savings-account-like apps — began giving users a bonus: a “governance token.” You got tokens for free in exchange for parking your money in Compound and those tokens gave users a say in how the app develops. But of course those tokens had value, and so a market arose for them. And as their value went up — earlier this fall a token was worth as much as $375 — billions of dollars rushed into Compound. Speculators were borrowing or trading crypto just so they could put it in Compound and get tokens.

What happened next is that all these other token-y apps began to pop up — because this was crypto, why not? DeFi is open-source, so anyone can build their own version by “cloning” another app. Something called Yam.finance arrived, and despite the fact that it was created explicitly as a “monetary experiment” and was unaudited (meaning there could be bugs in the code), more than $500 million poured into it on the first day. Unsurprisingly, Yam code did in fact have a bug, which resulted in the token’s value collapsing to literally zero a few days later. That didn’t slow down the craze one bit. More and more apps popped up and adopted an entire food court’s worth of culinary names: Sushiswap (with its SUSHI token) and Spaghetti (PASTA) and HotDogSwap (HOTDOG) and KimchiChef (KIMCHI) — the last of which is a clone of a clone of Sushi, which is itself a clone of the wildly popular DeFi token trading app Uniswap.

What’s the lesson here? Well, yes, DeFi might someday be used to build a viable, borderless, permissionless alternative to the current financial system. And yield farming, like a lot of what happens in crypto’s space, is a sideshow that detracts from what DeFi should be. It was mostly people who were rushing from liquidity pool to liquidity pool, pumping their tokens’ value and (hopefully!) dumping them before they crash. The people who time their moves perfectly can see gains of 1000% or more. The rest get stale sushi.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.