Finance for Humans

Should You Buy or Rent? A Quick Formula to See

There’s no 100%, can’t-miss way to figure out whether you’ll come out ahead owning or leasing a place. But one easy calculation will at least give you a hint.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Note: This story first ran in TLDR, Wealthsimple Media’s weekly, non-boring newsletter about money, markets, and crypto.

You know the story by now: Canada has long had a housing shortage, but a one-two punch of sky-high demand and painfully high interest rates has made homes wildly unaffordable. Which is upsetting for many folks because, as your parents probably told you, owning a home is one of the most reliable ways to build wealth. Or is it? One question that’s been overlooked amid the housing-crisis brouhaha is whether buying a house is still the best move financially. It’s a tricky question, because there are a million things to consider when weighing whether to rent or buy (which we’ll get into). So we won’t pretend there’s a magical way to make the right call. Still, there is a calculation that can point you in the right direction, and it’s called the price-to-rent ratio.

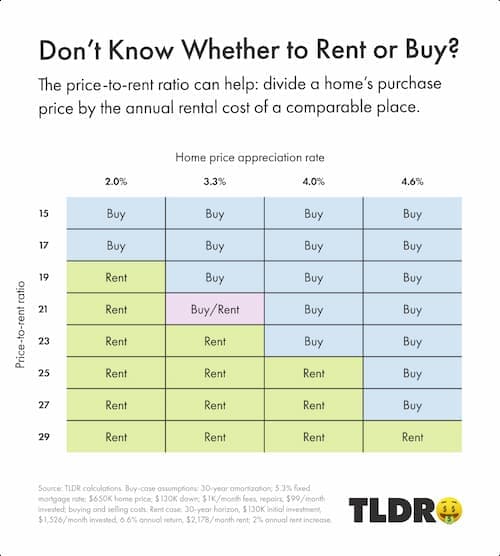

The Price-to-Rent Ratio. To get a ballpark guess whether renting or buying will build you more wealth long term, take the purchase price of a home and divide it by the annual cost of renting a similar place. If the result is 17ish or lower, you’re likely better off buying. If the number lands at or near 20, it could go either way. And if the ratio far exceeds 23, you should probably keep cutting your landlord a check each month. Why does this work? Because you’re essentially measuring whether a home for sale is overpriced relative to a comparable rental unit and, in a roundabout way, whether renting or buying will let you invest (and likely grow your money) more.

Give me an example! In the fall, the average Canadian home cost $650,000, while the typical rental unit went for $2,178 a month, or $26,136 a year. That’s a ratio of about 25, which suggests the scales tilted slightly toward renting (if you assume the home appreciates a pretty conservative 3.3% annually). Now let’s say that in January rent rises to $2,800 a month (or $33,600 a year). In that case, the ratio, at 19, tilts toward buying, provided you can still buy a comparable place for $650,000.

One big caveat: Renting comes out ahead only if you take all the money you save by not buying a home — including the money you would’ve spent on a down payment — and invest every penny of it in a diversified portfolio. None of the price-to-rent stuff matters if you spend your cash to lease a Cybertruck, which you use to drive yourself to lavish sushi dinners every night.

But wait! That’s not the only catch! Even if you diligently invest, myriad factors could influence whether you’ll build more wealth renting or buying — like interest rates, home repairs, etc. For instance, in the example above, if a $650K home appreciates 4% to 5% annually (or more), as opposed to the assumed 3.3%, buying might come out ahead. (See the table below.) Such variables are why it’s wise to spend some time with a few different rent-vs.-buy calculators, to game out different scenarios.

THE UPSHOT: We know this might be an annoying way to end this article, but it’s ultimately a judgment call whether to rent or buy. The price-to-rent ratio can give you a rough idea which way to go, but it can’t tell you with 100% confidence what will grow your wealth more, nor can any other formula. This uncertainty is why it’s smart to diversify, to safeguard your finances from risk. And that’s important no matter what you decide to do.

Jared Sullivan is an editor for Wealthsimple Magazine and author of the book "Valley So Low: One Lawyer's Fight for Justice in the Wake of America's Great Coal Catastrophe".