Finance for Humans

Is It Really Wise to Trust a New Company With My Nest Egg?

To understand why Wealthsimple is safe, you just have to understand how it works.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

I guess I’m the Worrier-in-Chief here. But here’s my concern: I wear sneakers that have been around longer than Wealthsimple. Why should I trust a company the same age as Prince George with my retirement savings?

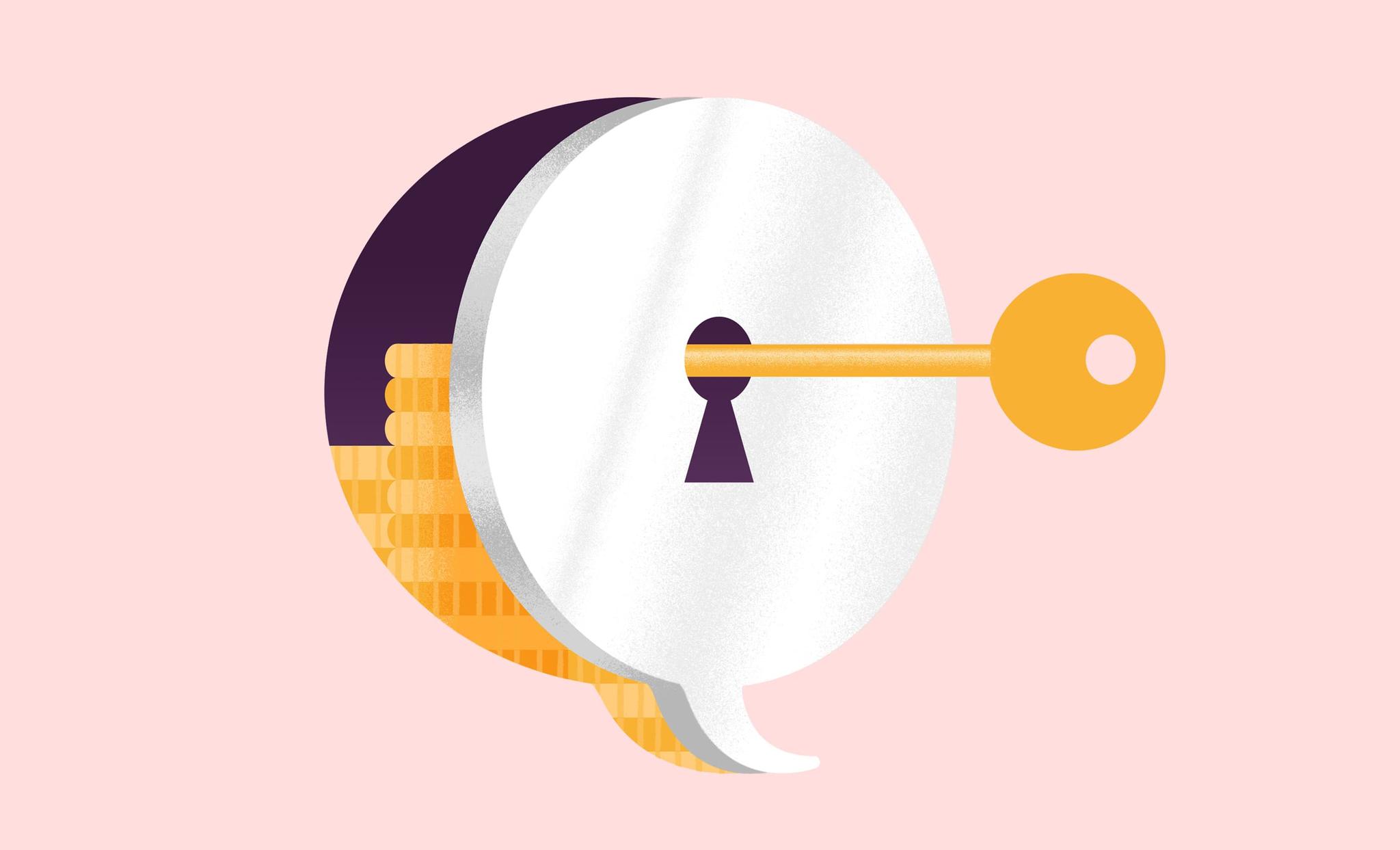

If you want to understand why the money you invest with Wealthsimple is as safe as it is anywhere, I’m going to need to get a little technical—you have only yourself to blame, Andrew! The first thing to know is that Wealthsimple is what’s called a portfolio manager. A portfolio manager is a company that’s registered to manage people's money by the Ontario Securities Commission (OSC). One of the things we’re legally allowed to do is buy and sell securities on your behalf. At Wealthsimple, our job as your portfolio manager is to help build you a diversified portfolio of ETFs. We help you choose a mix of investments, and then we execute those trades. We also legally have what’s called a fiduciary responsibility. This means that we’re obligated to make decisions that financially benefit you, not us or any other entity.

But here is the simplest answer to your question: We don't hold your money directly at Wealthsimple. We don’t even have the ability to touch your money, except to take our fees (which, as I’m sure you know, are incredibly low).

I know you dot-com types—there are probably high-stakes foosball tournaments in the office. But you’re telling me that if you lose big and need to cover your losses for a day or so, you’re not even able to get into my account?

We are not. That is correct.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

But you do have a foosball table in the office right?

No. We have a Ping-Pong table.

I knew it! OK, so if you don’t have my money, who does?

Your assets are actually held with Wealthsimple Investments Inc., which is a different kind of company, called a custodian. A custodian is a financial institution that can’t make any trades; it just safeguards assets. Wealthsimple Financial Corp is the name of the holding company that owns both Wealthsimple Inc., the portfolio manager, and Wealthsimple Investments Inc.

But then what if something happens to Wealthsimple Investments Inc.? Maybe it gets hit by an asteroid and all my money literally ignites.

Time to get into the financial weeds again a little. Wealthsimple Investments Inc. is a member of the Investment Industry Regulatory Organization of Canada (IIROC), which is the nonprofit organization that oversees all investment dealers in Canada. The purpose of IIROC is to protect investors as well as support the overall health of Canadian markets. All IIROC members are also members of CIPF, the Canadian Investor Protection Fund. At Wealthsimple Investments Inc., as with all CIPF members, every account is covered up to a million dollars against insolvency. So if Wealthsimple Investments Inc. were ever to go bankrupt, you're protected up to a million dollars per account. This is the same level of protection you would expect from any of the big banks.

Recommended for you

The other thing is that the funds you own are in your name. If anything happens, they just revert to you anyway.

Then I guess my question is how do I know the people at Wealthsimple Investments Inc. who actually hold my money aren’t a bunch of degenerate foosball gamblers who need my money to cover their debts?

Maybe it’s time to tell you a little bit about why Wealthsimple isn’t your typical start-up. Wealthsimple’s financial backer is Power Financial. It is one of the largest and most well-respected financial firms in the world. It’s controlled by the Desmarais family, which you may have heard of, and has more than $1.22 trillion in assets. You probably know some of the brands that Power Financial owns: Great West Life Insurance, London Life, Canada Life, Mackenzie Financial. They don’t own Wealthsimple entirely, but they have invested $30 million in us, and their powerful assets serve as a pretty major insurance policy so that we do well, and we do well by our clients.

The fact that you’re backed by heavy-hitters seems stable. But what about cases like the MF Global bankruptcy a few years ago—seemed totally legit, but it turned out that they were dipping into client accounts to cover shortages. It was in truth a bit of a Ponzi scheme.

MF Global did a lot of complicated and risky stuff—a lot of derivatives and derivative contracts and debt in margin. Wealthsimple's business is very boring and very straightforward. We buy ETFs to match our clients’ investment needs and manage those accounts so they’re truly optimized. We are not involved in lending, capital markets, or any of the high-risk businesses that caused banks to go under in the U.S. in 2008. We don't do derivatives. We don’t even have leverage—which is the common financial-industry practice of borrowing money and betting you can make more on it than the interest you owe to whomever you borrowed it from. The cash we use to buy client securities is the cash that the clients have in their account.

Is all automated investing this safe? Truth be told, I was shopping around the robo-advisor world and it feels like getting lost in the energy-drink aisle at the grocery store. There's WealthBar, Nest Wealth, Steady Hand, Tangerine. From a security standpoint, should I be worried about any of these?

I would say that so long as the firm is a member of either IIROC or of the MFDA, which is the Mutual Fund Dealers Association, you should feel comfortable that there's regulatory oversight, and if they're not doing the right thing then the regulators will tell them to do the right thing.

I was giving you a nice opportunity to slag your competitors and you whiffed.

I’m sorry to disappoint you, Andrew. But the way we see it, there is no other investing business like ours in Canada that has grown the way we have, has raised the kind of capital we have, or has the kind of team that we do.

Wow. I’m not used to such bold pronouncements from you. You’re normally so mild-mannered.

Shh. Don’t tell anyone.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.