Finance for Humans

Nervous About Overheated Stocks? Let’s Revisit Four of Our Best-Ever Insights

Everyone is talking (and fretting) about bubbles. You (probably) shouldn’t freak! Here’s why.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

This story first ran in TLDR, Wealthsimple’s weekly, non-boring newsletter about money, markets, and crypto.

Here’s a fast and fun (and by fun we mean sort of frightening) way to give yourself a heart attack: go to Google Trends and punch in “AI bubble,” “credit bubble,” or “tech bubble,” and you’ll get all-time high results for each. Everyone, in other words, is talking about bubbles right now, and no wonder — it’s natural to look at surging stocks prices and fret about how long all the up-and-to-the-rightness can continue before a correction drags markets down.

We don’t make predictions here at TLDR, and we can’t tell you with absolute certainty whether markets are in a bubble or if strong corporate earnings will end up justifying all the soaring stock prices. (They might! Who knows!?) Still, with so many questions swirling about stocks, we combed through all the analysis we’ve published since launching this newsletter in 2022 and found four insights that feel especially relevant right now. Think of this as our sitcom clip show, just with statistics and no gag sequences.

Recommended for you

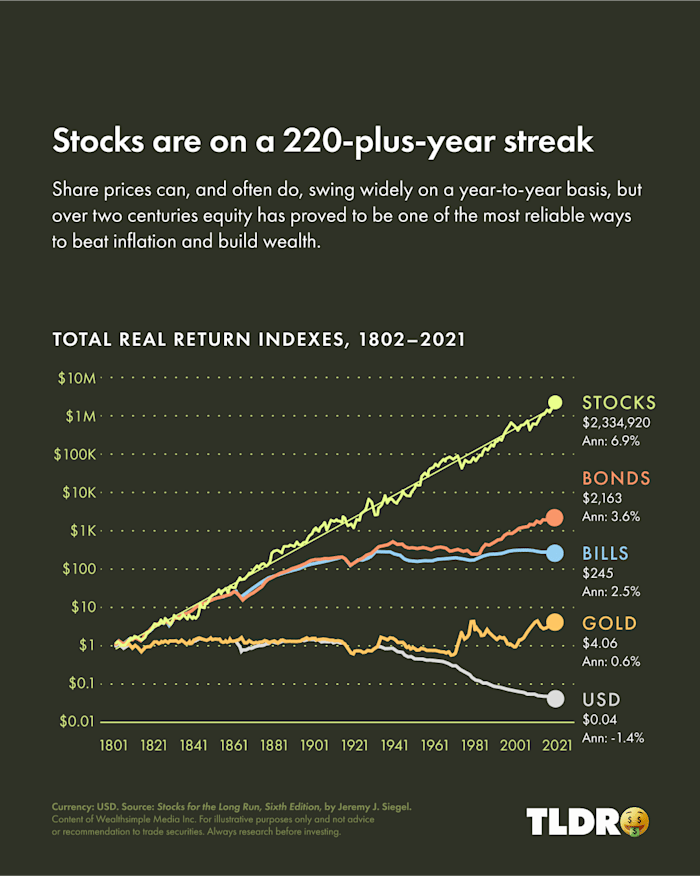

[1] Stocks have a stellar track record. Did that intro make you wonder whether it’s time to offload some stocks and buy lower-risk assets? Diversification is smart, especially if you’re nearing retirement. But bear in mind that stocks globally have marched up and up since the early 1800s, despite all sorts of horrible world-historic stuff. In fact, across two centuries, stocks have returned an impressive 7% per year after inflation. This chart is among our favourites here at TLDR HQ: it’s from Jeremy J. Siegel’s excellent book Stocks for the Long Run, and it illustrates the primacy of stocks relative to other asset classes.

[2] Most individual stocks are duds. OK, so while it’s true that stocks, broadly speaking, have relentlessly climbed, it’s also true that only a tiny number of them — about 4% — have generated nearly all meaningful returns for investors and earned more than banks pay in interest. Meaning: 96% of stocks are not worth owning. We pointed this out in our piece about how to be a lousy stock picker, but it bears repeating, and it’s why many advisors suggest diversified, low-cost index funds: they dramatically up your odds of holding the rare winners while also blunting your losses. The market’s big winners lately have been seven giant U.S. tech companies, aka the Mag 7. Whether their dominance will continue is a topic of debate. But if you’re diversified via index funds, your portfolio should, fingers crossed, grow steadily either way while also helping you weather industry-specific turmoil.

[3] Even if stocks are hot, you might still want to buy. Let’s dwell on the Mag 7 for a moment longer: over the past 30 years, the price-to-earnings ratio — a gauge of a stock’s value relative to earnings — for U.S. stocks has hovered around 17. Right now, the S&P 500’s five-year forward P/E ratio is around 22, meaning stocks are perhaps a tad expensive, thanks to the Mag 7’s lofty valuations. Does that mean a correction is imminent and it’s a bad time to invest? Not necessarily!

As we reported last year, the S&P 500 has traded within 5% of a record high 60% of the time over the past six decades, and it has notched a new all-time high about once every 14 trading days. Soaring stocks, in other words, are the norm. Some bull markets have lasted for decades, high P/E ratios be darned. And if you wait on the sidelines for prices to fall, you risk missing out on hefty returns.

[4] But brace yourself for periodic pain. Since the 1940s, the S&P 500 has fallen into a bear market, losing at least 20% of its value, 13 times. The TSX has done it 15 times. So basically once every five years or so, stocks tumbled big. Now for the good news: U.S. stocks have historically risen by nearly 150% during bull markets and fallen just 32% during bear markets. The TSX’s performance has been similar. Point being: investors have been rewarded for not panic selling during downturns — something we’ve repeated a gazillion times over the years, but a gazillion and one can’t hurt.

Jared Sullivan is an editor for Wealthsimple Magazine and author of the book "Valley So Low: One Lawyer's Fight for Justice in the Wake of America's Great Coal Catastrophe".

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.