Money Diaries

It’ll Work Itself Out (It Actually Won’t)

He’d finally achieved what he’d always wanted. He was a writer, in New York, people knew his name. But under his bed was a plastic bin that contained — in the form of bills and notices — another man entirely. An addict and a debtor. And that man had come calling.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

It was my nastiest, truest tradition: my Friday morning trip to the Bank of America on Bleecker Street.

I’d end up there every other week. Not the day you probably think. I never went on the Fridays that were paydays — though those were nice days. But on the other Fridays, always. The ones when I knew without looking that my account was low. The ones when I knew how far away the next payday was and that I might not make it with what I had.

So, twice a month, I’d go and overdraft the perfect amount.

It was a skill you had to learn. You couldn’t try to withdraw too much, because you ran the risk of Bank of America being like, “Hell no, broke scam boy. We’re locking down your card and maybe telling the police.” But, equally as troublesome, if you didn’t withdraw enough, and then spent it all, you couldn’t go back and withdraw more, because your account was already in the red. You only had this single chance.

I’d spend the day before, a well-meaning Thursday, getting my account down as close to $0 as possible, without going under. I knew my overdraft limit was $500. So if I walked into the ATM with $4 in my account, I could leave with $500 cash, and -$496 in my bank account. That $500 cash would need to get me to the following Friday at 4am, both when NYC officially closed down (and I might need to close my final tab) and when my direct deposit hit. I’d stand there at the ATM, totally aware that every day starting Monday, I’d get hit with a $25 fee. But when the money actually made it to my hand, I felt like I’d won. I’d lived to see another weekend and another week and my lease on New York, my aspirations, my ability to eat, my smokescreen of stability, my life — renewed.

At the end of the transaction the ATM would ask me if I wanted to see a receipt. Even though I’d say no, it would spit one out anyway. Then, even before the paper was finished printing, I’d rip it out, ball it up and throw it in the trash without looking at it.

There was pride, and shame, in the way I chose to survive.

My upbringing was stable. My mother created a world that made me feel like I could do anything I put my mind to. She wanted me to feel like there was no ceiling to my ambition and I took that to heart. I knew we didn’t have an excess, but I never felt without. I also knew that she was busting her ass to create that sense of stability for me, which was why I tried never to ask for much.

I left home, marched through college, and came out ready to take the world by storm and, in turn, make her proud. She’d invested a ton in me and I never wanted her efforts to be in vain. And equally as important, I never wanted her to worry about her son.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

But then, when I graduated, 2009 happened. The middle of a global recession. It’s funny because I don’t think of that as some moment of drama and tumult. I look back on that first year of the rest of my life fondly, the calm before the storm. I was a 22 year old with promise who’d lost his first job before he ever started. But there was nothing too demoralizing about it, because it was happening to everyone. I was blessed and cursed with a certain amount of delusion about how things would end up for me — the answer always being, “It’ll work itself out.”

The answer seemed, more specifically, to be: go back to school. So in 2010, like many, I jumped back into academia. I took out loans, stayed in New York City, and started a graduate program at Columbia University. This is when my complicated relationship to money truly reared its head.

There was something about money, both the having of it and the lack of it, that I’ve always resented. Growing up, the chip that lived on my shoulder was this: the people who had it didn’t deserve it and the people who didn’t were the ones who would do right by a certain amount of financial privilege. It was very black and white, and it was a generalization that I didn’t apply to everyone, but it gave me an enemy in life — not the people, the money.

From the moment I registered for classes at grad school, every day presented a fork in the road. Do I follow my dreams in this expensive city or do I make more practical decisions (like move home to Atlanta for a while) and, perhaps, never reach my unclear, vague goals? During the recession, and for the 7 years that followed, my answer was unwaveringly, “New York. Dreams. Let’s go.” And in this, what became a very intense sense of determination to not let New York City defeat me.

Me, and me alone.

So when it became time to make financial decisions, I wished them away. Not from a place of privilege, but because I was determined. And because it required a confrontation with money. The uncomfortable truth I was hiding. I never wanted to ask for help, I never wanted to talk about it, and frankly, I didn’t even want to think about it. I just wanted to live.

As the decade marched on and my twenties went from “early” to “middle,” I tried to handle the logistics of paying my student loans and taxes on my own. And in this journey of trying to handle life, solo, even when mistakes — important ones — felt imminent, I always fell back on: “It’ll work itself out.” I never wanted the people who loved me the most to worry. Their fears about my health, my safety, my financial stability would make me feel sad, which was a feeling that I didn’t have time to feel.

By age 24, I’d dropped out of a master’s program to become a professional Internet writer. In one calendar year, I went from sitting in the back of 2nd-year graduate lectures to being recognized in bars for blogs I’d written that week. My dream had actually come true — writing for my friends got me noticed by people who weren’t my friends, people who worked at websites. By Thanksgiving of 2011, I was sitting in my mother’s living room in Atlanta, telling her I wasn’t going back to Columbia, only a handful of credits away from graduating, because I was going to go work for the Internet.

I was a writer. I was getting paid to have fun and be serious and thoughtful, and I was getting paid enough to stay in this city that made me feel invincible. On the outside, to my friends and family and strangers, no one appeared worried. I’d done it. I was a success story.

As my twenties progressed, I picked up some very thrilling, nasty habits. I went from doing drugs in social settings to counting down the minutes until I could secure them, and then do them alone. I was years away from calling myself an addict, but the signs and the behavior were there. And in the moments when I realized my habits were over the edge, I was often alone. Nighttime, weekend, pre-party behavior — all that was once social, was now happening privately, daily, and all day long. And like everything else, I wanted to handle it alone. “I’ll get through it,” I told myself. “It’s a phase,” I’d repeat over and over. It’ll work itself out.

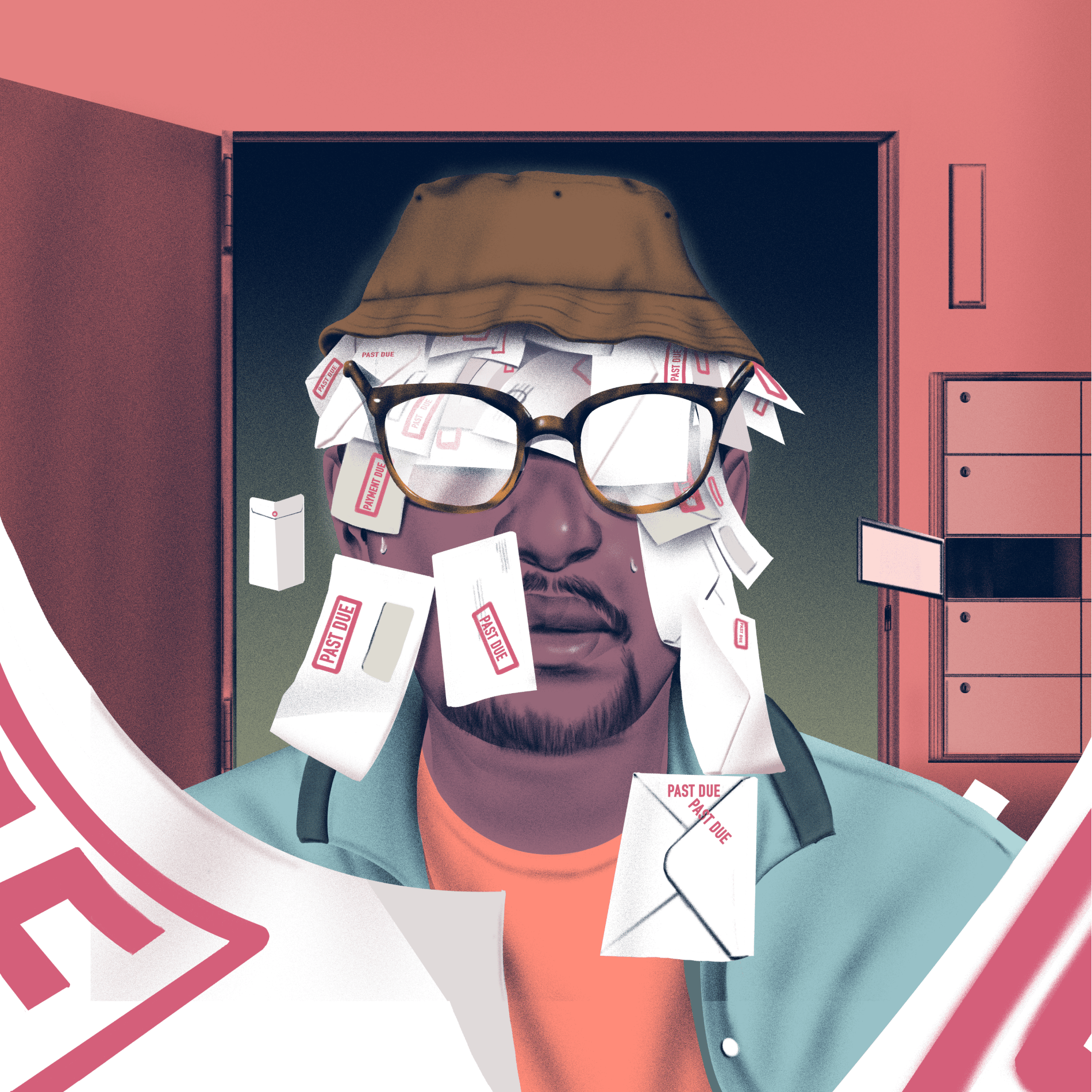

Meanwhile, my mailboxes became a thing of concern — email and, most notably, the one attached to my residence. Messages were coming in, to the person I kind of actually was. Little ransom notes – as if to say, “Hey, read this and deal with it or shit’s gonna get ugly.” The physical letters started coming in white envelopes. The first one I opened, because I used to love getting mail. They were from the IRS. I saw a dollar amount that I owed and a number to call. So I threw the letter away. Ew, deal with that? How about I go hang out downtown instead.

The IRS had officially become a distraction — from goals, from success. And I couldn’t deal with distractions, because I had a life to live that, finally, was going somewhere. It was faux-stability, which was better than no-stability, and if I simply ignored reality — and avoided the uncomfortable sight of debt — it would feel like the bad news wasn’t real.

There were also the calls. There were so many calls. They were about my student loans. Like the letters, I answered one of them. Spoke to one human. She mentioned a six figure number and something about setting up an appointment, which was when I first heard the word “collections.” I never answered those calls again. Every few months, a friend would tell me my voicemail box was full, and I’d go through, listening just long enough to hear that the call was from someone looking for me, and delete them.

It wasn’t only that I couldn’t deal with what were clear money troubles, it was that I couldn’t even bear the sight or sound of them. I knew I was in trouble, but I didn’t know how to get out. So my plan simply became, figure out a way to make more money.

I spent years with my head down, trying to be a great writer, being applauded for things, terrified to look at my checking account balance. The letters in the mail, eventually, went from white to yellow envelopes. I didn’t know if that meant things had gotten more serious or they’d simply gotten a new envelope supplier, but it felt bad. And as soon as I’d get them, I’d put them in a box from The Container Store under my bed.

I literally compartmentalized.

I always had a rough idea about how much money was in my account, but I was rarely willing to look. I couldn’t. I’d rather run the risk of my card getting declined (which it did, in both private and public settings) than simply know the uncomfortable truth of where I stood. This was my ebb and flow, not for weeks or months, but for years.

I never made enough money to make it all go away. I couldn’t imagine anything equaling the stress of my financial denial — being on the run from collectors, student loan officers, the IRS. But then a new challenger entered the ring: the denial of addiction.

In 2017, I went to rehab. Going in, I thought it would be the beginning of the end, but one thing about rehab for me was that it was an admirable beginning of the imperfect, flaw-filled, trek. Understanding, and slowly accepting, that you’re an addict sucks. But what’s wild is that the thing that on so many occasions could have killed me, also helps me confront my greatest enemy: discomfort. And has, slowly, helped me get rid of my oldest mantra: “It’ll work itself out.”

But this isn’t a story about my addiction, something I speak about in the present, not the past. This is about the money part. And the problem was that my answer was never simply, “It’ll work itself out,” but rather, “I hope it figures itself out, one day.” But finally, after three-plus decades of just trying to survive, I’m realizing the only way I’ll actually survive is by asking for help. By sitting with all of the things that make me uncomfortable. By opening my eyes and confronting these breadcrumbs of self-destruction I’ve been leaving myself my whole life.

So I reached under my bed, and started opening those envelopes. And then I got on the phone, with one of the many people hoping to track me down.

“Hi, I’m Rembert. I’m in some trouble and could use some help.”

Originally published April 19, 2021.

Rembert Browne is a writer from Atlanta. He lives in Los Angeles.