Money & the World

The Supreme Retirement Plan: How to Become a Millionaire by Flipping Streetwear

This morning, like every Thursday, entrepreneurs (and hypebeasts) lined up at the Supreme store to await the latest drop. Today we gave them a message about turning their hustle into wealth.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Part One: The View from the Window

Yep. So we put up a billboard across the street from the Supreme store to get people who resell streetwear to start investing their money for retirement. We did it because we thought it'd be interesting: if you polled everyone in a Supreme store about what's on their minds, approximately zero percent would say "retirement," and yet most of them are hustling hard to grow their money into more money. But we also did it because we respect the hustle of resellers—it's entrepreneurial, it's hard work (camping on a sidewalk sucks) and it's profitable. And the point of Wealthsimple is to help people turn the proceeds of their various hustles into real wealth.

Our offices happen to be across the street from Supreme, and as we watched people wait in line for hours every Thursday from our window (that's when “drops” happen—new limited edition gear hits the stores), we started thinking: we salute all the people waiting in line out there on Thursday mornings, but we don't want you to be waiting in line 30 years from now. We think you should be millionaires instead.

Part Two: The Challenge

“Supreme is the only company anywhere, outside of like Tesla or some shit, where the sell-through rate is literally like 99 or 100 percent,” Lawrence Schlossman, brand director at the premier online reseller Grailed, told Wealthsimple. “I can't think of any other brand that's comparable. It’s hard to really put into words how much bigger the demand and want and audience is for Supreme products versus the amount of Supreme that exists in the world. Proportionally speaking, I can't think of another business that has been so successful employing scarcity on purpose.”

Supreme, for people who don't know it, is an erstwhile skater clothing company that's become one of the most interesting brands in the modern era. You're as likely to see it on an actual skater as you are on the coolest dude on your subway headed to some job as a “creative” as you are on Rihanna. And the stuff they make is statistically more likely to skyrocket in value than the merchandise of pretty much any other consumer company in the world.

And we got to thinking: Supreme is a fascinating economy. And because we are first and foremost data and finance nerds (except for Pawel, who besides being a data guy is also a streetwear aficionado), we set a challenge for ourselves. If we used the power of Wealthsimple's passive investing platform, could reselling Supreme make you a millionaire before you're sixty?

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

Yes, it could. Here's how to do it.

Part Three: Learn the Rules of Reselling

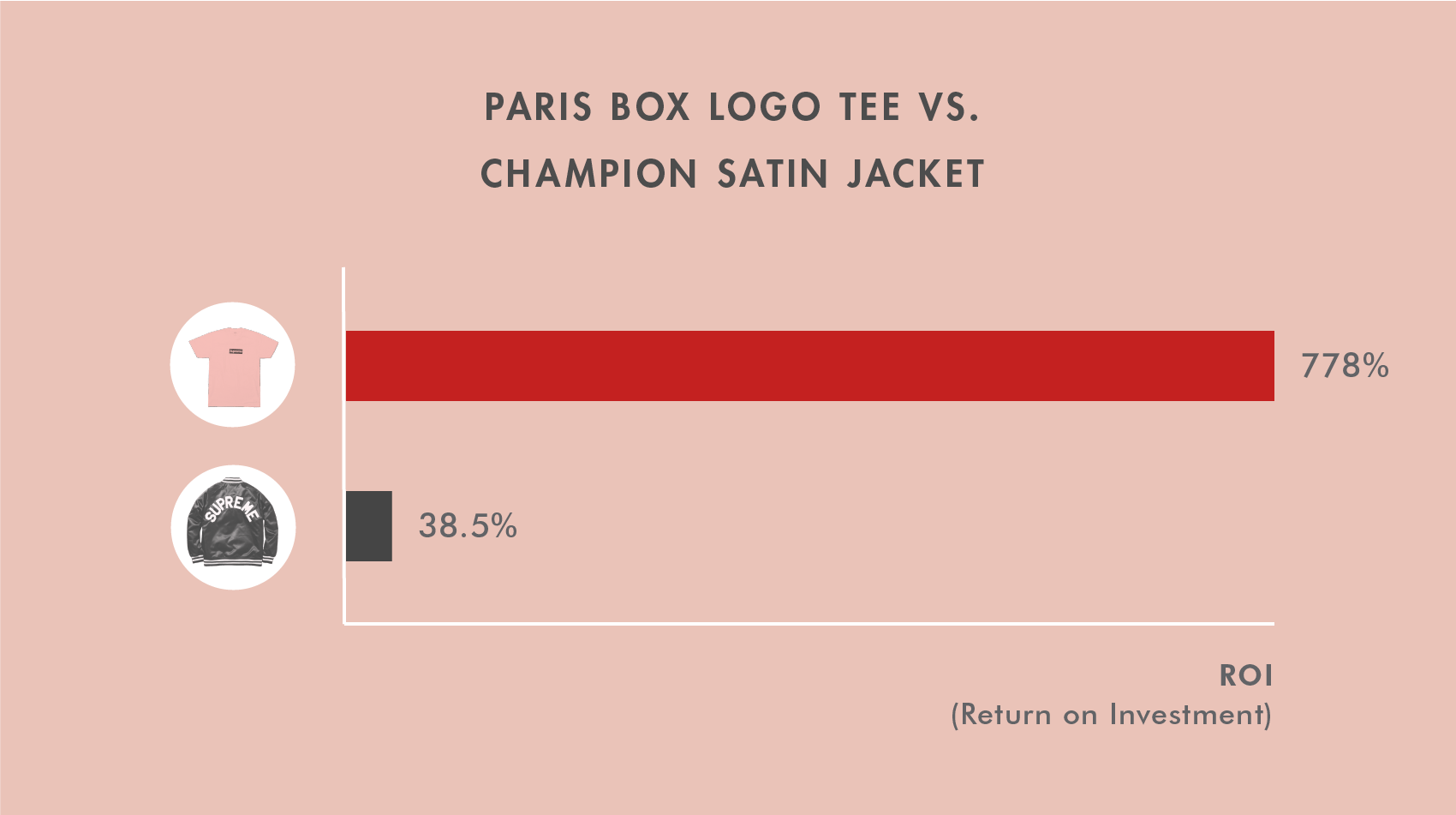

Rule 1: The box logo crushes pretty much everything. Supreme does some novel stuff. But the box logo always seems to appreciate more reliably than whatever else they try. Bonus points for a localized launch, like the above Paris box logo T-shirt, which fetched $430 (already worn once!) in part because you could only get it at the launch of the Paris store.

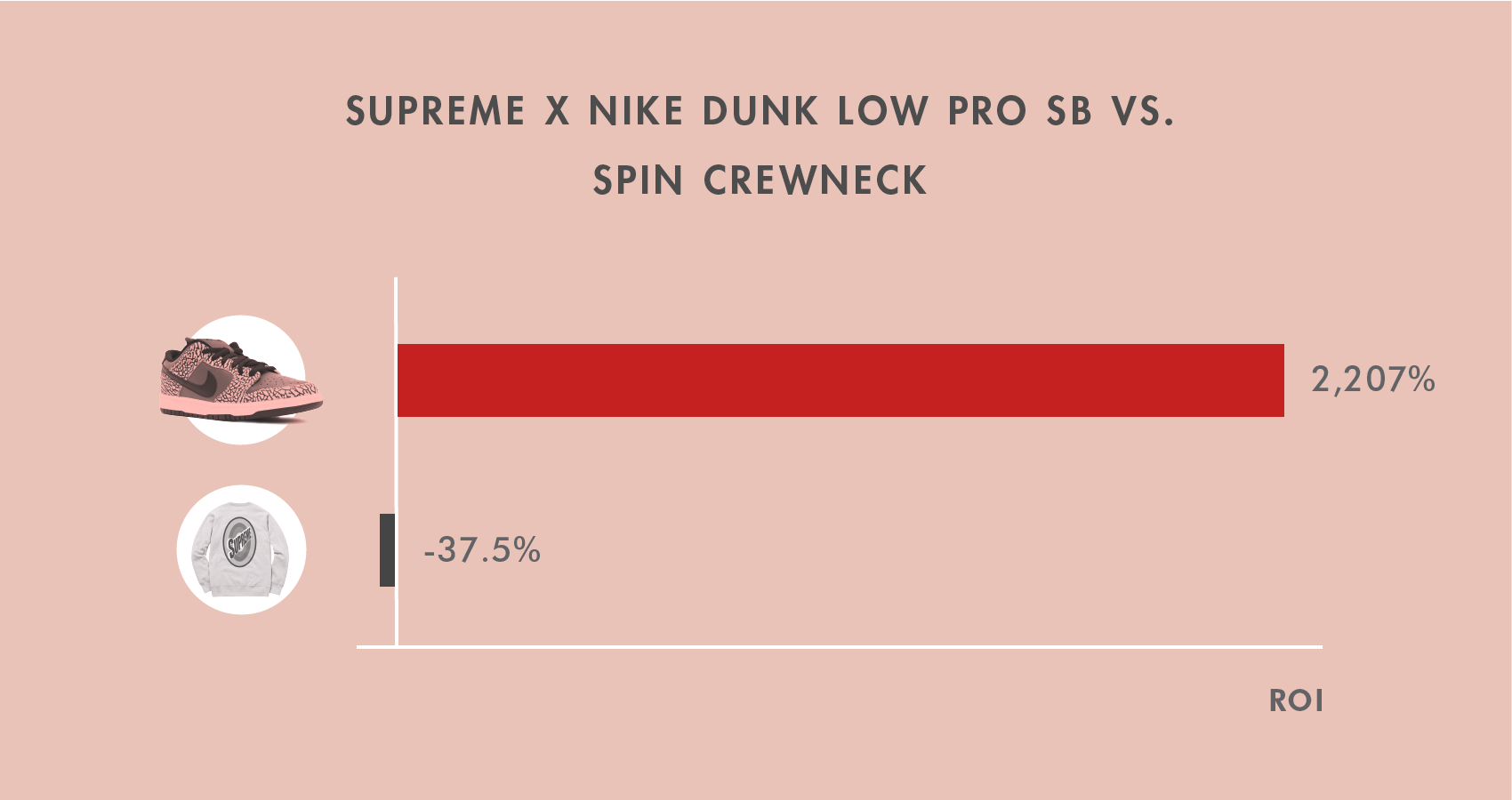

Rule 2: Collaborations are usually in demand. Though you do have to be careful about which brand Supreme is collaborating with—high-end partners like Stone Island and mass companies like Nike (above) have worked well because the brands complement each other. If you can combine two rules (like this Comme des Garçons T-Shirt, which checks both the "box logo" and "collaboration" boxes) it'll be even more likely to be a win.

Rule 3: Clothes outperform objects. Maybe it's because the novelty of objects wears out quickly or because Supreme is, after all, mostly a clothing company, but this seems to be the way things go. Evidence? Check out the airhorn that nets $14—hardly worth sleeping on a sidewalk for.

Rule 4: The surest thing is to sell quickly. Some things just keep going up in value; other things are stocked so deeply they'll never really appreciate. Knowing which one's which is awfully hard. If you have some otherworldly sixth sense about which Supreme items to buy, by all means go nuts. For the rest of us, your best bet is to unload while the pan is still hot, maybe even the same day you buy—wait too long and you risk that people won't even remember they wanted it. (Double benefit: the sooner you invest your money, the more benefit you get from it thanks to compounding.)

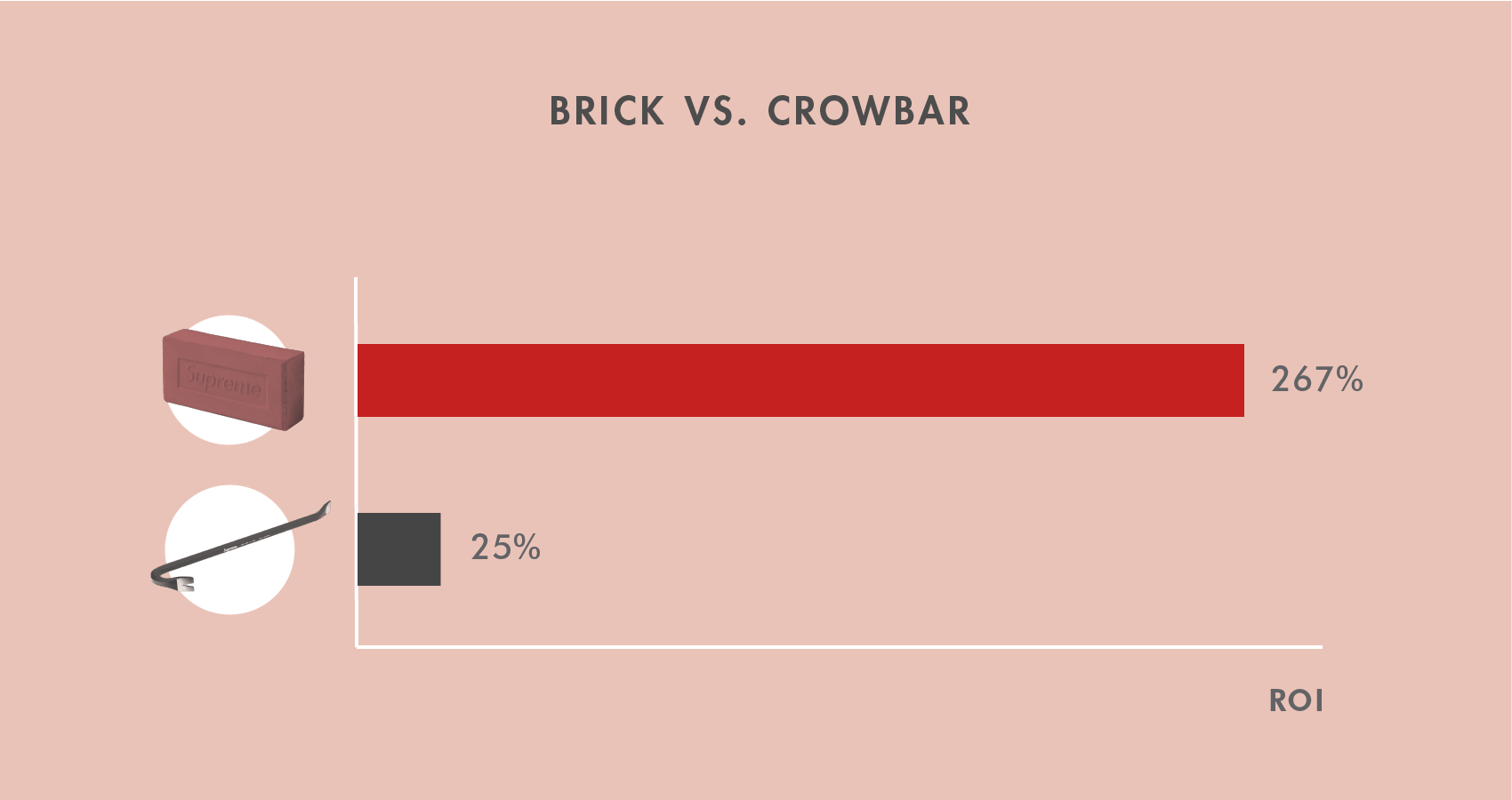

Rule 5: Even if you follow these rules completely, there will be surprises. Why is a motorcycle helmet listed for $2,000 at Stadium Goods, our favorite reselling store? Why did a brick—which seems to break several of the cardinal rules of Supreme investment—become a better investment than a crowbar? Because the world is not fully predictable. A world ruled in part by teens, even less so.

Part Four: Invest Your Resells

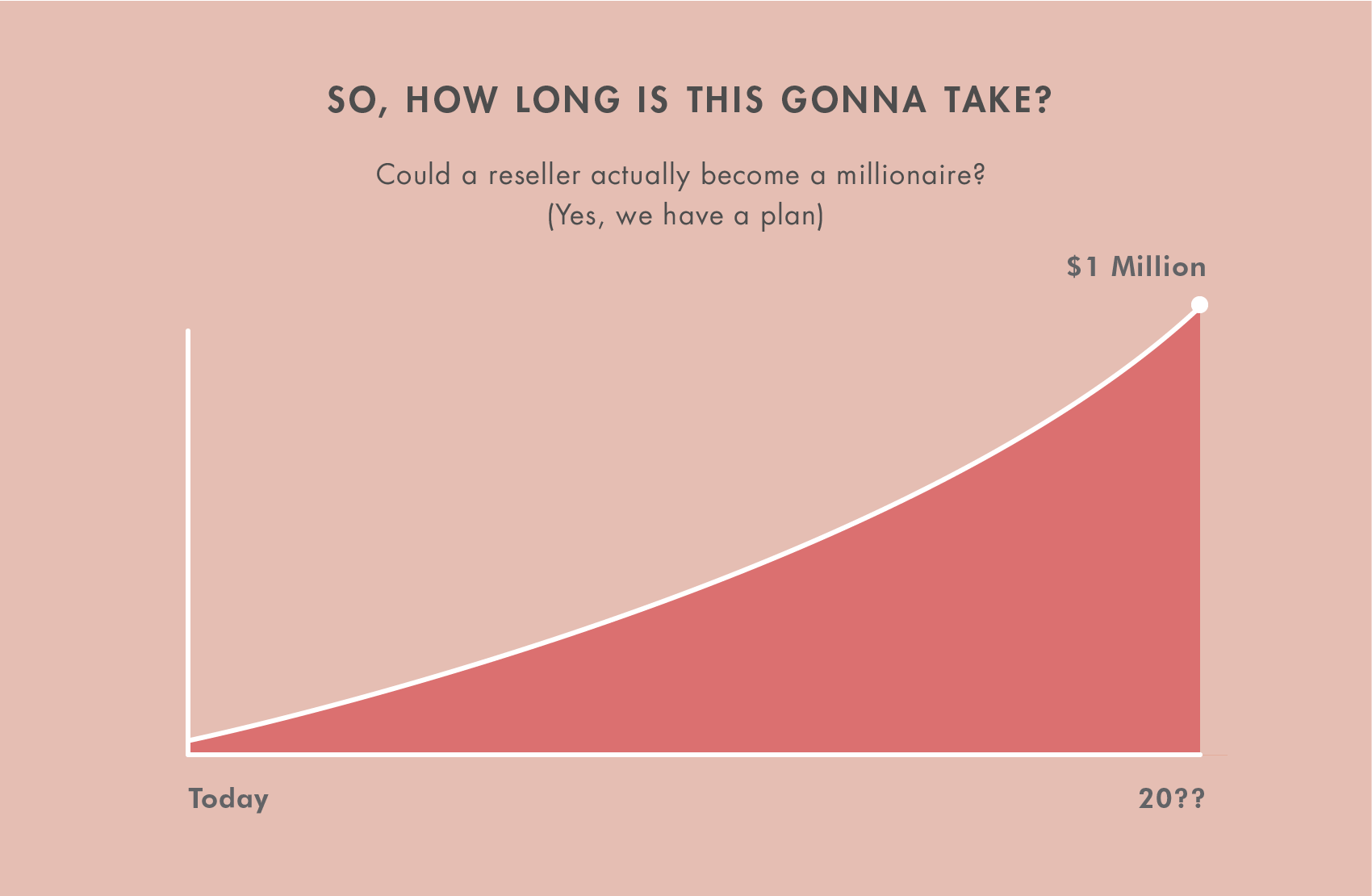

So how much savings are we talking? How can you become a millionaire just by reselling Supreme? Here's our math.

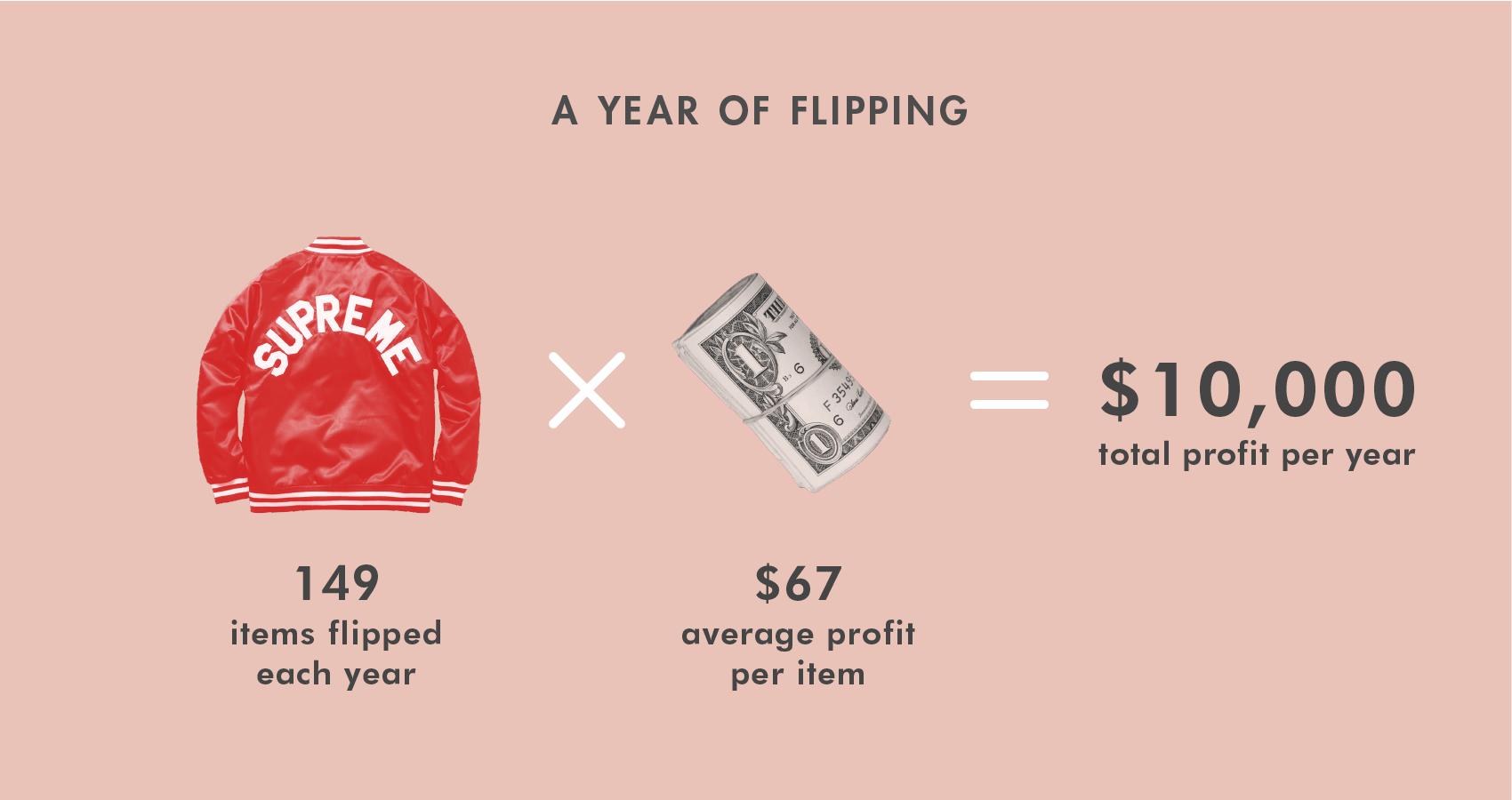

We were conservative. No Jeff Koons skate deck money (a set of three recently sold for more than $15,000)—just the hard work of showing up at the store (or online) and buying stuff at retail. And let’s assume you end up buying a bit more than 25% of them—149 items per year. If you sell everything a year later, your profit will be about $10,000 (we examined 40 representative items from last year—their average profit was about $67 per item). That’s not even assuming a couple items end up becoming really valuable, which is usually the case a couple times a year (last year’s pink denim jacket is a good example of that from 2016—it has sold for $1,000).

Recommended for you

Prediction Markets Are, Suddenly, Everywhere. Wall Street Wants In

Money & the World

Dumb Questions For Smart People: Why Parenting Inequities Make Mothers Leave the Workforce

Money & the World

The Most Compelling, Surprising, and Delightful Ideas of 2025

Money & the World

Canada’s Super-Secret Plan to Soar Past the U.S. Economy

Money & the World

The grand total? $10,000 per year of profit.

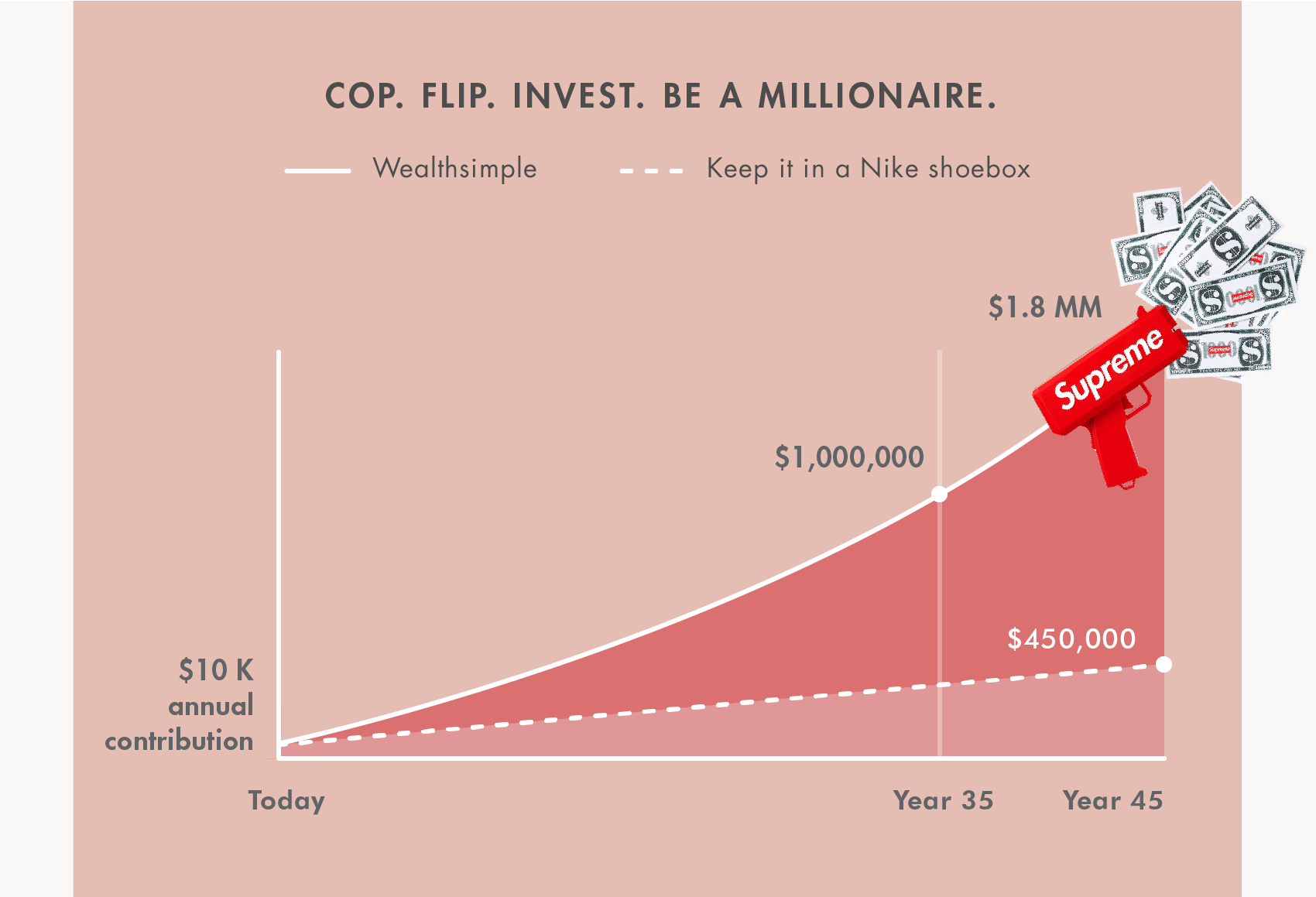

Now how do you turn $10,000 per year into $1,000,000? That's our speciality. We recommend using a combination of extremely low fees, beautifully efficient investment portfolios, and extra-awesome elegant simple software. You know, something like Wealthsimple. It's way better than putting it in a shoebox. Or a savings account.

*All figures in USD. Projections assume markets will go up by an average of 5.5% per year and the portfolio allocation stays the same. Our portfolios have actually achieved much higher returns over the past two years, but as you know, past returns are not indicative of future returns.

*Pricing Sources: Stadium Goods, Grailed, Wired, Supreme Community, Completed Listings on eBay

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.