Money Diaries

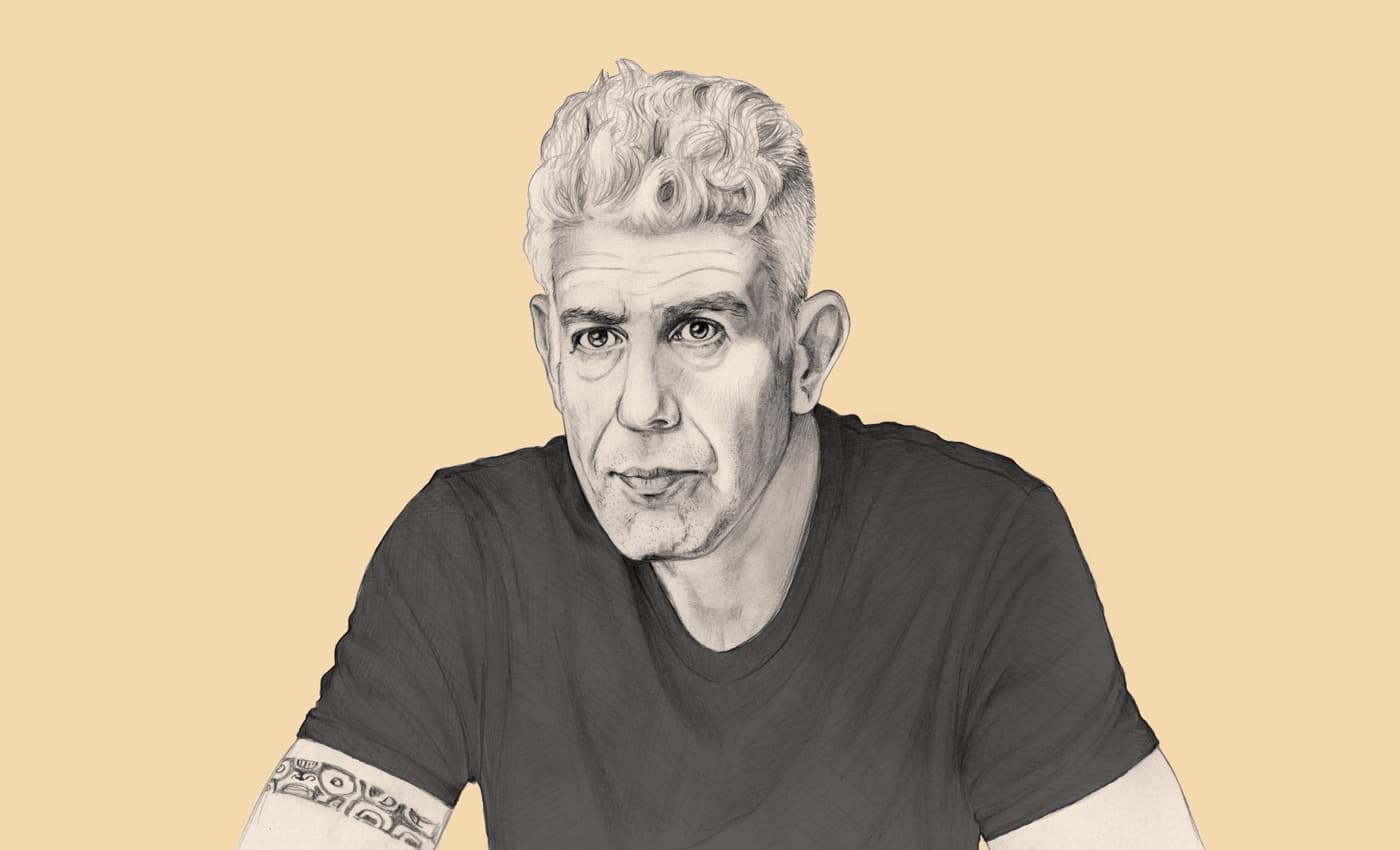

The Financial Realities of Being an Olympic Medalist

Chris Mazdzer, who just won silver in luge at the Pyeongchang Olympics, opens up about life as an elite athlete in a sport that pays more in prestige than dollars.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is an investing service that uses technology to put your money to work like the world’s smartest investors.In “Money Diaries,” we feature interesting people telling their financial life stories in their own words.

Typically the way kids get involved with luge is what we call the “slider search,” where talent scouts go around to major cities and tap little kids who do street luge. But I grew up next to the Olympic Training Center in Lake Placid, New York. And I loved sledding as a kid. So when they started this local program for kids ages eight to thirteen, I jumped on it. When I was twelve years old, I was on the development team. And they saw something in me when I was 13 years old, and sent me off to Europe with a bunch of 18 and 19 year olds, and I was competing in the Junior World Cup.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

It really is an expensive sport. The training, the travel. These sleds, when you factor in research and development, are tens of thousands of dollars. We try to customize the pods as close as possible to our bodies — everything is customizable. The weight of the athlete and the shape of the athlete will dictate how you have to set up a sled. Even luge runs are expensive. It depends on the track, but you’re looking at about $20 a run. Some tracks are $30. And we’ll take four runs, five runs a day. So there are times we’re spending a hundred dollars a day per person just on runs.

The United States Luge Association provides the basic equipment. For me they provided enough financial support that my parents only had to pay $3,000 a year — which is still a lot for some families. I mean, the Junior World Cup Circuit is ten weeks long. We were traveling from November through March. I'd say USLA was able to subsidize, easily, about $20,000 a year, including all coaching, housing, travel, food, all of my runs.

I'd be working banquets as a bartender and people would be having some drinks and they find out I'm an Olympic athlete and the next thing you know, the bride and groom are getting photos with me behind the bar.

The thing is, in this sport you’re not going to make a lot of money. I've always worked side jobs to have money for the basic pleasures of life. I was a fitness and trampoline instructor for a couple of years when I was younger. Then, when I made the 2010 Vancouver Olympics at 21 years old, I was a bartender at the Skwachays Lodge in Vancouver — I did banquets, I did weddings. I'd be working banquets as a bartender and people would be having some drinks and they find out I'm an Olympic athlete and the next thing you know, the bride and groom are getting photos with me behind the bar. I did well for myself, probably because I am personable and I put in really long hours. I wouldn’t work in the winter, obviously. But in the summer I could make a couple thousand dollars per month, which was enough to last me for the year and be able to pay for a vacation. I did that until I was 25.

Recommended for you

Then I medaled in my first World Cup. And once you medal in a World Cup, you do start to receive a little bit of money. I got a stipend of $500 a month. The idea is they don’t want you to work. They want you to be able to focus on your sport. So it wasn’t until I was 26 that I could concentrate on the sport full-time.

But it's still not a lot. During the 2015-2016 season, I was ranked third overall in the world. I medaled in five out of nine World Cup events. I had a dream season, I couldn’t have really done much better. The total prize money was $14,000, and I'm humbled to have that. It was amazing. But the season before the Olympics I made $700 — that's total prize winning the entire season.

Now I’m trying to set myself up for after the sport. I have my Bachelor’s degree, which I did online. DeVry University was a sponsor of the US Olympic Committee, so I got a full education there for free. I’m currently working toward my certificate in financial planning. I haven’t really been working side jobs—I’m just trying to learn as much as possible. I think what this sport has given me is not necessarily a bank account, but it’s given me so much life experience — other cultures, meeting people from around the world. I have a lot of emotional intelligence, and I really want to go into life coaching and life fulfillment planning. We can only do so much with what we have. And it’s really about becoming comfortable with who you are as a person.

This Olympic medal changes everything for me. It’s pretty wild. The United States Olympic Committee puts a lot of stress on Olympic medals because that’s really where they shine and you’re incentivized. Gold pays out $37,000, silver is $22,000, and I think bronze is $15,000. It may not be a lot, but then afterward a lot of our costs are covered — now I am fortunate enough to not have to worry about financials for the next four years.

I’m donating $5,000 from my winnings to this nonprofit that I work with called Classroom Champions. It feels so good to be able to give back like that. It provides me a voice. It provides me with opportunities to make change and be a positive role model to a lot of my peers. That’s the best part about having a silver medal.

As told to Brian Benjamin exclusively for Wealthsimple; transcript edited and condensed for clarity. Illustration by Jenny Mörtsell.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.