Money & the World

The Ten Words That Defined This Topsy-turvy Year in Money

Holy cow! So. Much. Happened. In. 2025. We compiled a list of words and terms to help you catch up on all things money-related you might have missed.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wow. The writers’ room sure crammed as much plot as possible into the past 12 months. To catalogue just how much the world has changed since January, we picked ten words that best sum it all up. Understand them, and you’ll be pretty much caught up on everything money-related that happened in 2025 — and well-prepared for 2026.

Abundance

The title of this poli-sci bestseller from journalists Derek Thompson and Ezra Klein became one of the most inescapable words of 2025 and is now shorthand for an entire philosophy toward modern governance. The book’s central thesis is that the U.S. has become a nation of shortages — in housing, infrastructure, health care, etc. — and liberals need to slash regulations in order to build more stuff and win back the swing and working-class voters they’ve lost. The book has resonated here in Canada and inspired a wave of so-called abundance bros who want to fast-track projects, even at the expense of social-justice and environmental considerations. Which has, of course, won them some criticism.

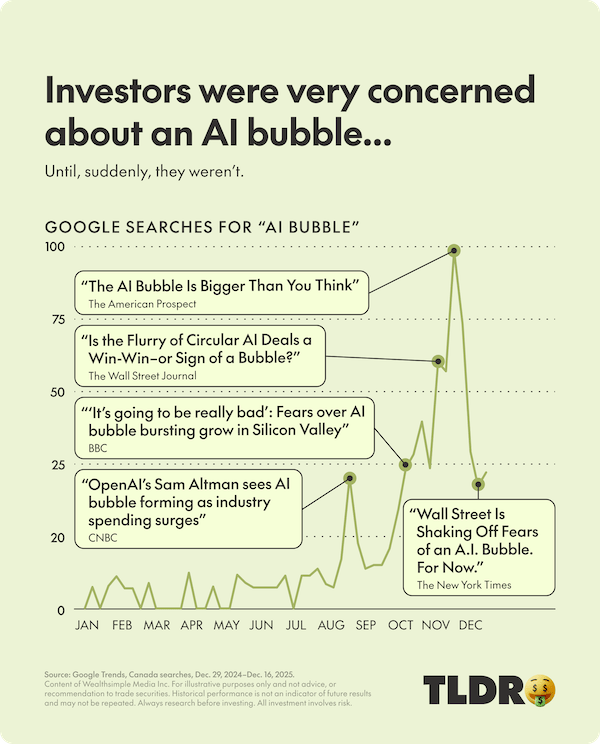

AI bubble

We could spill thousands of words laying out the cases for why AI is definitely a bubble (as Morgan Stanley did) and why it’s definitely not (as JPMorgan did). But both arguments are grappling with the same question: can AI generate enough profits to justify the outrageous fortunes — nearly half a trillion U.S. dollars in 2025 alone — that tech giants are spending to build out their platforms? Fears crested this fall amid weeks of stories about Enron-style circular deals propping up the entire sector and, by extension, much of the global stock market. But investors exhaled in late November when Nvidia’s oversized earnings seemed to settle the debate, or at least punted it into 2026.

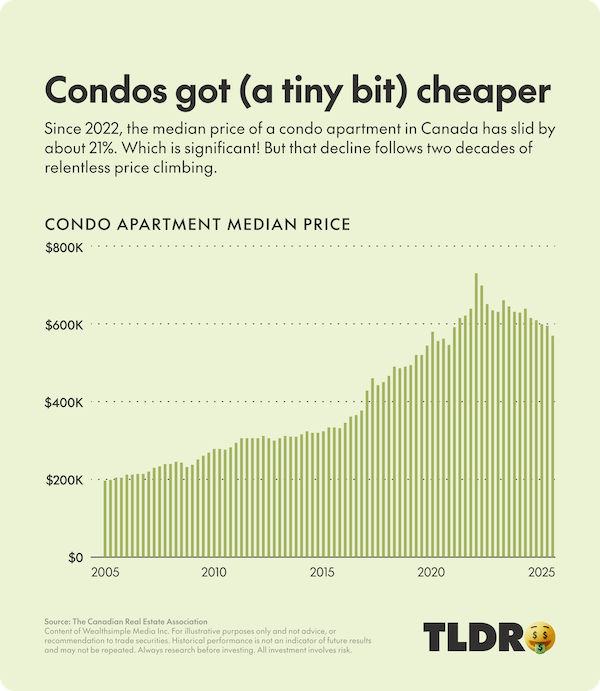

“Condo crash”

Canada’s high-rise condo perma-boom of the 2000s came to a halt in 2022, when interest rates shot up and demand collapsed. Since 2022, in fact, the total number of condo units sold in Toronto (the country’s biggest market) has declined 75%, meaning it’s effectively frozen. Prices across Canada have come down about 21%, prompting some media outlets to dub it a “condo crash,” which is a bit of a stretch. The drop is substantial, sure, but condo prices are still up 77% over the past decade — so units remain out of reach for many buyers.

Elbows up

A nod to Gordie Howe and his unflinching style of play, “elbows up” became a national rallying cry after Trump threatened to turn Canada into the “51st state” and slapped tariffs on Canadian steel, lumber, auto parts, and more. The U.S. Supreme Court is currently weighing whether to toss out Trump’s tariffs; prediction markets don’t like his chances. Win or lose, though, the president’s provocations succeeded in powering a wave of “buy Canadian” campaigns and a mass travel boycott of the States, as well as led to retaliatory tariffs on all sorts of U.S. imports (most of which have since been rolled back). We even sold more oil to non-U.S. countries than ever before, making America now slightly less far and away our biggest customer.

Enshittification

In his latest book, Canadian thinker/science-fiction author Cory Doctorow outlines his grand unifying theory of why tech platforms inevitably and inexorably turn, uh, sh*tty. The cycle goes like this: platforms lure in users with generous features, then gradually degrade them with monetization strategies (e.g., advertising), until the service stops providing any real value for users and exists only to rake in money. Doctorow coined the term in 2023, but his new book helped it go mainstream, and accusations of enshittification have been flying all year. NFL Redzone: enshittified. Instagram: enshittified. Xbox Game Pass: enshittified. (TLDR: never better, baby!)

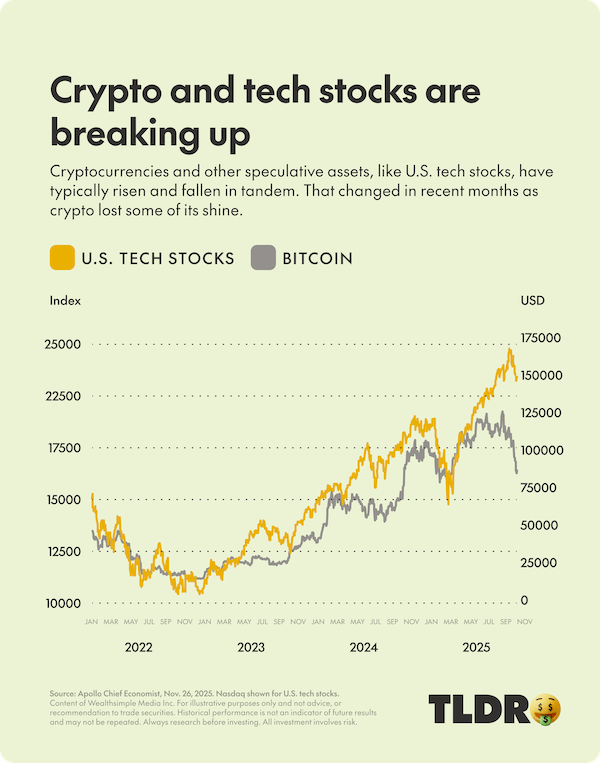

Great Divergence

For much of Bitcoin’s brief history, it has generally traded in lockstep with other speculative investments, particularly U.S. tech stocks. At least that was true until this October, when it pulled a Robert Frost and took a different path: U.S. tech stocks are now up more than 20% on the year, while Bitcoin is down 5.6%. Wasn’t 2025 supposed to be the year crypto went legit? Didn’t noted curmudgeon Jamie Dimon, of JPMorgan Chase, finally come around on Bitcoin? Yes. But with the economy on both sides of the border looking a little shaky, some crypto whales have apparently decided the time is ripe to cash out.

Prediction markets

Prediction markets — platforms that let you place bets on real-world news outcomes — exploded in 2025, minting the world’s youngest female billionaire and emerging as an existential threat to reigning juggernauts of online gambling. Now everyone’s racing to ante up. CNN and CNBC inked partnerships with Kalshi. The New York Stock Exchange’s parent company invested in Polymarket. The NHL struck a deal with Kalshi and Polymarket! (Prediction markets aren’t currently available in Canada, FWIW.) No matter your thoughts on these platforms — and, boy, people have lots of thoughts — what’s beyond dispute is the swift progress already on Kalshi’s stated goal to “financialize everything.” Consider these actual wagers:

TACO

As in: “Trump Always Chickens Out,” coined by Financial Times columnist Robert Armstrong to describe the president’s habit of threatening steep tariffs and then walking them back, creating reliably profitable dip-buying opportunities for seasoned BS-spotters. Here’s the moment when Trump learned about “TACO time” — he does not seem amused. 👀

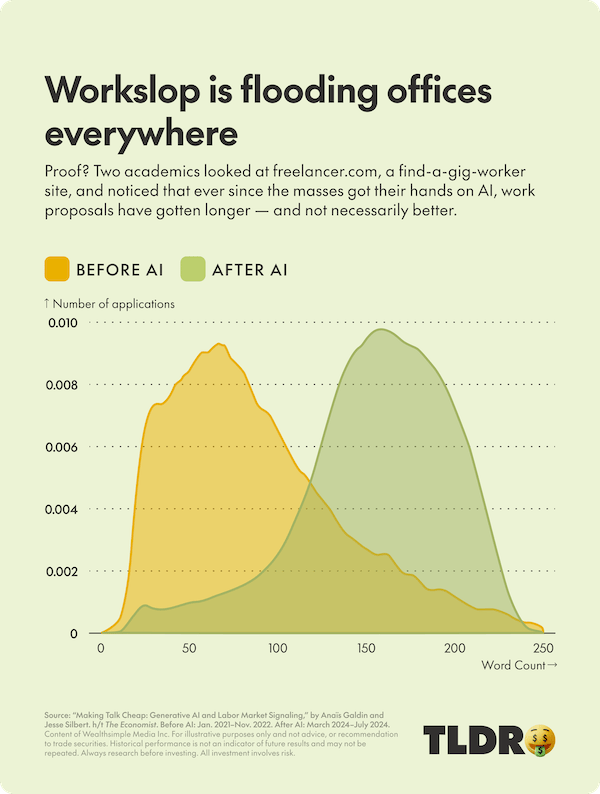

Workslop

Generative AI is supposed to make us all magically more productive. And it has reduced some workplace drudgery — one study found that Microsoft’s Copilot AI helped workers cut time spent writing emails by 1.4 hours a week, a 12% decline — but the trade-off for these modest efficiencies has been a deluge of workslop, i.e., low-quality, needlessly long AI-generated emails and memos with writing that can be generously described as, well, sloppy. Which is why in 2025, the drudgery of writing emails was replaced by the drudgery of parsing baggy, AI-written notes from colleagues.

Vladdy

Has any CA$700-million high-risk investment ever paid off so quickly? Kudos to the Rogers family for behaving like the stupendously wealthy, sports-franchise-gobbling juggernaut they are, and after coming up one inch short of a World Series title, double kudos for doubling down so far this offseason. The Blue Jays spent close to $300 million on a hard-throwing free agent pitcher, and they may yet bring back the original wearer of the Baby Vladdy Born Ready T-shirt, All Star Bo Bichette. That’ll cost another $300 million, but now we know they can afford it.

—By Brennan Doherty, Devin Gordon, Claire Porter Robbins, and Jared Sullivan. Illustrations by Antonio Giovanni Pinna

Claire Porter Robbins is a freelance journalist. She founded Btchcoin News, a financial and economics newsletter, and has written for a variety of publications including The Atlantic, the New Yorker, and The Globe and Mail.

Brennan Doherty is an education writer and researcher for Wealthsimple. His work has appeared in the Toronto Star, The Globe and Mail, TVO Today, MoneySense, BBC Business, and other publications.