Finance for Humans

Five Gloriously Silly Things To Do With Your Tax Refund

Getting a giant refund? Don’t want to be smart and invest it but short on ideas for what to do with it? We’re here to help.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

According to the latest statistics from the CRA on April 11, 60% percent of filers are eligible for refunds, and the average refund is $1,960. (To find out if you’re one of them — and how much you might get — check our tax calculator.) If you file your return online by the May 2 deadline, the CRA says your money should arrive about two weeks later. That’s not a whole lot of time to figure out how to blow it.

Recommended for you

Five Tax Enigmas That Confuse Basically Everyone

Finance for Humans

Nervous About Overheated Stocks? Let’s Revisit Four of Our Best-Ever Insights

Finance for Humans

You May (Still) Have to Pay Taxes on COVID-19 Benefits

Finance for Humans

The Perfect Guide to Every Little Tax Question You Have

Finance for Humans

You’re smart with money — you’re reading Wealthsimple Magazine, after all — so you know not to do anything silly like put your refund in a chequing account, where it won’t earn significant income, or pay down a low-interest mortgage, since other investments would presumably earn higher returns. And you probably know the smartest thing would be to put your money into an RRSP or other tax advantaged account — or, better yet, pay down your high interest debt. But what if this year you want to try something different? What if you’ve been so smart with your money for so long that you feel you’ve earned the right to be silly with it? Well, we can help you with that, too. To that end, we’ve compiled a list of the very silliest things you can do with your tax refund.

File for $0

WEALTHSIMPLE TAX

File for $0

Enjoy doing your taxes. Seriously. Your maximum refund is guaranteed.

Instead of: paying off any overdue utility bills or car payments

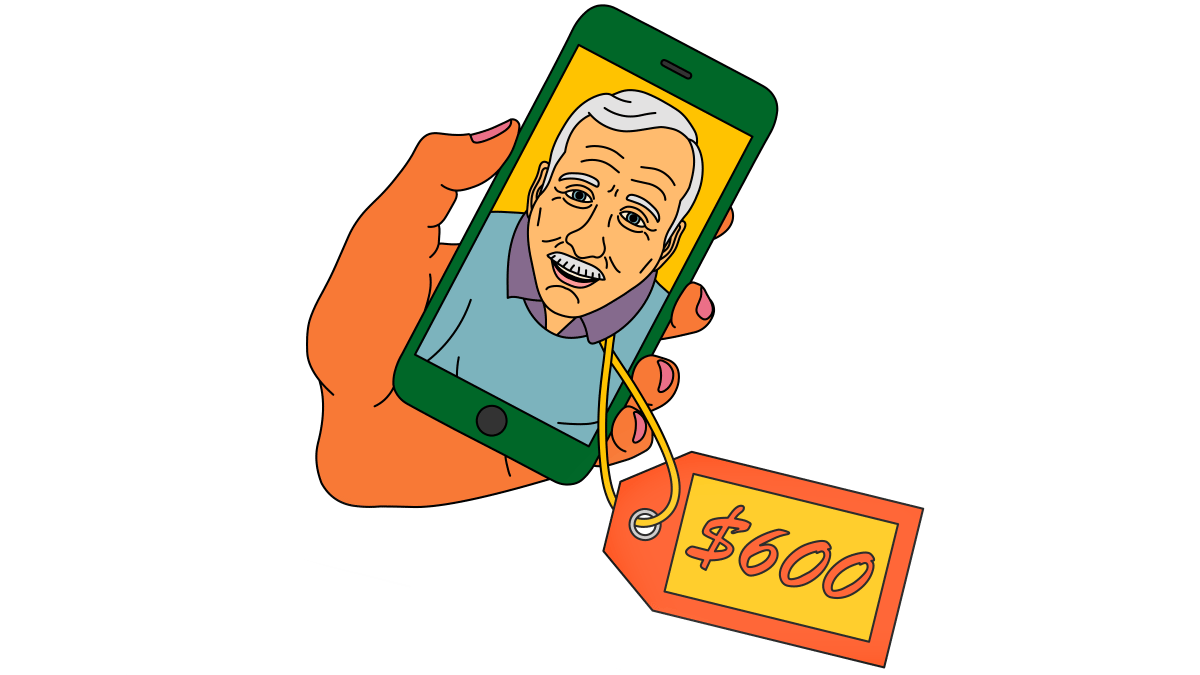

Try: giving your money to a rich celebrity Is having your car repossessed really that big of a deal when there’s so much good TV to watch? If you want to be truly silly, this year give your money to someone who doesn’t need it. Maybe an aging actor like Richard Dreyfuss, who earned tons of money doing stuff like killing Jaws in the 70s but hasn’t had a lot of work lately. Via the celebrity service site Cameo, he will take $600 to wish you a happy birthday. Unlike the few celebrities who donate their Cameo proceeds to charity, Mr. Dreyfuss will be taking your money for himself, and he isn’t saying what he plans to do with it.

Instead of: paying off credit card debt, starting with the card with the highest interest rate

Try: buying something useless The Building Bricks Waffle Maker people saw a need — the need to pretend to build things out of waffles — and decided to fill it. Just be sure to build the walls of your new waffle castle thick enough that any creditors won’t be able to find you.

Instead of: investing in index funds

Try: leasing a gas-guzzler

Leasing a half-million-dollar 2022 Rolls-Royce Phantom that gets 5.9 combined kilometres per litre during the worst gas crisis in 50 years does seem reckless, but if you put your whole tax refund into the down payment, it could reduce your monthly payment by… hardly anything.

Instead of: topping up your RRSP, thus saving for your future and reducing your 2022 taxable income

Try: buying conversation pieces Skip the cat bathrobe ($70) and diamond-encrusted contacts ($15,000) and invest in something like Canadian Diamond Boyz Virgin Set Grillz ($1,295.71 per tooth), which won’t scratch your eyes out like the contacts when you wear them, or your cat when you bathe him.

Instead of: putting any extra money in your TFSA

Try: naming an actual star You can name a star after someone for only $34.90 and get a certificate of authenticity. This one is doubly silly, actually, since you could say you named a star after someone and print your own certificate for free. They’ll never know, and the star won’t tell.

Stacey Woods is a regular contributor to Esquire, a former correspondent for The Daily Show with Jon Stewart, writes and consults on various TV shows, and has a recurring role as Tricia Thoon on Fox’s Arrested Development. Her first book, I, California, was published by Scribner. She lives in Joshua Tree, California with her music producer husband and their Italian Greyhound mix.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.