Finance for Humans

Seven Ways to Get Ready (Financially) for Your First Kid

There are a few simple ways to make sure you have your ducks in a row when you become a parent. Do them as soon as you can! You’re a responsible adult now, after all. Here’s how.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

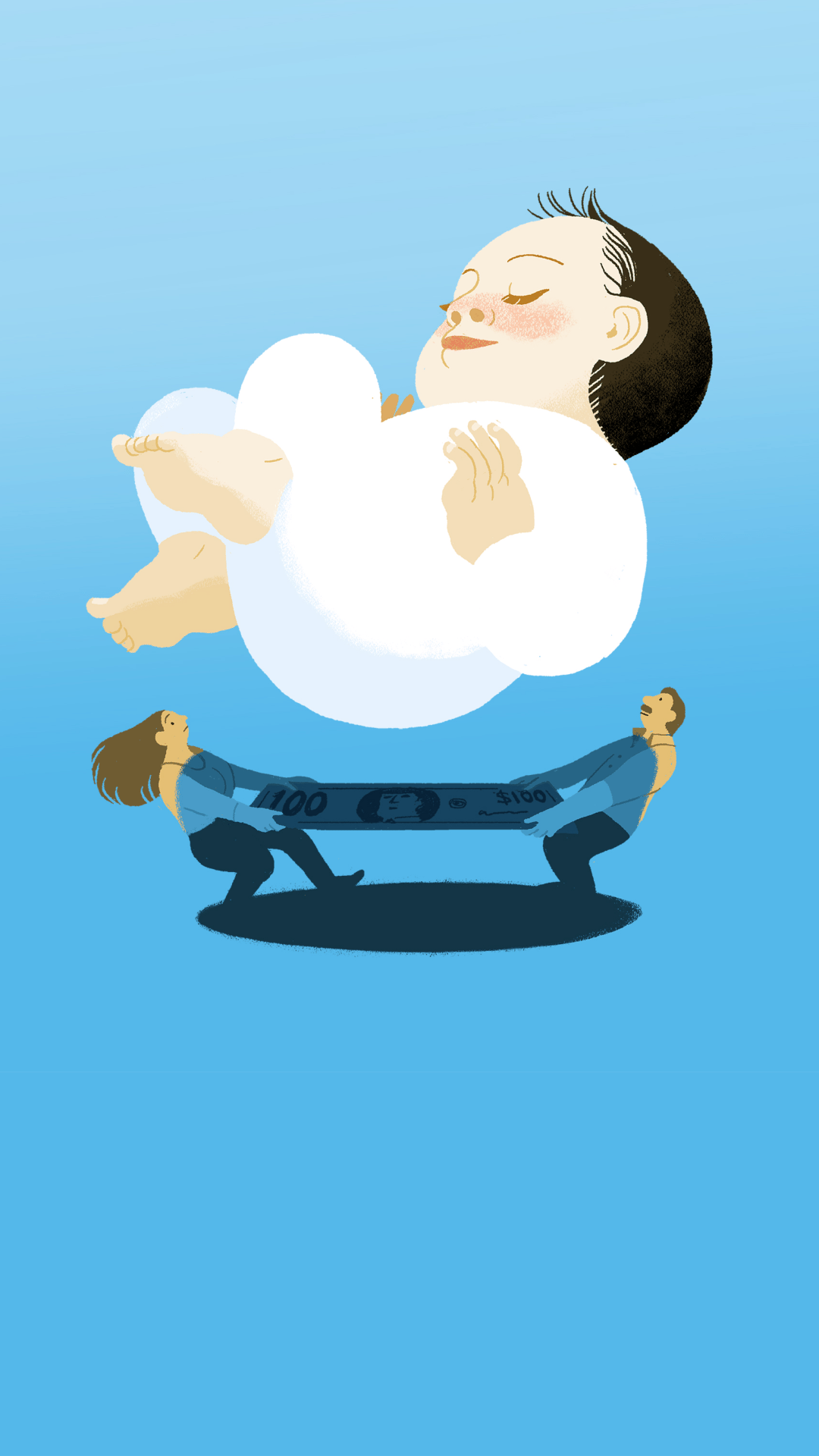

Childbirth and financial planning: two facts of life that have the potential to be so pain-inducing that most people choose to ignore the details until the last possible moment. While we can’t tell you how much to prepare for the physical arrival of a new family member, we do trade in wisdom regarding your bank account, and it just so happens that there are some specific things you’ll need to do to get the latter ready for the former. Here are seven important money things you absolutely have to do (if at all possible) before (or just after) you have a kid. You’re on your own with the delivery.

1. Start Saving

You may have the urge to deal with your excitement/joy/fear/anxiety/insert favourite emotion by buying a bunch of new baby things. Resist that urge. Or at the very least hold off until you’ve opened either a Registered Retirement Savings Plan (RRSP) or a Tax Free Savings Account (TFSA). Because here’s the thing: saving becomes exponentially more important once you have kids. One reason is simple math. There are literally going to be more people to take care of, and these new people are going to be revenue negative for the foreseeable future. The second reason is that having kids makes living paycheque to paycheque way more perilous and ill-advised. So unless you enjoy playing financial Tetris with your bank account every week, do future you a favour.

First thing to do is figure out which account is right for you. An RRSP is meant to help you save for retirement, so the government will allow you to make contributions tax-free (meaning you don’t have to pay income tax on the money you put in there); but you will be taxed when you make withdrawals. TFSAs work the other way — your contributions are after-tax, but you don’t pay any taxes when you withdraw. There’s a lot of fine print, so it’s best to do your homework.

But keep this in mind: because you can take money out of your TFSA whenever you want to, it’s a much better place to save for relatively short-term needs, like childcare. We’ll get to that soon while we have you in a saving state of mind…

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

2. Make a Will

The ironic part about bringing a life into the world is it suddenly means you have to think about your own exit from it. It’s not fun, it’s not sexy, and it can be a little scary, but having life insurance, and a will, is no longer just about you. It’s an act of thoughtfulness for your kids.

A will, for the uninitiated, is a legal document that outlines your wishes in the event of your passing, and for parents, it covers two key things: how your assets will be distributed, and who will take care of your minor children if you’re no longer around. If you die without a will that details these things, you’re what’s legally referred to as “intestate,” which means the courts get to decide what becomes of both your possessions and your offspring — which isn’t ideal. So don’t wait, call a lawyer, make an appointment, and think about the hard stuff.

Or do it online. If, like most people, you have a simple estate — e.g.: property owned in one country, some assets, maybe a kid or two — you can create your own with an online legal will platform, like Willful, with whom we partner from time to time. Wills don’t require a lawyer; they just need to be drafted by you (sorry, you can’t pass this on to your parents) and signed and witnessed correctly. Willful has simple tools designed by estate lawyers to help you. (It’s like Wealthsimple Tax for estate planning.) Bonus: it’s faster and less expensive than visiting a lawyer, and you don’t have to get out of your pyjamas.

That said, it’s always best to do a little research. If you think you have a complex estate, or want legal advice, an estate lawyer may be the way to go.

3. And Don’t Forget Life Insurance!

Once you have children — or anyone else who depends on you financially — life insurance is a very good idea. Especially if you have mortgages, loans, and other things your dependents and surviving family members will be liable for paying if they want to maintain their same living standards.

Life insurance comes in many flavours. But for most people, the best option is something called term life insurance. That type of policy means you pay a premium every year for a certain number of years, typically 10, 20, or 30 years. It’s The premium is the same amount every year, and if you die during that period of time, the insurer pays a predetermined amount of money to the beneficiary (i.e., the person you told them to pay when you got the policy). If you don’t die, which is also nice, the insurance company keeps the money and you never see it again. It’s as simple as that.

You’ll also want to figure out how big a policy to get. A good rule of thumb is that your policy should pay out between five and 10 years of your income in the event of a piano falling on you. But it may be a good idea to get a policy worth more than that — consider all the expenses your family will have to cover, like mortgage payments and college tuition, and see how close you can come to that.

4. Open an RESP and Collect Free Money to Put Towards Your Child’s Education

Your hard-earned money will start to disappear in new and unusual ways with the arrival of your baby. But there are ways in which your bundle of joy can actually bring in some cash. (No, we’re not talking about a career in infant modeling.) A Registered Education Savings Plan (RESP) is a government-sponsored saving and investment account designed to help parents save for their child’s post-secondary education. Parents can make contributions and build tax-free earnings, but what’s even better is that the federal government will also contribute money to your RESP in the form of a grant or bond.

With a Canada Education Savings Grant (CESG), the government will match 20% of your contributions — up to $500 for each child per year, and up to a lifetime maximum of $7,200. Here’s some quick math: you’ll need to contribute $2,500 a year of your own money to get the full grant of $500 a year from the government. Depending on your income, you may qualify for additional contributions, like the Canada Learning Bond (CLB). The CLB provides an additional $2,000 per child to help low-income families save in an RESP.

5. Apply for Child and Family Benefits

The Canada Child Benefit (CCB) is a tax-free monthly payment made to eligible families to help with the cost of raising children under 18 years of age. The Canada Revenue Agency (CRA) uses information from your income tax and benefit return to calculate if you qualify and how much your CCB payments will be. All you need to do is register your baby’s birth, and allow the province to share the information with the CRA. Also, as a new parent, you can get tax credits and deductions for expenses related to having or adopting a child. Here’s a list of all the ones available. But, in short, be sure to hang on to your receipts from medical procedures, adoption expenses, fertility treatments or pre-natal care, and childcare costs, because you can probably write off most of that.

6. Make a Plan for Childcare. Now. Really.

One of the most critical financial decisions you must make after you have a child is: will both parents go back to work, and if so, who’s going to watch the kid during normal business hours? While you may enjoy watching your child’s every waking (and possibly non-waking) moment, it’s highly unlikely you’ll be able to find someone who enjoys it enough to do it for free. Not only is child care not cheap, it can also be hard to come by. Start researching options well in advance of your work return date, and make a budget for it so the expense doesn’t cripple you. Knowing how much childcare you’ll need, and when, and what it’ll cost, can be affected by parental leave. Which brings us to our next point.

7. Make a Plan for Parental Leave

First, take a moment to celebrate that you live in Canada. Seriously, sing a few verses of “O Canada” and be grateful you don’t live down south where family leave is meagre and often unpaid. Depending on how long you’ve had your job, new moms can take 40 weeks of leave with benefits (and, as mentioned, up to 69 weeks with extended leave). And the law stipulates that you can’t lose your job because you had a kid or went on leave.

But figuring out how to navigate the financial and governmental and employer-related rules of leave can be complicated business. Just knowing what the government does and doesn’t provide can sometimes feel like it requires a master’s degree in public health. For instance, there are two kinds of leave — maternity and parental. Maternity leave is only for women who give birth, and entitles them to 15 weeks off with pay and benefits — unless you live in Quebec, where the government requires employers give mothers 18 weeks. Parental leave, meanwhile, is for either parent and is longer, at 40 weeks for standard parental leave and 69 for extended — and the time can be split between parents. For both kinds of leave, government Employment Insurance plans pay a percentage of insurable salary, but only up to $562 a week. Anything more than that (called “top-ups”) has to come from the employer. Have questions? Of course you do. It’s smart to educate yourself, so start by reading this.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.