Finance for Humans

How to Make Your Money Make Money

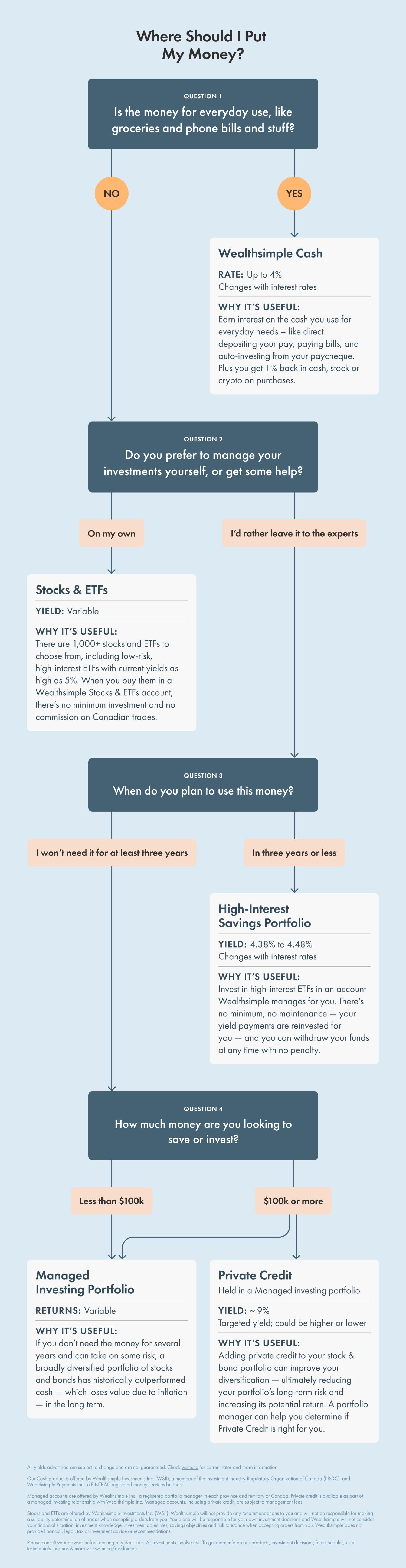

One problem with having so many great places to earn a return on your money? It can be hard to keep them straight — and even harder to choose the right one.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

If there’s any benefit to all the interest rate hiking Tiff Macklem and the Bank of Canada have done lately — other than, you know, stopping rampant inflation — it’s that you can finally earn some real money on your money. You’re no longer stuck accepting the tiniest fraction of a percentage of interest a bank might give you on your savings account. And high-interest ETFs are almost cool enough to talk about at dinner parties. (Still better not to risk it.)

Whatever your financial goals, there are more great places to park your money than ever before. And, not to brag, but Wealthsimple has the best of them:

Wealthsimple Cash: Think of it like a debit card that pays you back. To earn 3% interest on the balance in your account, all you have to do is auto deposit your paycheque. If you have more than $100,000 across all of your Wealthsimple accounts, we’ll bump it up to 4%. In case that’s not enough, we’ll also give you 1% back on all purchases in the form of stock, crypto, or cash.

High-Interest Savings Portfolio: These accounts currently earn you 4.38-4.48% by investing in low-risk, high-interest ETFs. They’re a great way to earn money on your emergency fund or any other balances you’ve got plans for in the short term. (Think saving for a wedding, a down payment on a house, or new calf implants.) The best part? There’s no minimum deposit required and you can withdraw your money at any time without a penalty.

Private Credit: Never heard of this one? That’s likely because it was primarily reserved for huge institutional investors. A high-yield diversifier for a portfolio of stocks and bonds, Private Credit lets investors lend money directly to customers — kind of like a bank — and collect interest on those loans. Our fund currently targets a 9% yield and is available exclusively to managed investing clients with $100,000 or more in deposits across their accounts.

Choosing the right option (or more likely, the right two or three) depends on a few things: what you’re saving for, when you plan to use your money, and how much money we’re talking about. If that sounds intimidating, don’t worry: we made a flow chart!*

*As handy as flow charts can be, there are a lot more considerations than we can fit here. Just like you would before writing a will or growing a moustache, we recommend speaking with an expert before making any big decisions.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.

All yields advertised are subject to change and are not guaranteed. Check wsim.co for current rates and more information.

Our Cash product is offered by Wealthsimple Investments Inc. (WSII), a member of the Investment Industry Regulatory Organization of Canada (IIROC), and Wealthsimple Payments Inc., a FINTRAC registered money services business.

Managed accounts are offered by Wealthsimple Inc., a registered portfolio manager in each province and territory of Canada. Private credit is available as part of a managed investing relationship with Wealthsimple Inc. Managed accounts, including private credit, are subject to management fees.

Stocks and ETFs are offered by Wealthsimple Investments Inc. (WSII). Wealthsimple will not provide any recommendations to you and will not be responsible for making a suitability determination of trades when accepting orders from you. You alone will be responsible for your own investment decisions and Wealthsimple will not consider your financial situation, investment knowledge, investment objectives, savings objectives and risk tolerance when accepting orders from you. Wealthsimple does not provide financial, legal, tax or investment advice or recommendations.

Please consult your advisor before making any decisions. All investments involve risk. To get more info on our products, investment decisions, fee schedules, user testimonials, promos & more visit wsim.co/disclaimers.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.