Finance for Humans

How to 10x Your Tax Refund (Without Breaking the Law)

If you’re among the millions of Canadians getting a tax refund this year, you have a choice to make. You can spend that money, which would be fun. Or you can turn it into more money, which would be smart.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

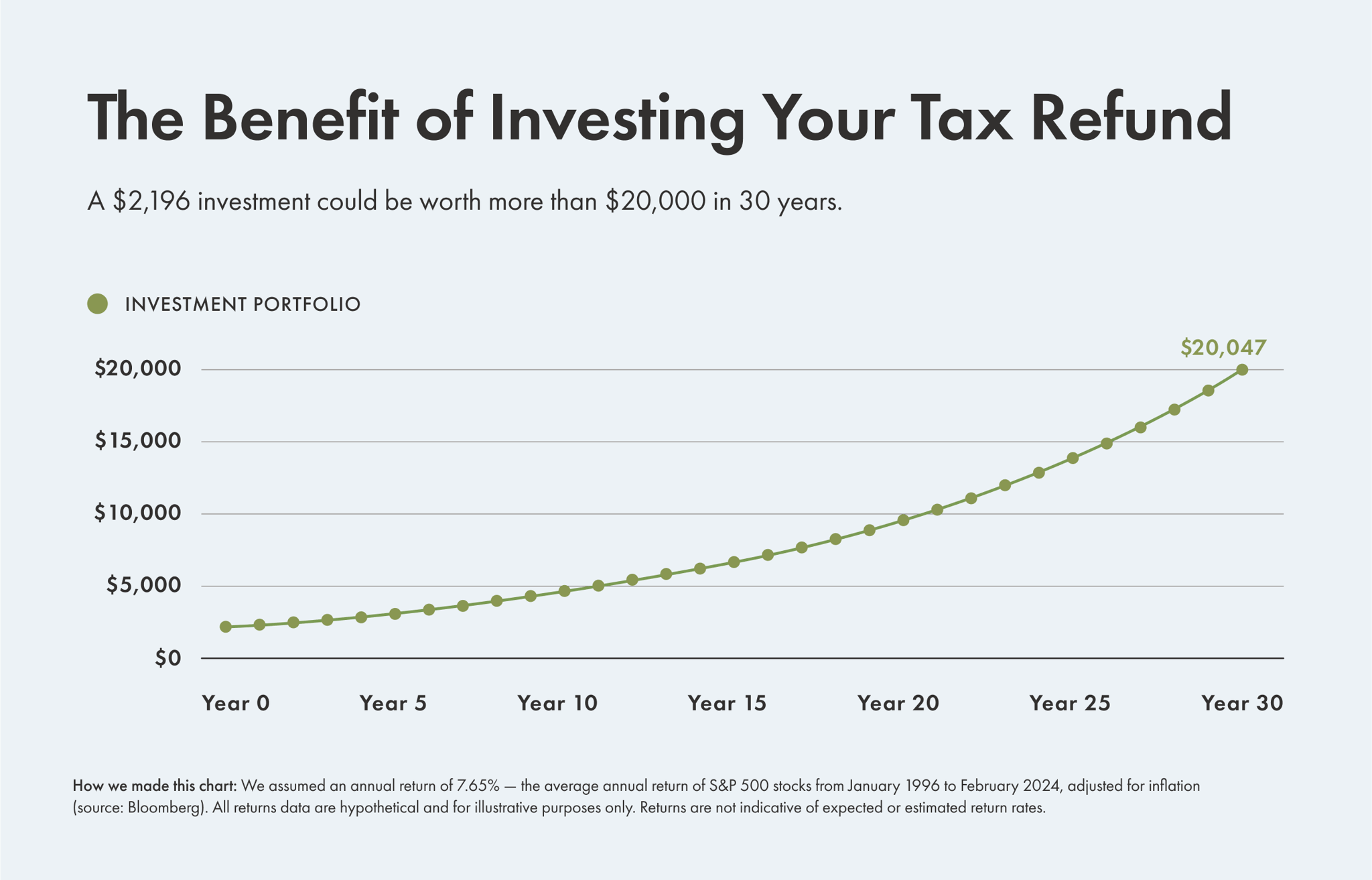

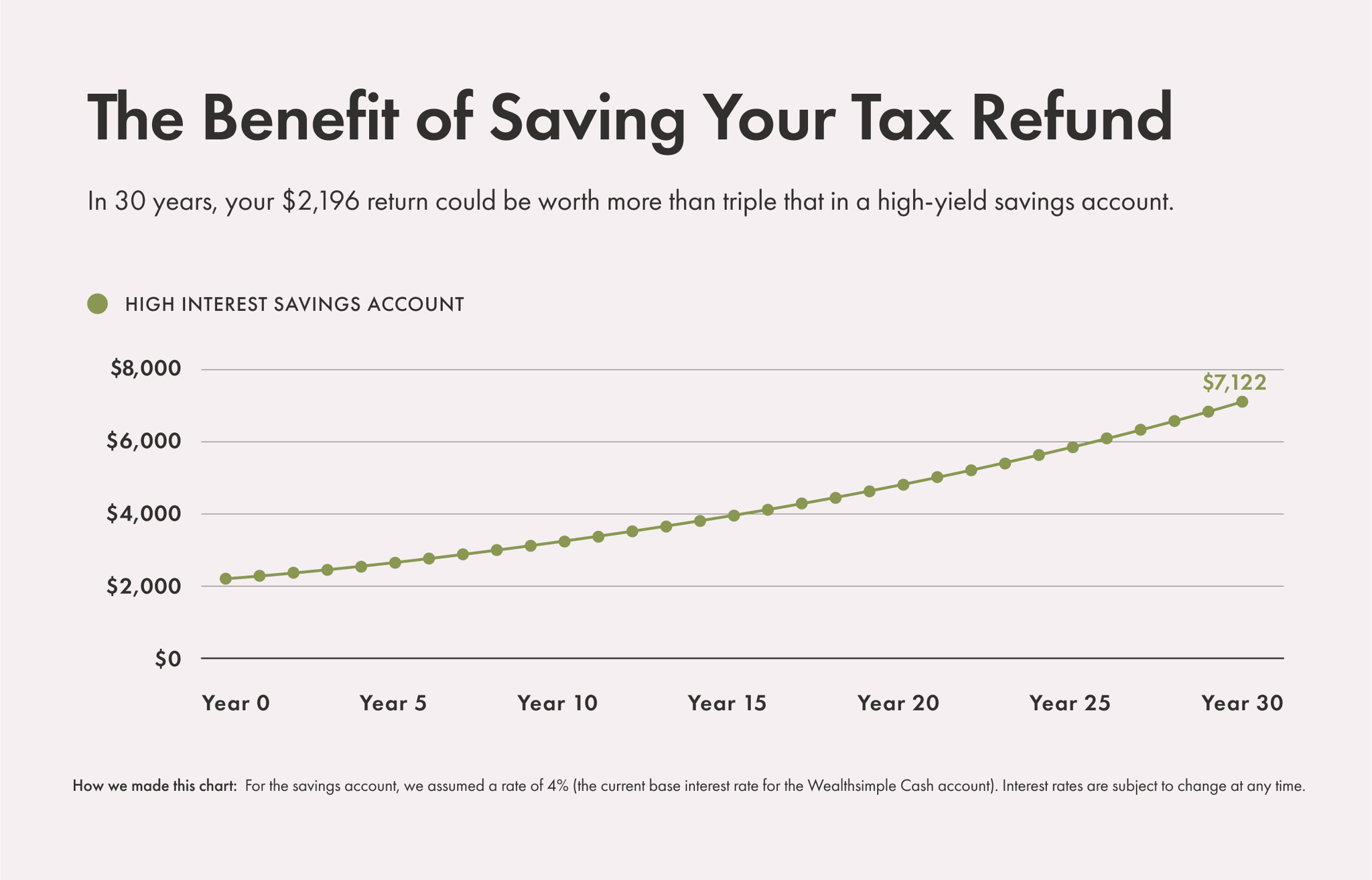

According to the CRA, the average refund for 2023 taxes is $2,196 — one hundred dollars more than last year. Take that, inflation! And while it’s nice to have a little extra cash, every refund comes with a choice: blow the money on something fun or let it grow (and grow).

While buying a new TV or a diamond-encrusted collar for your pet ferret might feel like the right thing to do, it’s not that financially sound. By investing your money — especially in a tax-sheltered account like an RRSP, TFSA, or FHSA — or, to a lesser extent, saving in a high-interest savings account, you give yourself the best chance of having more money later. Your ferret will thank you.

The best choice for you depends on your personal circumstances, of course, along with your tolerance for risk. Here’s how to think things through.

Option 1: Invest It

If you’re planning on buying a house or making another big purchase (a second ferret?) in the next three years, you’re probably better off skipping to the saving option below.

But if you don’t think you’ll need your money in the short term, a medium- or higher-risk portfolio increases your odds of earning high returns. And with the longer investment timeline, if there is a downturn, your portfolio still has ample time to recover.

The only question left is where to put your investments. A TFSA or an RRSP is often your best option, since they’re both tax-sheltered and will save you a lot of money. If you’re interested in buying your first home, a FHSA actually combines the tax savings of both. (For a flowchart to help you choose among the three, click here.)

Option 2: Save It

Say you really need that renovation or you’ve put off your wedding long enough that your in-laws are on the verge of cutting you out of the family before you’ve technically even joined it. If that’s the case, you’d be wise to put your tax return into a savings account. And not just any account: you need a high-interest savings account.

One of the benefits to consumers of the last year of interest rate hikes is that some savings accounts now offer exceptional interest rates, often 4% or higher. It’s not quite what you can expect to make in the market, but there’s little to no risk. And it’s a ton better than letting money sit in an interest-free chequing account — or around the neck of your favourite ferret.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.