Finance for Humans

How to Invest in Legos and Make a Bazillion Dollars

Please note: You will not make a bazillion dollars. But read on to learn about the weird market for Legos and how it’s a model for lots of other markets.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

You’re not going to believe us when we tell you, but Legos, the children’s toys responsible for countless childhood memories and foot injuries, have garnered a larger return on investment than gold in the last 15 years. Yes, Legos. Those little Danish plastic bricks, when purchased wisely, can make you lots of money. Why? How? Because Legos have been beloved for years, and now that the adults who grew up on them have more disposable income to invest, a secondary market has emerged, with pristine sets increasing 12% each year since 2000. It’s the nostalgia economy.

Now, we’re not advising you to cash in your ETFs and invest in 1,000-piece Millennium Falcon sets. But since we here at Wealthsimple are all about giving you all the information you need to make great investments (and also informing you about entertaining ways people try to make money), we sought the advice of Jeff Maciorowski, who runs the Lego-investing business Brick Picker. Here’s our novice’s guide for how to get in on the brick market, what to look for, and what the Holy Grail of all Lego sets is.

How Exactly Is Money Made in the Lego-ing Business?

There’s no magic here. You buy something, it goes up in value (if you buy the right thing), and then you sell it. As Maciorowski explains it: “This is no different from the stock market.” Or the shoe market. Except you’re buying Legos instead of shares of Nike (or actual Nikes). At the same time, the Lego market is different from a lot of postconsumer markets. These aren’t Beanie Babies. Some Lego sets sell for upwards of $6,000 or $7,000. And they’re not just going to magically be worth practically nothing overnight, as happened to the Jerry Garcia Beanie Baby.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

“These items are very expensive,” Maciorowski says. “They are not a $4 Beanie Baby that even a 10-year-old kid can buy with his weekly allowance money. While there have been a few worthy investments that retailed for $24.99, most investable Lego sets start at $70 and are often more expensive than that. Many of the top performers retail at $199.99 and higher, which eliminates a majority of (prepubescent) would-be investors who would dilute the market. Another reason Legos tend to go up in value is the way Lego runs its business. Namely, it doesn’t overproduce its sets. It’s true that popular sets may stay on retail shelves longer, but Lego doesn’t produce millions upon millions of its most desirable toys. Like Beanie Babies did.

Here Are Five Investments We All Wish We Would Have Made:

1.Millennium Falcon: Retailed for $499.99 in 2007. Fetches anywhere from $5,000 to $7,000 these days.

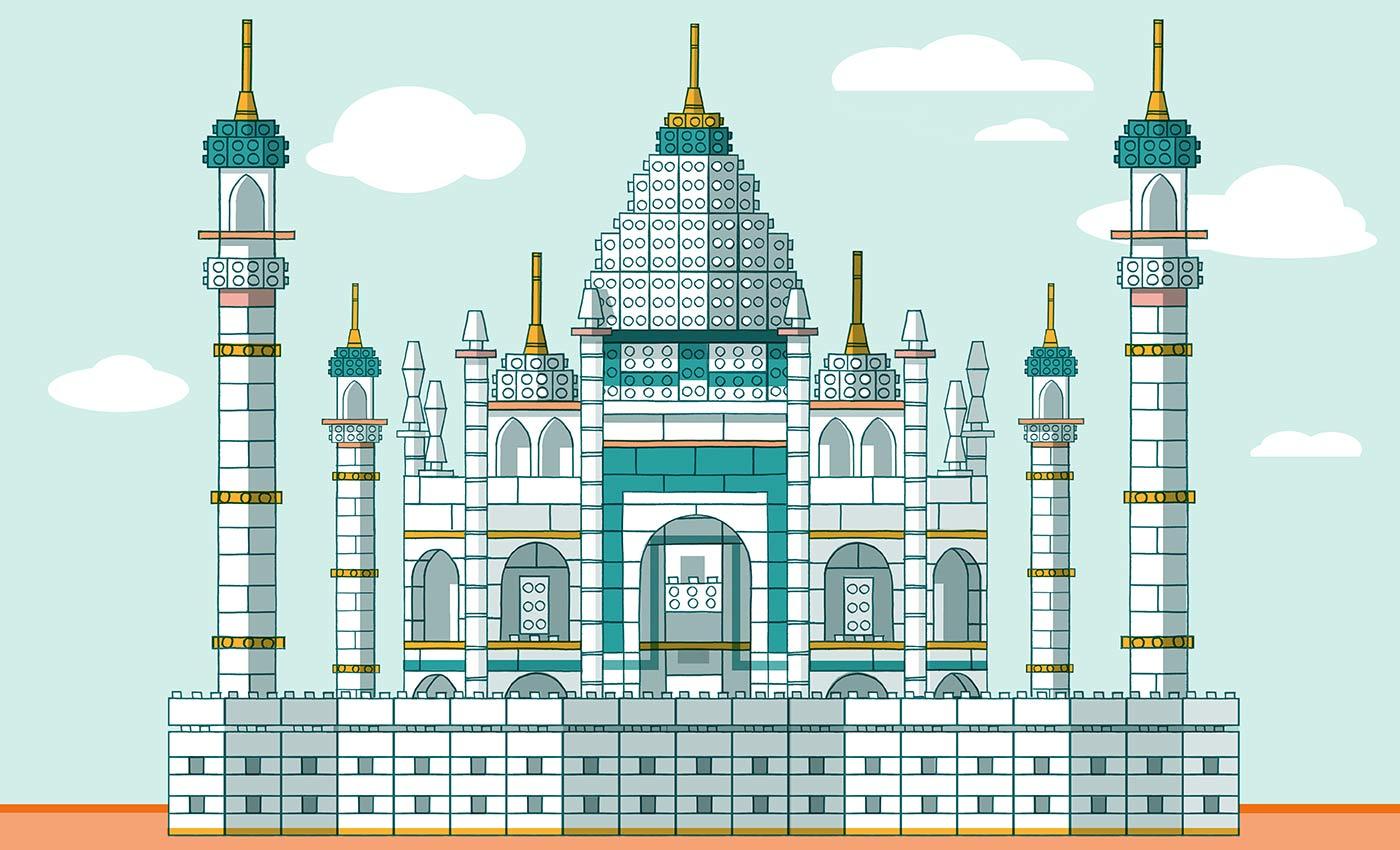

2.Taj Mahal: Retailed for $299.99 in 2008. Now the second-most coveted, and goes for between $2,500 and $3,500 on the secondary market.

Recommended for you

A Freelancer’s Guide to Saving Like a Corporate Lifer

Finance for Humans

The Budget for People Who Hate Budgeting (and Also Want a Bidet)

Finance for Humans

Five Tax Traps — And How, If You Start Now, You Can Avoid Them

Finance for Humans

Is This the Year to Try Wealthsimple Tax? (Um, Probably. Yes)

Finance for Humans

3.Grand Carousel: Retailed for $249.99 in 2009. Regularly sells for $2,600 on eBay.

4.The Statue of Liberty: Retailed for $198.99 in 1998. Can now net you upwards of $2,000.

5.Death Star II: Retailed for $299.99 in 2005. Routinely goes for $1,700 now.

Don’t Buy Stuff That’s Already Overvalued.

This is another way of saying (and this is true for shoes or whisky): Buy retail. The secondary market is where you make your money. “The goal is to buy retail and on discount,” Maciorowski says. So that means hitting up local big-box stores and toy emporiums looking for sales, digging deep on the shelves of the Lego aisle for whatever’s being sold now and might be sold for more later. Windfalls happen when you find a gem or rarity at retail price and sit on it.

Be a Value Investor.

Listen, most Legos are going to go down in value the minute you buy them. Just try selling some generic Legos on Craigslist and see what the response is. The point isn’t to simply stock up on whatever Legos you can find. There are things to look for:

Buy “sets.” Fully packaged, in-the-box kits for building something specific. We’re talking everything from a Star Wars Super Star Destroyer to a Teenage Mutant Ninja Turtles Lair Chaser.

Make those sets big, and hopefully limited editions. Limited-edition and seasonal sets typically appreciate well—as you likely know, the combination of rarity and desirability is the magic formula for appreciation. So do big ones (think: thousands of pieces) with intricate details. And anything related to movies or franchises (Star Wars, Disney, Teenage Mutant Ninja Turtles, et al.) tend to garner strong returns.

Avoid generic kids’ stuff. Fire stations and police stations go on sale regularly, but Maciorowski warns they’re not typically investment winners. Steer clear of the Lego City sets, which are lemons. (Unless you’re five years old. Then they’re awesome.)

If you want to see what sells well, check out Brick Picker—it’s the industry clearinghouse. Its forums and price guide are the best resource online. “It's just like the stock market,” Maciorowski says, repeating his mantra. “You’ve got to do your research.”

Please Do Not Enjoy Yourself.

You can’t actually build your Star Wars Super Star Destroyer. These sets need to stay unopened and untouched to build value. And whatever you do, don’t stack them on top of each other—that will mess up the boxes. Creased corners mean lower prices. Stack them vertically as you would books on a bookshelf.

Then Try to Time the Market (Note From a Firm That Advises Against Trying to Time the Market: Always Risky!).

Keep an eye on the market. If people go crazy about a new Star Wars release and you bought a few at retail price, you could be sitting on a quick flip. “Once all the people go out there and clear the shelves of every Walmart, Target, Amazon, whatever, then you just watch the value on eBay climb, climb, climb,” Maciorowski says. Say you bought a $99.99 set on sale for $75, and Lego retired the set one year later, and it’s going for $400 on eBay. After your fees, that’s a really solid return on investment—one that any brick investor should be thrilled with. But Maciorowski, who estimates his Lego collection is “six figures easily,” is playing the long game—he hasn’t sold a set yet. “The way we look at it,” he says. “It's almost a 401(k) plan of a different stature.”

Remember: You’re at the Mercy of Lego.

The rarer a set, the more money it’s worth. But Lego can do another run whenever it feels like it. The new Cinderella Castle, which was released last month, is a good example. It’s a 4,000-piece set, based on the Disney Resort castle. It has all the makings of a great investment: big set, never before released, and inspired by a behemoth brand—Disney. “It's a $350 set that may hit $1,000 in a few months because every little girl in the world is going to want to build Cinderella’s castle,” he says. “On the flip side, Lego may keep making them for 10 years.” No one ever knows what Lego is thinking, so you need to be comfortable with your investment.

And if you do know what Lego is thinking—that’s called insider trading! The toy police are going to get you.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.