Money Diaries

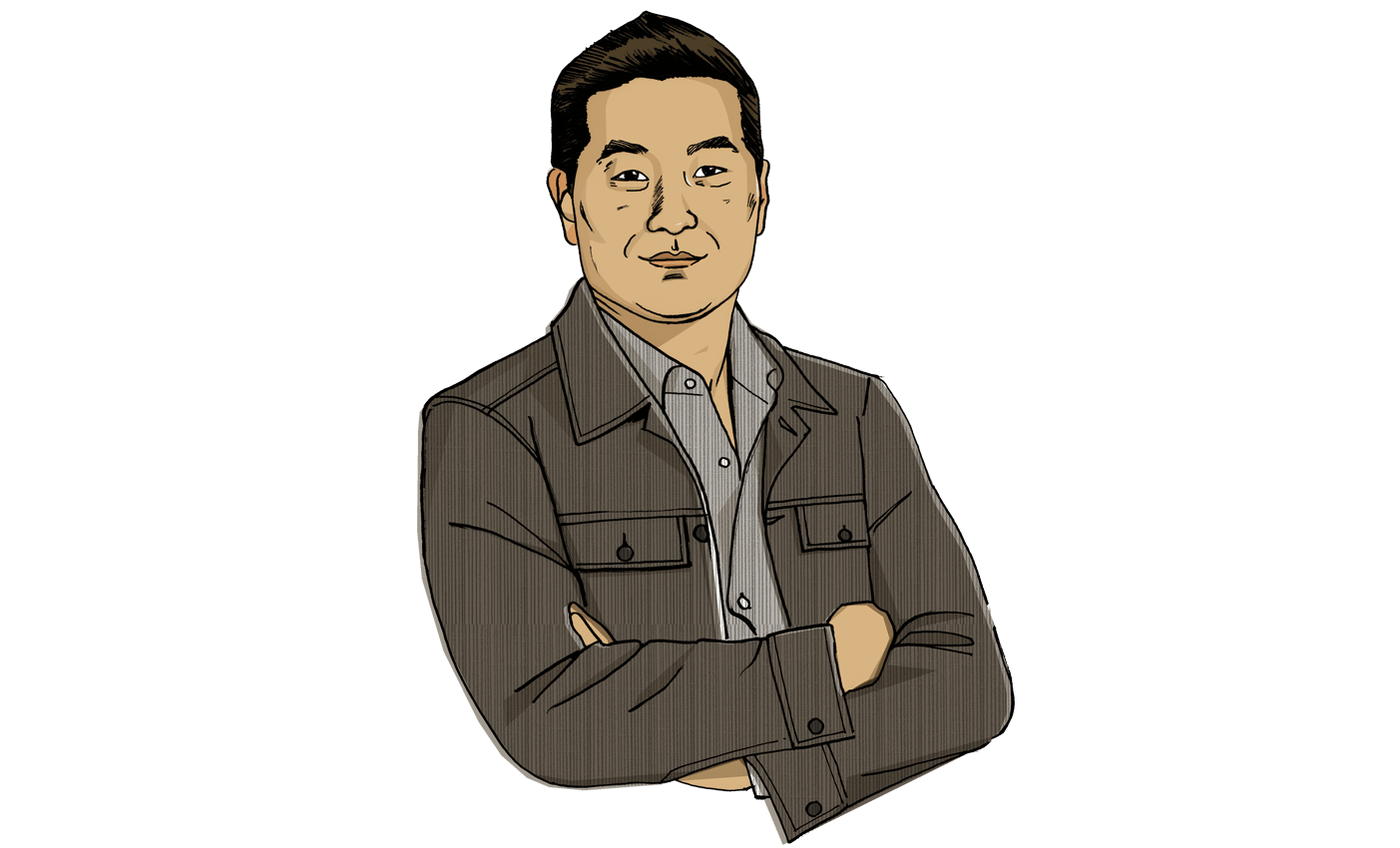

The Cofounder of Frank + Oak Tells Wealthsimple About Living Frugally and Spending Richly

Ethan Song thinks we should all plan our futures really carefully—including blowing cash on what makes life fun.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is a whole new kind of investing service. This is the latest installment of our recurring series “Money Diaries,” where we ask interesting people to open up about the role money has played in their lives. Ethan Song is CEO and cofounder of the fashion retailer Frank + Oak.

Right now, I have $60 in my pocket. I would say that’s normal for me. I'm very much a digital guy, so I don't carry a lot of cash —just enough for tips and small things like that. One thing that's interesting about me is I don't really believe in material goods. I don’t buy a lot of expensive things. If I had to tell you the most expensive material thing I’ve bought, I would say it was probably a jacket. I'm all about things that you use right away. Travel, food, going out. I think that’s what’s important in life, which says a lot about my personality.

I was born in Tianjin, China. I moved at the age of six. My father was doing his PhD in physics at University Laval in Quebec City, and I grew up in Montreal. It's a typical immigrant story, but he ended up starting a 3-D-imaging company and was very successful. But he was never really about material things, either. He believed if you're going to do something, it needs to make you happy, and it needs to bring something to the world.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

I realized at a very young age that if I wanted to be able to do the things I wanted to do, I needed to plan things out financially. So I keep a budget. Absolutely. I set a monthly budget — an annual budget is too far away — and I keep it on a spreadsheet. I think when you create a budget, you want to be realistic. You want a budget that aligns with the lifestyle you want to have.

"I think that the idea of enjoyment is not always simple. For me I enjoy what makes my entire life richer."

As part of that budget, I set money aside on a monthly basis for what I want to do. So as an example, if I want to go on a trip, I make sure I set aside, say, 200 bucks every single month. So I know that in a while, I'll have more than enough to go to Europe. Maybe it sounds a little silly, but it works, and then I don't have to worry about it. My parents, being first-generation immigrants, didn't have a lot when they first got started here. And it was always important for them to both save money and also plan for the things that matter in life.

You know the smartest thing I've ever bought in my life? When I was about 18 years old, I bought a five-week intensive course to learn the English language in Halifax. I think that was a smart move. Before that, I spoke Chinese, and then I learned French.

I’ve had jobs since I was 16 years old. My first job was as a camp counselor. After that I had the chance to work at an independent movie theater; I loved that. I haven’t had a lot of bad jobs to tell you the truth. I studied electrical and computer engineering, and then my first job out of college was working at Deloitte as a management consultant. It was awesome, actually. I never thought that I would work as a consultant—I'm such a consumer-oriented person. But I didn't have any money to start a business when I got out of school, so I applied, got an internship there, and turned that into a job. I was there for about two years. The main thing it gave me was a level of responsibility that I think not a lot of people in their early 20s get. That job gave me the confidence to go out on my own.

Recommended for you

And I saved a lot of money because the day I went to work at Deloitte, I already knew that I wanted to start a business. I really didn't change my lifestyle from when I was a student. I still had roommates. I would say that's something unique about this generation: We like the communal aspect; we like the simple things. I didn’t feel like I needed to upgrade anything. I have never owned a car. I don't feel the need to. I think it's part of my philosophy, I guess.

My partner, Hicham, and I have known each other since high school. Around 2011, we saw that there was an opportunity in the men's space because there was this whole new generation of men. And there weren’t a lot of brands that were speaking to that new millennial male generation. We started our business in 2012.

We each put in about $25,000 to start Frank + Oak. Since then, it's scaled quite a bit. We have more than 200 employees now. We're selling in 40 countries. We’re in Deloitte's Fast Fifty. Last year we were the fastest-growing company in Canada with 18,000% growth over four years.

There is some satisfaction in watching the worth of my company grow, definitely. I think that something that's interesting about me is that I really want to have a big impact. So to say that size doesn't matter, I think that wouldn’t be accurate. We definitely want to grow a big business; we want to grow a globally known brand.

When it comes to personal finances, I think that careful planning is important—it's what makes it so you can have the life that you want, not just in the next five years but for the next 50 years. A lot of young people don't necessarily think about that and end up having a lot of debt by the age of 30, and I think that makes things really hard. So it’s a balance between planning and living in the present: You can't just be future-focused, just saving money for when you're dead —you're not going to enjoy it.

For me, travel is something I like to spend money on. I prefer exotic places. I'm a very curious person, and I'm always interested in discovering a new culture. One of the most interesting trips I went on was when I took a train from Moscow all the way to Ukraine, through Belarus and some of the countries in Eastern Europe and the old Soviet Union. I thought that was really interesting. I think that the idea of enjoyment is not always simple. For me I enjoy what makes my entire life richer.

I don’t think I’ll retire in the sense that I’ll sit around and do nothing. I will always have projects, whether they are business projects or they're personal projects. I'm just really bad at staying home.

As told to Wealthsimple. We make smart investing simple and affordable.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.