Money Diaries

Elaine Lui Tells Wealthsimple Why She Loves Investing in Herself—and Shoes

Lui—you may know her from CTV’s etalk and The Social—explains being addicted to opportunity and how her financial philosophy can be explained by Chinese astrology.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is a whole new kind of investing service. This is the latest installment of our recurring series “Money Diaries,” where we ask interesting people to open up about the role money has played in their lives. Elaine Lui is a reporter for CTV's etalk and co-host of CTV's daily talk series The Social.

My mother, who immigrated here from Hong Kong, had no education. She only got up to grade ten, and she found herself in a position where she was quite dependent on the men in her life. So when I was growing up, her perspective on money was: You’d better have your own and protect it. I guess she just didn’t want me to repeat the experiences she had. She really wanted me to be self-sufficient.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

In an immigrant family, you’re raised to take every opportunity you can. You work harder and longer than anyone else. I guess because you’re used to the idea that there might be zero opportunity for you, when opportunities arise, you keep taking them. That’s pretty much my work ethic—and that’s been the backbone of my success. The flip side of this is that I struggle with saying no. I've been constructed to say yes to everything.

My principles about finance all go back to Chinese astrology. I’m an ox. The ox is a worker. This is how I know that I'm destined to make my money—through hard work and not by chance.

I think my upbringing also had unintended consequences. When I moved out of our house—when I got that first taste of freedom in my early 20s and had my own money to spend—it was sometimes hard to regulate myself. I was irresponsible with money in those days; I liked to gamble and shop. I’d spend money I didn’t even have. I’d take out cash advances on my credit card.

Recommended for you

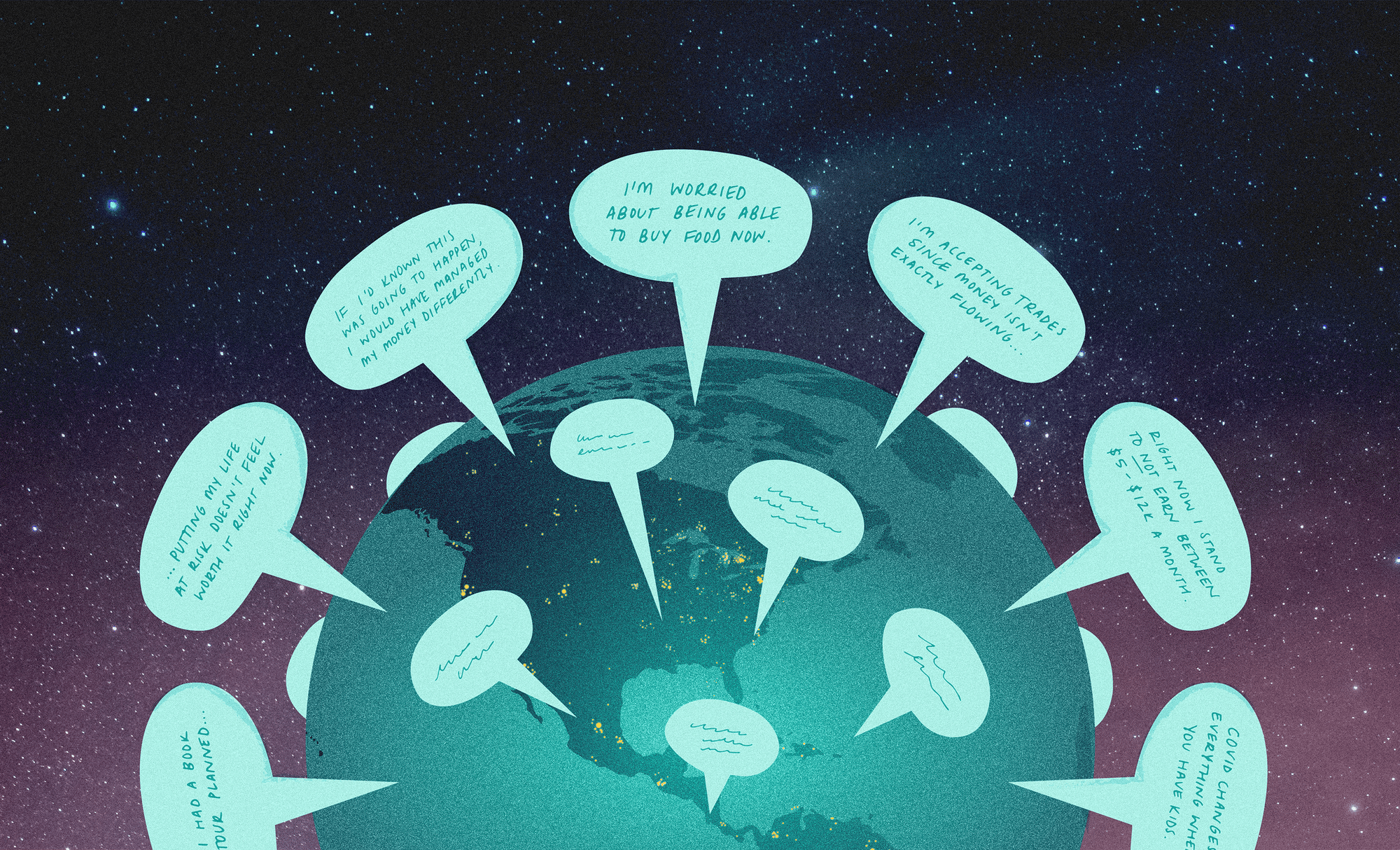

Pandemic Money Diaries — Panic at Trader Joe’s Edition

Money Diaries

Anthony Bourdain Does Not Want to Owe Anybody Even a Single Dollar

Money Diaries

Stories From Our New Economy: Bullish on Bidets Edition

Money Diaries

She Was Living in a Shelter Six Years Ago. Now She’s the CEO of Her Own Beauty Company

Money Diaries

Now when I gamble, it’s within a set limit. I go with my girlfriends, and we make a social outing of it. When we reach that limit, we stop placing bets. I’m still quite a big shopper, but I shop within my means. And I’ve learned to be more decisive about the things I do spend my money on so I don’t get buyer’s remorse. Rarely do I have any regret. That’s because I’m a big believer in really earning everything you’ve got. I can feel comfortable buying things now, simply because they make me happy: I worked for it, I earned every bit of it, and I can enjoy it fully—whether it’s a closet full of shoes (I know it sounds silly, but my shoes make me very happy!) or paying off our mortgage.

What’s interesting is that despite how I was raised—and I know this goes against the advice of every financial adviser out there—my husband and I do not have separate accounts. We share everything. For us, it’s part of our marriage, part of being a team. What works for us is we put away a certain amount of money for retirement every month, and we don’t spend until that money is set aside. We are very good about saving. When it comes to investing, we take a bit of a different approach. In investing in our business, for example, we really put a lot of emphasis on investing in people; it’s about being able to build our talent, and I include myself in that group. I want to always be able to invest in myself. It’s critical to have me be my most creative and have our writers be creative, too.

It may sound odd, but my principles about finance all go back to Chinese astrology. I’m an ox. The ox is a worker sign: They’re always in the field, working. This is how I know that I'm destined to make my money—through hard work and not by chance. So far, it’s come true: I’m successful because I’m a good worker. I’m never going to be that person who gets rich simply by investing in Apple stocks.

As told to Melissa Hughes exclusively for Wealthsimple. We make smart investing simple and affordable.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.