Finance for Humans

Nine Ways to Be Smart When the Market Goes Down

Smart investors don’t try to avoid downturns, which are inevitable. Instead, they make sure they’re in a good place when the markets go back up. Because that’s inevitable, too.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Odds are, if you invested money in the stock market over the past decade or so, you’ve done pretty well. U.S. and Canadians stocks have basically been in one long bull market since 2009, with short-lived downturns in 2020 and 2022, because of COVID-19 and interest-rate hikes. Stocks have marched steadily upward over the past 200-odd years and are typically considered a good long-term bet for anyone with long investment horizons. But, because the market is cyclical, you can be sure that there’s another bust coming — maybe today, maybe years from now, but one is definitely coming. Or maybe you’re reading this story because a correction or bear market has already arrived.

So what should you do? Sell everything and hide in a bomb shelter? Put all of your capital into Beanie Babies and fancy watches? Well, in short: no. Don’t do any of that. Because one thing that history has taught us is that if you panic, you’re going to miss out. A bear market has followed every bull market since people invented phrases like bull market and bear market. (A bear market, by the way, is defined as an extended period of losses during which the market falls 20% or more.) But bear markets don’t last forever. Even with the 2008 meltdown, the 2020 COVID crash, and the 2022 downturn, the S&P 500 is still up something like 280% since January 2008. That’s a truly spectacular return. It’s so spectacular, in fact, that many seasoned investors warn that stocks haven’t always done quite so absurdly awesome. Historic bull market aside, stocks are no doubt an extremely effective way to build wealth over time. That’s why it’s often smart to invest in the entire stock market with diversified exchange-traded funds, or ETFs. Because, while traders tend to lose money betting on individual stocks, your odds of making money are a lot higher if you invest in the market as a whole.

Meaning: if you panic, you’re going to miss out. There’s a right way and a wrong way to go through a downturn. Lucky for us, the right way is far easier. Read on.

Do not panic, unless you like losing money.

Whenever the bear shows up to the party, he inevitably causes the natural emotional response anyone would feel if a ferocious wild animal wandered into a social gathering — panic and fear. All of those gains obliterated! Savings decimated! The world is ending! Sell everything! Hide the clam dip! This is a good way to make sure your losses stay losses.

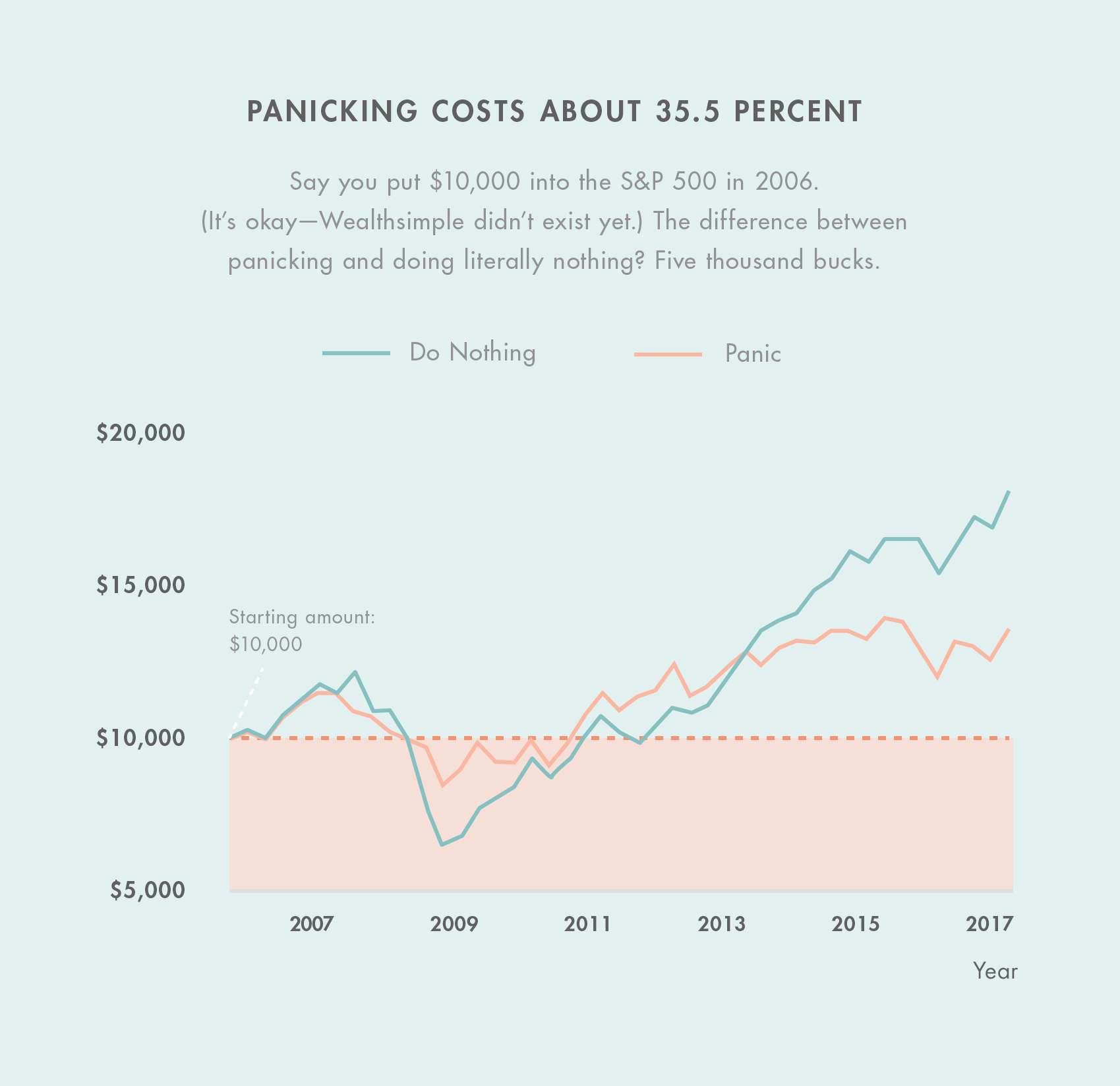

Don’t believe us? The below chart shows what would happen if you’d invested using one of two scenarios. (We made the chart back in 2017, but what it illustrates is still relevant, so stick with us.) In the first, you do nothing. In the second, you employ what’s been called a panic-selling strategy — sell everything when the market drops more than 2% in a day, and then buy back 20 days later if things are looking flat or better. It turns out the guy who lost the password to his brokerage account would have done better. By a lot. And that’s not including transaction fees.

(Ok, ok, one more caveat: the chart does show the single greatest economic recovery ever; the Dow didn’t fully bounce back from the 1929 crash until 1954. BUT the don’t-panic principle still holds true.)

Remember your timelines.

If you’re saving for retirement, but you don’t plan on retiring in the next decade, stop looking at the short term. What happens now shouldn’t really matter to you. It’s what the longer-term trend line looks like that matters. And the long-term trend line for all markets since forever has been up. What you’re betting on when you do passive investing is human progress. If you stop believing in that, you’ll have bigger problems than bad portfolio returns. Which leads us to:

Remind yourself that bear markets have historically been shorter than bull markets.

Since the 1930s, bear markets have lasted an average of only 18 months. The average time it’s taken for a portfolio of stocks to both endure a bear market and fully recover its value has been just over three years.

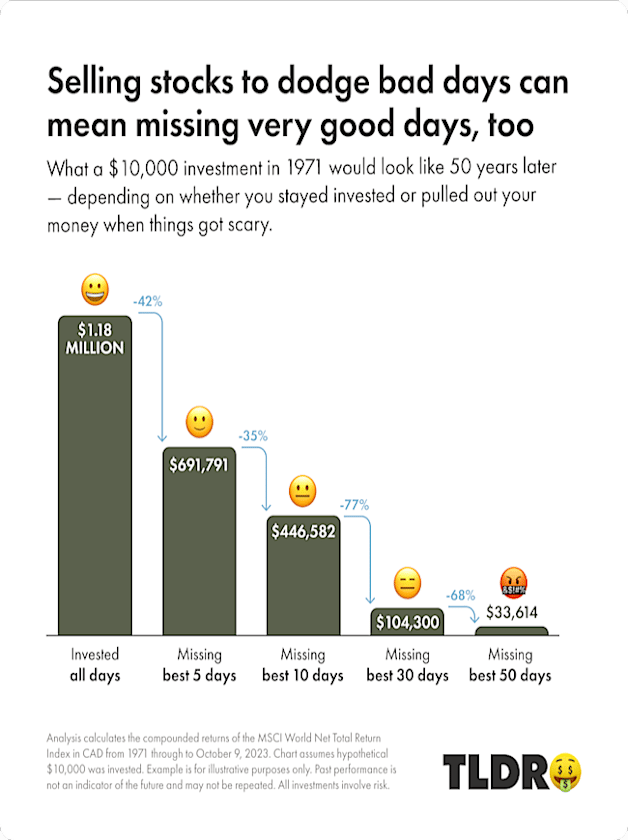

Do not try to time the market. DO. NOT. TRY. TO. TIME. THE MARKET.

Everyone knows that the goal of investing is to buy low and sell high. So if the market’s bound to go down sooner rather than later, why not liquidate your investments, and after the inevitable downturn happens, snap up all those bargain-priced stocks? You may be smart. (You found us, after all.) But, no offense, you’re probably not smart enough to perfectly time the stock market. Why? Because no one is really that smart. Not even Warren Buffett, who likes to remind smart investors to stay the course, and stay invested, despite any market fluctuations. Research shows that trying to time the market more often than not leads to worse returns. Similarly, indicators show that extremely negative investor sentiment precedes higher returns on average. Meaning: a lot of investors should stop trying to trust their guts. The steady-as-she-goes investment strategy beats pretty much everything else. One big risk of selling your stocks and trying to time your reentry is that no one knows when things will turn around and prices will surge big. Stock gains aren’t evenly distributed, and history suggests that if you miss one of market’s best days, your portfolio will suffer.

Find an investment firm that can set up automated deposits so you don’t have to think about it.

The best way to take emotion out of investing is to automate it. There are places that take the decision-making out of your hands and apply simple, cold logic and a little something called automatic deposits.

If you’re a new investor, automatic deposits are doubly important.

Here’s the thing about starting to invest: new investors tend to be way more emotional than old hands. Which means that, when the market goes down, they tend to freak. Freaking = bad. That much we’ve established, right? So if new investors can take the decision making (should I put more money in? Should I take my money out?) out of the process, and just keep making small, regular deposits regardless of what the market is doing, it’s a great help in riding out the short-term gyrations of the market.

Here’s the most important piece of advice we can offer.

Do absolutely nothing.

Especially if someone is automatically rebalancing your portfolio.

After any market drop, your portfolio will inevitably get a bit lopsided. A balanced portfolio of equities and bonds might suddenly appear too bond-heavy, since bonds tend to lose less value during downturns. It’s good to rebalance your portfolio periodically to make sure these ratios remain consistent and you’re never too exposed in any one investment sector.

Log off your account, relax, congratulate yourself on your shrewd financial decision, and tune out all the doomsayers.

This story was originally published in June 2017 and updated in April 2025.

Sources: Graph 1. Definition of panic-selling derived from Savita Subramanian at Bank of America Merrill Lynch

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.