Money & the World

Prediction: The Predictions Will Be Wrong

We are going to reveal whether people think the stock market will go up or down! And also what that information is actually good for.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is a whole new kind of investing service. This is the latest installment of our “Data” series, where we dig into the numbers to learn more about how the world of money works.

Attention investors! The stock markets are predicted to go up this year! (Please read this before you do anything about that prediction.)

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

It's prediction season. Why? Because it's the new year. Because the world hates uncertainty and wants to pretend it knows what will happen. Because lots of smart (and some not-so-smart) people need to have something to go on TV and talk about. And the epicentre of the prediction industry is: predictions about money. Will the market go up? Down? Rhomboid? Will Bitcoin make you rich or poor and are renewables the future and when will the next recession hit, and and and...

Wealthsimple, as you know, is a service that helps you become a financial genius (without having to read quarterly reports and keep track of the global supply of lithium or things like that). And as we enter into this season of everyone trying to tell you what to do with your money by predicting things, we are offering a handy guide to forecasting by going back and looking at some of our favourite recent moments in financial predictions.

Recommended for you

(Spoiler alert: if you know one thing about Wealthsimple, it's that we're not big on trying to predict what's going to happen. We're big on diversifying your investments, making a longterm plan, and sticking to it regardless of market, currency, or any other fluctuations.)

Without further ado, we present Wealthsimple's Great Moments in Recent Economic Forecasts!

#1: The Great Depression. Of 1990.

Prediction: In the late 1980s, the economist Ravi Batra predicted that in 1990 there would be the greatest economic depression the world has ever seen. And it came true!

Result: Just kidding, everything was fine.

#2: AOL is unstoppable!

Prediction: In 1999, SmartMoney magazine named a few dot-com stocks as sure-bet, can't-lose money-makers. Among their picks? AOL.

Result: In 2000, the dot-com bubble burst and AOL entered into a famously disastrous merger with Time Warner — and lost 70% of its value.

#3: There is no real estate bubble.

Prediction: In 2006, the chief economist of the National Association of Realtors came out with a book predicting that the real estate boom would continue “into the foreseeable future.” (You could say US Fed Chairman Alan Greenspan made a similar mistake.)

Result: In 2007, the collapse of the housing market triggered the subprime mortgage crisis and a three-year-long global recession.

#4: 2008: A great year for the economy!

Prediction: In late 2007, Goldman Sachs chief investment strategist Abby Joseph Cohen predicted a big economic rebound in 2008; the S&P 500 would climb 14%.

Result: In 2008 a severe economic recession hit that took the stock market — and the world — several years to recover from.

What's our point here?

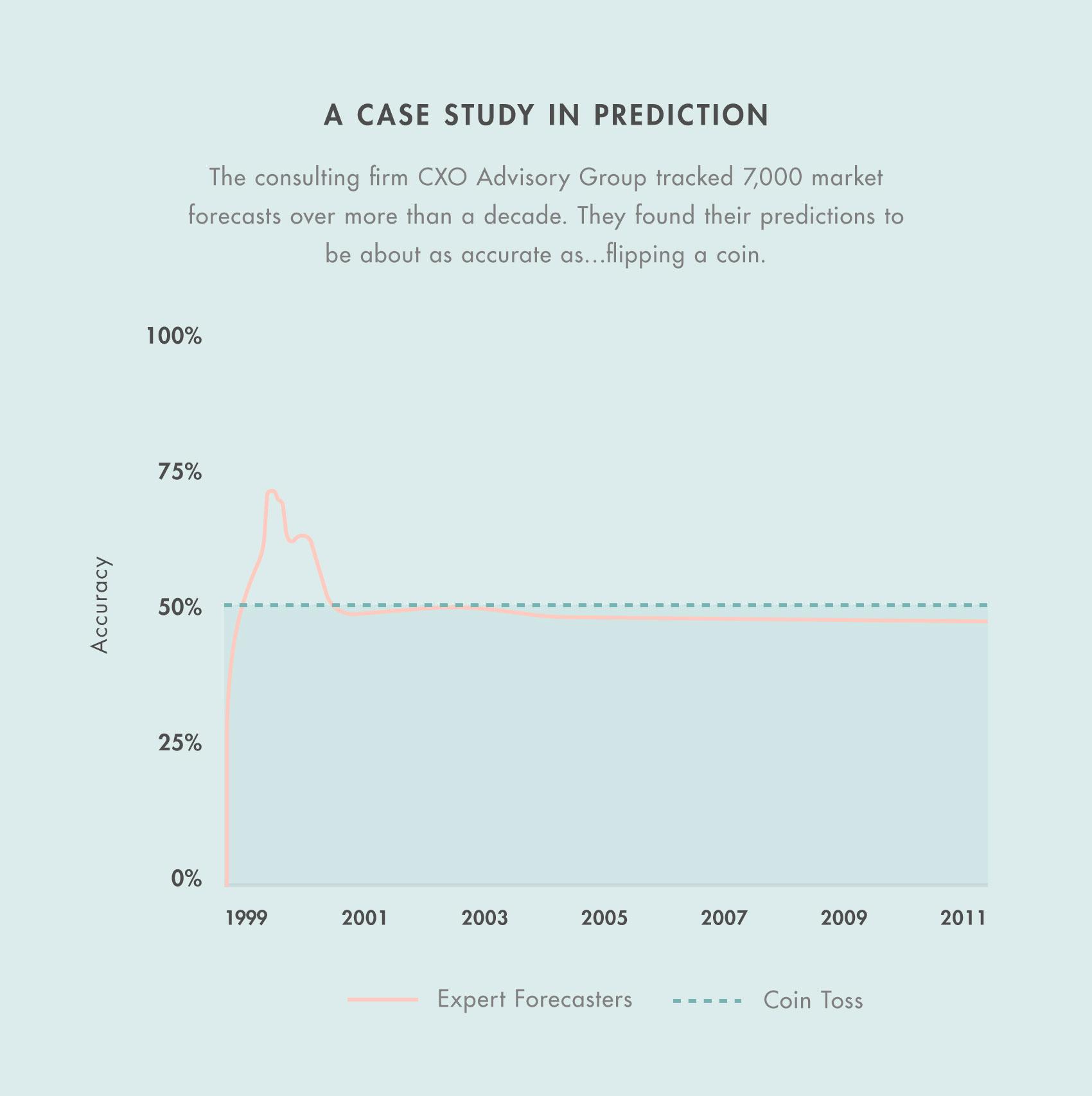

No matter how many data points and geo-political analyses and expert opinions and astrological charts we have to work with, history shows we're not very good at predicting the future. The world is complicated, forces are unseen and markets are volatile.

What does that have to do with me, you ask? Active investing — people sitting in offices picking stocks and bonds and other financial instruments — is based on predictions. Passive investing is based on surrendering to the idea that we don't know the answers except in the most macro sense — that human progress means markets move up and to the right. And, as Warren Buffett proved in a recent wager, passive investing is a smarter bet.

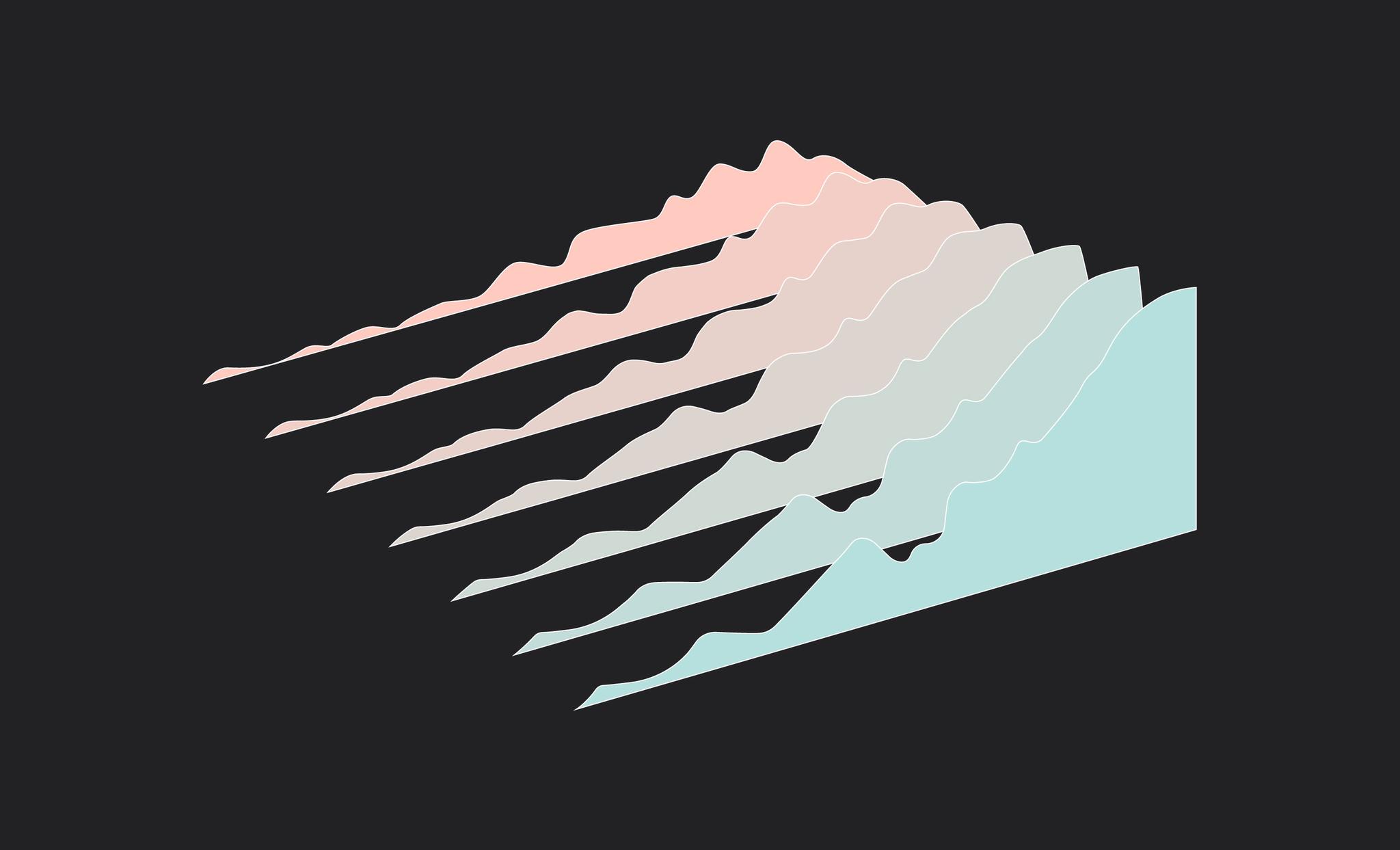

Here's a simple example of passive versus active investing. Consider this experiment, in which researchers looked at forecasts from the 22 Chief Market Strategists of the top banks on Wall Street, issued each January, predicting the closing price of the S&P 500 for that year. If you'd guessed that the S&P would go up 9% for the year — its historic average — you'd have been a little better off than listening to their predictions.

So what's our forecast for 2018?

The stock market will go up. Or it will go down. Investors who try to guess exactly when it will go up and down will, according to all research, most likely get it wrong and lose money. And investors who stay diversified, stay disciplined and stick to their plan will get richer in the longterm.

Wealthsimple makes smart investing simple and affordable.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.