Money Diaries

My Credit Card History: a Self Portrait

Everyone tells you to make a budget. The author avoided doing that her whole life. When she decided to try it, she ended up reckoning with a lot more than her expenses.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is an investing service that uses technology to put your money to work like the world’s smartest investors. In “Money Diaries,” we feature interesting people telling their financial life stories. In this story from the print edition of our Magazine, Darcie Wilder, author of Literally, Show Me a Healthy Person, shares the financial details of her life.

Dad explained the way credit cards worked at a higher-end fast-food place near the West Side Highway, scribbling out interest rates on a worn napkin, his cheap Bic pen ripping it apart with every movement. Already 24 years old but without any credit cards, I still had only the most rudimentary understanding of how money works. “See, this is where they FUCK you,” he repeated over and over, listing out interest rates for missed monthly payments, “and then you get FUCKED, and it’s impossible to get out from under....”

I ignored this and all his financial lessons — probably because “track your purchases, limit your expenses, stop buying cups of coffee” lacked a certain spark or magic. Dad had started giving me an allowance when I was about 10 or 11, just $1, so little that he neglected to tell my mom about it. Eventually I saved up what seemed at the time like a king’s ransom, and I skateboarded from bodega to bodega buying as much candy and soda as possible.

I went to the hardware store and bought seeds just because I could. When my mom found them, she assumed I shoplifted them — why would I spend money on seeds, and where would I have even gotten that money? And we got into a fight, her screaming, “I deal with LIARS every day, Darcie, I can tell when someone is lying,” and me, on my knees, screaming until my voice went dry that there was nothing I could do to prove to her I was innocent. I’m still scared of being mistaken for being a shoplifter, and I get nervous that people think I’m lying when I’m telling the truth.

The whole idea of money freaks me out, and sometimes, when I’m staring off into space, it hits me that money is a way to earn points, and the points signify how much the world wants you to stay alive.

My family has a long history of being broke — as opposed to poor. Our financial issues were born of folly, poor decision-making, and bad luck, rather than the systemic poverty that left us unable to afford the basics. My mom was a compulsive spender; my dad, a penny pincher. I was raised to believe that every product is tricking you — beauty products, anything advertised on television, even soap — it’s all a scam.

Strangely, that cynicism made me more susceptible to the miracle purchase, the problem solver, the tiny “hack,” or the big splurge that, once bought, will save money everywhere, the one purchase that will cure the rest. In the past it was acrylic nails, various types of day planners, an infinite amount of weird clothes bought in bulk, shampoos, conditioners, hair masks, and, one time, a dog. The dog, by far, lived up to and exceeded my wildest hopes and dreams.

Everything was different after my mom died. She had taken a job with the state to support herself, but mostly to get health insurance for her cancer treatments and later hospice. She’d qualified for life insurance benefits, by the skin of her teeth, by working seven days beyond the cutoff. That inheritance paid for my state school college tuition, and I whittled the rest away on diner food and school projects until it evaporated completely when I turned 23. For some reason, my self-discipline — no matter the resource — and ability to moderate has always been permanently compromised.

All this means that my relationship with money — like all of ours — is fucked-up. The whole idea of money freaks me out, and sometimes, when I’m staring off into space, it hits me that money is a way to earn points, and the points signify how much the world wants you to stay alive.

I craved a change, or, actually, change earthquaked into my life. It is 2018, and I have, for my adult years, had a career in the media industry. And everything around me began to shift, sometimes slowly, but often suddenly and scarily, like our political landscape becoming so repulsive. My entire department was laid off, and I became lost and confused and without a sense of clear direction. Now I needed to reorient myself and my life without my old patterns — though they were painful — which revolved around staying out late and finding the next fun thing to do. I stopped partying. I logged off WebMD and started seeing real, live doctors. I took a break from dating and began sleeping eight hours. I went vegan. I went on medication.

While other aspects of my life have become clearer and more manageable, I realized I’m still avoiding a clear, honest look at my financial ins and outs. Despite hard proof that this method — avoidance — is not only unhelpful but also harmful, I have continued to faithfully follow it. Like the kids in Jurassic Park, I acted as though if you stand very still, if you play dead, if you pretend nothing is going wrong, maybe then you can escape.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

It’s become important to me to get more familiar with how much money I’m making and spending: what my financial life looks like month to month, what exactly I’m buying, and what behaviours help and hurt me. I opened my banking app in a moment of non-avoidance. There it was. I could see my expenses across the board. Then I picked up an actual pen and paper. Somehow it was the pen and paper — not a screen – that helped things click into place for me. This was a quieter, more intimate way of seeing who I am financially. It slowed me down.

The problem was…

Well, there are several problems.

—

How Much I Make

First, I’m not sure how much money I make anymore. I used to trade my boredom for a reliable cheque — I made about $35,000 as a receptionist at a PR firm, and then $70,000 as a social media editor. I would rationalize my spending as: It’s OK if the expenses add up, because even if I’m not getting paid a bunch, it seems like I’m probably getting paid enough to cover them. My brain, broken from years of misguided survival tactics, confused being able to pay for something with actually affording it.

These are the gig economy times in the industry I’m in — the unstructured, chaotic work environments of permanent freelance, of post-layoffs seeping into permanent semi-unemployment.

Now, within the past year, I’ve bounced around as a freelancer, sometimes grabbing fuller-time employment, stringing together a few weeks before moving on. I try to have at least a few hundred in my chequing account to avoid swiping a declined card. I have gotten four $5,000 cheques that went into savings — before being whittled away by transfers into chequing. Sometimes I get surprised with a royalty cheque or a freelance gig, which can run from a few hundred to $1,000.

These are the gig economy times in the industry I’m in — the unstructured, chaotic work environments of permanent freelance, of post-layoffs seeping into permanent semi-unemployment. Everyone I know has been subject to or adjacent to layoffs, myself included. There is mounting student debt, the notion that we should be open to taking internships and doing some writing as a kind of a charitable donation known as “paying dues,” or “getting your name out there.” And meanwhile, the entire media landscape folds in ever more catastrophic ways. It’s a difficult time to simply exist and work in this industry when it’s morphing, shrinking, dissipating like a paper set aflame.

And yet, I don’t want to change what I do because I like it. So let’s take this kind of uncertainty as a given.

My Rent

A myth of New York is that you can clock someone’s class by their neighbourhood, but that doesn’t always check out. There are weird little nooks and crannies, cheap and bad apartments and secretly rent-stabilized places. A sketchy block in a fancy neighbourhood can plummet a room into affordable territory — or a too-long walk to the train, or a landlord who doesn’t care enough to inflate the price with the market. Where we live, and how we live there, is subject to the same obfuscation as any other expense. My rent is its own confusing nightmare of funhouse mirrors, both the privilege of an amazing deal and an endless roll of red tape that I’m terrified to screw up.

My apartment is technically Section 8 housing, a federally subsidized housing complex that the city of New York bought when a condo company hit bankruptcy. The city filled it with working artists and actors as a way to rationalize the purchase, I assume, but also to clean up a rough neighbourhood while retaining the integrity of the Theater District so working actors weren’t priced out of the area. I moved in with my grandma in high school as my mom was dying, and after my grandma died, took over the apartment completely. The wait list for entry is rumoured to be around 40 years.

According to the rules, my rent fluctuates — it’s meant to be around 30% of what I’m making. This shakes out to more rent than my peers usually pay. When I worked in an office, my coworkers making the same salary would pay anywhere between $700–$1,500 for rent while mine climbed up, bordering $2,000. But then other months I’ve paid as little as $113.

The Needs (Monthly)

• Toothpaste ($4)

• Toothbrush Refills ($4.75)

• Makeup and Skincare ($60)

• Zoloft ($5)

• Body Lotion ($7)

• Body Wash ($12)

• Razors ($4)

• Shaving Cream ($6)

• Deodorant ($5)

• Food ($200)

• Dog food, laundry detergent, and card refills ($20)

My daily essentials center around whatever chemicals my body is relying on currently. In the past, this would be a $30 bar tab every few days, or being thrifty and going around the corner to sneak in a bottle for about $15. But now none of my vices require photo ID — coffee, mostly any diet soda (but preferably Coke Zero), and an assortment of chewy candies, like Now and Later, Spree, SweeTarts, anything sour. My 7-Eleven tab ends up around $10, or sometimes $15 if I’m stocking up on Coke Zeros for my fridge. I haven’t reached the commitment level of buying a 12-pack from the grocery store, because it’s more fun to have a little trip to 7-Eleven.

Then there’s the difference between hygiene and vanity. I’ve swum through every makeup and skincare phase and come out the other end, throwing my hands in the air. I figure I will always have the same feeling about my appearance no matter how minimal or elaborate my routine — that it’s pretty OK, but there’s room for improvement — so why stress on maxing it out?

My fantasy is subsisting on scoops of batch-made rice and beans with a few sprigs of spinach and, every so often, eggs and fish.

I used to start off every morning with a $4 iced coffee (adding $1 for a tip) on my way to the subway to work in an office. Now I marinate Bustelo in a mason jar while I sleep, and it’s stronger and tastier than any coffee I’d buy. The whole jar ends up being around $5 and lasting for a week or two. Then again, I’ve been up for six hours after sleeping three, and I’ve also had three of these cold brews, and I just realized I’ve heard several death rattles, so I think I’ve got to quit coffee.

Lately, I’ve been trying to learn how to grocery shop, which is a skill. I live above a grocery store that my neighbours call “the rip-off store.” I used to shop there nearly exclusively all the years I was steadily employed. I told myself I did it because I was exhausted and felt that I deserved that ease because I worked. I began to walk a longer distance to some locally owned but dubious spots, but these still left a bit to be desired. But lately I’ve swallowed the idea that it’s fine to take the bus across town to Trader Joe’s, and it’s fallen into place.

My fantasy is subsisting on scoops of batch-made rice and beans with a few sprigs of spinach and, every so often, eggs and fish. In my mind this is flawless and perfect. I keep rice on hand and have a Post-it Note reminding me, if I’m at a loss, that it takes only 25 minutes to cook. I also have a note reminding me of simple meals, like hard-boiled eggs and spinach, in case I forget. I recently began cooking farfalle and spaghetti for the first time, after a few decades of avoiding them out of spite for my Italian grandfather and also misguided diet advice. This replaces bread, which ends up being more expensive because I can’t keep a loaf in the house without eviscerating it in two days, tops.

I joke that my dog was an impulsive decision, but her adoption was actually a 27-year obsession that was finally realized when I looked at the actual cost of keeping a dog. Another false assumption I had was that dogs are for rich or old people, or for people who weren’t me. Dogs required regular dog walkers, expensive vet visits, and “were a whole thing.” My heart ached for a dog, but when you ask “Should I get a dog?” a friend’s responsibility is to say no, because otherwise, if the dog doesn’t work out, they are partially responsible. I found my dog, Coco, at Social Tees animal rescue and fell in love. She is perfect. Upon pickup, Social Tees required $400, non-refundable.

She came with all her shots, paperwork, dog license, and some items that her foster owner had picked up. (Later I found out that she had splurged on a $100 dog bag, which: thank you!) Coco’s biggest expense is health insurance. She has priority; I spent a few months without while she was comfortably padded. I pay her insurance semi-annually, $248 each time. This feels great and relieving because of the terror of the unexpected, like the surprise $4,000 emergency surgery I’ve seen happen with other dogs.

As for food, she eats from a giant bag of kibble. Sometimes she goes on a hunger strike, and I get it. Kibble is boring. I spice it up with scrambled eggs or chicken broth, or split it up with a $2 can of dog food. Every month she gets an $8–$10 toy, which she destroys in five minutes, tearing out the tiny plastic squeaker. I confiscate the plastic, and she parades the fuzzy skin of the zebra or elephant or hedgehog or whatever form the toy came in, for months after, picking apart the fabric with her teeth. Every three months we get a three-pack of small squeaky tennis balls, which ends up being around $4. She has access to these only during daily fetch, otherwise she rips off all the green fur.

I like doing this — listing out my non-negotiable necessities. It feels grounding. It also feels kind of gritty and unglamorous, seeing all the hygienic items, as if it’s the red tape involved in maintaining a human body. The idea of it, like when I think of exactly how many showers I’ll have to take for the rest of my life, is daunting. I’m not sure if I learned anything new about myself from seeing my cheap coffee next to the price of my shaving cream, but it’s exactly the type of behaviour I find fascinating in other people. If we associate brand loyalty and preference with each others’ personalities so much, an itemized list of what we refuse to go without seems telling.

Total: $327.75

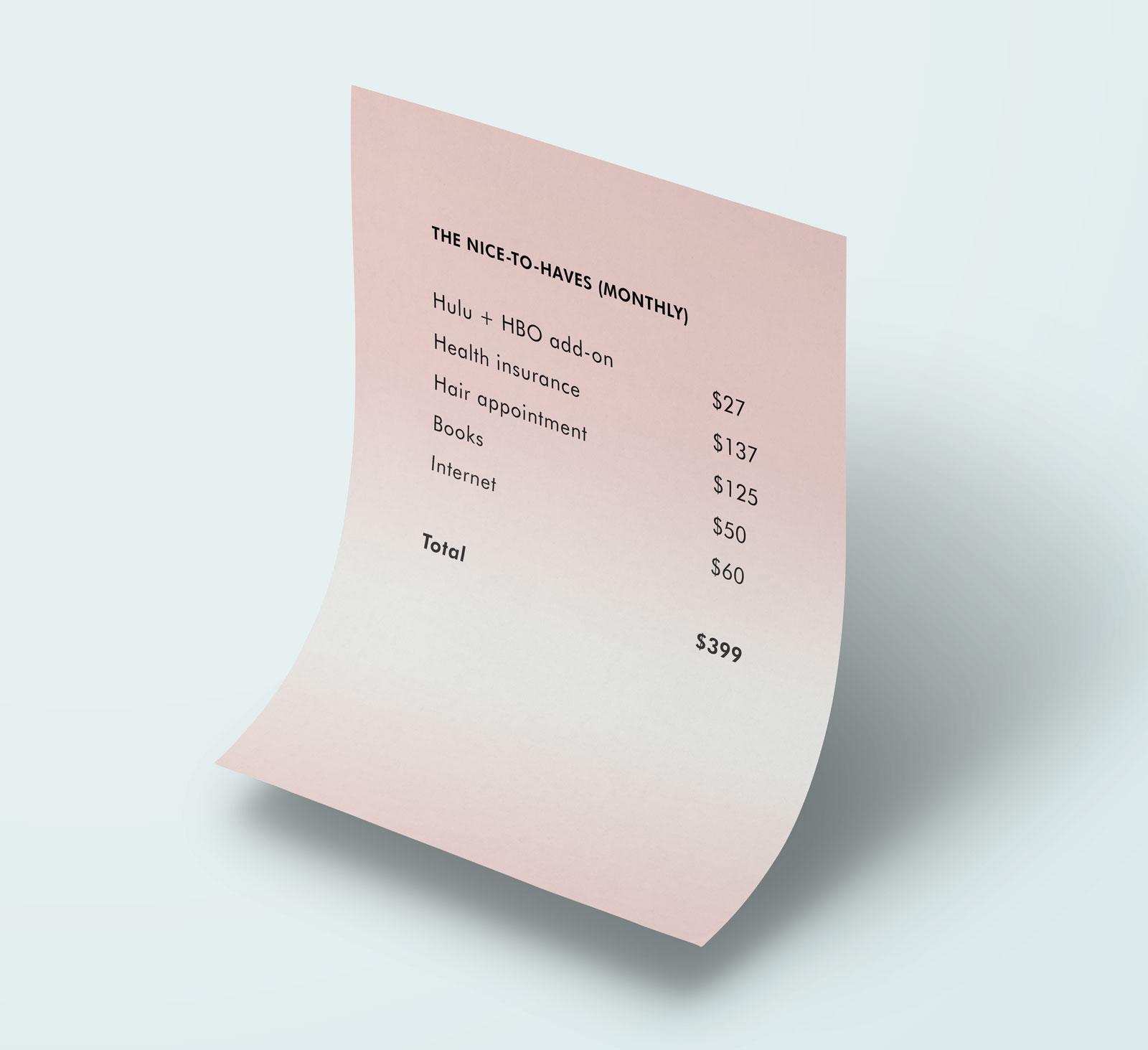

The Nice-To-Haves (Monthly)

•Hulu + HBO add-on ($27)

•Health insurance ($137)

•Hair Appointment ($125)

•Books ($50)

•Internet ($60)

Outside of keeping myself alive, I’m trying to have a fun time while I’m doing it. Whereas the previous section hinges on dire consequences if I attempt to go without, absences in this section do not equate with physical distress. This stuff is primarily peace of mind and wellness.

My go-to relaxation is throwing something on a screen, so most of my monthly bills are streaming services. I pay for Hulu and HBO, and split Netflix with my dad (but he still, for some reason, insists on using my profile and messing up my algorithm). Every so often I’ll disgust myself with how much time I spend streaming and watching, and will try to cancel one of these services.

I’ve also looked into cancelling my Wi-Fi, which for years was $80/month and then was reduced to $60 for some reason. I still have a suspicion that I’m overpaying, but changing that would require someone coming into my home and moving wires around. I will never consider cancelling my Apple Music subscription because it is a dream to have access to such an amount of music.

Books have always been super important to me, and I forget that they’re an expense and not a right. I rely on the library, but always end up paying some fines, which are usually just actual nickels and dimes. Still, each month I buy about $40 to $50 worth of books — never from Amazon for ethical reasons — from bookstores and used books websites. I subscribe to the New York Times Crossword, which I will continue to purchase until my rent demands $6.99 more than I can afford.

My biggest vanity splurge is my hair appointment, every two months or so. I drop around $125 to get my roots done to stay blonde. I cut off all my hair a bit over a year ago and went as blonde as possible, and everything started making sense. I liked the way I occupied the world better, so it’s been something I rely on.

I pay my health insurance, which I never use, every three months. It’s mostly there in case I get hit by an ambulance and owe a hospital so much that I end up having to take up residence in their basement in order to work off my debts and earn back the rights to my precious life. So when I get that thick envelope with dark red letters that says, “IMPORTANT INFORMATION REGARDING YOUR COVERAGE,” I pay it off. The cost is $430 every few months. It’s unfortunate that this is my quasi-luxury section instead of a basic necessity, but it’s a sign of the times.

Sometimes it’s hard to know which column certain items belong in. The difference between luxury and necessity, I guess, ends up being another iteration of the difference between hygiene and vanity. Stand too far on one side or the other and it ends up being either bleak (too little vanity) or empty (too little hygiene). Forever I will be standing in a drugstore aisle staring at a product in the wee hours of the morning, entranced by the ’90s soft rock song I’m trying to remember the name of, staring at the packaging wondering if I truly need it. It’s what marketing preys upon, the fuzzy line where things are kind of too expensive, but you find the reasons why they’re worth it.

Total: $399

The Dear-God-C’mon-What-Is-This(es)

Obviously, the last section is the splurges, the late-night Amazon scrolls when I should just close the window and breathe, count to 10, and come back to it later, or hopefully not at all. Some idea will pop into my head, something I need or want, and start a campaign, like a sit-in, and I spend a lot of time contemplating whether or not this thing will solve my problems. I used to think I would, once I found the right thing, be a whole person.

Fancy notebooks always seem like a good thing, but end up psyching me out, like I have to meet them by standing up straight and really trying.

For instance: a $150 back massager, an impulse purchase at Bed Bath & Beyond on Christmas Eve. I saw it in my friend’s aunt’s living room, where it became fused with the idea of her luxurious, comfortable lifestyle, and I deluded myself into thinking it was worthwhile. I would save so much on massages. I wasn’t even getting massages. But I knew I’d heard somewhere that they had real health benefits and weren’t just a hedonistic luxury. I also thought that if I somehow forgot to get a gift for someone, it was good to have this one on hand. I’ve used it twice.

Fancy notebooks always seem like a good thing, but end up psyching me out, like I have to meet them by standing up straight and really trying. It makes the contents that fill them too precious, and thus not conducive to my creative output. I started buying 99-cent notebooks to do morning pages, the meditative exercise where you let yourself write everything, every morning, and throw out the pages, never to revisit them, just to get it out of your system. And now those notebooks are the only way I can write.

My $170 Philips Sonicare Diamond Clean Classic Rechargeable, 5 Brushing Modes, Electric Toothbrush, however, is a problem. I have bad teeth; I grew up chugging soda and crunchy chips and candy without spending the necessary time repairing the damage with daily cleanings. I never flossed. A hygienic tool is more necessary than an aesthetic luxury, but this product was enough of a splurge that I wouldn’t be able to forgive myself if I didn’t use it twice a day, every single day. This was a purchase in which spending a lot of money actually led to lasting change.

But on the other hand, my beautiful expensive toothbrush is a monster. It is the ghost in the bathroom, the bogeyman under my bed, letting me believe that maybe the splurges are worth it sometimes because it worked out this time.

##The Final Tally

The idea that true humanity can be reflected in a receipt is neither new nor interesting. Unfortunately the 1990 Fugazi lyric “You have no control/You are not what you own” is still relevant. It’s daunting to imagine a lifetime of numbers and direct deposit slips and tax forms and standing in an aisle, deciding which body wash to purchase. But maybe that is the mundane beauty and work of the maintenance of a human life. Still, there’s something about tallying these expenses. As soon as I hit the “calculate” button, I feel relief. It’s refreshing to see it all listed out, to see myself in relation to the numbers, to see what importance floats to the top. The mystery is gone.

It reminds me of math class. The best kids in math and science always said they loved that there was a final answer, that you were right or wrong, that you worked hard to achieve a tangible goal. I always relished English classes, where you marinated with ideas and presented an argument, an opinion. This, I think, taught me to believe my own bullshit. It’s not to blame, and it’s not the problem, but I certainly have used the plausibility of an argument to rationalize my way into a purchase, or an excuse to avoid awareness of my finances.

But for now, at least, I know I have to make around $706.75 a month to cover my bases. I think I more or less keep floating above the break-even line — given that I don’t know how much I make. Because that’s the life I’ve chosen. Broke but never poor. For now.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.