Money Diaries

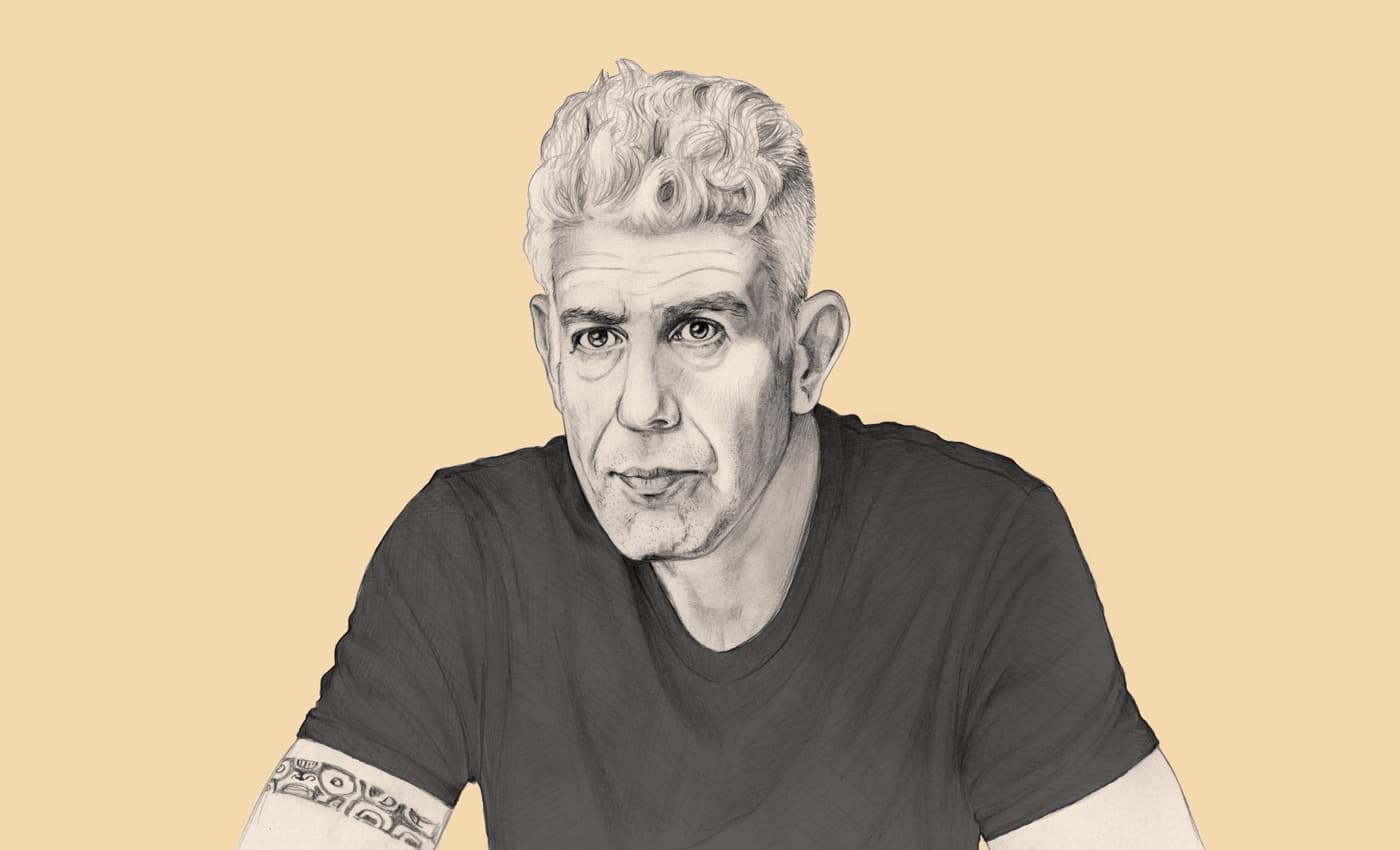

Dan Levy on How Paying His Cable Bill Got Him on MTV

The creator of Schitt’s Creek—and, yes, son of Eugene—says it was his mom who kept him from being a freeloading millennial.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Wealthsimple is a whole new kind of investing service. This is the latest installment of our recurring series “Money Diaries,” where we ask interesting people to open up about the role money has played in their lives.

I was kicked out of a moving vehicle at 15, after a bar mitzvah, in front of a Gap Kids and told not to come home until I’d gotten a job application. That’s how my family operates. I’ve been working ever since. My mom is really good at all the business stuff in the family that I don’t have the brain for and I know my dad doesn’t have the brain for. She’s the one who imparted the financial wisdom. It resonated with me from a young age. I’ve always saved, and I’ve always worked.

There’s a thrill to spending your money on yourself. It’s gratifying. And it also means you don’t want to waste it.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

My mom has a lot of interest in the stock market. The other day she was explaining The Big Short to me because I didn’t have time to see the movie three times to get it. Particularly, she has an interest in where your money goes. It’s a wonderful curiosity. I don’t have it myself. But my mom’s greatest gift was sitting me down and explaining how much better it feels to spend your own money than someone else’s. I went to a private school in middle school but a public high school, so I saw two sides of the spectrum. I have friends whose parents continue to support them entirely. They’re, like, interning at a fashion house and vacationing in Bora-Bora. It doesn’t make sense. I firmly believe there’s a coffee table book in me somewhere down the line called Where’d You Get Your Money? It would just be screen grabs of people’s Facebook photos.

My mom’s philosophy was: What does it do for your independence, for your sense of adventure, for your sense of accomplishment if I lay the stones down in front of you as you walk into adulthood? And she was right, ultimately. There’s a thrill to spending your money on yourself. It’s gratifying. And it also means you don’t want to waste it.

When I was about 18 years old, I went on a trip to the Dominican Republic with my friends. I’d been saving up my Gap money for a couple of years—and now I was working at a Rogers Video. I finally had enough to take a weeklong vacation with friends. It rained the whole time. I was the only person who’d paid for the trip himself. I was so beside myself, and none of my friends could really understand it. They said, “Oh well, we can just come back next year.” And I was like, “Do you know how many hours at the video store I had to put in for this vacation? I will not be coming back next year—it does not seem like a worthwhile investment!”

The only reason that I was able to come to Los Angeles to look for work a long time ago was because I had savings. The life of an actor is so uncertain —you have to be good about saving. You don’t know where your next pay cheque is coming from. So I set up a savings account that took money straight out of my pay cheques. My rule is: you want to have enough for six months’ rent in your bank account if you can.

I was still working at Rogers Video when I got my job at MTV. I was part of this weird reality show that was about finding an MTV host. One of the challenges was to give each of us $100 in cash—there were probably 13 of us at the time—and send us into the city. We had to come back in an hour having spent the $100 and be ready to talk about it. Someone bought a yoga mat so they could talk about their spiritual side; someone bought a Jewel CD because they liked music. I had gone and paid my cable bill and I came back with the receipt. I got the job. It was a practical way to spend that $100, but I think they misconstrued it as being badass. I guess I pulled the wool over their eyes.

When we came up with the premise for Schitt’s Creek it was very timely. We were coming off of the financial crisis and the BernieMadoff scandal and all of these stories of wealth being stripped from people. You heard stories of millionaires losing everything overnight. We know how rich people live down to the last detail thanks to the likes of the Kardashians. What would happen if you took a Kardashian-style family with very materialistic priorities, and you watched the undoing of that until they had nothing?

We researched how people might lose their money overnight—the way that money could be taken from people or how they might go bankrupt. We came across a story about Kim Basinger. In the early ’90s, she bought a town in Georgia, I think assuming it would be used as a location in film and television. It didn’t work out that way. We thought that could be funny: What if this family had bought a town and that was all they were left with?

The lesson was don’t buy a town! Though I guess it worked out for our characters, since it was something they ended up being able to use.

As told to Nojan Aminosharei exclusively for Wealthsimple. We make smart investing simple and affordable.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.