Finance for Humans

What if I Missed the Entire Bull Market?

Say you’re a millennial who came of age right at the cusp of the Great Recession. Or you didn’t start investing because you were freaked out by that recession. Or you had student loans weighing you down. And now the ride is over. What to do if you missed the bull market?

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

Part One: I Feel Like a Hopeless Idiot!

Perhaps you’ve noticed global stock markets have lost their ever-loving minds. There are lots of different names for this phenomenon: correction, sell-off, fluctuation, total full-fledged hair-on-fire panic. It also marks a kind of bookend to the events of 2008. A year that denotes both the nadir of the last economic crisis, and, more importantly for some, the beginning of a bull market that would last the next decade plus. The longest bull market in history.

But it was only a bull market if you were in it, and a lot of people weren’t. At the end of last year, one study showed that half of all millennials weren’t invested in the market at all. There are a lot of good reasons to have missed out. Lack of income, being in school, debt. Maybe you watched your parents delay their retirement because their portfolio lost 40% of its value overnight and wondered: is this really for me? But still, miss out you did.

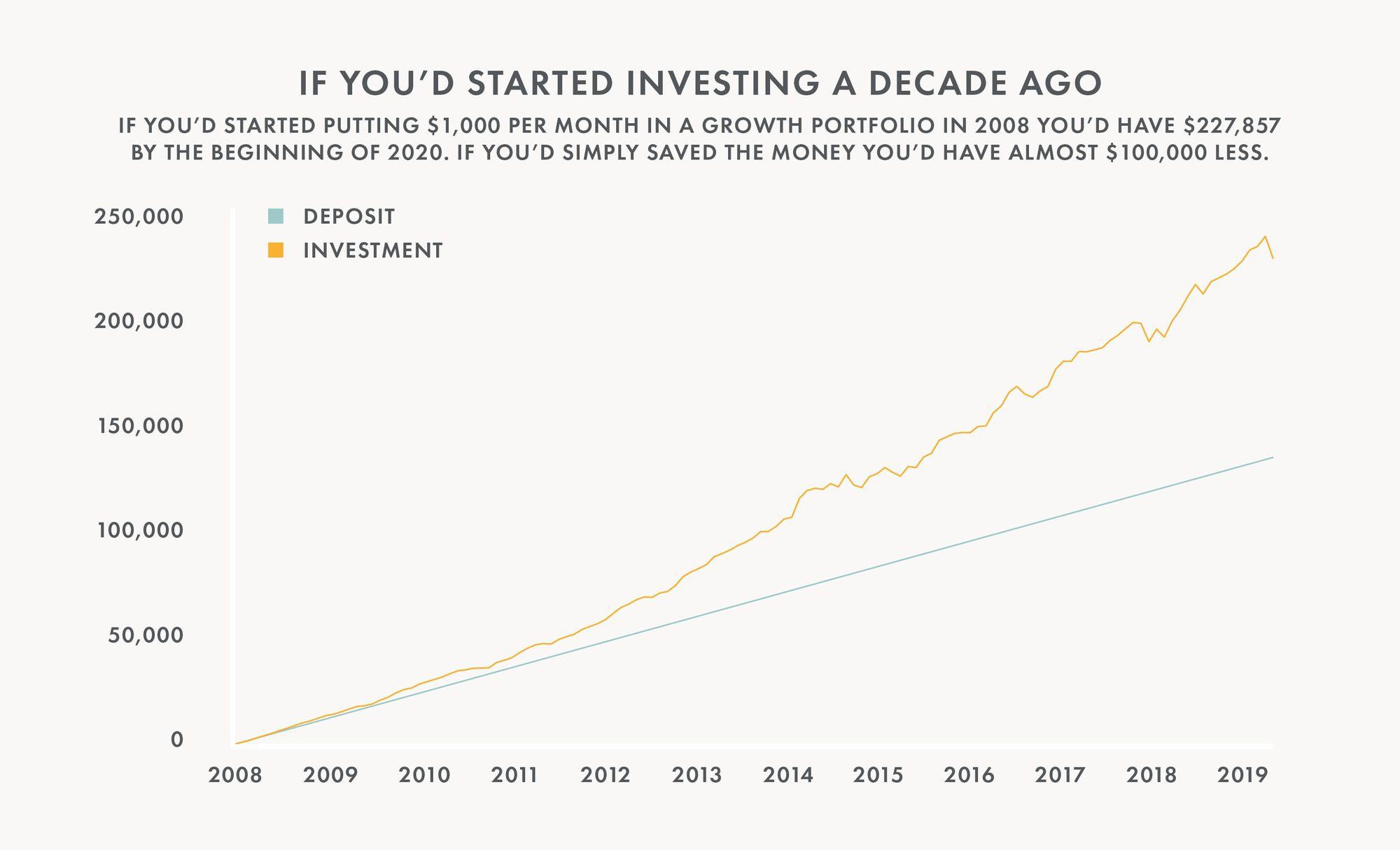

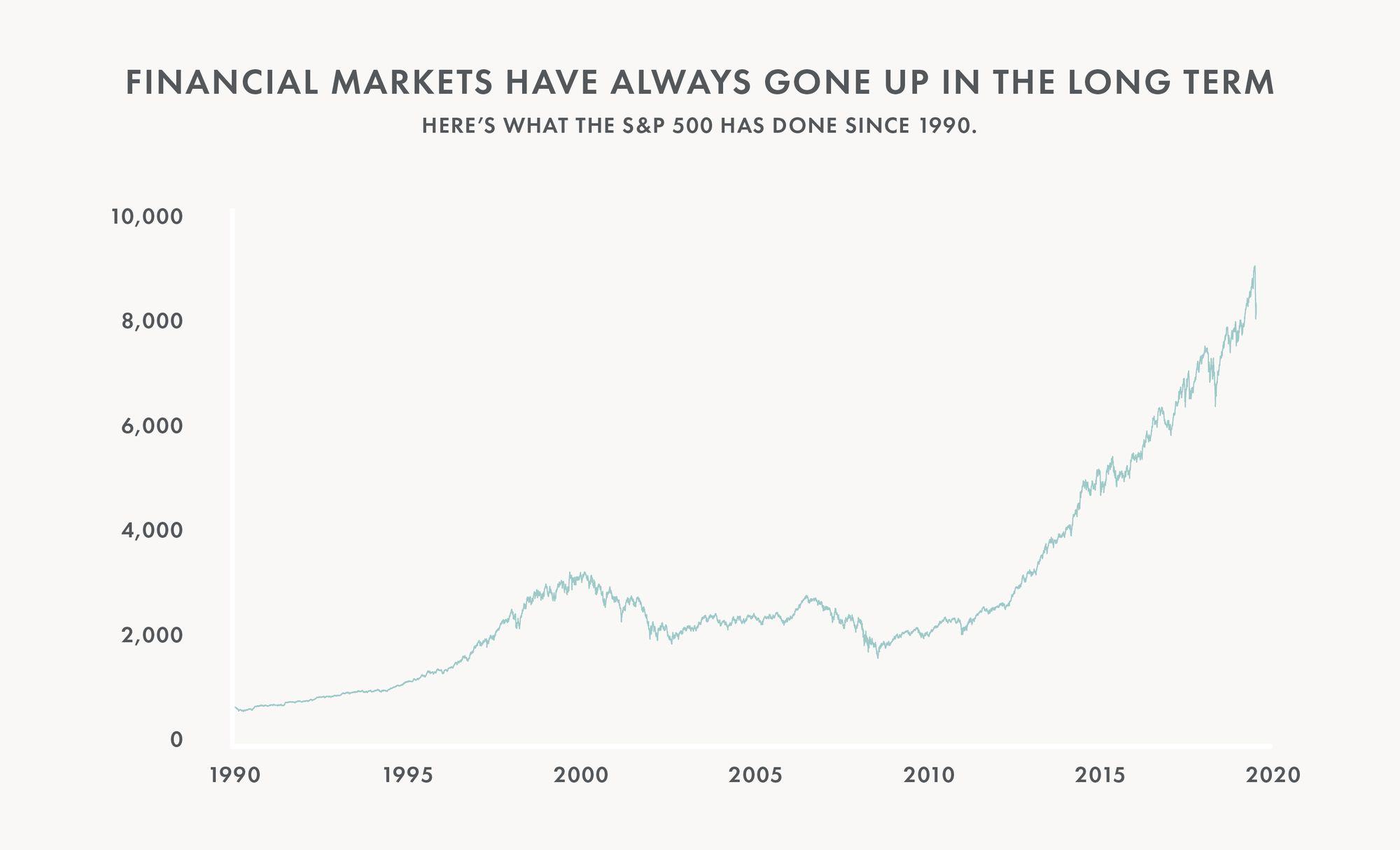

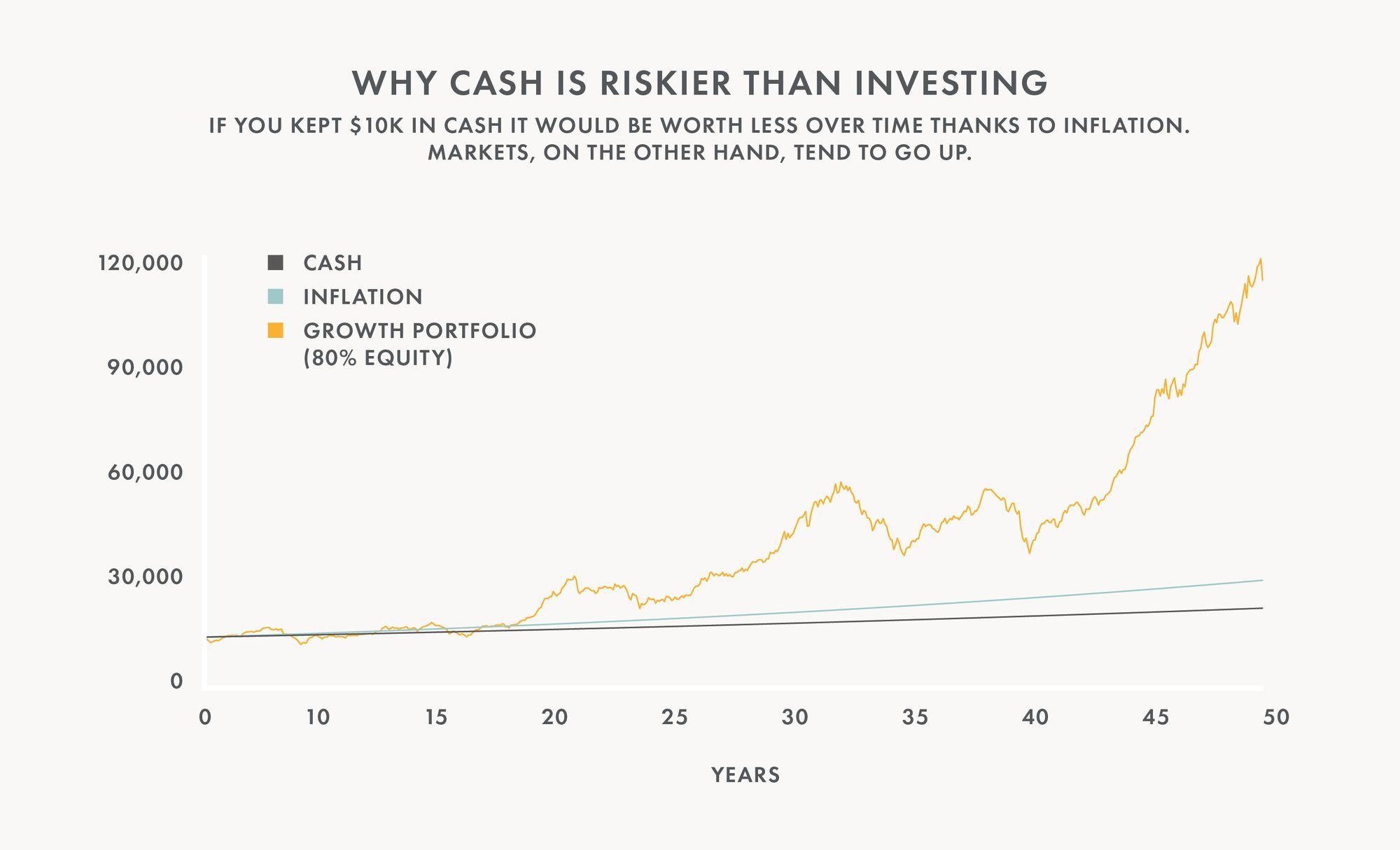

The first question you may want answered is: what did I miss out on, really, if I was on the sidelines? “There’s no way to sugarcoat it,” says Zoe Wolpert, Senior Investment and Retirement Specialist at Wealthsimple. “You would have benefited a lot if you had been investing for the past 10 years.” Between 2008 and 2019 the Dow Jones has risen 331.6% and S&P has increased 351%. That meant huge gains for investors. Check out the graph below to understand the difference between investing a thousand dollars a month in a growth portfolio (which holds 80% equities) and sticking the same amount into your chequing account.

Part Two: It’s always a bull market if you wait long enough

Anyone who knows anything about financial markets — or doesn’t know anything about financial markets but has watched movies or listened to numbskulls talk too loud at the gym — says you should buy low and sell high. And if you missed out on the buying low part, the question becomes, what do you do now? It probably feels like the answer is: just feel bad. Pretty much everyone can relate to that depressed feeling. It’s too late. FOMO. I screwed up so what’s the point now.

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

The most enervating thing about a missed opportunity is that it makes you discount the power of making good decisions now. The good news here is everyone started too late if you take into account you would have likely missed out on gains in any given decade. And even if you missed out on the gains of the past decade, it’s most likely still a very smart decision to start investing. Here is the reasoning underpinning that philosophy.

First: Most every expert and historian and money manager expects markets to go up over time.

Second is that cash is actually riskier than the financial markets in the long run. That’s because of something known as inflation. Inflation causes your money to be worth less and less over time — a virtual lock on negative returns.

Three is that downturns feel pretty bad (and if you’re about to retire and haven’t pulled back on risk, they are very bad), but they’re normal parts of the market cycle. In fact, if you invest over the long term, you’re virtually guaranteed to run into a handful of downturns over the course of your life. One could argue starting to invest in a bear market is actually a good thing, since the price of the shares you’re buying would be relatively low. We’d argue against this kind of thinking, or any thinking in which you’re trying to time the market.

And just as important, like bull markets, bear markets don’t last forever, either. In fact, they’re usually shorter than bull markets. History teaches us the average bull market is about four and a half years; the average bear lasts roughly 14 months.

So what happens if this correction becomes a full-fledged bear? Nothing! In terms of your approach, it doesn’t matter.

Part Four: So if I want to start now, what do I do? Put it all in TSLA? (No.)

If you’re ready to start investing, there are some ways to do it that are more successful than others.

Let’s begin with money you’ve saved outside your emergency fund (and anything you want to spend in the short-term if you’re, say, buying a home) that may be sitting there, collecting dust in a savings or chequing account. You may be surprised to learn that investing that money as a lump sum — as opposed to a little at a time — is statistically the best way to do it.

For those of us who don’t have a big old lump sum lumping around in our accounts, it’s smart to start by putting a little bit away, no matter how little it is. And just as important is to make putting money away part of your financial routine — regularly, over time. This may be a good way to get started even if you do have a chunk, but feel shell shocked from recent market tumult. “Don't force yourself to invest some amount that's going to keep you up at night — nobody wants that,” Wolpert says. "Getting comfortable with investing can take time, and that’s OK.”

Then of course you have to invest the right way. The important things to think about are making sure your portfolio is diversified, is built to suit your risk tolerance and financial goals, and that you keep fees as low as possible. (Here’s a little bit about how our portfolios do that.) And the most important thing: stick to your long-term plan, regardless of the gyrations of the short term. Repeat after us: Don’t. Time. The. Market. Getting out of the market at a low point can do serious damage to your net worth — so can getting excited and buying when the market is up.

Above all, remember this: throughout recorded history, the market goes up much more often than it goes down. A portfolio made up of 50% stocks and 50% bonds has about a 70% chance of making money on any given year and 85% for any five year period (a more aggressive portfolio that’s 80% stocks has about a 65% chance of making money in any given year; 85% for any five year period). Those periods where losses happen will be stressful, but keep your eye on the ball.

Look, everyone’s made financial mistakes. And since we’re emotional animals, humans feel losses more intensely than gains. But the biggest mistake you can make is to let that feeling paralyze you and lead to more inaction. You don’t want to be in the same boat — only riding even lower in the water — ten years from now.

Illustration by Cari Vander Yacht.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.