Money & the World

Bonds Are Supposed to Limit Losses When Stocks Are Down. What Happened?

When stocks fall, bonds typically go up. But for the first time in a (very) long time, that hasn’t been the case.

Wealthsimple makes powerful financial tools to help you grow and manage your money. Learn more

You might not think you care about bonds. But if you’re an investor, you probably care about bonds even while you’re not caring about bonds. Especially now.

It’s been a rough start to the year for bonds. Since January, Canadian bonds have been down more than 12%, and U.S. bonds are down nearly 10%. That may not sound so bad when compared to stocks — some indexes have sunk nearly 30% in that same time. But it’s not usually supposed to happen this way. And bonds’ poor performance is the underlying secret to why many investment portfolios are struggling a lot more than expected.

Traditionally, when stock prices fall, the price for bonds tend to go up. That’s a big part of why diversified portfolios typically include both. This is the first time in nearly 30 years that both stocks and bonds have fallen by more than 10% in the same period. What luck!

Sign up for our weekly non-boring newsletter about money, markets, and more.

By providing your email, you are consenting to receive communications from Wealthsimple Media Inc. Visit our Privacy Policy for more info, or contact us at privacy@wealthsimple.com or 80 Spadina Ave., Toronto, ON.

So why is this happening? Is it going to last? What should you do right now if you don’t want to have such crappy returns? Well, the first thing to do is understand what bonds are, how they work, and why they’re currently letting us down. Where can you do that? Right here.

What are bonds, anyway?

Bonds are a lot like loans. When you buy them, you are loaning money with the promise of getting it back later, plus interest. How much you’ll get back and when depends on the type of bond. The riskier it is, the higher the interest rate.

There are a ton of different types of bonds. The most common are corporate bonds and treasuries. Corporate bonds are issued by companies to raise money. They tend to be riskier and pay higher rates since there’s always the chance that the company will get in trouble and not be able to pay you back. Treasuries are also called government-issued bonds. When people say bonds are down — or up! Let’s stay positive here — they’re usually talking about government bonds. Although they come with a lower interest rate, the benefit of treasuries is that there’s very little chance you won’t get your money back. Whatever gripes you may have with the government, they pay bond debts with the consistency of a Lannister.

Recommended for you

The Racial Wealth Gap Is a Problem

Money & the World

How Canada, and Much of the World, Got Stuck in a Land Trap

Money & the World

What’s Up With All Those Crypto Laser-Eyes Profile Pics? A Definitive Investigation

Money & the World

Data: Who Really Traded GME? Why? And What Happened to Them?

Money & the World

Why do I want them in my portfolio?

In typical times, bonds are a pretty safe investment. They don’t offer the potential rewards of stocks, but they also don’t have the same risk. That’s why so many financial advisors suggest including at least some bonds in your portfolio. If stocks go sideways, owning bonds helps your overall holdings go… a little less sideways.

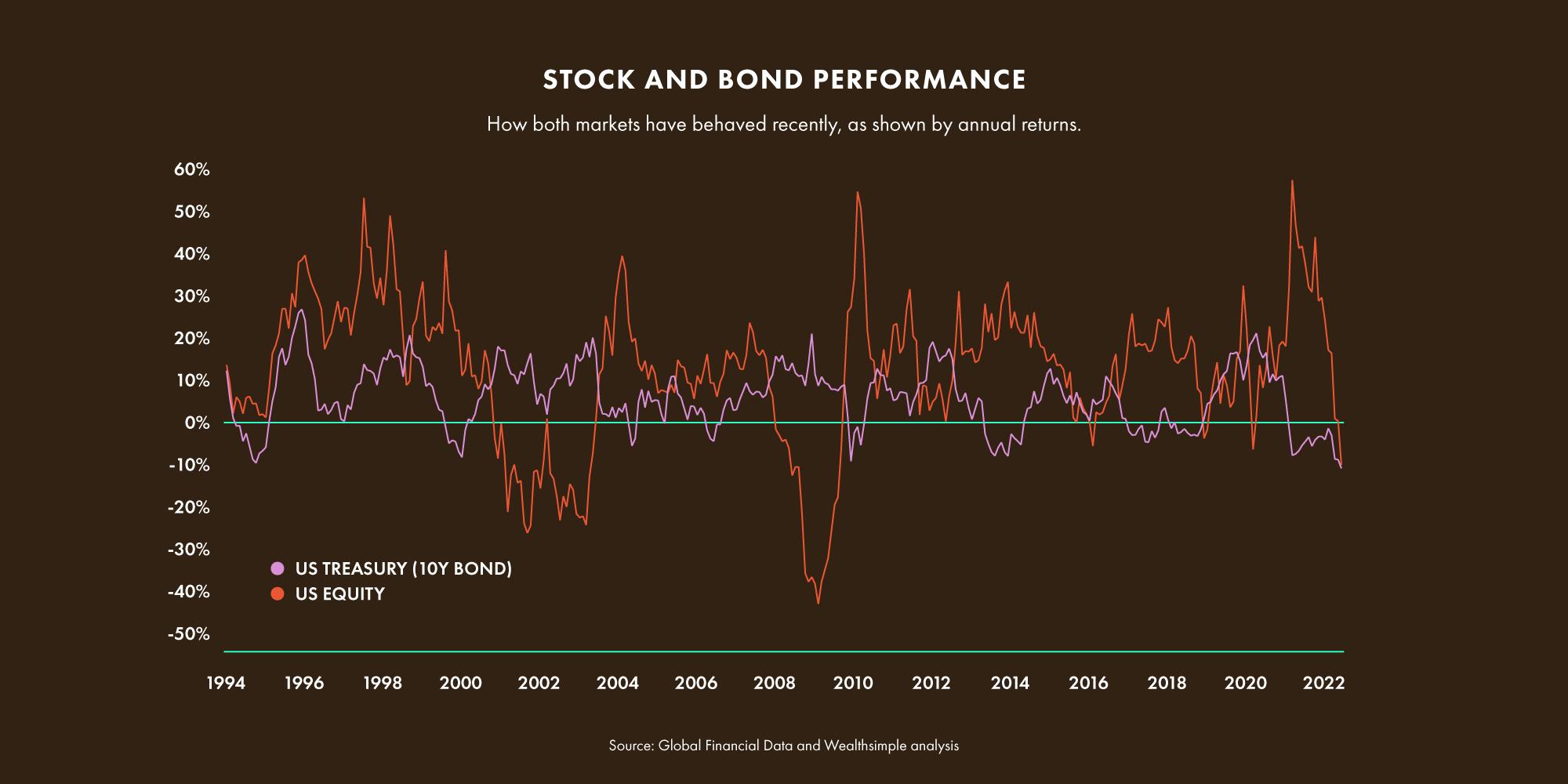

Historically, stocks and bonds have both produced positive returns, but with their relative performance tend to balance each other out (particularly during the recessions and market booms). When markets are doing well, investors are more likely to put their money in stocks over bonds, in the hopes of earning higher returns and bond prices typically going down. When the markets go down, however, bond prices tend to go up as investors look to move their money into safer assets. You can see that relationship in the chart below.

So why aren’t bonds doing what they’re supposed to? What’s so special about the current market?

So now we know that while both stocks and bonds tend to be positive over time, their movements don’t normally mirror each other like financial synchronized swimmers during boom and bust cycles — they tend to be inverse. Bonds do worse than average in the best years for stocks, and better than average in the worst years for stocks. But, there are a set of circumstances where they start to act the same — and those circumstances are happening right now.

Namely, it’s when there is high inflation (which means the economy is running hot and the costs of things are way up) and rising interest rates (which is how central bankers respond to that high inflation to try to cool things down and make life more affordable). When both of those things hit pretty quickly, like they did this year, stocks and bonds both tend to freak out and fall. The higher the interest rates get, the more attractive cash becomes (if you can get a better return by keeping money in the bank, there’s less incentive to invest it in other things) and the less attractive stocks and bonds are. The big question is when and whether those circumstances will change.

So what might happen next?

First, it’s possible things could get worse before they get better. But long-term, it’s very unlikely this weirdness will hang around, and that’s for one important reason: this is not a sustainable situation. And we don’t mean that in the sense of, “this whole scenario is really frustrating and we aren’t sure how much longer we can take it” (although that’s true too). We mean it in the sense that something’s eventually got to give.

The most logical question is when. As in, when will bonds revert to their normal behaviour? The path inflation is taking might give us a clue. Governments have raised interest rates to try to quell inflation — bad for bonds. But investors have already locked in those losses. As long as inflation eventually abates, bonds are likely to perform well and return to their normal behaviour. There are also structural reasons to think that bonds will produce positive returns over the long-term. The same levers that cause economies to keep growing and performing well over time – productivity and innovation – move the bond market, too. For the last century, bonds have largely performed well through all sorts of environments (yes, including higher inflation). And, historically, if the 1980s are any guide, the transition back to normalcy could happen much quicker than we expect.

So you’re saying I should still have bonds in my portfolio?

Well, that depends on your financial goals. But bonds can be useful for a few reasons. Markets are really steeling themselves to respond to inflation. If policymakers are successful in bringing inflation down, bonds will most likely revert to their normal relationship with stocks. And, they could be particularly useful if policymakers overdo it and the economy goes into a recession. Shifts like that can happen too fast to react to, so it’s good to be prepared (ask anyone who was holding bonds when inflation hit). If you sell now, you could both lock in losses and leave yourself unprepared against all the risk bonds can help to protect against.

OK, but when will things get better (for bonds)?

Like we always say, no one has a (working) crystal ball. It could last for a while. But then again, there are a lot of people (central bankers especially) who are working to bring down inflation, which would be good news for bonds. Chances are, we’re in the middle of an exception, not the start of a new rule. The fact that you’ll want a portfolio that includes bonds, and, as a result, will be more insulated from risks like recession and disinflation, is true for the short-term, but even more true if your timeline is measured in years or decades.

Wealthsimple's education team is made up of writers and financial experts dedicated to making the world of finance easy to understand and not-at-all boring to read.

The content on this site is produced by Wealthsimple Media Inc. and is for informational purposes only. The content is not intended to be investment advice or any other kind of professional advice. Before taking any action based on this content you should consult a professional. We do not endorse any third parties referenced on this site. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.